卧的贸易孝 1951 Chapter 4 Managing Interest Rate Risk: Gap and Earnings Sensitivity

Chapter 4 Chapter 4 Managing Interest Rate Managing Interest Rate Risk: Gap and Earnings Gap and Earnings Sensitivity Sensitivity

Asset and liability management The phrase,asset -liability management has generally;however, come to refer to managing interest rate risk ■Interest rate risk ..unexpected changes in interest rates which can significantly alter a bank's profitability and market value of equity. 猫行贺影小号

Asset and liability Asset and liability management management The phrase, asset – liability management has generally; however, come to refer to managing interest rate risk Interest rate risk … unexpected changes in interest rates which can significantly alter a bank’s profitability and market value of equity

Asset and liability management committee A bank's asset and liability management committee (ALCO) coordinates all policy decisions and strategies that determine a bank's risk profit and profit objectives. Interest rate risk management is the primary responsibility of this committee. 麓的贫香小手

Asset and liability Asset and liability management committee management committee A bank's asset and liability management committee (ALCO) coordinates all policy decisions and strategies that determine a bank's risk profit and profit objectives. Interest rate risk management is the primary responsibility of this committee

Net interest income or the market value of stockholders'equity? Banks typically focus on either: net interest income or ■ the market value of stockholders'equity as a target measure of performance. GAP models are commonly associated with net interest income (margin) targeting. Earnings sensitivity analysis or net interest income simulation,or "what if" forecasting 碰制酥价贸易大孝

Net interest income or the market Net interest income or the market value of stockholders' equity? value of stockholders' equity? Banks typically focus on either: net interest income or the market value of stockholders' equity as a target measure of performance. GAP models are commonly associated with net interest income (margin) targeting. Earnings sensitivity analysis or net interest income simulation, or “what if ” forecasting

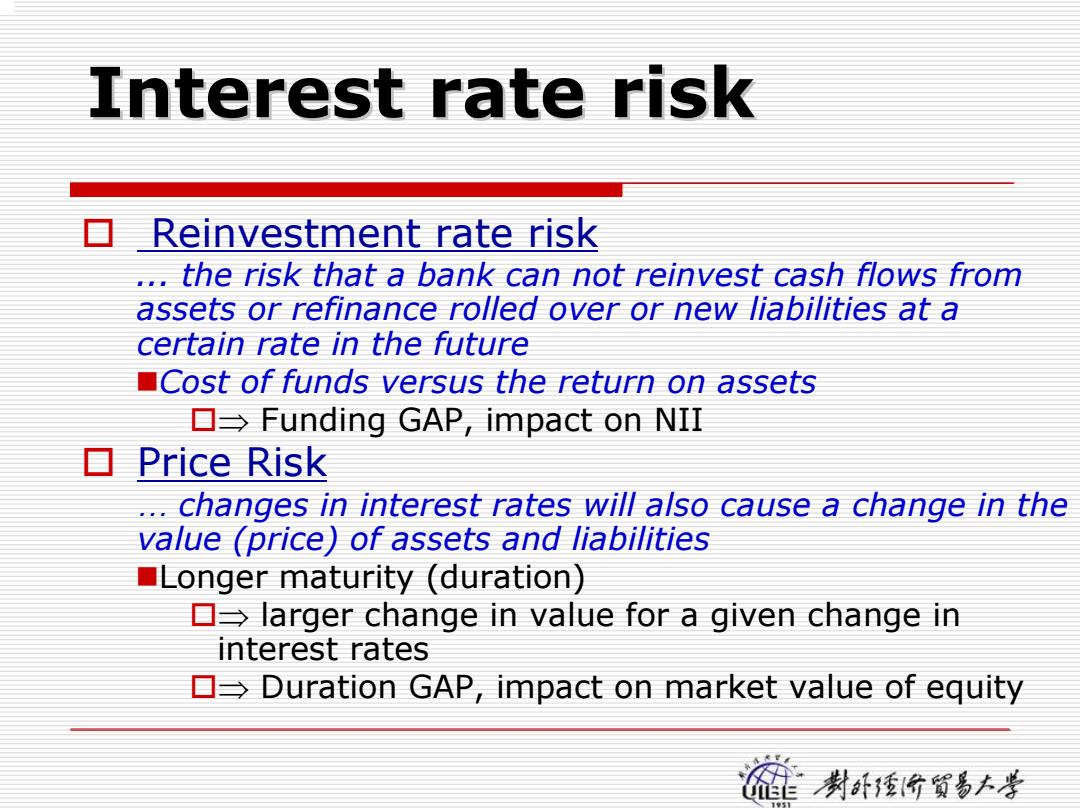

Interest rate risk 目 Reinvestment rate risk ..the risk that a bank can not reinvest cash flows from assets or refinance rolled over or new liabilities at a certain rate in the future Cost of funds versus the return on assets ▣→Funding GAP,impact on NII ▣Price Risk changes in interest rates will also cause a change in the value (price)of assets and liabilities Longer maturity (duration) ▣→larger change in value for a given change in interest rates Duration GAP,impact on market value of equity 麓行贺影≠考

Interest rate risk Interest rate risk Reinvestment rate risk ... the risk that a bank can not reinvest cash flows from assets or refinance rolled over or new liabilities at a certain rate in the future Cost of funds versus the return on assets ⇒ Funding GAP, impact on NII Price Risk … changes in interest rates will also cause a change in the value (price) of assets and liabilities Longer maturity (duration) ⇒ larger change in value for a given change in interest rates ⇒ Duration GAP, impact on market value of equity