2.1 Assumptions re:capital flows a. domestic foreign bonds are perfect substitutes (same risk,maturity,etc.) b.perfect capital mobility: no restrictions on international trade in assets c. economy is small: cannot affect the world interest rate,denoted()r* a b implyr=r* c implies r*is exogenous CHAPTER 8 The Open Economy slide 12

CHAPTER 8 The Open Economy slide 12 Assumptions re: capital flows a. domestic & foreign bonds are perfect substitutes (same risk, maturity, etc.) b. perfect capital mobility: no restrictions on international trade in assets c. economy is small: cannot affect the world interest rate, denoted(表示) r* a & b imply r = r* c implies r* is exogenous 2.1

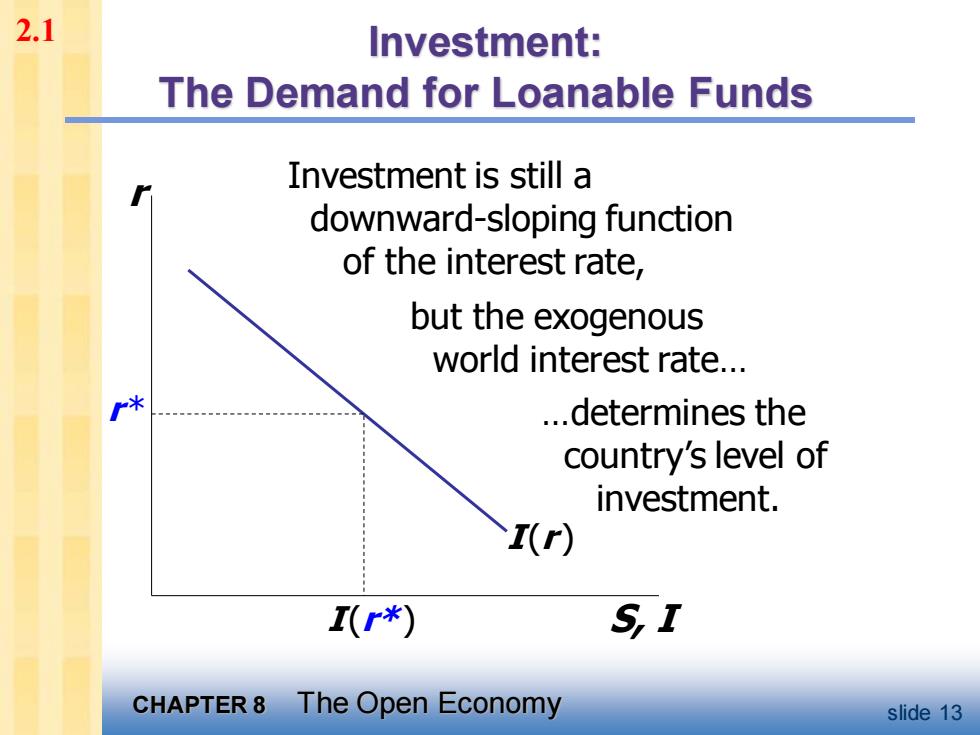

2.1 Investment: The Demand for Loanable Funds Investment is still a downward-sloping function of the interest rate, but the exogenous world interest rate. 米 .determines the country's level of investment. I(r) I(r*) SI CHAPTER 8 The Open Economy slide 13

CHAPTER 8 The Open Economy slide 13 Investment: The Demand for Loanable Funds Investment is still a downward-sloping function of the interest rate, r * but the exogenous world interest rate. .determines the country’s level of investment. I (r*) r S, I I (r ) 2.1

2.1 If the economy were closed. .the interest rate would adjust to equate investment and saving: re I(r) I(r) SI =S CHAPTER8 The Open Economy slide 14

CHAPTER 8 The Open Economy slide 14 If the economy were closed. r S, I I(r ) S rc ( ) c I r = S .the interest rate would adjust to equate investment and saving: 2.1

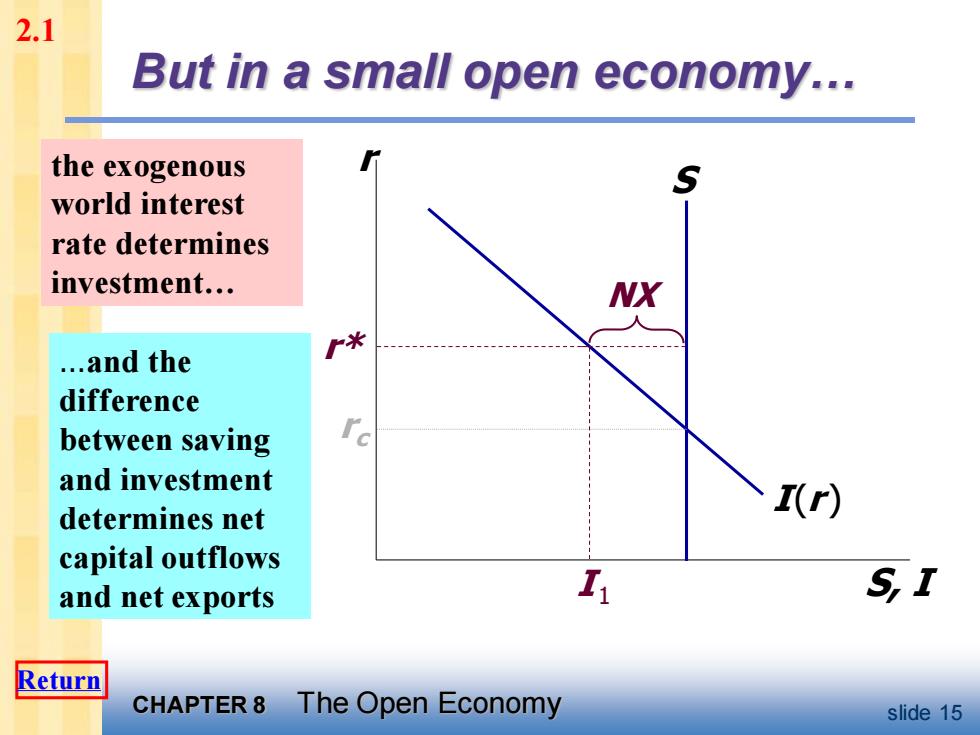

2.1 But in a small open economy. the exogenous world interest rate determines investment. NX 一米 .and the difference between saving and investment determines net I(r) capital outflows and net exports SI Return CHAPTER 8 The Open Economy slide 15

CHAPTER 8 The Open Economy slide 15 But in a small open economy. r S, I I(r ) S rc r* I 1 the exogenous world interest rate determines investment. .and the difference between saving and investment determines net capital outflows and net exports NX 2.1 Return

2.2 Policies influencing the trade balance 1.Fiscal policy at home 2.Fiscal policy abroad 3.An increase in investment demand CHAPTER 8 The Open Economy slide 16

CHAPTER 8 The Open Economy slide 16 Policies influencing the trade balance 1. Fiscal policy at home 2. Fiscal policy abroad 3. An increase in investment demand 2.2