Process Costing and Spoilage Example Big Mountain,Inc.,manufactures skiing accessories. All direct materials are added at the beginning of the production process. In October,$95,200 in direct materials were introduced into production. Assume that 35,000 units were started,30,000 good units were completed,and 1,000 units were spoiled (all normal spoilage) 海南大学董建华讲授 7-11日

海南大学董建华讲授 7- 11 Process Costing and Spoilage Example Big Mountain, Inc., manufactures skiing accessories. All direct materials are added at the beginning of the production process. In October, $95,200 in direct materials were introduced into production. Assume that 35,000 units were started, 30,000 good units were completed, and 1,000 units were spoiled (all normal spoilage)

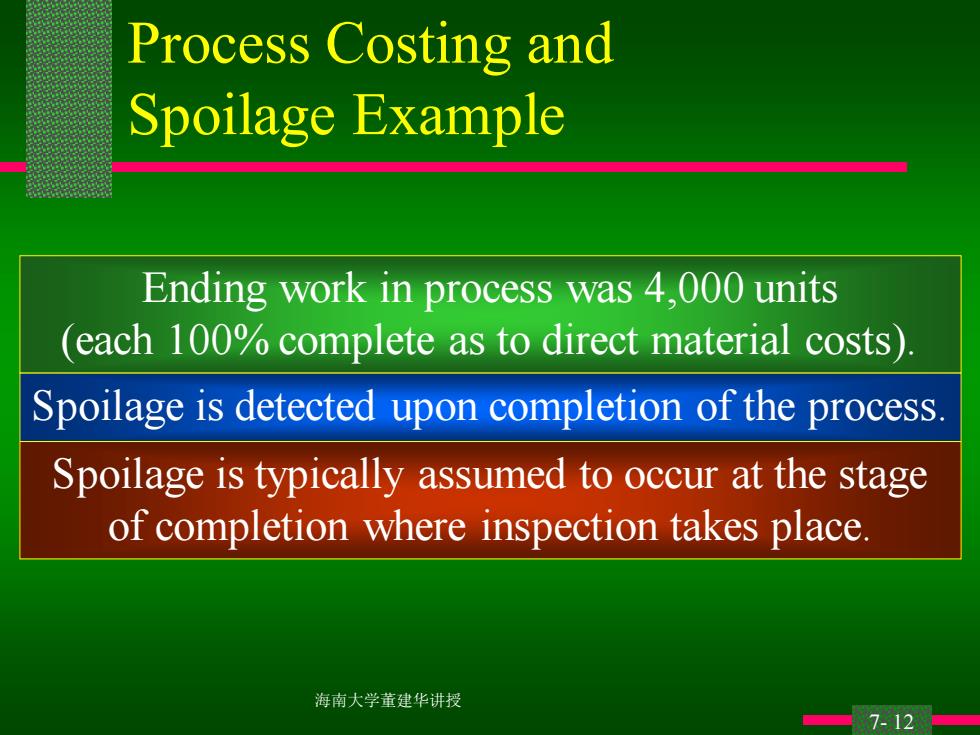

Process Costing and Spoilage Example Ending work in process was 4,000 units each 100%complete as to direct material costs). Spoilage is detected upon completion of the process. Spoilage is typically assumed to occur at the stage of completion where inspection takes place. 海南大学董建华讲授 7-12

海南大学董建华讲授 7- 12 Process Costing and Spoilage Example Ending work in process was 4,000 units (each 100% complete as to direct material costs). Spoilage is detected upon completion of the process. Spoilage is typically assumed to occur at the stage of completion where inspection takes place

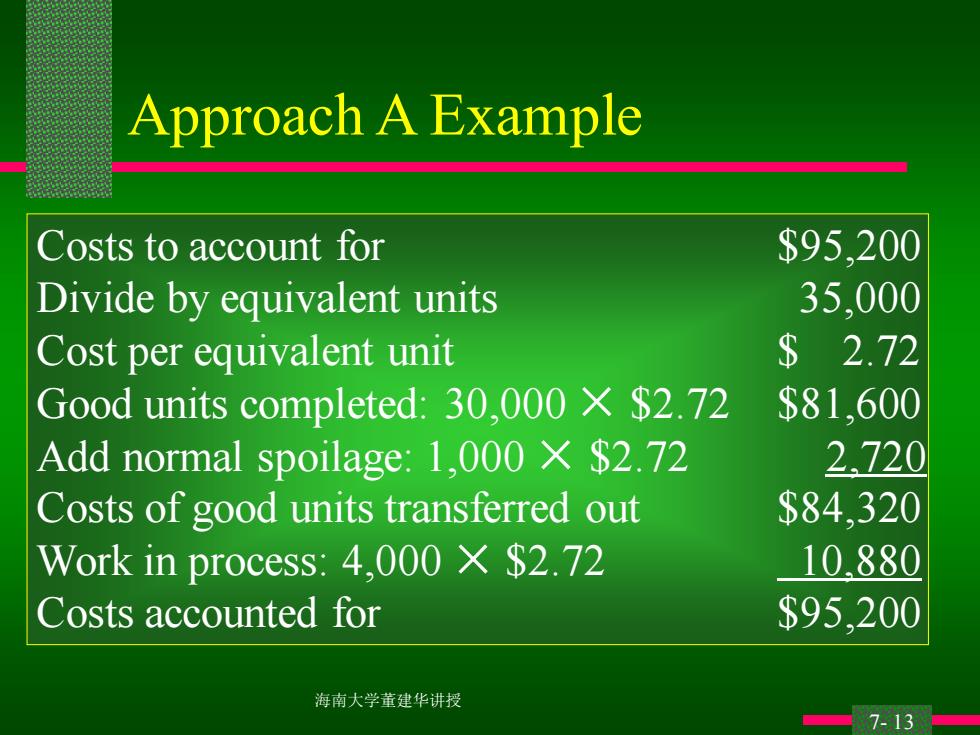

Approach A Example Costs to account for $95,200 Divide by equivalent units 35,000 Cost per equivalent unit $2.72 Good units completed:30,000 X $2.72 $81,600 Add normal spoilage:1,000 X $2.72 2.720 Costs of good units transferred out $84,320 Work in process:4,000 X $2.72 10.880 Costs accounted for $95,200 海南大学董建华讲授 ☐7-13

海南大学董建华讲授 7- 13 Approach A Example Costs to account for $95,200 Divide by equivalent units 35,000 Cost per equivalent unit $ 2.72 Good units completed: 30,000 × $2.72 $81,600 Add normal spoilage: 1,000 × $2.72 2,720 Costs of good units transferred out $84,320 Work in process: 4,000 × $2.72 10,880 Costs accounted for $95,200

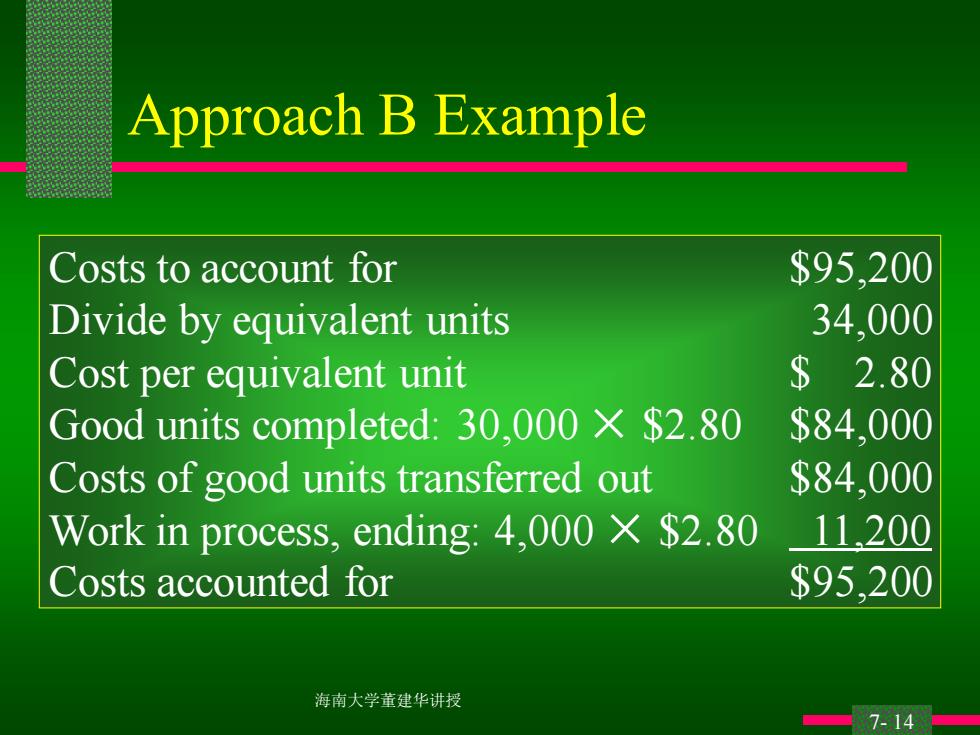

Approach B Example Costs to account for $95,200 Divide by equivalent units 34,000 Cost per equivalent unit $2.80 Good units completed:30,000 X $2.80 $84,000 Costs of good units transferred out $84,000 Work in process,ending:4,000 X $2.80 11.200 Costs accounted for $95,200 海南大学董建华讲授 14

海南大学董建华讲授 7- 14 Approach B Example Costs to account for $95,200 Divide by equivalent units 34,000 Cost per equivalent unit $ 2.80 Good units completed: 30,000 × $2.80 $84,000 Costs of good units transferred out $84,000 Work in process, ending: 4,000 × $2.80 11,200 Costs accounted for $95,200

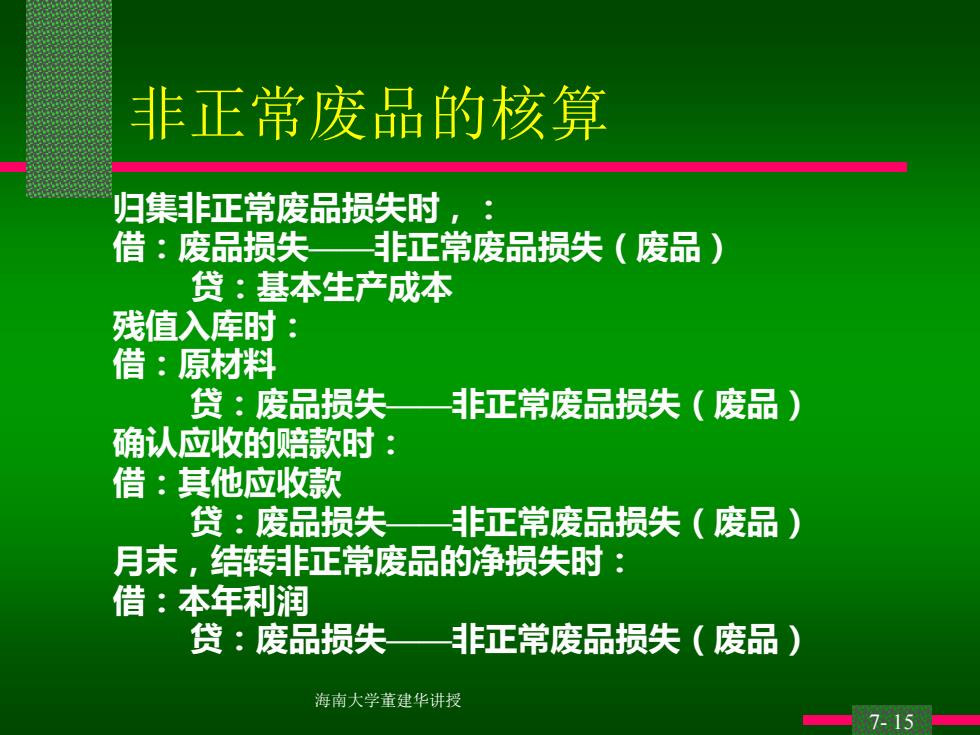

非正常废品的核算 归集非正常废品损失时,: 借:废品损失 非正常废品损失(废品) 贷:基本生产成本 残值入库时: 借:原材料 贷:废品损失 非正常废品损失(废品) 确认应收的赔款时: 借:其他应收款 贷:废品损失非正常废品损失(废品) 月末,结转非正常废品的净损失时: 借:本年利润 贷:废品损失一非正常废品损失(废品) 海南大学董建华讲授 ☐7-15

海南大学董建华讲授 7- 15 非正常废品的核算 归集非正常废品损失时,: 借:废品损失——非正常废品损失(废品) 贷:基本生产成本 残值入库时: 借:原材料 贷:废品损失——非正常废品损失(废品) 确认应收的赔款时: 借:其他应收款 贷:废品损失——非正常废品损失(废品) 月末,结转非正常废品的净损失时: 借:本年利润 贷:废品损失——非正常废品损失(废品)