Assume that the farmer sells the corn at $3 and the market goes up to$3.50.Since the cost of production is $2,the farmer has made $1 profit per bushel and is happy to have locked in the cost of production. The speculator who bought the $2contract and sold it at $3.50 has make money as well. The farmer may not have made the mos money possible,but has still made money and has had the option of buying back the contract well before it went to $3.50.In this case,both he buyer and the seller have made money. On a broader scales,the consumer or end use benefits as well,since producers or manufacturing firms that use the futures markets wisely can control their coss,thereby (hopefully)passing on some of the cost savings to the consumer

9 Assume that the farmer sells the corn at $3 and the market goes up to $3.50. Since the cost of production is $2, the farmer has made $1 profit per bushel and is happy to have locked in the cost of production. The speculator who bought the $2 contract and sold it at $3.50 has make money as well. The farmer may not have made the most money possible, but has still made money and has had the option of buying back the contract well before it went to $3.50. In this case, both the buyer and the seller have made money. On a broader scales, the consumer or end user benefits as well, since producers or manufacturing firms that use the futures markets wisely can control their costs, thereby (hopefully) passing on some of the cost savings to the consumer

Market Participants Four broad categories of market participants 5 minutes nfutures trading: Producer End User Speculator Floor Trader or Pit Broker Producer5 minutes This group of market participants manufactures,grows,mines,or otherwise produces the goods that re conracted for in a futures transaction.These goods can be anything from grain to livestock to Swiss francs to silver.The producer may be a seller of goods as well as a buyer. A farmer,for example,may sell soybean futures against his or her own production,but may also be a buyer or seller of petroleum futures to hedge the cost of fuel,or may also be a buyer o T Bond futures in order to hedge the cost of money to run the farming operation. End User This group often consists of manufacturers or 5 minutes large users of raw products.As an example,an automobile producer would be a buy hedger of items like copper,platinum,currencies,and perhaps other metals.This end user might also hedge in the interest rate markets to defray the cost of borrowing operating capital. Speculator The speculator is neither producer nor end 5 minutes user.The speculator can be either a buyer or a seller,depending on hisor her analysis of and orientation to the markets.The speculator is often willing to take a position contrary to the current market trend in the hope of making a profit 10

10 Market Participants 5 minutes Four broad categories of market participants in futures trading: Producer End User Speculator Floor Trader or Pit Broker Producer5 minutes This group of market participants manufactures, grows, mines, or otherwise produces the goods that are contracted for in a futures transaction. These goods can be anything from grain to livestock to Swiss francs to silver. The producer may be a seller of goods as well as a buyer. A farmer, for example, may sell soybean futures against his or her own production, but may also be a buyer or seller of petroleum futures to hedge the cost of fuel, or may also be a buyer or T Bond futures in order to hedge the cost of money to run the farming operation. End User 5 minutes This group often consists of manufacturers or large users of raw products. As an example, an automobile producer would be a buy hedger of items like copper, platinum, currencies, and perhaps other metals. This end user might also hedge in the interest rate markets to defray the cost of borrowing operating capital. Speculator 5 minutes The speculator is neither producer nor end user. The speculator can be either a buyer or a seller, depending on his or her analysis of and orientation to the markets. The speculator is often willing to take a position contrary to the current market trend in the hope of making a profit

Floor Trader or Pit Broker The purpose of the floor broker is to facilitate minutes the transactions between buyers and sellers by matching buy and sell orders.Often the floor broker takes the role ofa speculator;but most often the floor broker merely fills orders.Due to the advent oforder matching.the floor trader may bea vanishing breed. Price Risk Price risk occurs as a result of time 5 minutes intervention in a transaction. Conditions:drought,flood,war,political upheaval,storms Intense competition Seasonal harvest and seasonal demand.In short,Time and unpredictable circumstances The Early History of the In medieval Europe,fair letters were the crude Futures Contract in Europe forerunners of the modern futures contract. and Japan The first recorded example of actual fuures trading occurred in Japan in 1697. Dojima Rice Market-the world's first futures market-where speculators traded the certificates ofreceipt,which were actually contracts for the future delivery of riceIn 848.the Chicago Board of Trade was established as a place where grain merchants could meet and attempt to solve some of the problems they encountered. By 1865 the Chicago Board of Trade had established standards for contract size,quality. and delivery as well as a set of rules for trading contracts. The History of the Futures Zhengzhou Commodity Exchange(ZCE),the Contract in China first futures market in China,was established on 5minutes October 12th,1990.ZCE started futures trading

11 Floor Trader or Pit Broker5 minutes The purpose of the floor broker is to facilitate the transactions between buyers and sellers by matching buy and sell orders. Often the floor broker takes the role of a speculator; but most often the floor broker merely fills orders. Due to the advent of electronic order matching, the floor trader may be a vanishing breed. Price Risk 5 minutes Price risk occurs as a result of time intervention in a transaction. Conditions: drought, flood, war, political upheaval, storms. Intense competition Seasonal harvest and seasonal demand.In short, Time and unpredictable circumstances The Early History of the Futures Contract in Europe and Japan In medieval Europe, fair letters were the crude forerunners of the modern futures contract. The first recorded example of actual futures trading occurred in Japan in 1697. Dojima Rice Market– the world’s first futures market– where speculators traded the certificates of receipt, which were actually contracts for the future delivery of rice In 1848, the Chicago Board of Trade was established as a place where grain merchants could meet and attempt to solve some of the problems they encountered. By 1865 the Chicago Board of Trade had established standards for contract size, quality, and delivery, as well as a set of rules for trading contracts. The History of the Futures Contract in China 5 minutes Zhengzhou Commodity Exchange (ZCE), the first futures market in China, was established on October 12th, 1990. ZCE started futures trading

on May 28th,1993 with 5 commodities listed.Dalian Commodity Exchange (DCE)is non-profit membership legal entity authorize by the State Council,examined by the China Securities Regulatory Commission and Registered in the State Administration for industry&Commerce. DCE was founded on February 1993.and began futures trading on November 18 in the same year. Shanghai takes the lead in establishing a futures market.During a market shake-up in 1995.Shanghai Metal Exchange,Shangha Cereals&Oils Exchange and Shanghai Commodity Exchange which originated from a merger of petroleum,building materials, agricultural,chemical exchanges were launche as pilot futures exchanges. Consistent with a request issued by the State Council in August 1998 on further consolidation of futures market,and under the centralized regulation of China Securities Regulatory Commission,the three exchanges were conglomerated as Shanghai Futures Exchange that started its formal operation in Dec.1999. Regulation of the Futures The earliest government regulation of futures Industry 3 minutes trading in the United States occurred in1916 vith the enactment of the Cotton Futures Act. In 1922 with the Grain Futures Act,which was amended in the 1930s and changed to the Commodity Exchange Act. Mr.Shang Fulin Mr.Shang Fulin was born in November 1951 CHAIRMAN OF CHINA into a family of Han 12

12 on May 28th, 1993 with 5 commodities listed. Dalian Commodity Exchange (DCE) is a non-profit membership legal entity authorized by the State Council, examined by the China Securities Regulatory Commission and Registered in the State Administration for industry & Commerce. DCE was founded on February 28, 1993, and began futures trading on November 18 in the same year. Shanghai takes the lead in establishing a futures market. During a market shake-up in 1995, Shanghai Metal Exchange, Shanghai Cereals & Oils Exchange and Shanghai Commodity Exchange which originated from a merger of petroleum, building materials, agricultural, chemical exchanges were launched as pilot futures exchanges. Consistent with a request issued by the State Council in August 1998 on further consolidation of futures market, and under the centralized regulation of China Securities Regulatory Commission, the three exchanges were conglomerated as Shanghai Futures Exchange that started its formal operation in Dec.1999. Regulation of the Futures Industry 3 minutes The earliest government regulation of futures trading in the United States occurred in 1916 with the enactment of the Cotton Futures Act. In 1922 with the Grain Futures Act, which was amended in the 1930s and changed to the Commodity Exchange Act. Mr. Shang Fulin CHAIRMAN OF CHINA Mr. Shang Fulin was born in November 1951 into a family of Han ethnic origin

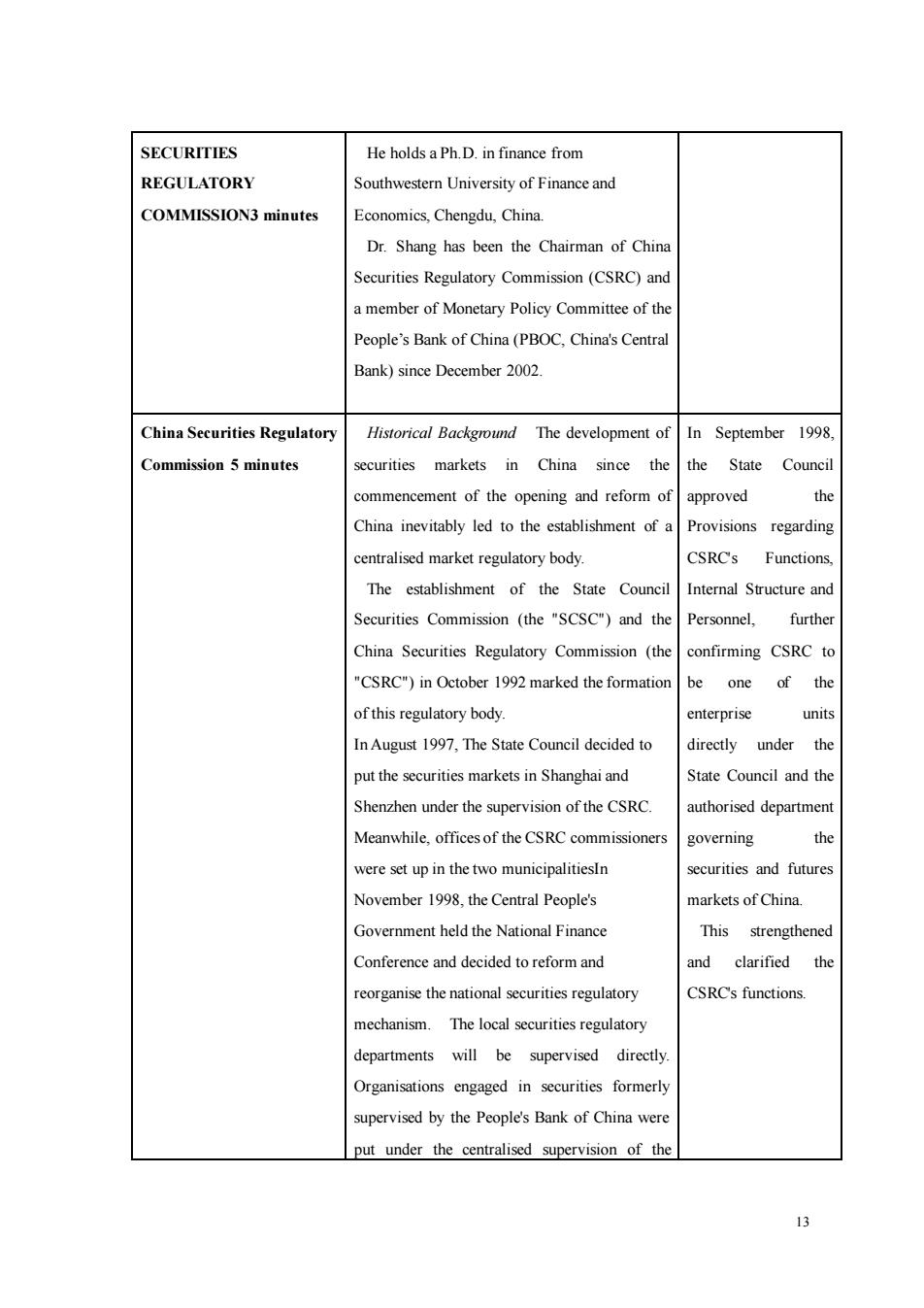

SECURITIES He holds a Ph.D.in finance from REGULATORY Southwestern University of Finance and COMMISSION3 minutes Economics,Chengdu,China. Dr.Shang has been the Chairman of China Securities Regulatory Commission (CSRC)and a member of Monetary Policy Committee of the People's Bank of China (PBOC,China's Central Bank)since December 2002. China Securities Regulatory Historical Background The development of In September 1998. Commission 5minutes securities markets in China since the the State Council commencement of the opening and reformof approved the China inevitably led to the establishment of a Provisions regarding centralised market regulatory body. CSRCs Functions, The establishment of the State Council Internal Structure and Securities Commission (the "SCSC")and the Personnel,further China Securities Regulatory Commission(the confirming CSRC to "CSRC)in October 1992 marked the formation be one of the of this regulatory body. enterprise units In August 1997.The State Council decided to directly under the put the securities markets in Shanghai and State Council and the Shenzhen under the supervision of the CSRC authorised department Meanwhile,officesof the CSRC commissioners governing the were set up in the two municipalitiesIn securities and futures November 1998,the Central People's markets of China. Government held the National Finance This strengthened Conference and decided to reform and and clarified the reorganis the national regulatory CSRCs functions. mechanism.The local securities regulatory departments will be supervised directly Organisations engaged in securities formerly supervised by the People's Bank of China were put under the centralised supervision of the 13

13 SECURITIES REGULATORY COMMISSION3 minutes He holds a Ph.D. in finance from Southwestern University of Finance and Economics, Chengdu, China. Dr. Shang has been the Chairman of China Securities Regulatory Commission (CSRC) and a member of Monetary Policy Committee of the People’s Bank of China (PBOC, China's Central Bank) since December 2002. China Securities Regulatory Commission 5 minutes Historical Background The development of securities markets in China since the commencement of the opening and reform of China inevitably led to the establishment of a centralised market regulatory body. The establishment of the State Council Securities Commission (the "SCSC") and the China Securities Regulatory Commission (the "CSRC") in October 1992 marked the formation of this regulatory body. In August 1997, The State Council decided to put the securities markets in Shanghai and Shenzhen under the supervision of the CSRC. Meanwhile, offices of the CSRC commissioners were set up in the two municipalitiesIn November 1998, the Central People's Government held the National Finance Conference and decided to reform and reorganise the national securities regulatory mechanism. The local securities regulatory departments will be supervised directly. Organisations engaged in securities formerly supervised by the People's Bank of China were put under the centralised supervision of the In September 1998, the State Council approved the Provisions regarding CSRC's Functions, Internal Structure and Personnel, further confirming CSRC to be one of the enterprise units directly under the State Council and the authorised department governing the securities and futures markets of China. This strengthened and clarified the CSRC's functions