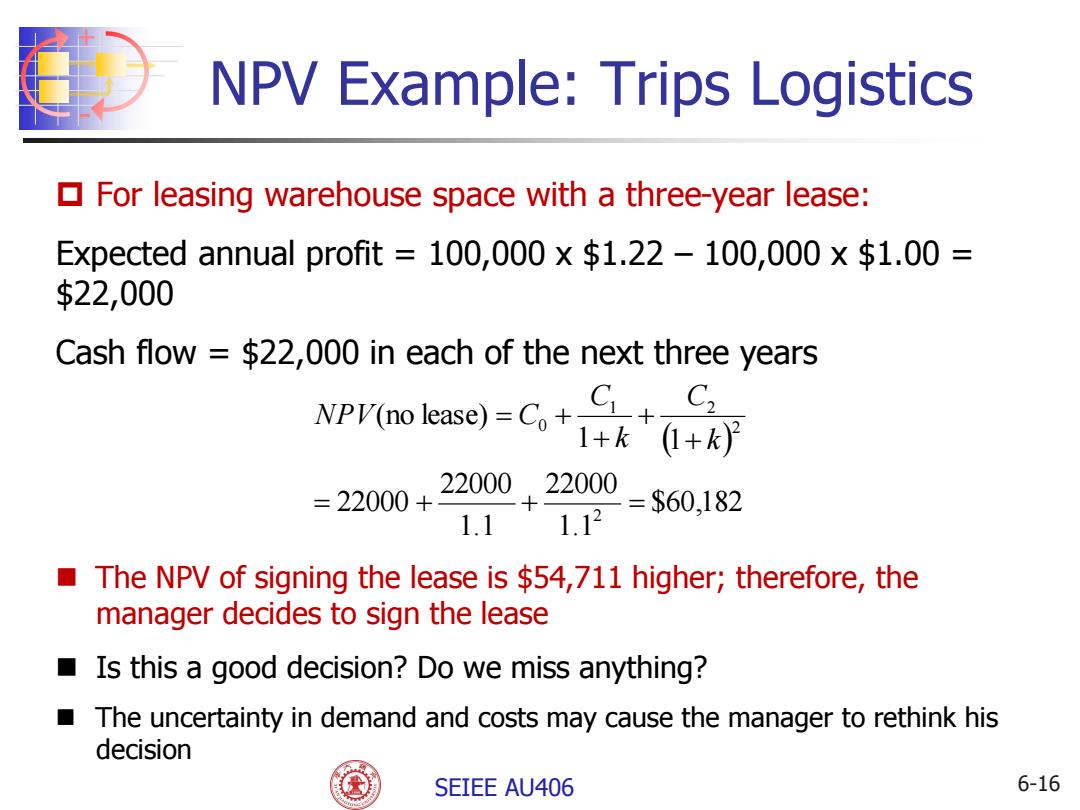

NPV Example:Trips Logistics For leasing warehouse space with a three-year lease: Expected annual profit 100,000 x $1.22-100,000 x $1.00= $22,000 Cash flow $22,000 in each of the next three years NPV(no lease)=Co+ C1,C2 1+k (1+k)2 =22000+ 22000,22000 =$60,182 1.1 1.12 The NPV of signing the lease is $54,711 higher;therefore,the manager decides to sign the lease ■ Is this a good decision?Do we miss anything? The uncertainty in demand and costs may cause the manager to rethink his decision SEIEE AU406 6-16

+ - SEIEE AU406 NPV Example: Trips Logistics For leasing warehouse space with a three-year lease: Expected annual profit = 100,000 x $1.22 – 100,000 x $1.00 = $22,000 Cash flow = $22,000 in each of the next three years $60,182 1.1 22000 1.1 22000 22000 1 1 (no lease) 2 2 1 2 0 k C k C NPV C The NPV of signing the lease is $54,711 higher; therefore, the manager decides to sign the lease Is this a good decision? Do we miss anything? The uncertainty in demand and costs may cause the manager to rethink his decision 6-16

Representations of Uncertainty Binomial Representation of Uncertainty Other Representations of Uncertainty SEIEE AU406 6-17

+ - SEIEE AU406 Representations of Uncertainty Binomial Representation of Uncertainty Other Representations of Uncertainty 6-17