SCENARIO 1:No Banks With no banks, D=0andM=C=$1000. CHAPTER 18 Money Supply and Money Demand slide 5

CHAPTER 18 Money Supply and Money Demand slide 5 SCENARIO 1: No Banks With no banks, D = 0 and M = C = $1000. 1

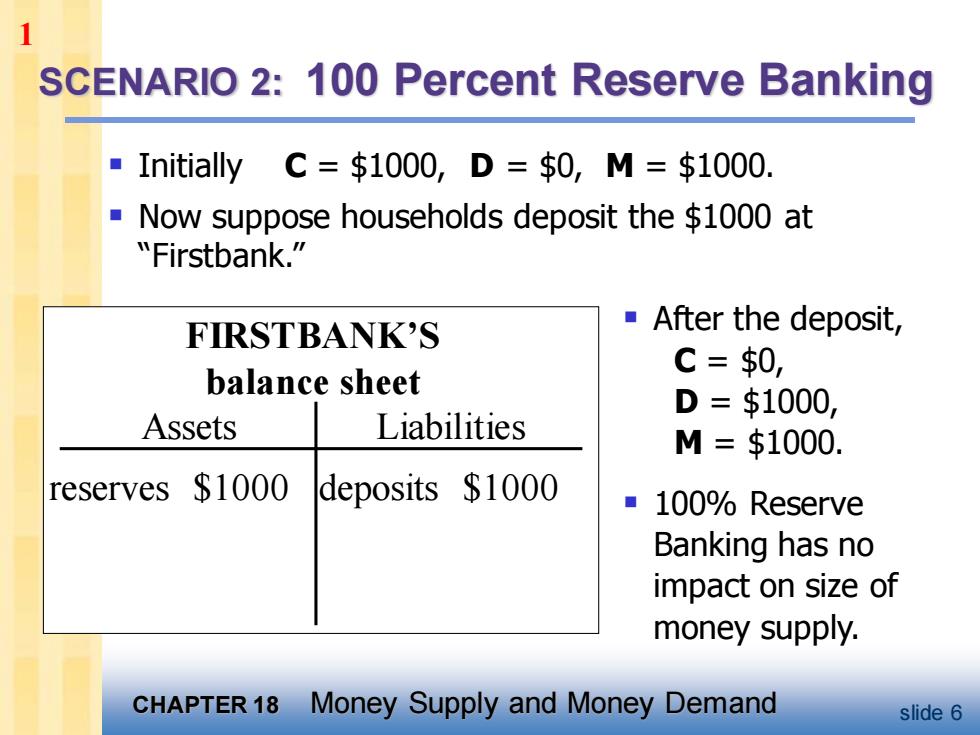

SCENARIO 2:100 Percent Reserve Banking ·Initially C=$1000,D=$0,M=$1000. Now suppose households deposit the $1000 at "Firstbank." FIRSTBANK'S After the deposit, balance sheet C=$0, D=$1000, Assets Liabilities M=$1000. reserves $1000 deposits $1000 ■100%Reserve Banking has no impact on size of money supply. CHAPTER 18 Money Supply and Money Demand slide 6

CHAPTER 18 Money Supply and Money Demand slide 6 SCENARIO 2: 100 Percent Reserve Banking ▪ After the deposit, C = $0, D = $1000, M = $1000. ▪ 100% Reserve Banking has no impact on size of money supply. FIRSTBANK’S balance sheet Assets Liabilities reserves $1000 deposits $1000 ▪ Initially C = $1000, D = $0, M = $1000. ▪ Now suppose households deposit the $1000 at “Firstbank.” 1

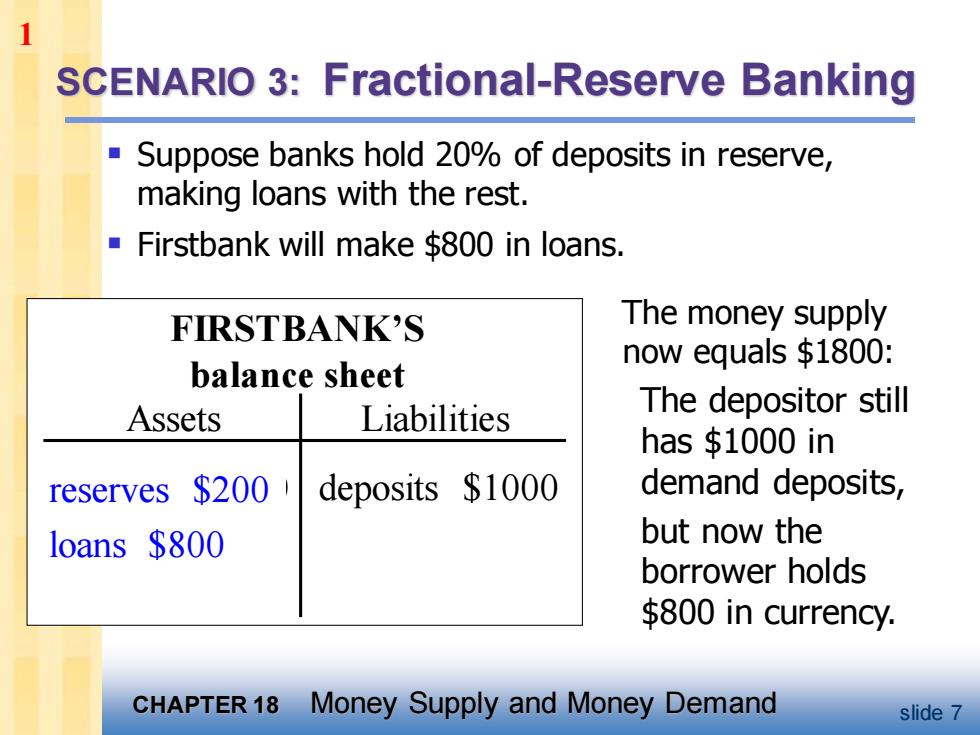

SCENARIO 3:Fractional-Reserve Banking Suppose banks hold 20%of deposits in reserve, making loans with the rest. Firstbank will make $800 in loans. FIRSTBANK'S The money supply now equals $1800: balance sheet Assets Liabilities The depositor still has $1000 in reserves $200 deposits $1000 demand deposits, loans $800 but now the borrower holds $800 in currency. CHAPTER 18 Money Supply and Money Demand slide 7

CHAPTER 18 Money Supply and Money Demand slide 7 SCENARIO 3: Fractional-Reserve Banking The money supply now equals $1800: The depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency. FIRSTBANK’S balance sheet Assets Liabilities deposits $1000 ▪ Suppose banks hold 20% of deposits in reserve, making loans with the rest. ▪ Firstbank will make $800 in loans. reserves $1000 reserves $200 loans $800 1

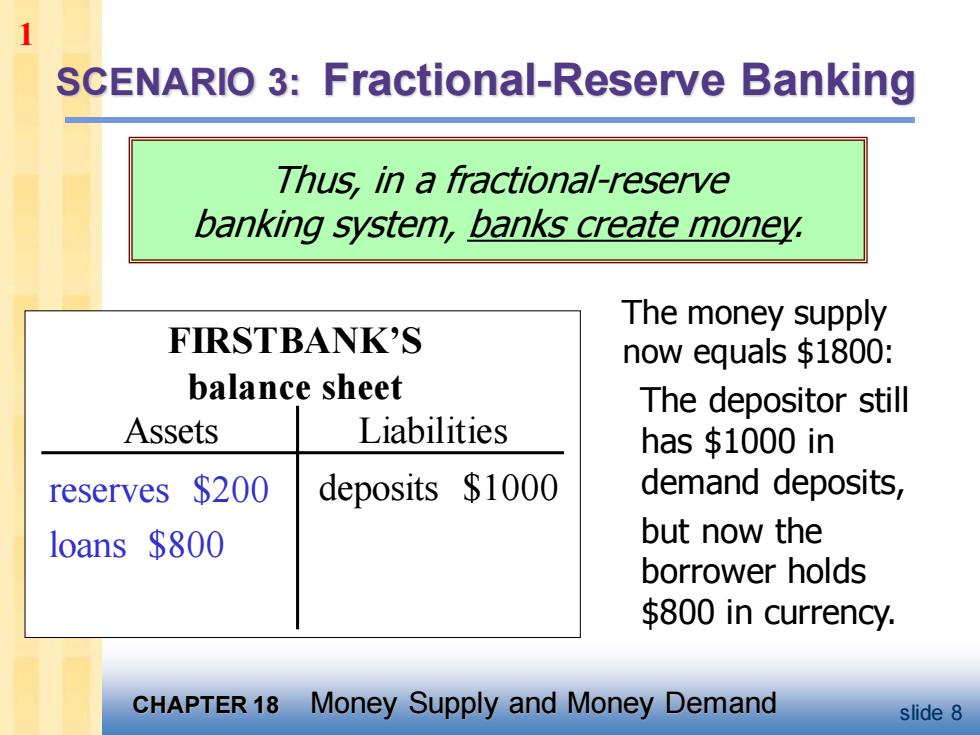

SCENARIO 3:Fractional-Reserve Banking Thus,in a fractional-reserve banking system,banks create money. The money supply FIRSTBANK'S now equals $1800: balance sheet The depositor still Assets Liabilities has $1000 in reserves $200 deposits $1000 demand deposits, loans $800 but now the borrower holds $800 in currency. CHAPTER 18 Money Supply and Money Demand slide 8

CHAPTER 18 Money Supply and Money Demand slide 8 SCENARIO 3: Fractional-Reserve Banking The money supply now equals $1800: The depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency. FIRSTBANK’S balance sheet Assets Liabilities reserves $200 loans $800 deposits $1000 Thus, in a fractional-reserve banking system, banks create money. 1

1 SCENARIO 3:Fractional-Reserve Banking ■ Suppose the borrower deposits the $800 in Secondbank. Initially,Secondbank's balance sheet is: SECONDBANK'S ■But then balance sheet Secondbank will loan 80%of this Assets Liabilities deposit reserves $160 deposits $800 and its balance loans $640 sheet will look like this: CHAPTER 18 Money Supply and Money Demand slide 9

CHAPTER 18 Money Supply and Money Demand slide 9 SCENARIO 3: Fractional-Reserve Banking ▪ But then Secondbank will loan 80% of this deposit ▪ and its balance sheet will look like this: SECONDBANK’S balance sheet Assets Liabilities reserves $800 loans $0 deposits $800 ▪ Suppose the borrower deposits the $800 in Secondbank. ▪ Initially, Secondbank’s balance sheet is: reserves $160 loans $640 1