Present and Future Value of Streams Frequent and Continuous Compounding Suppose that r is the nominal annual interest rate and interest is compounded at m equally spaced periods per year.Furthermore,suppose that cash flows occur initially and at the end of each period for a total of n periods,forming a stream (xo,X1;...,xn).Then n X Suppose now that the nominal interest rate r is compounded continuously and cash flows occur at times to,t1,...,tn.Denote by x(tk)the cash flow at time tk.Then PV=∑xtk)et k=0 Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 21/174

Present and Future Value of Streams Frequent and Continuous Compounding Suppose that r is the nominal annual interest rate and interest is compounded at m equally spaced periods per year. Furthermore, suppose that cash flows occur initially and at the end of each period for a total of n periods, forming a stream (x0, x1, . . . , xn). Then PV = Xn k=0 xk [1 + (r/m)]k . Suppose now that the nominal interest rate r is compounded continuously and cash flows occur at times t0,t1, . . . ,tn. Denote by x(tk ) the cash flow at time tk . Then PV = Xn k=0 x(tk )e −rtk . Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 21 / 174

Present and Future Value of Streams Present Value and an Ideal Bank In general,if an ideal bank can transform the stream (xo,X1,...,xn)into the stream (yo,y1,...,yn),it can also transform in the reverse direction. Definition Two streams that can be transformed into each other are said to be equivalent streams. Theorem (Main theorem on present value) The cash flow streams x =(xo,x1,...,xn)and y=(yo,y1,...,yn)are equivalent for a constant ideal bank with interest rate r if and only if the present values of two streams,evaluated at the bank's interest rate,are equal. Proof. Since x(vx,0,...,0)and y(vy,0,...,0),the result is obvious. )Q0 Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 22/174

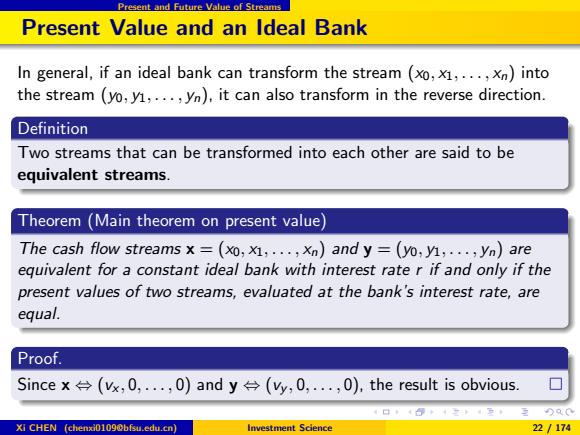

Present and Future Value of Streams Present Value and an Ideal Bank In general, if an ideal bank can transform the stream (x0, x1, . . . , xn) into the stream (y0, y1, . . . , yn), it can also transform in the reverse direction. Definition Two streams that can be transformed into each other are said to be equivalent streams. Theorem (Main theorem on present value) The cash flow streams x = (x0, x1, . . . , xn) and y = (y0, y1, . . . , yn) are equivalent for a constant ideal bank with interest rate r if and only if the present values of two streams, evaluated at the bank’s interest rate, are equal. Proof. Since x ⇔ (vx , 0, . . . , 0) and y ⇔ (vy , 0, . . . , 0), the result is obvious. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 22 / 174

Internal Rate of Return Outline Principal and Interest Present Value 3 Present and Future Value of Streams Internal Rate of Return Evaluation Criteria Applications and Extensions 4口40+4三4至,至)只0 Xi CHEN (chenxi01090bfsu.edu.cn) Investment Science 23/174

Internal Rate of Return Outline 1 Principal and Interest 2 Present Value 3 Present and Future Value of Streams 4 Internal Rate of Return 5 Evaluation Criteria 6 Applications and Extensions Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 23 / 174

Internal Rate of Return Definition Let (xo,x1,...,xn)be a cash flow stream.Then the internal rate of return of this stream is a number r satisfying the equation 0=为 台a+=0+千,+a中序++ Xn (1+rn Equivalently,it is a number r satisfying 1/(1+r)=c,where c satisfies the polynomial equation n 0=∑xd=x0+x1c+2c2+.+xc”. i=0 Example Consider again the cash flow sequence(-2,1,1,1).Its internal rate of return is r=0.23 with c=0.81 Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 24/174

Internal Rate of Return Definition Let (x0, x1, . . . , xn) be a cash flow stream. Then the internal rate of return of this stream is a number r satisfying the equation 0 = Xn i=0 xi (1 + r) i = x0 + x1 1 + r + x2 (1 + r) 2 + . . . + xn (1 + r) n . Equivalently, it is a number r satisfying 1/(1 + r) = c, where c satisfies the polynomial equation 0 = Xn i=0 xi c i = x0 + x1c + x2c 2 + . . . + xnc n . Example Consider again the cash flow sequence (−2, 1, 1, 1). Its internal rate of return is r = 0.23 with c = 0.81. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 24 / 174

Internal Rate of Return Exercise (Newton's method) Suppose that we define f()=-ao+a1入+a22+..+an入n,where al∥ ai's are positive and n>1.Here is an iterative technique that generates a sequence o,1,2.....Xk,...of estimates that converges to the root 0.solving f(=0.Start with any o>close to the solution. Assuming Xk has been calculated,we use f'(Ak)=a1+2a2Xk+3a3+..+nanXg1,Xk+1=Ak- f(入k) F(XK) Try the above procedure on the function f(A)=-1+A+A2 with the starting points0=±1,±10,. Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 25/174

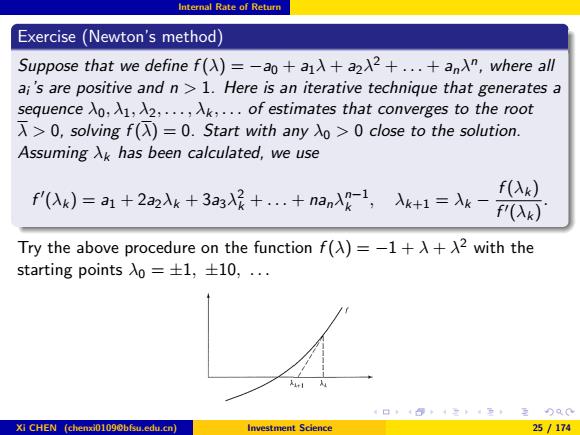

Internal Rate of Return Exercise (Newton’s method) Suppose that we define f (λ) = −a0 + a1λ + a2λ 2 + . . . + anλ n , where all ai ’s are positive and n > 1. Here is an iterative technique that generates a sequence λ0, λ1, λ2, . . . , λk , . . . of estimates that converges to the root λ > 0, solving f (λ) = 0. Start with any λ0 > 0 close to the solution. Assuming λk has been calculated, we use f 0 (λk ) = a1 + 2a2λk + 3a3λ 2 k + . . . + nanλ n−1 k , λk+1 = λk − f (λk ) f 0(λk ) . Try the above procedure on the function f (λ) = −1 + λ + λ 2 with the starting points λ0 = ±1, ±10, . . . Xi CHEN (chenxi0109@bfsu.edu.cn) Investment Science 25 / 174