對酥竹贸易本孝 1951 Chapter 3 Managing Noninterest Income and Noninterest Expense

Chapter 3 Chapter 3 Managing Managing Noninterest Noninterest Income and Income and Noninterest Noninterest Expense Expense

Trend of Non-interest income A common view among bank managers and analysts is that banks must rely less on net interest income and more on noninterest income to be more successful. The highest earning banks will be those that generate an increasing share of operating revenue from noninterest sources. The fundamental issue among managers is to determine the appropriate customer mix and business mix to grow profits at high rates, with a strong focus on fee-based revenues. 麓行贺影≠考

Trend of Non Trend of Non-interest income interest income A common view among bank managers and analysts is that banks must rely less on net interest income and more on noninterest income to be more successful. The highest earning banks will be those that generate an increasing share of operating revenue from noninterest sources. The fundamental issue among managers is to determine the appropriate customer mix and business mix to grow profits at high rates, with a strong focus on fee-based revenues

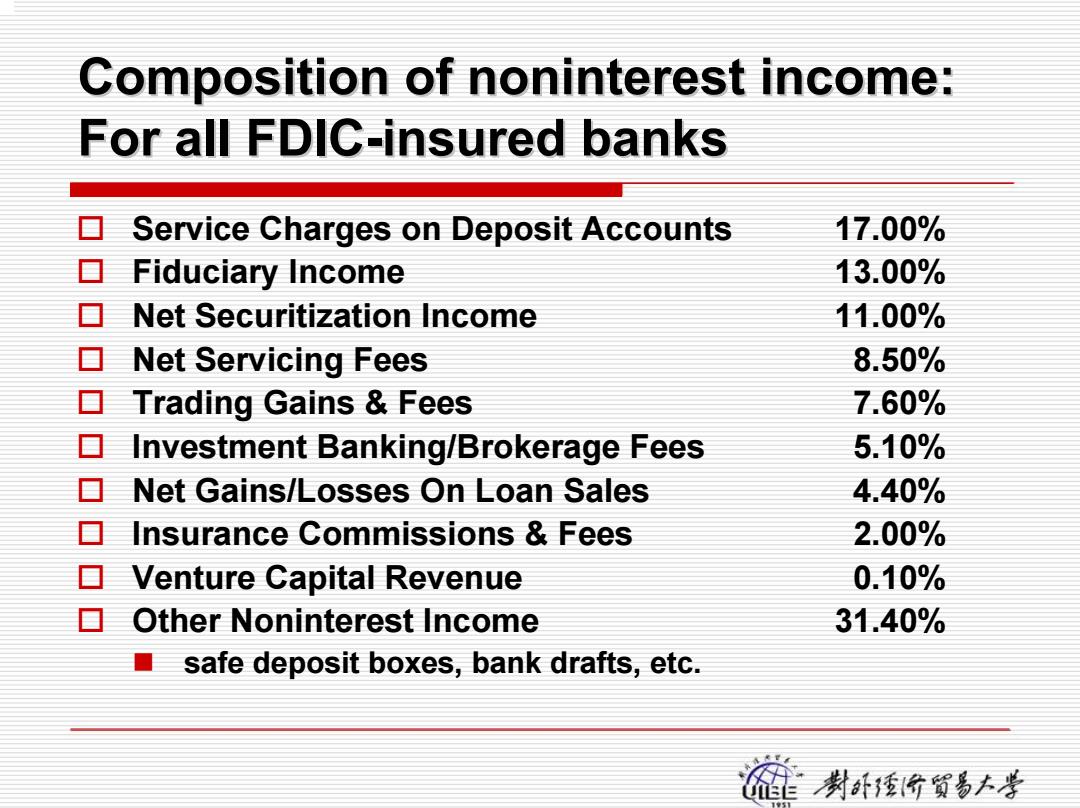

Composition of noninterest income: For all FDIC-insured banks Service Charges on Deposit Accounts 17.00% ▣Fiduciary Income 13.00% Net Securitization Income 11.00% ▣Net Servicing Fees 8.50% ▣Trading Gains&Fees 7.60% Investment Banking/Brokerage Fees 5.10% Net Gains/Losses On Loan Sales 4.40% Insurance Commissions Fees 2.00% Venture Capital Revenue 0.10% Other Noninterest Income 31.40% safe deposit boxes,bank drafts,etc. 碰喇酥价贸易大孝

Composition of Composition of noninterest noninterest income: income: For all FDIC For all FDIC -insured banks insured banks Service Charges on Deposit Accounts 17.00% Fiduciary Income 13.00% Net Securitization Income 11.00% Net Servicing Fees 8.50% Trading Gains & Fees 7.60% Investment Banking/Brokerage Fees 5.10% Net Gains/Losses On Loan Sales 4.40% Insurance Commissions & Fees 2.00% Venture Capital Revenue 0.10% Other Noninterest Income 31.40% safe deposit boxes, bank drafts, etc

Non-interest income in large banks v.s.small banks Increasing amount of fees from investment banking and brokerage activities at the larger banks. Investment and brokerage activities contribute a far greater portion of noninterest income at the largest banks. ■ This explains why noninterest income is a much higher fraction of their operating revenue. These fees are highly cyclical in nature and depend on the capital markets. In late 1998,many large banks reported large trading losses on activities in Russia and Asia. Community banks generated most of their noninterest income from deposit account fees,trust fees,mortgage fees,insurance product fees and commissions and investment product fees. 制酥价贸号大孝

Non-interest income in interest income in large banks v.s. small banks large banks v.s. small banks Increasing amount of fees from investment banking and brokerage activities at the larger banks. Investment and brokerage activities contribute a far greater portion of noninterest income at the largest banks. This explains why noninterest income is a much higher fraction of their operating revenue. These fees are highly cyclical in nature and depend on the capital markets. In late 1998, many large banks reported large trading losses on activities in Russia and Asia. Community banks generated most of their noninterest income from deposit account fees, trust fees, mortgage fees, insurance product fees and commissions and investment product fees

Less on net interest income and more on noninterest income 目 The highest earning banks will be those that generate an increasing share of operating revenue from noninterest sources. A related assumption is that not all fees are created equal. Some fees are stable and predictable over time,while others are highly volatile because they derive from cyclical activities. 目 The fundamental issue among managers is to determine the appropriate customer mix and business mix to grow profits at high rates, with a strong focus on fee-based revenues. 碰封酥价贸易大孝

Less on Less on net interest income net interest income and more and more on noninterest noninterest income The highest earning banks will be those that generate an increasing share of operating revenue from noninterest sources. A related assumption is that not all fees are created equal. Some fees are stable and predictable over time, while others are highly volatile because they derive from cyclical activities. The fundamental issue among managers is to determine the appropriate customer mix and business mix to grow profits at high rates, with a strong focus on fee-based revenues