JIAOTONG UNIVERSITY 196 Supply Chain Management Lecture 4 Supply Chain Drivers and Metrics Instructor(s) Prof.Jianjun Gao Department of Automation School of Electronic Information and Electrical Engineering SCM by J.J.Gao SEIEE AU406

Supply Chain Management Instructor(s) SEIEE AU406 + - SCM by J. J. Gao Supply Chain Drivers and Metrics Prof. Jianjun Gao Department of Automation School of Electronic Information and Electrical Engineering Lecture 4

Outline Financial Measure of the Performance Drivers of supply chain performance A framework for structuring drivers Facilities Inventory Transportation Information Sourcing Pricing SEIEE AU406 3-2

+ - SEIEE AU406 3-2 Outline Financial Measure of the Performance Drivers of supply chain performance A framework for structuring drivers Facilities Inventory Transportation Information Sourcing Pricing

Financial Measure of the Performance Recall that growing the supply chain surplus is the ultimate goal of a supply chain management a In the following part,we define important financial measures that are reported by a firm and impacted by supply chain performance In later sections,we then link supply chain drivers and associated metrics to the various financial measures SEIEE AU406 3

+ - SEIEE AU406 Financial Measure of the Performance Recall that growing the supply chain surplus is the ultimate goal of a supply chain management In the following part, we define important financial measures that are reported by a firm and impacted by supply chain performance In later sections, we then link supply chain drivers and associated metrics to the various financial measures 3

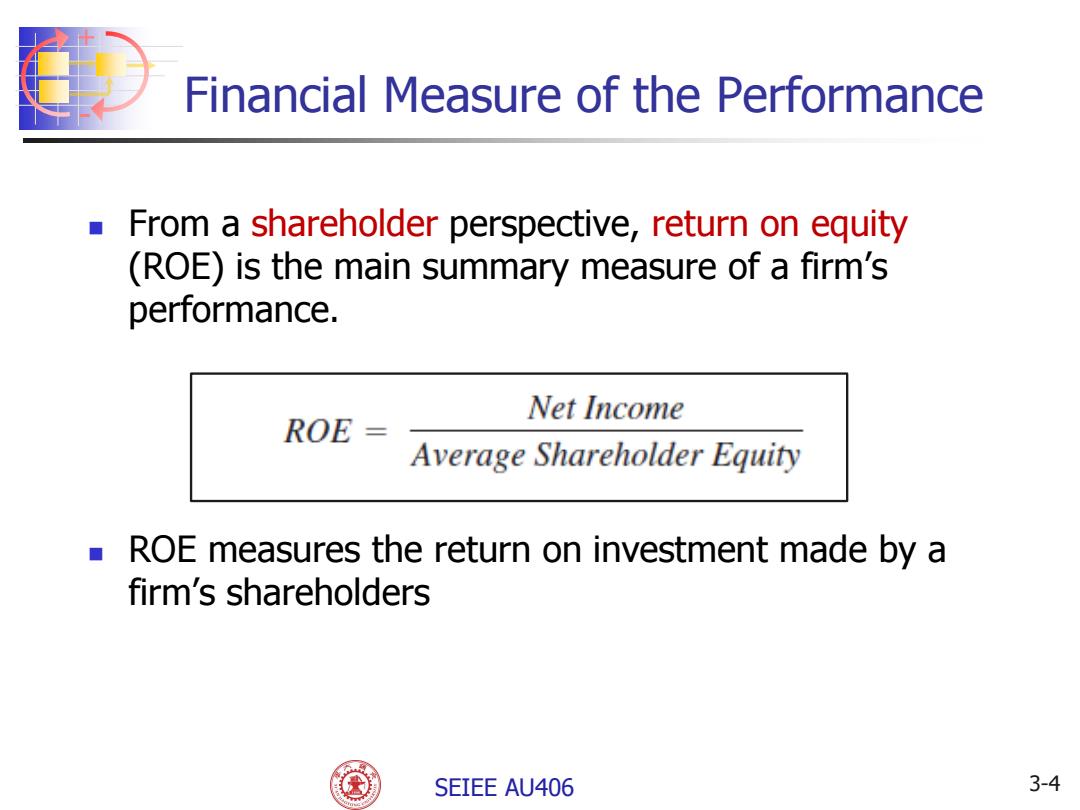

Financial Measure of the Performance ■ From a shareholder perspective,return on equity (ROE)is the main summary measure of a firm's performance. Net Income ROE= Average Shareholder Equity ROE measures the return on investment made by a firm's shareholders SEIEE AU406 3-4

+ - SEIEE AU406 From a shareholder perspective, return on equity (ROE) is the main summary measure of a firm’s performance. 3-4 Financial Measure of the Performance ROE measures the return on investment made by a firm’s shareholders

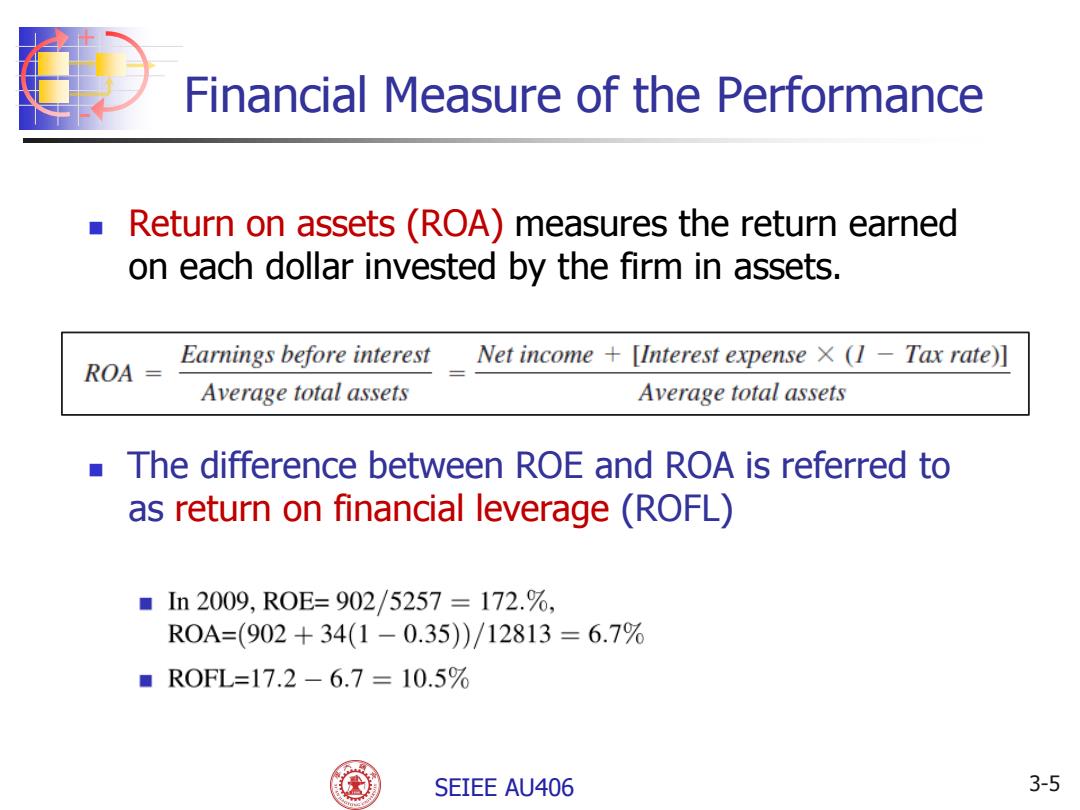

Financial Measure of the Performance Return on assets(ROA)measures the return earned on each dollar invested by the firm in assets. Earnings before interest Net income [Interest expense x (1 -Tax rate)] ROA Average total assets Average total assets The difference between ROE and ROA is referred to as return on financial leverage (ROFL) ■In2009,R0E=902/5257=172.%, R0A=(902+34(1-0.35)/12813=6.7% ■R0FL=17.2-6.7=10.5% SEIEE AU406 3-5

+ - SEIEE AU406 Return on assets (ROA) measures the return earned on each dollar invested by the firm in assets. 3-5 Financial Measure of the Performance The difference between ROE and ROA is referred to as return on financial leverage (ROFL)