Portfolio Mean and Variance Outline Asset Return Random Variables (self-learning) Random Returns (self-learning) Portfolio Mean and Variance The Feasible Set ⑥The Markowitz Model The Two-Fund Theorem Inclusion of a Risk-Free Asset The One-Fund Theorem 4口4+4三4至,至)只0 Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 12/81

Portfolio Mean and Variance Outline 1 Asset Return 2 Random Variables (self-learning) 3 Random Returns (self-learning) 4 Portfolio Mean and Variance 5 The Feasible Set 6 The Markowitz Model 7 The Two-Fund Theorem 8 Inclusion of a Risk-Free Asset 9 The One-Fund Theorem Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 12 / 81

Portfolio Mean and Variance Mean Return of a Portfolio Suppose that there are n assets with (random)rates of return ri's and expected values Fi's,i=1,2,...,n. Suppose that we form a portfolio of these n assets using the weights wi, i=1,2,...,n.The rate of return of the portfolio in terms of the return of the individual returns is r= ∑wn i=1 We may take the expected values of both sides,and obtain (r)=T=∑wE()=∑w7 i=1 i=1 The expected rate of return of the portfolio is found by taking the weighted sum of the individual expected rates of return! Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 13/81

Portfolio Mean and Variance Mean Return of a Portfolio Suppose that there are n assets with (random) rates of return ri ’s and expected values ri ’s, i = 1, 2, . . . , n. Suppose that we form a portfolio of these n assets using the weights wi , i = 1, 2, . . . , n. The rate of return of the portfolio in terms of the return of the individual returns is r = Xn i=1 wiri . We may take the expected values of both sides, and obtain E(r) = r = Xn i=1 wiE(ri) = Xn i=1 wiri . The expected rate of return of the portfolio is found by taking the weighted sum of the individual expected rates of return! Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 13 / 81

Portfolio Mean and Variance Variance of Portfolio Return Denote the variance of the return of asset i by o?,the variance of the return of the portfolio by o2,and the covariance of the return of asset i with asset j by oij. n--刚={店t6可店s列} -E 店三列-三 Example (Two-asset portfolio) Suppose that there are two assets with T1=0.12,72 =0.15,o1 =0.20, o2=0.18 and 012=0.01 (values typical for two stocks).A portfolio is formed with weights wi=0.25 and w2=0.75.The mean and the variance of this portfolio are 7=0.1425 and o2=0.024475. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 14/81

Portfolio Mean and Variance Variance of Portfolio Return Denote the variance of the return of asset i by σ 2 i , the variance of the return of the portfolio by σ 2 , and the covariance of the return of asset i with asset j by σij . var(r) = E (r − r) 2 = E "Xn i=1 wi(ri − ri) # Xn j=1 wj(rj − rj) = E Xn i=1 Xn j=1 wiwj(ri − ri)(rj − rj) = Xn i=1 Xn j=1 wiwjσij . Example (Two-asset portfolio) Suppose that there are two assets with r 1 = 0.12, r 2 = 0.15, σ1 = 0.20, σ2 = 0.18 and σ12 = 0.01 (values typical for two stocks). A portfolio is formed with weights w1 = 0.25 and w2 = 0.75. The mean and the variance of this portfolio are r = 0.1425 and σ 2 = 0.024475. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 14 / 81��

Portfolio Mean and Variance Diversification The variance of the return of a portfolio can be reduced by including additional assets in the portfolio,a process referred to as diversification. Don't put all your eggs in one basket! Suppose that the rate of return of each of uncorrelated assets has mean m and variance o2.Let wi=1/n for each i.Then -=m0=(- 791113151719 91113151719 (a)Uncorrelated assets (b Corelated assets DaO Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 15/81

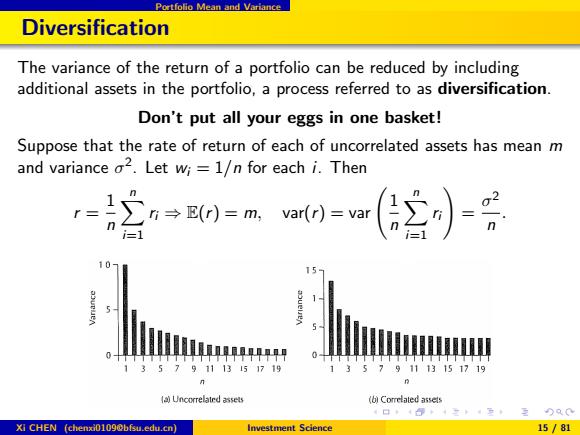

Portfolio Mean and Variance Diversification The variance of the return of a portfolio can be reduced by including additional assets in the portfolio, a process referred to as diversification. Don’t put all your eggs in one basket! Suppose that the rate of return of each of uncorrelated assets has mean m and variance σ 2 . Let wi = 1/n for each i. Then r = 1 n Xn i=1 ri ⇒ E(r) = m, var(r) = var 1 n Xn i=1 ri ! = σ 2 n . Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 15 / 81

Portfolio Mean and Variance Suppose again that each asset has a rate of return with mean m and variance o2,but now each return pair has a covariance of cov(ri,rj)=0.302 for i j.Then =(空-店+ 是[m2+0.3r-=07a2+03a2 It is impossible to reduce the variance below 0.302,no matter how large n is made! In general,diversification may reduce the overall expected return while reducing the variance.Blind diversification is not necessarily desirable. This is the motivation behind the general mean-variance approach developed by Markowitz. )Q0 Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 16/81

Portfolio Mean and Variance Suppose again that each asset has a rate of return with mean m and variance σ 2 , but now each return pair has a covariance of cov(ri ,rj) = 0.3σ 2 for i 6= j. Then var(r) = var 1 n Xn i=1 ri ! = 1 n 2 X i=j σij + X i6=j σij = 1 n 2 nσ 2 + 0.3(n 2 − n)σ 2 = 0.7σ 2 n + 0.3σ 2 . It is impossible to reduce the variance below 0.3σ 2 , no matter how large n is made! In general, diversification may reduce the overall expected return while reducing the variance. Blind diversification is not necessarily desirable. This is the motivation behind the general mean-variance approach developed by Markowitz. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 16 / 81��