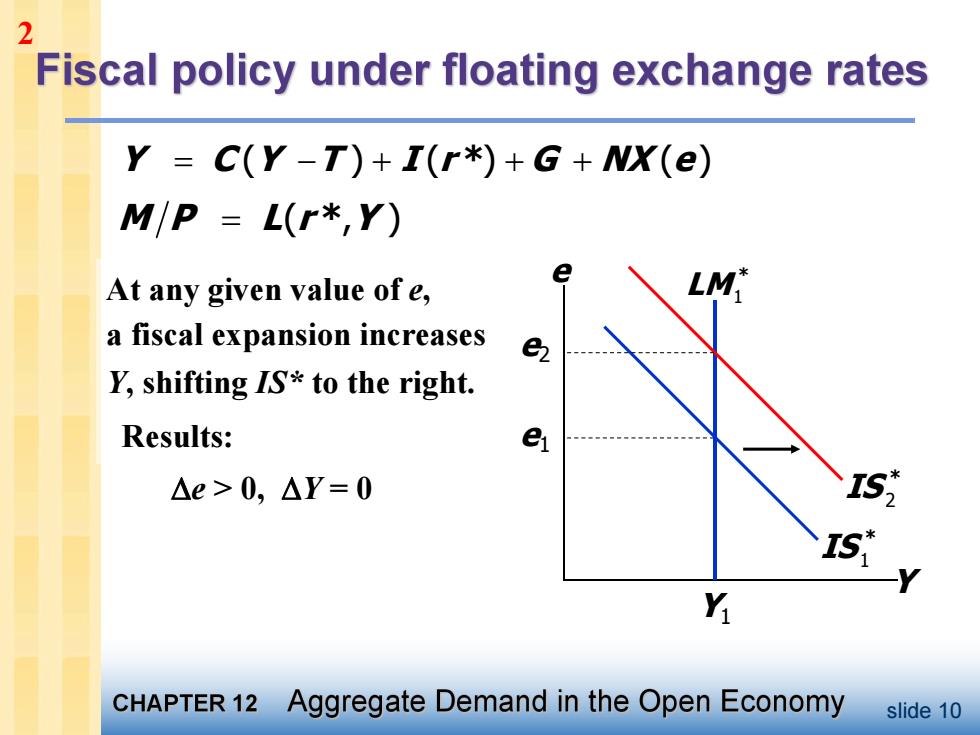

2 Fiscal policy under floating exchange rates Y =C(Y-T)+I(r*)+G+NX(e) M/P L(r*,Y) At any given value of e, LM* a fiscal expansion increases e Y,shifting IS*to the right. Results: e △e>0,△Y=0 Y CHAPTER 12 Aggregate Demand in the Open Economy slide 10

slide 10 Y e M P L(r * ,Y ) Y C (Y T ) I (r *) G NX (e) Y1 e1 1 * LM 1 * IS 2 * IS e2 At any given value of e, a fiscal expansion increases Y, shifting IS* to the right. Results: e > 0, Y = 0 2

2 Lessons about fiscal policy In a small open economy with perfect capital mobility, fiscal policy is utterly incapable of affecting real GDP. 。“Crowding out” ·closed economy: Fiscal policy crowds out investment by causing the interest rate to rise. ·small open economy: Fiscal policy crowds out net exports by causing the exchange rate to appreciate. CHAPTER 12 Aggregate Demand in the Open Economy slide 11

slide 11 § In a small open economy with perfect capital mobility, fiscal policy is utterly incapable of affecting real GDP. § “Crowding out” • closed economy: Fiscal policy crowds out investment by causing the interest rate to rise. • small open economy: Fiscal policy crowds out net exports by causing the exchange rate to appreciate. 2

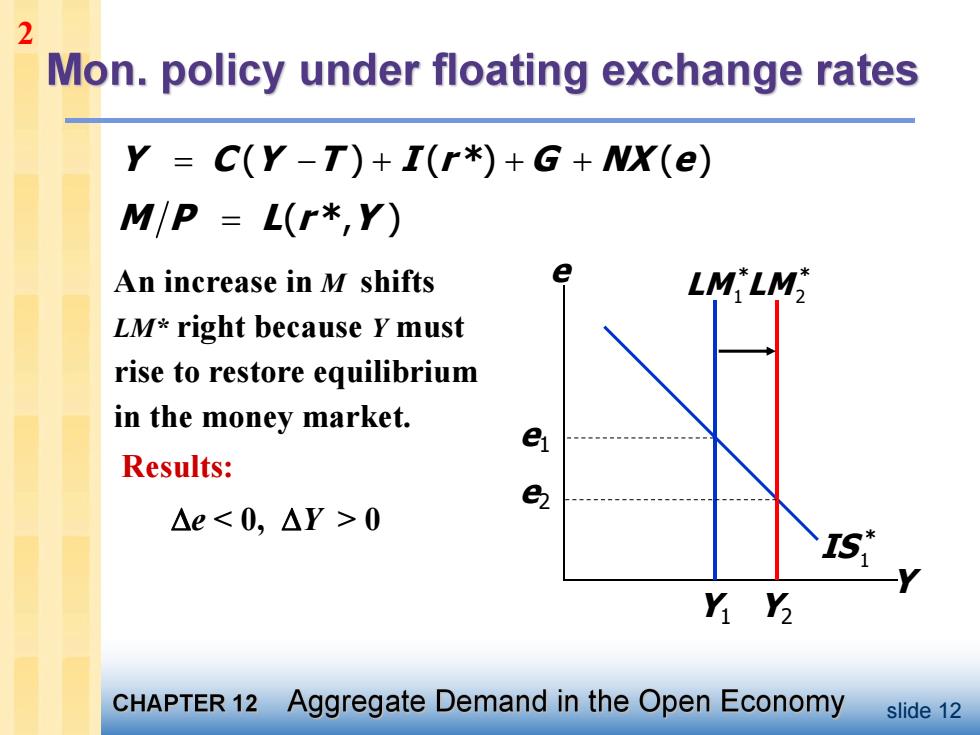

2 Mon.policy under floating exchange rates Y =C(Y-T)+I(r*)+G+NX(e) M/P L(r*,Y) An increase in M shifts e LM'LM LM*right because Y must rise to restore equilibrium in the money market. e Results: e △e<0,△>0 yY CHAPTER 12 Aggregate Demand in the Open Economy slide 12

slide 12 Y e M P L(r * ,Y ) Y C (Y T ) I (r *) G NX (e) e1 Y1 1 * LM 1 * IS Y2 2 * LM e2 An increase in M shifts LM* right because Y must rise to restore equilibrium in the money market. Results: e < 0, Y > 0 2

2 Lessons about monetary policy ■ Monetary policy affects output by affecting one (or more)of the components of aggregate demand: closed economy:个M→↓r→↑I→↑Y small open economy:个M→↓e三↑WX三个y Expansionary money policy does not raise world aggregate demand,it shifts demand from foreign to domestic products. Thus,the increases in income and employment at home come at the expense of losses abroad. CHAPTER 12 Aggregate Demand in the Open Economy slide 13

slide 13 § Monetary policy affects output by affecting one (or more) of the components of aggregate demand: closed economy: M r I Y small open economy: M e NX Y § Expansionary money policy does not raise world aggregate demand, it shifts demand from foreign to domestic products. Thus, the increases in income and employment at home come at the expense of losses abroad. 2

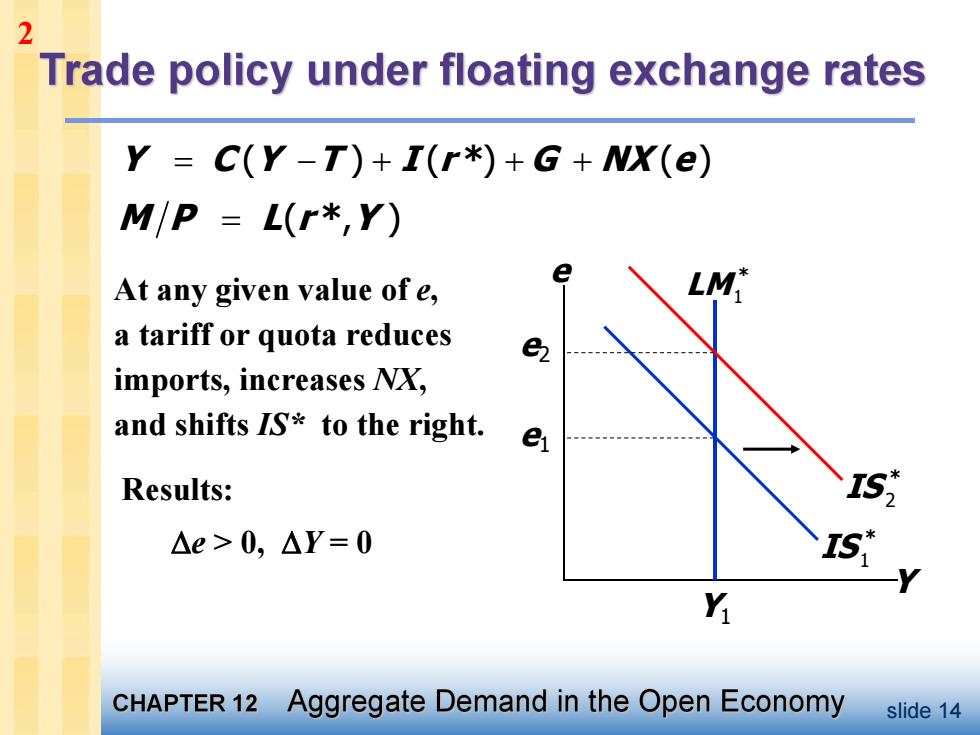

2 Trade policy under floating exchange rates Y =C(Y-T)+I(r*)+G+NX(e) M/P L(r*,Y) At any given value of e, M,* a tariff or quota reduces e imports,increases NX, and shifts IS*to the right. e Results: △e>0,△Y=0 Y CHAPTER 12 Aggregate Demand in the Open Economy slide 14

slide 14 M P L(r * ,Y ) Y C (Y T ) I (r *) G NX (e) Y e e1 Y1 1 * LM 1 * IS 2 * IS e2 At any given value of e, a tariff or quota reduces imports, increases NX, and shifts IS* to the right. Results: e > 0, Y = 0 2