Internal Rate of Return Theorem(Main theorem of internal rate of return) Suppose the cash flow stream (xo,x1,...,xn)has xo<0 and xk >0 for all k,k =1,2,...,n,with at least one term being strictly positive.Then there is a unique root to the equation 0=∑为c=x0+xc+x2c2+..+xnc”, i=0 Furthermore,ifxk>0(meaning that the total amount returned exceeds the initial investment),then the corresponding IRR is positive. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 26/174

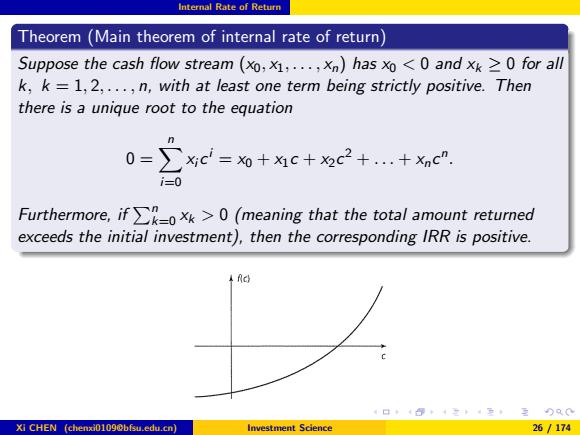

Internal Rate of Return Theorem (Main theorem of internal rate of return) Suppose the cash flow stream (x0, x1, . . . , xn) has x0 < 0 and xk ≥ 0 for all k, k = 1, 2, . . . , n, with at least one term being strictly positive. Then there is a unique root to the equation 0 = Xn i=0 xi c i = x0 + x1c + x2c 2 + . . . + xnc n . Furthermore, if Pn k=0 xk > 0 (meaning that the total amount returned exceeds the initial investment), then the corresponding IRR is positive. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 26 / 174

Evaluation Criteria Outline Principal and Interest Present Value 3 Present and Future Value of Streams Internal Rate of Return Evaluation Criteria Applications and Extensions 4口,40+4立4至,三)及0 Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 27/174

Evaluation Criteria Outline 1 Principal and Interest 2 Present Value 3 Present and Future Value of Streams 4 Internal Rate of Return 5 Evaluation Criteria 6 Applications and Extensions Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 27 / 174

Evaluation Criteria Net Present Value Definition Net present value is the present value of the benefits minus the present value of the costs. Example Suppose that you have the opportunity to plant trees that later can be sold for lumber.This project requires an initial outlay of money to purchase and plant the seedlings.No other cash flow occurs until the trees are harvested.However,you have a choice as to when to harvest:after 1 year or after 2 years.If you harvest after 1 year,you get your return quickly;but if you wait an additional year,the trees will have additional growth and the revenue generated from the sale of the trees will be greater.(r=10%) (-1,2),cut early,NPV=0.82. (-1,0,3),cut later,NPV =1.48. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 28/174

Evaluation Criteria Net Present Value Definition Net present value is the present value of the benefits minus the present value of the costs. Example Suppose that you have the opportunity to plant trees that later can be sold for lumber. This project requires an initial outlay of money to purchase and plant the seedlings. No other cash flow occurs until the trees are harvested. However, you have a choice as to when to harvest: after 1 year or after 2 years. If you harvest after 1 year, you get your return quickly; but if you wait an additional year, the trees will have additional growth and the revenue generated from the sale of the trees will be greater. (r = 10%) 1 (−1, 2), cut early, NPV = 0.82. 2 (−1, 0, 3), cut later, NPV = 1.48. X Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 28 / 174

Evaluation Criteria Internal Rate of Return Provided that it is greater than the prevailing interest rate,the higher the internal rate of return,the more desirable the investment. Example (contd.) Let us use the internal rate of return method to evaluate the two tree harvesting proposals.The equations for the internal rate of return in the two cases are 11 -1+2c=0→c=2=1+7 →r=1.0. -1+3c2=0→c=y3-1 31+r →r=0.7. In other words,for cut early,the internal rate of return is 100%,whereas for cut late,it is about 70%.Hence under the internal rate of return criterion,the best alternative is to cut early. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 29/174

Evaluation Criteria Internal Rate of Return Provided that it is greater than the prevailing interest rate, the higher the internal rate of return, the more desirable the investment. Example (contd.) Let us use the internal rate of return method to evaluate the two tree harvesting proposals. The equations for the internal rate of return in the two cases are 1 −1 + 2c = 0 ⇒ c = 1 2 = 1 1 + r ⇒ r = 1.0. X 2 −1 + 3c 2 = 0 ⇒ c = √ 3 3 = 1 1 + r ⇒ r = 0.7. In other words, for cut early, the internal rate of return is 100%, whereas for cut late, it is about 70%. Hence under the internal rate of return criterion, the best alternative is to cut early. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 29 / 174

Evaluation Criteria Discussion of the Criteria There is considerable debate as to which of the two criteria,NPV or IRR, is the most appropriate for investment evaluation.Both have attractive features,and both have limitations. Net present value is simplest to compute; o does not have the ambiguity associated with the several possible roots of the internal rate of return equation;and o can be broken into component pieces,unlike internal rate of return. However,internal rate of return has the advantage that it depends only on the properties of the cash flow stream,and not on the prevailing interest rate (which in practice may not be easily defined) Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 30/174

Evaluation Criteria Discussion of the Criteria There is considerable debate as to which of the two criteria, NPV or IRR, is the most appropriate for investment evaluation. Both have attractive features, and both have limitations. Net present value is simplest to compute; does not have the ambiguity associated with the several possible roots of the internal rate of return equation; and can be broken into component pieces, unlike internal rate of return. However, internal rate of return has the advantage that it depends only on the properties of the cash flow stream, and not on the prevailing interest rate (which in practice may not be easily defined). Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 30 / 174