Cournot duopoly model of incomplete information cont'd Firm 2's marginal cost depends on some factor(e.g.technology) that only firm 2 knows.Its marginal cost can be HIGH:cost function:C2(g2)=cng2. LOW:cost function:C2(g2)=cL42. Before production,firm 2 can observe the factor and know exactly which level of marginal cost is in. However,firm 1 cannot know exactly firm 2's cost.Equivalently, it is uncertain about firm 2's payoff. Firm 1 believes that firm 2's cost function is C2(q2)=cng2 with probability 0,and >C2(g2)=cL92 with probability 1-0. All the above are common knowledge The Harsanyi Transformation Independent types 12

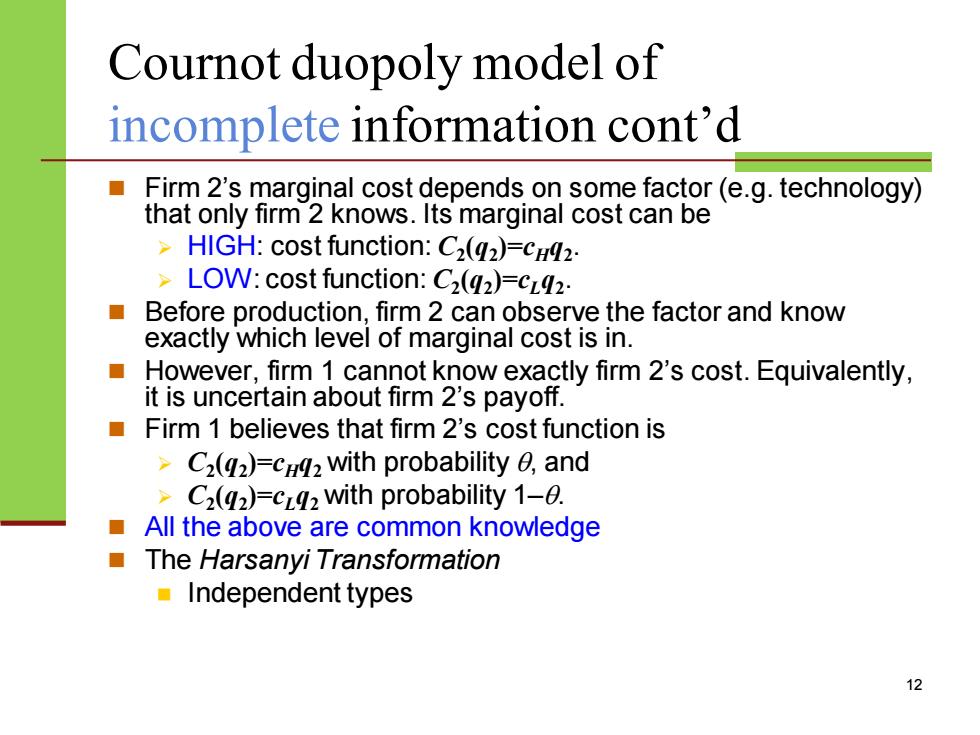

Cournot duopoly model of incomplete information cont’d ◼ Firm 2’s marginal cost depends on some factor (e.g. technology) that only firm 2 knows. Its marginal cost can be ➢ HIGH: cost function: C2 (q2 )=cHq2 . ➢ LOW: cost function: C2 (q2 )=cLq2 . ◼ Before production, firm 2 can observe the factor and know exactly which level of marginal cost is in. ◼ However, firm 1 cannot know exactly firm 2’s cost. Equivalently, it is uncertain about firm 2’s payoff. ◼ Firm 1 believes that firm 2’s cost function is ➢ C2 (q2 )=cHq2 with probability , and ➢ C2 (q2 )=cLq2 with probability 1–. ◼ All the above are common knowledge ◼ The Harsanyi Transformation ◼ Independent types 12

Cournot duopoly model of incomplete information cont'd A solution for the Cournot duopoly model of incomplete information Firm 2 knows exactly its marginal cost is high or low. If its marginal cost is high,i.e.C2(2)=cH2,then,for any given g,it will solve Max 92[a-(91+92)-cH] S.t. 92≥0 ·F0c:a-9h-242-cH=0→92(cn)=2(a-g-cH) .g2(cH)is firm 2's best response to g,if its marginal cost is high. 13

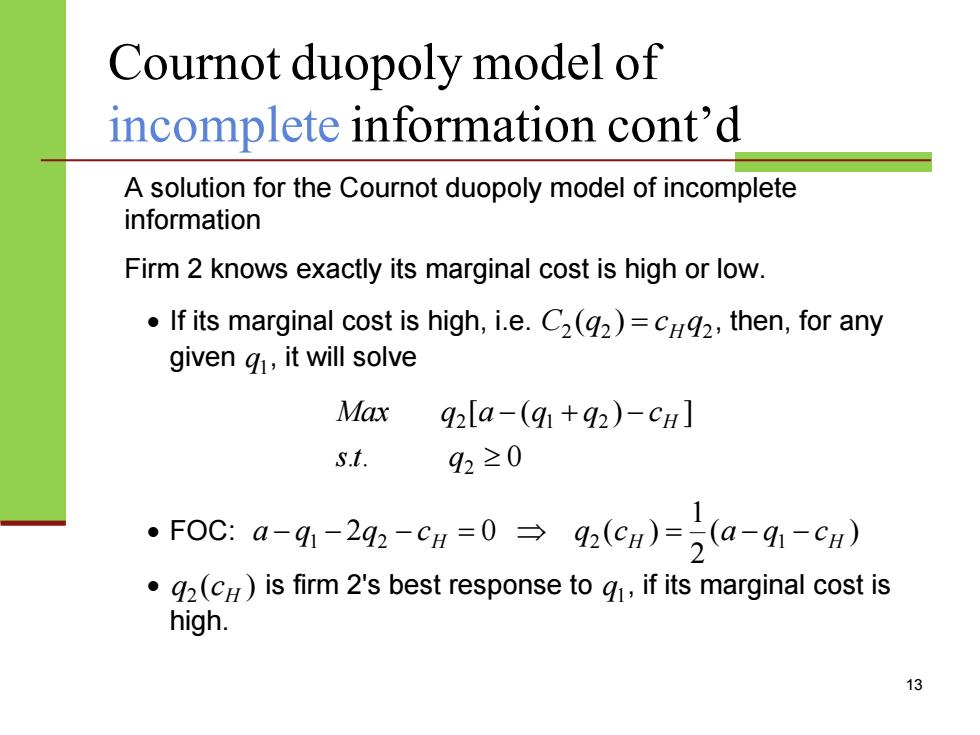

Cournot duopoly model of incomplete information cont’d A solution for the Cournot duopoly model of incomplete information Firm 2 knows exactly its marginal cost is high or low. • If its marginal cost is high, i.e. 2 2 2 C (q ) = cH q , then, for any given 1 q , it will solve . . 0 [ ( ) ] 2 2 1 2 − + − st q Max q a q q cH • FOC: ( ) 2 1 2 0 ( ) 1 2 H 2 H 1 H a − q − q − c = q c = a − q − c • ( ) 2 H q c is firm 2's best response to 1 q , if its marginal cost is high. 13

Cournot duopoly model of incomplete information cont'd Firm 2 knows exactly its marginal cost is high or low. .If its marginal cost is low,i.e.C2(2)=cL2,then,for any given g,it will solve Max g2la-(g+92)-cL] s.t. 92≥0 ·F0C:a-41-2g2-cz=0→ 9e)a--6) .g2(cL)is firm 2's best response to gi,if its marginal cost is low. 14

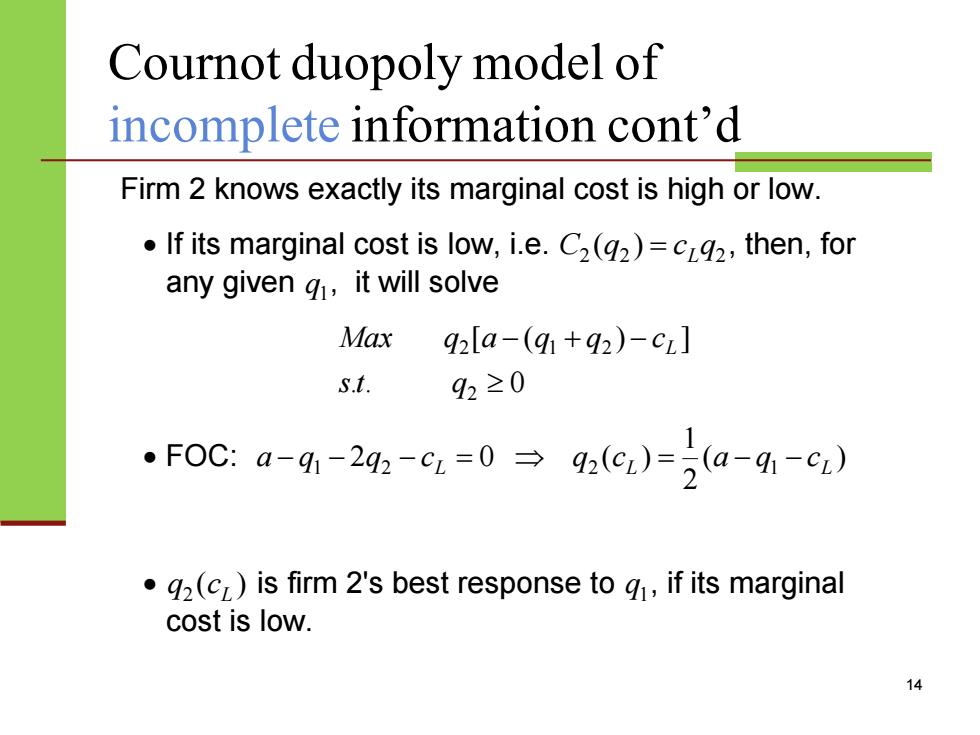

Cournot duopoly model of incomplete information cont’d Firm 2 knows exactly its marginal cost is high or low. • If its marginal cost is low, i.e. 2 2 2 C (q ) = cLq , then, for any given 1 q , it will solve . . 0 [ ( ) ] 2 2 1 2 − + − st q Max q a q q cL • FOC: ( ) 2 1 2 0 ( ) 1 2 L 2 L 1 L a − q − q − c = q c = a − q − c • ( ) 2 L q c is firm 2's best response to 1 q , if its marginal cost is low. 14

Cournot duopoly model of incomplete information cont'd Firm 1 knows exactly its cost function C(g)=cg. Firm 1 does not know exactly firm 2's marginal cost is high or low. But it believes that firm 2's cost function is C2(2)=CH2 with probability e,and C2(2)=cL2 with probability 1-6 Equivalently,it knows that the probability that firm 2's quantity is g2(cH)is and the probability that firm 2's quantity is g2(c)is 1-0.So it solves Mar0×q1[a-(91+92(cH)-c] +(1-0)×91[a-(91+92(cz)-c] s.t. 91≥0 15

Cournot duopoly model of incomplete information cont’d • Firm 1 knows exactly its cost function 1 1 1 C (q ) = cq . • Firm 1 does not know exactly firm 2's marginal cost is high or low. • But it believes that firm 2's cost function is 2 2 2 C (q ) = cH q with probability , and 2 2 2 C (q ) = cLq with probability 1− • Equivalently, it knows that the probability that firm 2's quantity is ( ) 2 H q c is , and the probability that firm 2's quantity is ( ) 2 L q c is 1− . So it solves . . 0 (1 ) [ ( ( )) ] [ ( ( )) ] 1 1 1 2 1 1 2 + − − + − − + − st q q a q q c c Max q a q q c c L H 15

Cournot duopoly model of incomplete information cont'd ●Firm1's problem: Max 0xg[a-(g1+92(cH))-c] +(1-θ)×q1[a-(q1+q2(c)-c] s.t. 91≥0 ●FOC: θLa-2q1-92(cH)-c]+(1-8)[a-2q41-92(cz)-c]=0 Hence.-Ola-q(Cx)-c]+(-OIa-ga(C)-c 2 .g is firm 1's best response to the belief that firm 2 chooses g2(CH)with probability 0,and g2(c)with probability 1-0

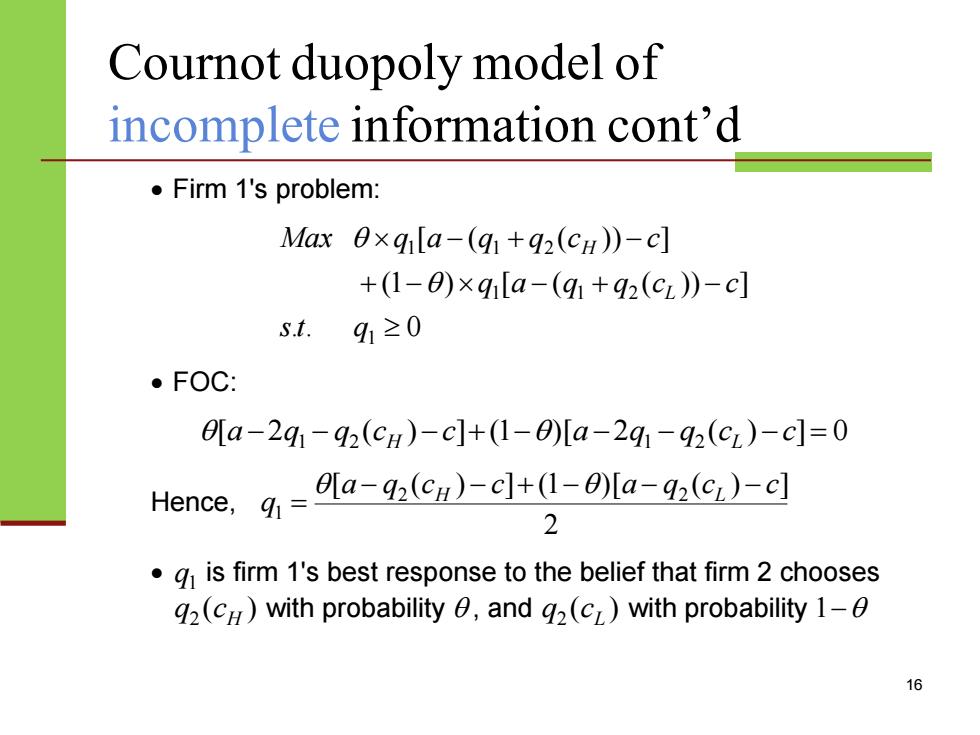

Cournot duopoly model of incomplete information cont’d • Firm 1's problem: . . 0 (1 ) [ ( ( )) ] [ ( ( )) ] 1 1 1 2 1 1 2 + − − + − − + − st q q a q q c c Max q a q q c c L H • FOC: [a −2q1 − q2 (cH ) −c]+ (1−)[a −2q1 − q2 (cL ) −c]= 0 Hence, 2 [ ( ) ] (1 )[ ( ) ] 2 2 1 a q c c a q c c q − H − + − − L − = • 1 q is firm 1's best response to the belief that firm 2 chooses ( ) 2 H q c with probability , and ( ) 2 L q c with probability 1− 16