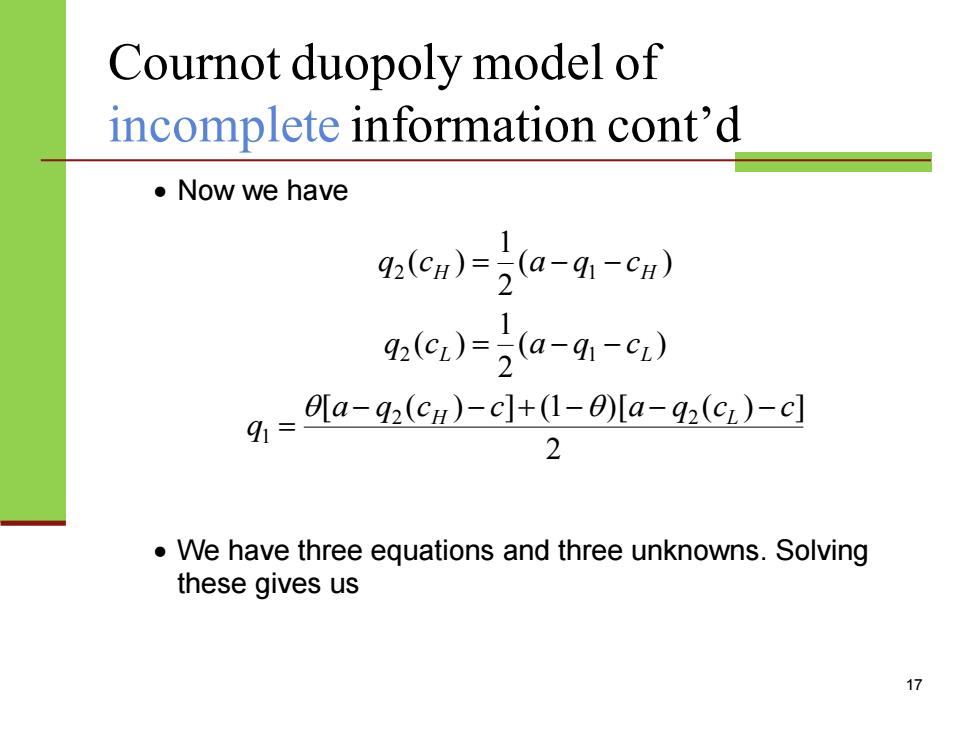

Cournot duopoly model of incomplete information cont'd ·Now we have g,(cn)=5a-q-cn) 2 1 92(c)=(a-41-cz) g-61a-9scH)-c+0-0a-92c)-q 2 We have three equations and three unknowns.Solving these gives us >

Cournot duopoly model of incomplete information cont’d • Now we have ( ) 2 1 ( ) 2 H 1 H q c = a − q − c ( ) 2 1 ( ) 2 L 1 L q c = a − q − c 2 [ ( ) ] (1 )[ ( ) ] 2 2 1 a q c c a q c c q − H − + − − L − = • We have three equations and three unknowns. Solving these gives us 17

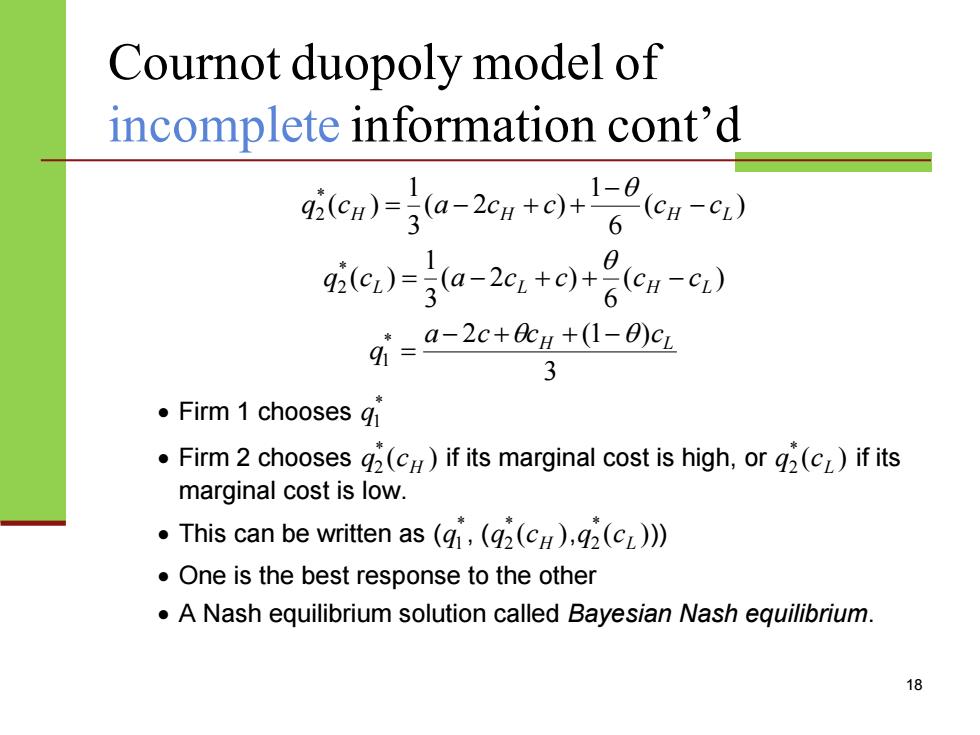

Cournot duopoly model of incomplete information cont'd 9icn)a-2n+o+1.2 +6(c-c) 1 0 9i(c)-3a-2c+c0 (CH-CL) 6 分=a-2c+4+1-0e 3 ·Firm1 chooses Firm 2 chooses g2(cH)if its marginal cost is high,or g2(cL)if its marginal cost is low. ·This can be written as(q,(q2(cH),q2(cz)》 One is the best response to the other A Nash equilibrium solution called Bayesian Nash equilibrium. 18

Cournot duopoly model of incomplete information cont’d ( ) 6 1 ( 2 ) 3 1 ( ) * 2 H H H L q c a c c c − c − = − + + ( ) 6 ( 2 ) 3 1 ( ) * 2 L L H L q c = a − c + c + c − c 3 * 2 (1 ) 1 H L a c c c q − + + − = • Firm 1 chooses * 1q • Firm 2 chooses ( ) * 2 H q c if its marginal cost is high, or ( ) * 2 L q c if its marginal cost is low. • This can be written as ( * 1q , ( ( ) * 2 H q c , ( ) * 2 L q c )) • One is the best response to the other • A Nash equilibrium solution called Bayesian Nash equilibrium. 18

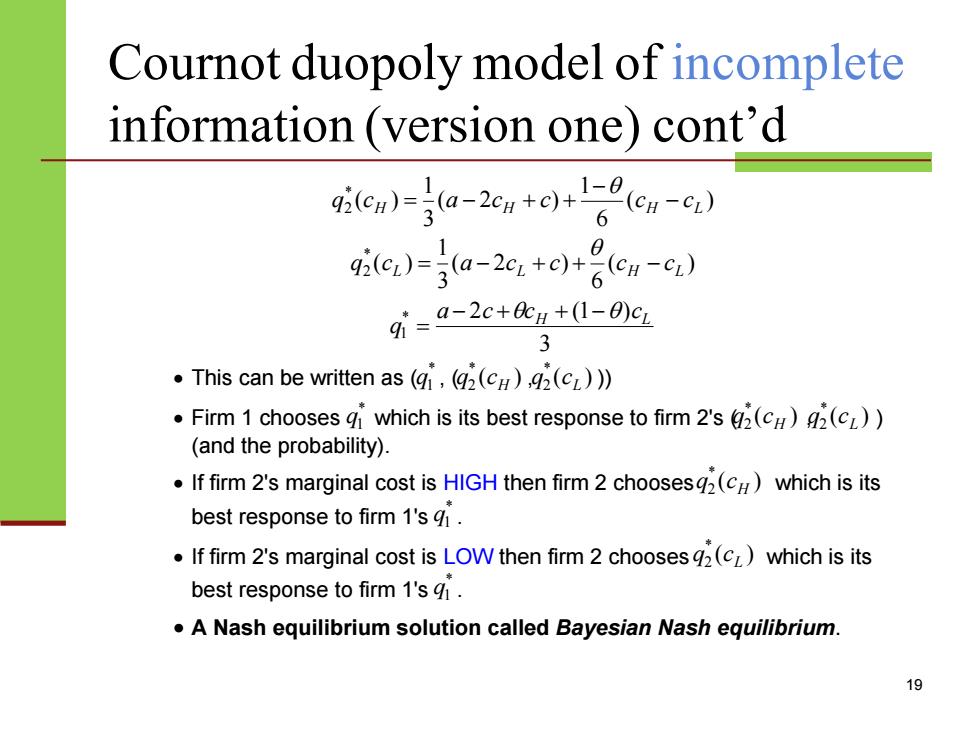

Cournot duopoly model of incomplete information (version one)cont'd itc )(a(c) 6 io,)=3a-2c,+o+6ea-6W qi-a-2c+@n+(1-0)c. .This can be written as ((g2(cH),g(cL))) Firm 1 chooses gi which is its best response to firm 2's(c)(cL)) (and the probability). If firm 2's marginal cost is HIGH then firm 2 choosesg2(C)which is its best response to firm 1's g1. If firm 2's marginal cost is LOW then firm 2 chooses 2(cL)which is its best response to firm 1's g1. A Nash equilibrium solution called Bayesian Nash equilibrium. 19

Cournot duopoly model of incomplete information (version one) cont’d ( ) 6 1 ( 2 ) 3 1 ( ) * 2 H H H L q c a c c c − c − = − + + ( ) 6 ( 2 ) 3 1 ( ) * 2 L L H L q c = a − c + c + c − c 3 * 2 (1 ) 1 H L a c c c q − + + − = • This can be written as ( * q1 , ( ( ) * 2 H q c , ( ) * 2 L q c )) • Firm 1 chooses * q1 which is its best response to firm 2's ( ( ) * 2 H q c , ( ) * 2 L q c ) (and the probability). • If firm 2's marginal cost is HIGH then firm 2 chooses ( ) * 2 H q c which is its best response to firm 1's * 1q . • If firm 2's marginal cost is LOW then firm 2 chooses ( ) * 2 L q c which is its best response to firm 1's * 1q . • A Nash equilibrium solution called Bayesian Nash equilibrium. 19

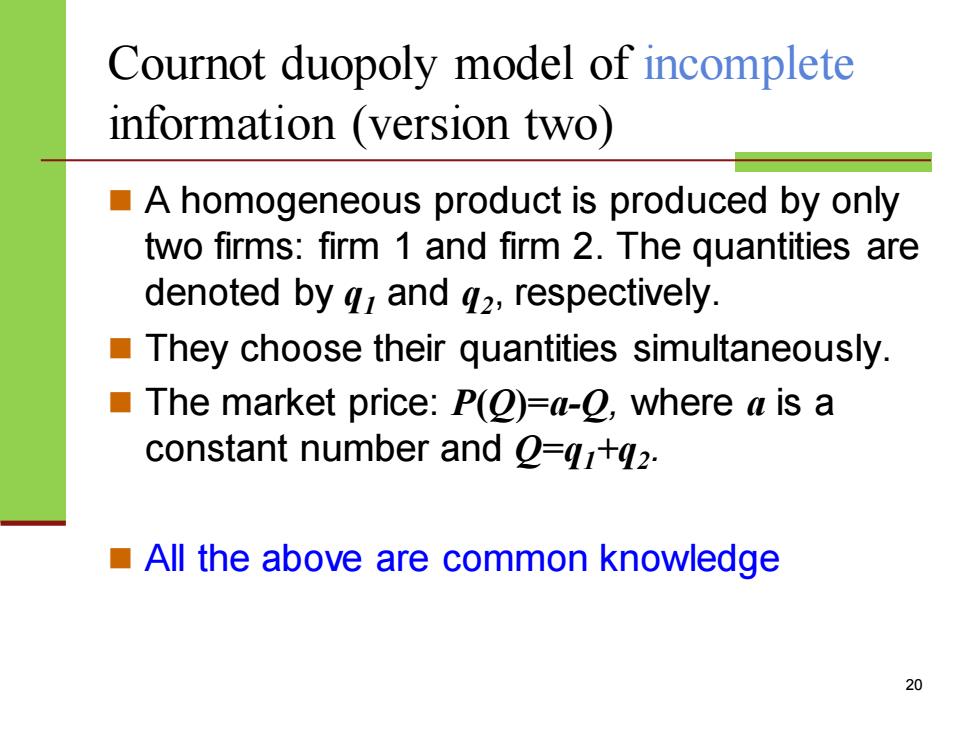

Cournot duopoly model of incomplete information (version two) A homogeneous product is produced by only two firms:firm 1 and firm 2.The quantities are denoted by q and 42,respectively. They choose their quantities simultaneously. The market price:P(Q)=a-2,where a is a constant number and Q=q1+q2. All the above are common knowledge 20

Cournot duopoly model of incomplete information (version two) ◼ A homogeneous product is produced by only two firms: firm 1 and firm 2. The quantities are denoted by q1 and q2 , respectively. ◼ They choose their quantities simultaneously. ◼ The market price: P(Q)=a-Q, where a is a constant number and Q=q1+q2 . ◼ All the above are common knowledge 20

Cournot duopoly model of incomplete information (version two)cont'd Firm 2's marginal cost depends on some factor (e.g technology)that only firm 2 knows.Its marginal cost can be HIGH:cost function:C2(g2)=cH42. LOW:cost function:C2(q2)=cL42. Before production,firm 2 can observe the factor and know exactly its marginal cost is high or low. However,firm 1 cannot know exactly firm 2's cost. Equivalently,it is uncertain about firm 2's payoff. Firm 1 believes that firm 2's cost function is C2(g2)=cnq2 with probability e,and -C2(g2)=cLq2 with probability 1-0. 21

Cournot duopoly model of incomplete information (version two) cont’d ◼ Firm 2’s marginal cost depends on some factor (e.g. technology) that only firm 2 knows. Its marginal cost can be ➢ HIGH: cost function: C2 (q2 )=cHq2 . ➢ LOW: cost function: C2 (q2 )=cLq2 . ◼ Before production, firm 2 can observe the factor and know exactly its marginal cost is high or low. ◼ However, firm 1 cannot know exactly firm 2’s cost. Equivalently, it is uncertain about firm 2’s payoff. ◼ Firm 1 believes that firm 2’s cost function is ➢ C2 (q2 )=cHq2 with probability , and ➢ C2 (q2 )=cLq2 with probability 1–. 21