2 Lessons about trade policy Import restrictions cannot reduce a trade deficit. ■ Even though NX is unchanged,there is less trade: the trade restriction reduces imports the exchange rate appreciation reduces exports Less trade means fewer gains from trade.' Return CHAPTER 12 Aggregate Demand in the Open Economy slide 15

slide 15 § Import restrictions cannot reduce a trade deficit. § Even though NX is unchanged, there is less trade: – the trade restriction reduces imports – the exchange rate appreciation reduces exports Less trade means fewer ‘gains from trade.’ 2 Return

2 Lessons about trade policy Import restrictions on specific products save jobs in the domestic industries that produce those products, but destroy jobs in export-producing sectors. Hence,import restrictions fail to increase total employment.Worse yet,import restrictions create "sectoral shifts,"which cause frictional unemployment. Return CHAPTER 12 Aggregate Demand in the Open Economy slide 16

slide 16 § Import restrictions on specific products save jobs in the domestic industries that produce those products, but destroy jobs in export-producing sectors. Hence, import restrictions fail to increase total employment. Worse yet, import restrictions create “sectoral shifts, ” which cause frictional unemployment. 2 Return

3 Fixed exchange rates Under a system of fixed exchange rates,the country's central bank stands ready to buy or sell the domestic currency for foreign currency at a predetermined rate. In the context of the Mundell-Fleming model,the central bank shifts the LM*curve as required to keep e at its preannounced rate. This system fixes the nominal exchange rate.In the long run,when prices are flexible,the real exchange rate can move even if the nominal rate is fixed. CHAPTER 12 Aggregate Demand in the Open Economy slide 17

slide 17 § Under a system of fixed exchange rates, the country’s central bank stands ready to buy or sell the domestic currency for foreign currency at a predetermined rate. § In the context of the Mundell-Fleming model, the central bank shifts the LM* curve as required to keep e at its preannounced rate. § This system fixes the nominal exchange rate. In the long run, when prices are flexible, the real exchange rate can move even if the nominal rate is fixed. 3

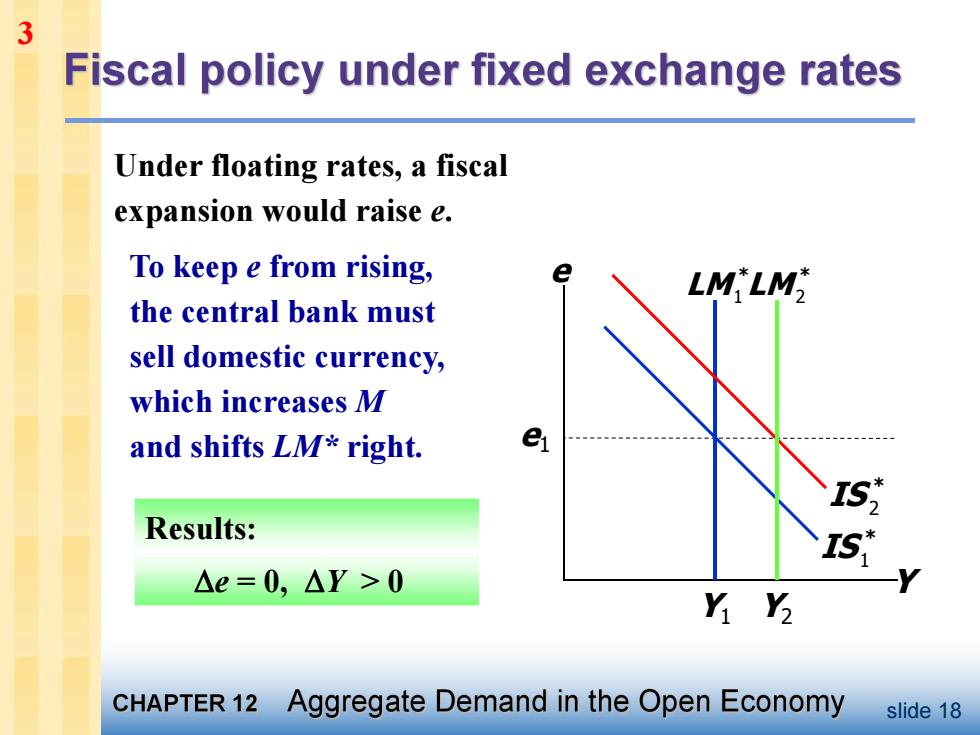

3 Fiscal policy under fixed exchange rates Under floating rates,a fiscal expansion would raise e. To keep e from rising, e LM'LM the central bank must sell domestic currency, which increases M and shifts LM*right. e IS," Results: 51 △e=0,△Y>0 n r CHAPTER 12 Aggregate Demand in the Open Economy slide 18

slide 18 Y e Y1 e1 1 * LM 1 * IS 2 * IS Under floating rates, a fiscal expansion would raise e. Results: e = 0, Y > 0 Y2 2 * LM To keep e from rising, the central bank must sell domestic currency, which increases M and shifts LM* right. 3

3 Money policy under fixed exchange rates An increase in M would shift LM*right and reduce e. To prevent the fall in e,the LM'LM central bank must buy domestic currency,which reduces M and shifts LM* e back left. Results: △e=0,△Y=0 Y CHAPTER 12 Aggregate Demand in the Open Economy slide 19

slide 19 2 * LM An increase in M would shift LM* right and reduce e. Y e Y1 1 * LM 1 * IS e1 To prevent the fall in e, the central bank must buy domestic currency, which reduces M and shifts LM* back left. Results: e = 0, Y = 0 2 * LM 3