The Impact of Uncertainty on Network Design Supply chain design decisions include investments in number and size of plants,number of trucks,number of warehouses These decisions cannot be easily changed in the short-term There will be a good deal of uncertainty in demand, prices,exchange rates,and the competitive market over the lifetime of a supply chain network Therefore,building flexibility into supply chain operations allows the supply chain to deal with uncertainty in a manner that will maximize profits SEIEE AU406 6-11

+ - SEIEE AU406 The Impact of Uncertainty on Network Design Supply chain design decisions include investments in number and size of plants, number of trucks, number of warehouses These decisions cannot be easily changed in the short- term There will be a good deal of uncertainty in demand, prices, exchange rates, and the competitive market over the lifetime of a supply chain network Therefore, building flexibility into supply chain operations allows the supply chain to deal with uncertainty in a manner that will maximize profits 6-11

Discounted Cash Flow Analysis What is your choice of the following options: √Receive$100now Receive $100 one month later Supply chain decisions are in place for a long time,so they should be evaluated as a sequence of cash flows over that period Discounted cash fow(DCF)analysis evaluates the present value of any stream of future cash flows and allows managers to compare different cash flow streams in terms of their financial value Based on the time value of money -a dollar today is worth more than a dollar tomorrow SEIEE AU406 6-12

+ - SEIEE AU406 Discounted Cash Flow Analysis Supply chain decisions are in place for a long time, so they should be evaluated as a sequence of cash flows over that period Discounted cash flow (DCF) analysis evaluates the present value of any stream of future cash flows and allows managers to compare different cash flow streams in terms of their financial value Based on the time value of money – a dollar today is worth more than a dollar tomorrow 6-12 What is your choice of the following options: Receive $100 now Receive $100 one month later

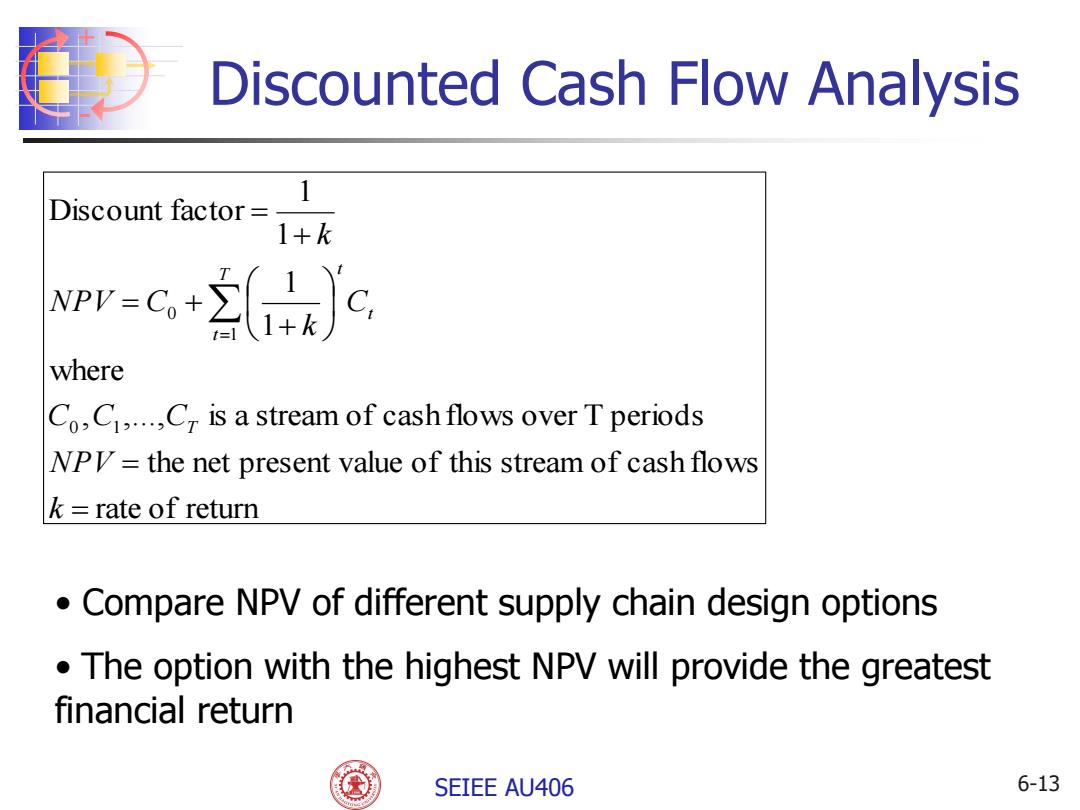

Discounted Cash Flow Analysis Discount factor= 1+k wPV-Cc where Co.C..C is a stream of cash flows over T periods NPI=the net present value of this stream of cash flows k=rate of return Compare NPV of different supply chain design options The option with the highest NPV will provide the greatest financial return SEIEE AU406 6-13

+ - SEIEE AU406 Discounted Cash Flow Analysis rate o f return the net present value o f this stream o f cash flows , ,..., is a stream o f cash flows over T periods where 1 1 1 1 Discount factor 0 1 1 0 k NPV C C C C k NPV C k T T t t t • Compare NPV of different supply chain design options • The option with the highest NPV will provide the greatest financial return 6-13

NPV Example:Trips Logistics How much space to lease in the next three years? Demand =100,000 units Requires 1,000 sq.ft.of space for every 1,000 units of demand(1 unit/sq.ft) Revenue $1.22 per unit of demand Decision is whether to sign a three-year lease or obtain warehousing space on the spot market Three-year lease:cost $1 per sq.ft. Spot market:cost =$1.20 per sq.ft. k=0.1 Question:Sign a three-year lease or lease in spot market every year? SEIEE AU406 6-14

+ - SEIEE AU406 NPV Example: Trips Logistics How much space to lease in the next three years? Demand = 100,000 units Requires 1,000 sq. ft. of space for every 1,000 units of demand(1 unit/ sq.ft) Revenue = $1.22 per unit of demand Decision is whether to sign a three-year lease or obtain warehousing space on the spot market Three-year lease: cost = $1 per sq. ft. Spot market: cost = $1.20 per sq. ft. k = 0.1 Question: Sign a three-year lease or lease in spot market every year? 6-14

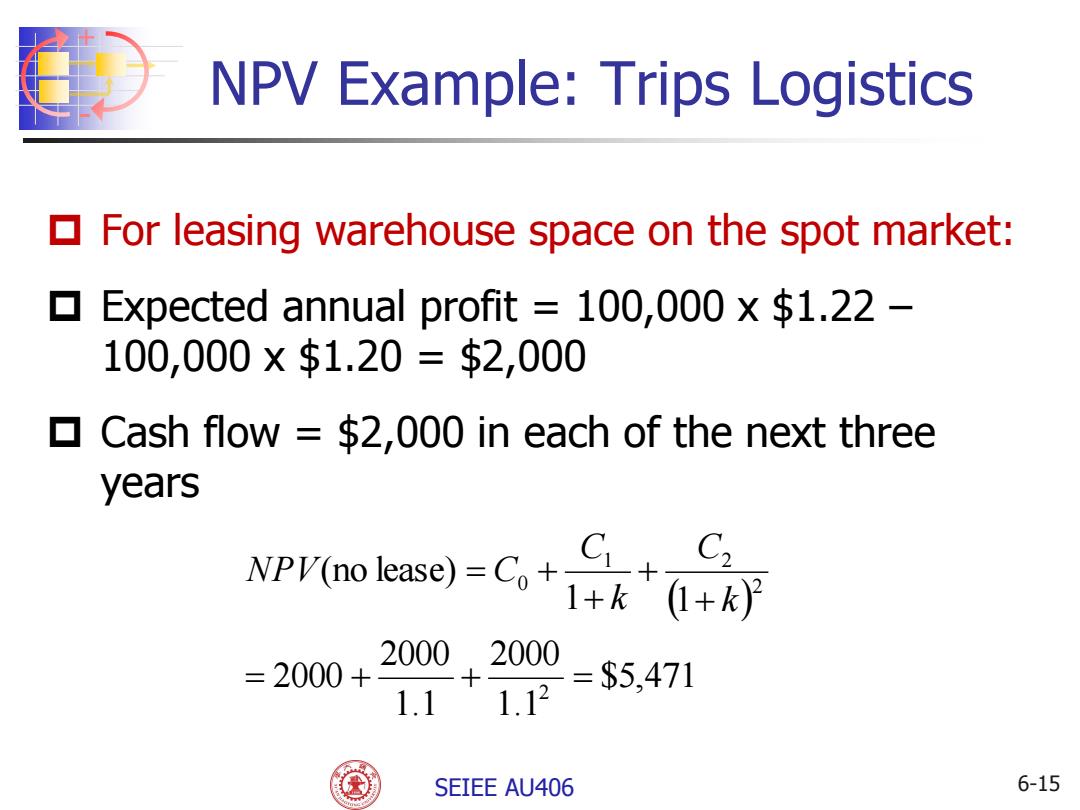

NPV Example:Trips Logistics For leasing warehouse space on the spot market: Expected annual profit 100,000 x $1.22- 100,000×$1.20=$2,000 Cash flow =$2,000 in each of the next three years wOm-G+台+ar =2000+ 2000, 2000 $5,471 1.1 1.12 SEIEE AU406 6-15

+ - SEIEE AU406 NPV Example: Trips Logistics For leasing warehouse space on the spot market: Expected annual profit = 100,000 x $1.22 – 100,000 x $1.20 = $2,000 Cash flow = $2,000 in each of the next three years $5,471 1.1 2000 1.1 2000 2000 1 1 (no lease) 2 2 1 2 0 k C k C NPV C 6-15