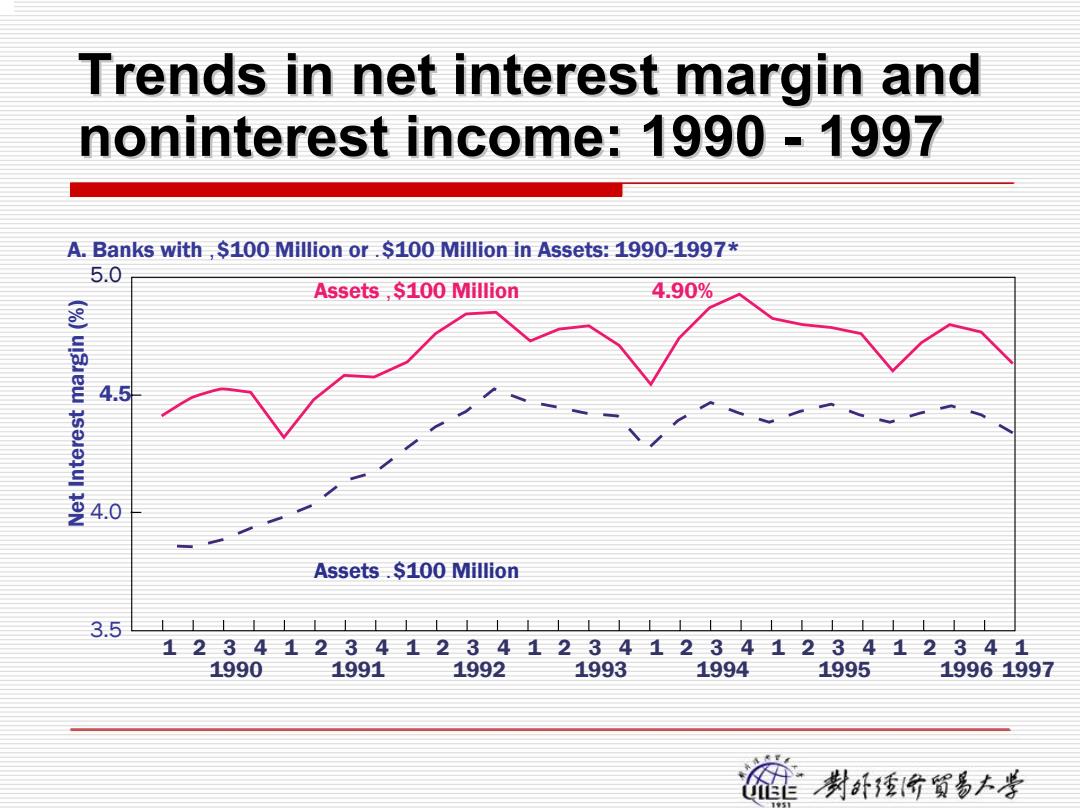

Trends in net interest margin and noninterest income:1990 -1997 A.Banks with,$100 Million or.$100 Million in Assets:1990-1997* 5.0 Assets,$100 Million 4.90% 4.5 4.0 Assets.$100 Million 3.5 ⊥1111上⊥1上11⊥1 12341234123412341234123412341 1990 1991 1992 1993 1994 1995 19961997 猫行贺影小号

Trends in net interest margin and Trends in net interest margin and noninterest noninterest income: 1990 income: 1990 - 1997 1 3.5 4.0 4.5 5.0 1990 1991 1992 1993 1994 1995 1996 1997 Assets ,$100 Million Assets .$100 Million 4.90% Net Interest margin (%) A. Banks with ,$100 Million or .$100 Million in Assets: 1990-1997* 234123412341234 1234123412341

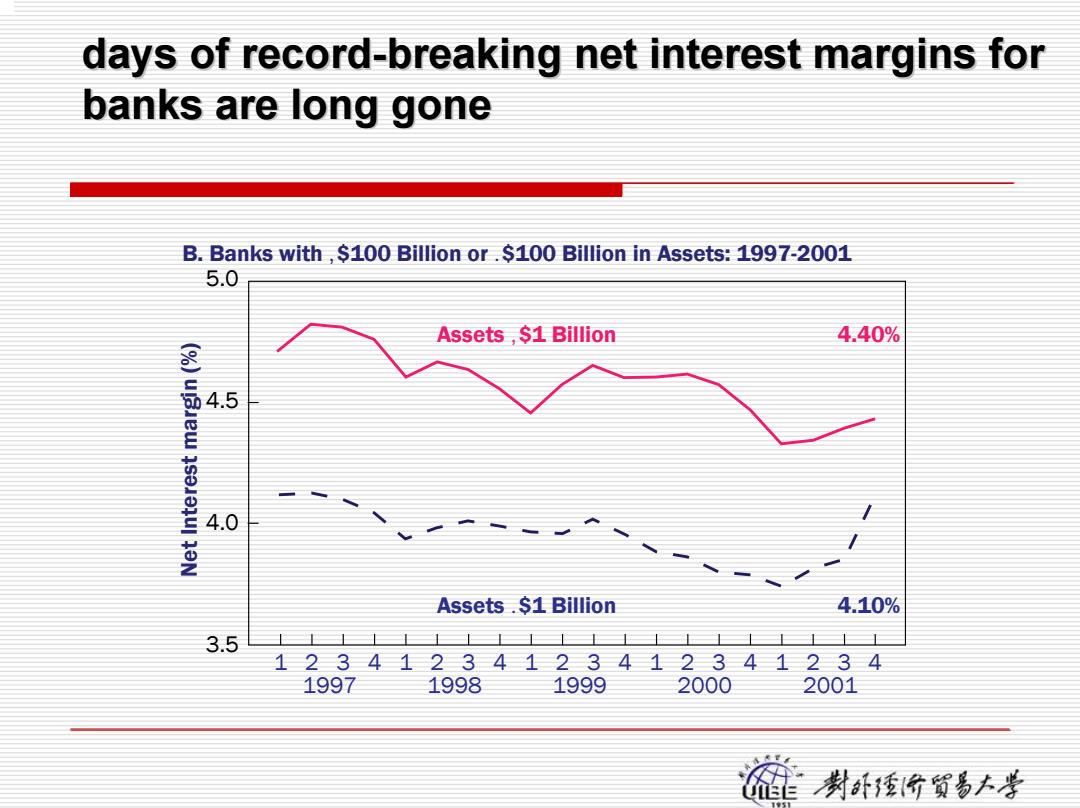

days of record-breaking net interest margins for banks are long gone B.Banks with,$100 Billion or.$100 Billion in Assets:1997-2001 5.0 Assets $1 Billion 4.40% 4.5 4.0 Assets.$1 Billion 4.10% 3.5 12341234123412341234 1997 1998 1999 2000 2001 麓竹贺影小号

days of record days of record-breaking net interest margins for breaking net interest margins for banks are long gone banks are long gone 1 3.5 4.0 4.5 5.0 1997 1998 1999 2000 2001 Assets ,$1 Billion Assets .$1 Billion 4.40% 4.10% Net Interest margin (%) B. Banks with ,$100 Billion or .$100 Billion in Assets: 1997-2001 234123412341234 123 4

Pressure on margins 目 The growth in inexpensive,core deposits at banks has slowed because customers have many alternatives,such as mutual funds and cash management accounts,that offer similar transactions and savings services and pay higher Loan yields have similarly fallen on a relative basis because of competition from nonbank lenders,such as commercial and consumer finance companies and leasing companies, and other banks that compete for the most profitable small business loans,credit card receivables,and so on. 的资5土号

Pressure on margins Pressure on margins The growth in inexpensive, core deposits at banks has slowed because customers have many alternatives, such as mutual funds and cash management accounts, that offer similar transactions and savings services and pay higher Loan yields have similarly fallen on a relative basis because of competition from nonbank lenders, such as commercial and consumer finance companies and leasing companies, and other banks that compete for the most profitable small business loans, credit card receivables, and so on

Over-reliance on net interest margin? Potential earnings difficulties are compounded by the fact that asset quality was quite strong during the late 1990s,such that loan loss provisions were low and not likely to show much improvement. Problem loans are often made at the peak or end of the business cycle. ■ The U.S.economy fell into a modest recession in March 2001,around which loan quality worsened. The impact is that banks must grow their noninterest income relative to noninterest expense if they want to see net income grow. 爸封强的黄香+孝

Over-reliance on net interest margin? reliance on net interest margin? Potential earnings difficulties are compounded by the fact that asset quality was quite strong during the late 1990s, such that loan loss provisions were low and not likely to show much improvement. Problem loans are often made at the peak or end of the business cycle. The U.S. economy fell into a modest recession in March 2001, around which loan quality worsened. The impact is that banks must grow their noninterest income relative to noninterest expense if they want to see net income grow

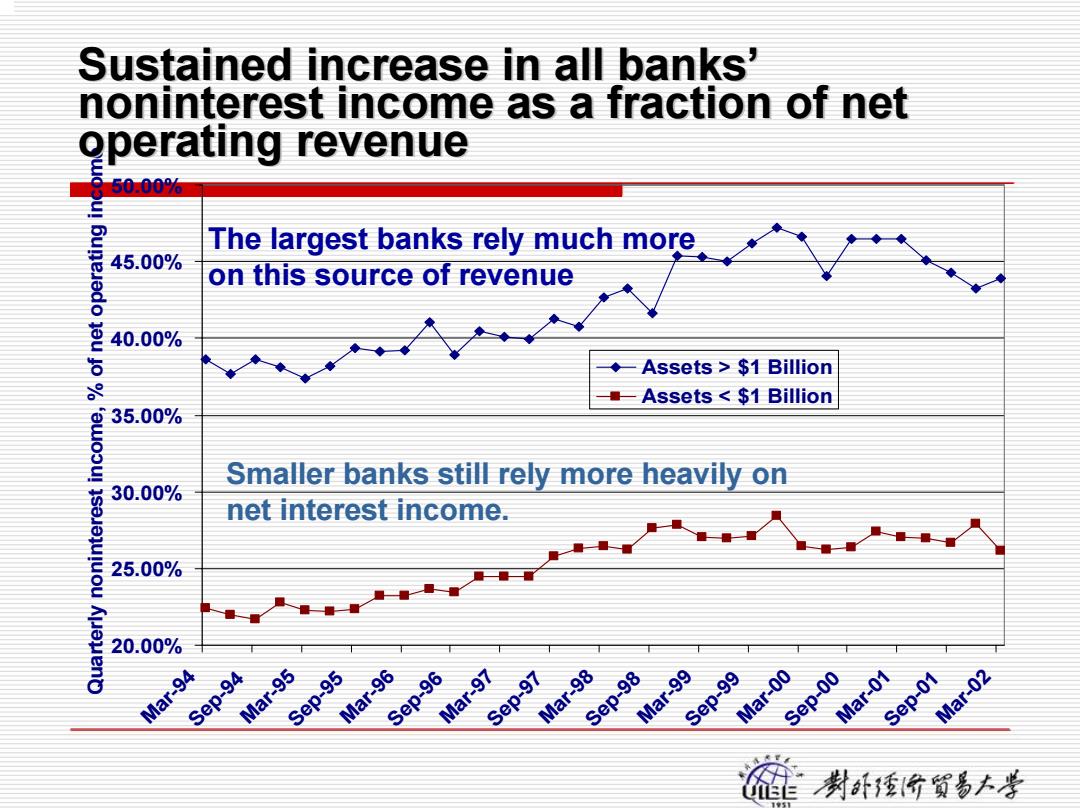

Sustained increase in all banks' noninterest income as a fraction of net operating revenue 50.00% 50% The largest banks rely much more on this source of revenue 40.0% ◆-Assets>$1 Billion 8 一 Assets $1 Billion 350 Smaller banks still rely more heavily on 30.00% net interest income. 25.00% 20.00% Mar-94 Sep-94 Mar-95 Sep-95 Mar-96 Sep-96 Mar-97 Sep-97 Mar-98 Sep-98 Mar-99 Sep-99 Mar-00 Sep-00 Mar-01 Sep-01 Mar-02

20.00% 25.00% 30.00% 35.00% 40.00% 45.00% 50.00% Mar-94 Sep-94 Mar-95 Sep-95 Mar-96 Sep-96 Mar-97 Sep-97 Mar-98 Sep-98 Mar-99 Sep-99 Mar-00 Sep-00 Mar-01 Sep-01 Mar Q -02 uarterly noninterest income, % of net operating income Assets > $1 Billion Assets < $1 Billion Sustained increase in all banks Sustained increase in all banks’ noninterest noninterest income as a fraction of net income as a fraction of net operating revenue operating revenue The largest banks rely much more on this source of revenu e Smaller banks still rely more heavily on net interest income