對酥竹贸易木学 1951 Chapter 11 Evaluating Consumer Loans

Chapter 11 Chapter 11 Evaluating Consumer Evaluating Consumer Loans

Recent trends in consumer lending ▣Credit scoring more lenders use statistical models to predict which individuals are good and bad credit risks. Rapid consolidation of the credit card business ■ at year-end 1997,for example,the 10 largest bank card issuers held approximately 85%of all credit card loans. 碰封酥价贸易大孝

Recent trends in consumer Recent trends in consumer lending lending Credit scoring more lenders use statistical models to predict which individuals are good and bad credit risks. Rapid consolidation of the credit card business at year-end 1997, for example, the 10 largest bank card issuers held approximately 85% of all credit card loans

Evaluating consumer loans When evaluating consumer loan requests,an analyst addresses the same issues discussed with commercial loans: the use of loan proceeds, the amount needed, the primary and secondary source of repayment. 麓的贫香小手

Evaluating consumer loans Evaluating consumer loans When evaluating consumer loan requests, an analyst addresses the same issues discussed with commercial loans: the use of loan proceeds, the amount needed, the primary and secondary source of repayment

Installment loans Installment loans require the periodic payment of principal and interest. Installment loans may be either direct or indirect loans. A direct loan is negotiated between the bank and the ultimate user of the funds. An indirect loan is funded by a bank through a separate retailer that sells merchandise to a customer. 麓的贫香小手

Installment loans Installment loans Installment loans require the periodic payment of principal and interest. Installment loans may be either direct or indirect loans. A direct loan is negotiated between the bank and the ultimate user of the funds. An indirect loan is funded by a bank through a separate retailer that sells merchandise to a customer

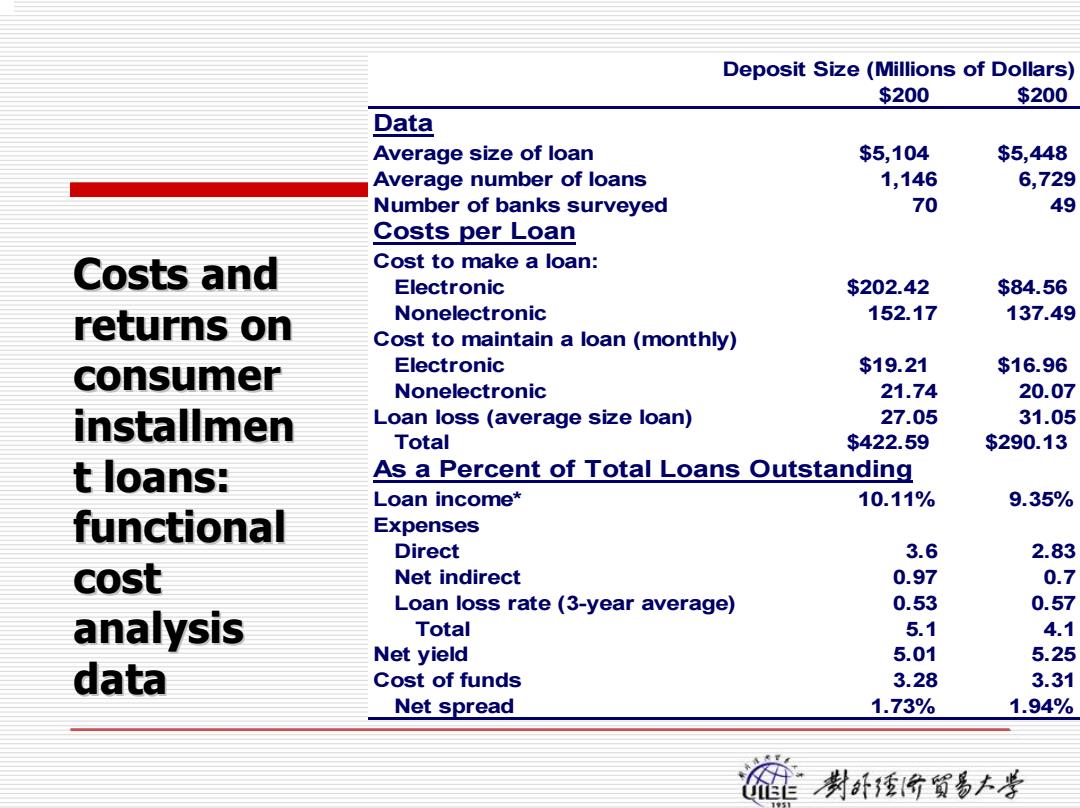

Deposit Size(Millions of Dollars) $200 $200 Data Average size of loan $5,104 $5,448 Average number of loans 1,146 6,729 Number of banks surveyed 70 49 Costs per Loan Costs and Cost to make a loan: Electronic $202.42 $84.56 returns on Nonelectronic 152.17 137.49 Cost to maintain a loan(monthly) consumer Electronic $19.21 $16.96 Nonelectronic 21.74 20.07 installmen Loan loss (average size loan) 27.05 31.05 Total $422.59 $290.13 t loans: As a Percent of Total Loans Outstanding Loan income* 10.11% 9.35% functional Expenses Direct 3.6 2.83 cost Net indirect 0.97 0.7 Loan loss rate(3-year average) 0.53 0.57 analysis Total 5.1 4.1 Net yield 5.01 5.25 data Cost of funds 3.28 3.31 Net spread 1.73% 1.94% 制委价贸易土孝

$200 $200 Da t a Average si z e o f l oan $5, 104 $5,448 Average number of l oans 1,146 6,729 N u m ber o f banks surveyed 70 49 C o s ts per Loa n C ost t o make a l oan: Elect r o nic $202.42 $84.56 N onelect r o nic 152. 1 7 137.49 C o s t t o m ain t ain a lo a n ( m o n t hly) Elect r o nic $19.21 $16.96 N onelect r o nic 21.74 20.07 L o a n l oss (average si z e l oan) 27.05 31.05 T o tal $422.59 $290.13 As a Percent of T o t al Loa n s O u t s t anding L o a n i nco m e * 10.11% 9.35% Expenses Di r e c t 3.6 2.8 3 N e t indi r ect 0.97 0. 7 Loan l o s s r a t e ( 3-yea r a v e r age) 0.5 3 0.5 7 T o tal 5. 1 4.1 N e t yiel d 5.0 1 5.2 5 C ost of funds 3.2 8 3.3 1 N e t spread 1.73% 1.94% De posit Si z e (Millio n s o f D olla r s) Costs and Costs and returns on returns on consumer consumer installmen installmen t loans: t loans: functional functional cost analysis analysis data