《国际贸易融资(引进)》课程教学大纲 课程基本信息 中文名称:国际贸易融资(引进) 课程名称 英文名称:International Trade Finance 课程代码 043231A1 课程性质 ☑必修口选修 开课学院 商学院 课程负责人 孙丽江 课程团队 胡君茹王岐闻 授课学期 第七学期 学分/学时 3/48 课内学时 48 理论学时32实验学时16 实训(含上机)0 实习 0 其他 面向专业 国际经济与贸易 授课语言 ☑线下课程 ☑全英语课程 口线上线下混合课程 授课模式 (网站: 在线开放课程 (课程网站 对先修的要求及 本课程要求学生了解国际贸易发展现状,掌握国际经济与贸易学科的基 先修课程 本理论、基本知识,熟悉国际货物买卖的一般流程和基本业务程序。先 修课程包含有国际贸易学、进出口贸易实务。 本课得使学生了望和量据从事国际贸易T作议需的国际间倩权债冬结 对后续的支撑及 着力培养学生们独立的 后续课程 英语函电等误程。 课程思政目标 教学内容 教学方法 Cultivating students' I aw ideals and beliefs value international customs orientation,political and practice which are Discussion belief and social related to responsibility international trade 果程思政设计 The preparation of Cultivating students bill of exchange Making out the drafts integrity spirit and under traditional professional ethics as Case study international payment personnel engaged in techniques Analysis of risks in collection 9

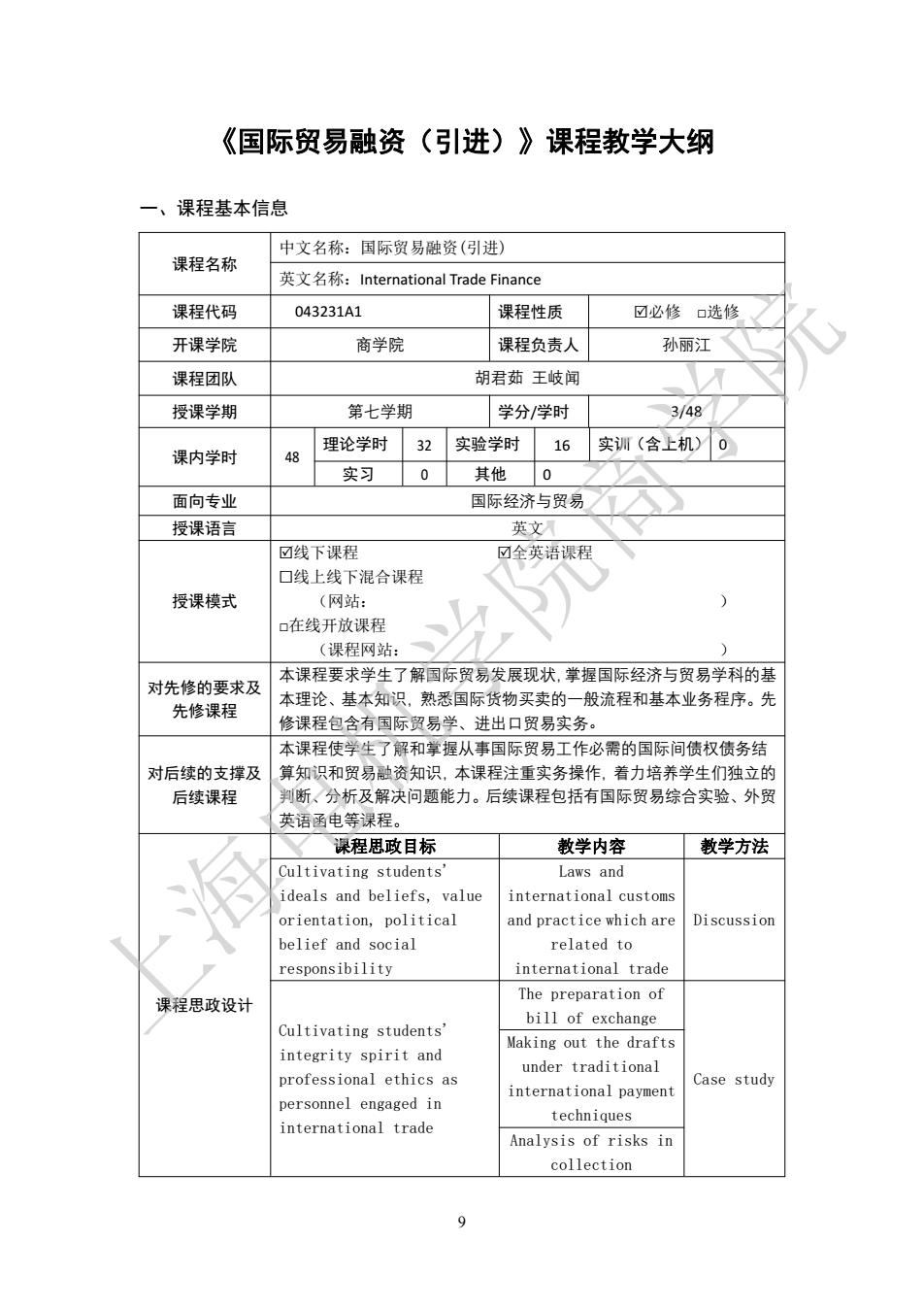

9 《国际贸易融资(引进)》课程教学大纲 一、课程基本信息 课程名称 中文名称:国际贸易融资(引进) 英文名称:International Trade Finance 课程代码 043231A1 课程性质 必修 □选修 开课学院 商学院 课程负责人 孙丽江 课程团队 胡君茹 王岐闻 授课学期 第七学期 学分/学时 3/48 课内学时 48 理论学时 32 实验学时 16 实训(含上机) 0 实习 0 其他 0 面向专业 国际经济与贸易 授课语言 英文 授课模式 线下课程 全英语课程 线上线下混合课程 (网站: ) □在线开放课程 (课程网站: ) 对先修的要求及 先修课程 本课程要求学生了解国际贸易发展现状,掌握国际经济与贸易学科的基 本理论、基本知识,熟悉国际货物买卖的一般流程和基本业务程序。先 修课程包含有国际贸易学、进出口贸易实务。 对后续的支撑及 后续课程 本课程使学生了解和掌握从事国际贸易工作必需的国际间债权债务结 算知识和贸易融资知识,本课程注重实务操作,着力培养学生们独立的 判断、分析及解决问题能力。后续课程包括有国际贸易综合实验、外贸 英语函电等课程。 课程思政设计 课程思政目标 教学内容 教学方法 Cultivating students' ideals and beliefs, value orientation, political belief and social responsibility Laws and international customs and practice which are related to international trade Discussion Cultivating students' integrity spirit and professional ethics as personnel engaged in international trade The preparation of bill of exchange Case study Making out the drafts under traditional international payment techniques Analysis of risks in collection 上海电机学院商学院

The examination and amendment of letters of credit The different payment methods Cultivating students' careful and rigorous Projec professional quality and Group Project presentat team spirit on 二、课程简介 《国际贸易融资》是国际经济与贸易的一门专业必修课程,采用全英文教学。国际贸易 融资以国际贸易交易为前提,依托于国际贸易货款支付而产生,在国际贸易各环节对于进出 口商提供资金融通和信用支持。通过本课程的学习,学生能够了解近年来国际贸易融资领域 的新趋势,熟悉金融票据和结算票据的主要特征,掌握传统及新兴国际贸易融资手段和国际 贸易支付方式的基本知识和理论,增加风险防范意识,能够根据国际贸易业务的实际情况选 择及运用国际贸易支付方式和融资方式,具有相关单据的制作及审核能力。 三、课程目标及对毕业要求(及其指标点)的支撑 专业类课程的课程目标及支排专业的毕业要求及其指标点 序号 课程目标 支撞毕业要求指标点 毕业要求 目标l:nastering the application of 指标点4-10:能熟纺 various types of negotiable 阅读各种业务单证: 1 instruments and other documents 能制作贸易过程中名 毕业要求4:应 the transac ction of internationa 环节所需要的单证 用能力 trade 甲据。 目标2 astering the payment methods 指标点4-1】:能掌橱 in the transaction of international 不同结算方式,不后 trade 币种的结算周期和济 毕业要求4:应 目标3:mastering the financing 程:能根据不同结算 用能力 techniques employed in international 方式的单据要求进行 审核。 trade 四、教学内容及进度安排 序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 o

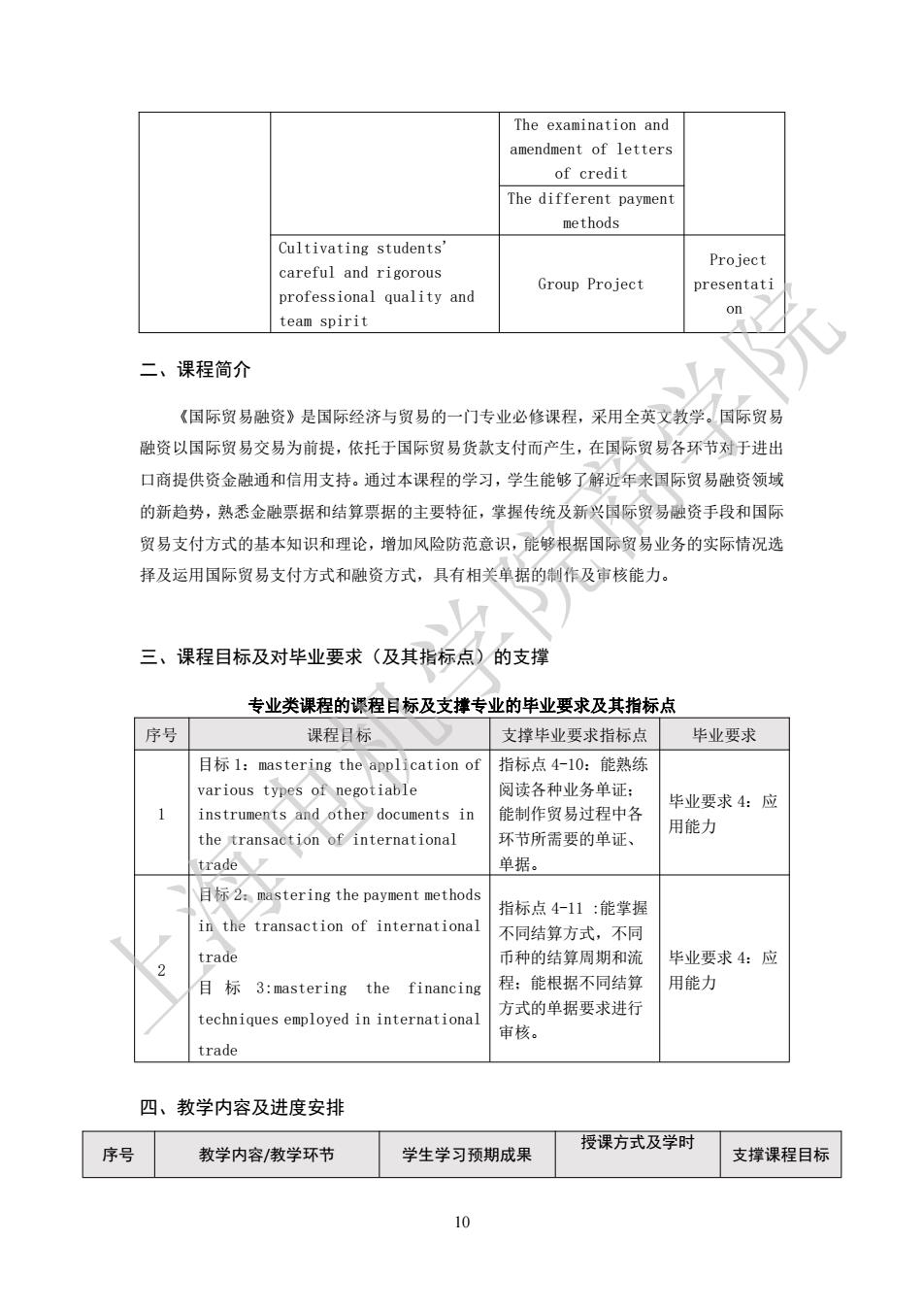

10 The examination and amendment of letters of credit The different payment methods Cultivating students' careful and rigorous professional quality and team spirit Group Project Project presentati on 二、课程简介 《国际贸易融资》是国际经济与贸易的一门专业必修课程,采用全英文教学。国际贸易 融资以国际贸易交易为前提,依托于国际贸易货款支付而产生,在国际贸易各环节对于进出 口商提供资金融通和信用支持。通过本课程的学习,学生能够了解近年来国际贸易融资领域 的新趋势,熟悉金融票据和结算票据的主要特征,掌握传统及新兴国际贸易融资手段和国际 贸易支付方式的基本知识和理论,增加风险防范意识,能够根据国际贸易业务的实际情况选 择及运用国际贸易支付方式和融资方式,具有相关单据的制作及审核能力。 三、课程目标及对毕业要求(及其指标点)的支撑 专业类课程的课程目标及支撑专业的毕业要求及其指标点 序号 课程目标 支撑毕业要求指标点 毕业要求 1 目标 1:mastering the application of various types of negotiable instruments and other documents in the transaction of international trade 指标点 4-10:能熟练 阅读各种业务单证; 能制作贸易过程中各 环节所需要的单证、 单据。 毕业要求 4:应 用能力 2 目标 2:mastering the payment methods in the transaction of international trade 目 标 3:mastering the financing techniques employed in international trade 指标点 4-11 :能掌握 不同结算方式,不同 币种的结算周期和流 程;能根据不同结算 方式的单据要求进行 审核。 毕业要求 4:应 用能力 四、教学内容及进度安排 序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 上海电机学院商学院

序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 教学重点:History and 课堂讲授(1.5课时) evolution of international 讨论(0.5课时) payment methods;Players. financial intermediaries and their roles in interational Understanding History trade and evolution of 教学难点:无 intemational payment 主要教学内容:Overview of methods: rade financ Mastering players, financial students'ideals and beliefs intermediaries and alue political their roles in through the discussion ntemational trade (topicLaws and international customs and practice which elated to inter national trade) 教学重点: 课堂讲授(6课时) Essential items required in a 案例教学(1课时) bill of exchange:Acts 小组项目(2课时) associated with bill of exchange:Various classification of bill of exchange 教学难点: Essential bill of exchange 主要教学内容: mastering the Negotiable instrumer application of various 患政融合点: rough the ypes of negotiable 目标1 nstruments(B/E.P/N preparation of bill of and Cheque) exchange.cultivating studentsintegrity spirit and professional ethics as personnel engaged in international trade: and rigorous professional quality and team spirit in the process of completing group projects

11 序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 1 教学重点:History and evolution of international payment methods;Players, financial intermediaries and their roles in international trade 教学难点:无 主要教学内容:Overview of international trade finance 思政融合点:Cultivating students' ideals and beliefs, value orientation, political belief and social responsibility through the discussion (topic:Laws and international customs and practice which are related to international trade) Understanding History and evolution of international payment methods; Mastering players, financial intermediaries and their roles in international trade 课堂讲授(1.5 课时) 讨论(0.5 课时) 目标 1 目标 2 目标 3 2 教学重点: Essential items required in a bill of exchange; Acts associated with bill of exchange; Various classification of bill of exchange 教学难点: Essential items required in a bill of exchange 主要教学内容: Negotiable instrument 思政融合点:Through the preparation of bill of exchange, cultivating students' integrity spirit and professional ethics as personnel engaged in international trade; cultivating students' careful and rigorous professional quality and team spirit in the process of completing group projects mastering the application of various types of negotiable instruments (B/E, P/N, and Cheque) 课堂讲授(6 课时) 案例教学(1 课时) 小组项目(2 课时) 目标 1 上海电机学院商学院

序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 教学重点: 课堂讲授(16课时) The procedures of the 案例教学(6课时) different types of the 小组项目(1课时) Collection procedures unde clean and documentary collection Maior types of documentary credit corresponding procedures The content of letter of credit Financing services provided under traditional international payment techniques 教学难点:The content of 简学院 letter of credit Possessing the Financing services s provided under traditional unds are transferred between any two international payment countries by meanings tachoiques 目标1 主要教学内容: fcertainfinancial instruments in the 图 Various traditional transaction of international payment techniques international trade, 思政融合点: Through making out the of credit. drafts under traditional ayment techniques,the case analysis of risks in collection and the examination and amendment of letters of credit,cultivating studentsintegrity spirit and professional ethics as professionals engaged in international trade; cultivating students'carefu and rigorous professional quality and team spirit in the process of completing group 女

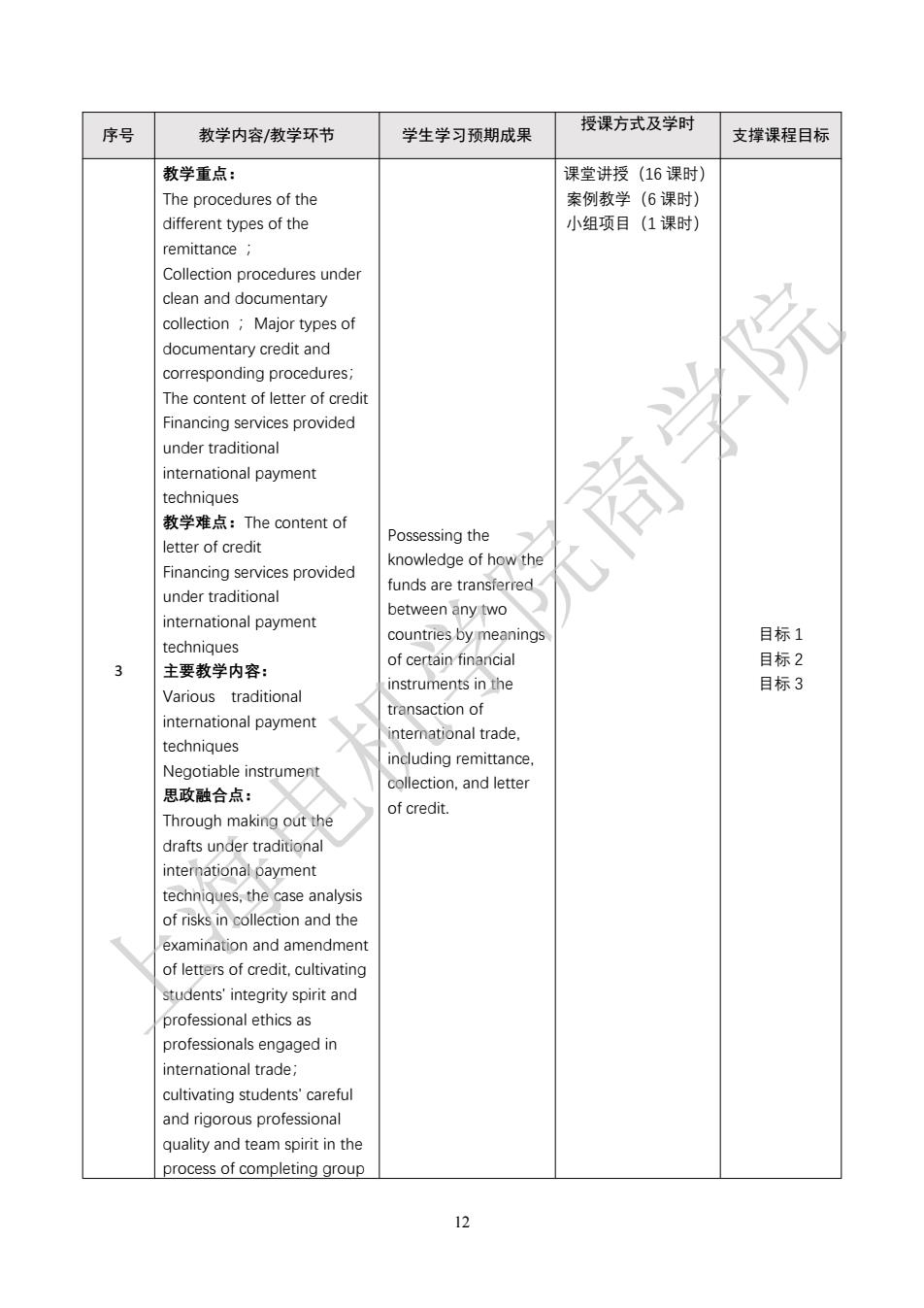

12 序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 3 教学重点: The procedures of the different types of the remittance ; Collection procedures under clean and documentary collection ;Major types of documentary credit and corresponding procedures; The content of letter of credit Financing services provided under traditional international payment techniques 教学难点:The content of letter of credit Financing services provided under traditional international payment techniques 主要教学内容: Various traditional international payment techniques Negotiable instrument 思政融合点: Through making out the drafts under traditional international payment techniques, the case analysis of risks in collection and the examination and amendment of letters of credit, cultivating students' integrity spirit and professional ethics as professionals engaged in international trade; cultivating students' careful and rigorous professional quality and team spirit in the process of completing group Possessing the knowledge of how the funds are transferred between any two countries by meanings of certain financial instruments in the transaction of international trade, including remittance, collection, and letter of credit. 课堂讲授(16 课时) 案例教学(6 课时) 小组项目(1 课时) 目标 1 目标 2 目标 3 上海电机学院商学院

序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 projects 教学重点: 课堂讲授(6.5课时) Comparison between letter of credit and standby letter of credit: types of bank of quarantees. Features of intemational factoring and forfeiting; Financial services provided by financial institutions 教学难点: mastering the Financial services provided by financing techniques employed in 简学院 讨论(0.5课时) 主要教学内容: intemational trade 4 Bank /other financial including bank 目标2 institutions facilitation in 目标3 international trade 思政融合点: ntemational factoring Through the comparison the and forfaiting different payment methods. cultivating students'integ spirit and professional ethics as professionals engaged in international trade cultivating studentscareful and rigorous professional quality and team spirit in the process of completing aroup projects 教学重点: 小组项目(5课时) Invoice:Bill of Lading: Insurance Policy Certificate being capable of of Origin;Inspection Certificate 教学难点: the transaction of 目标3 Bill of Lading:Insurance ntemational trade Policy 主要教学内容:

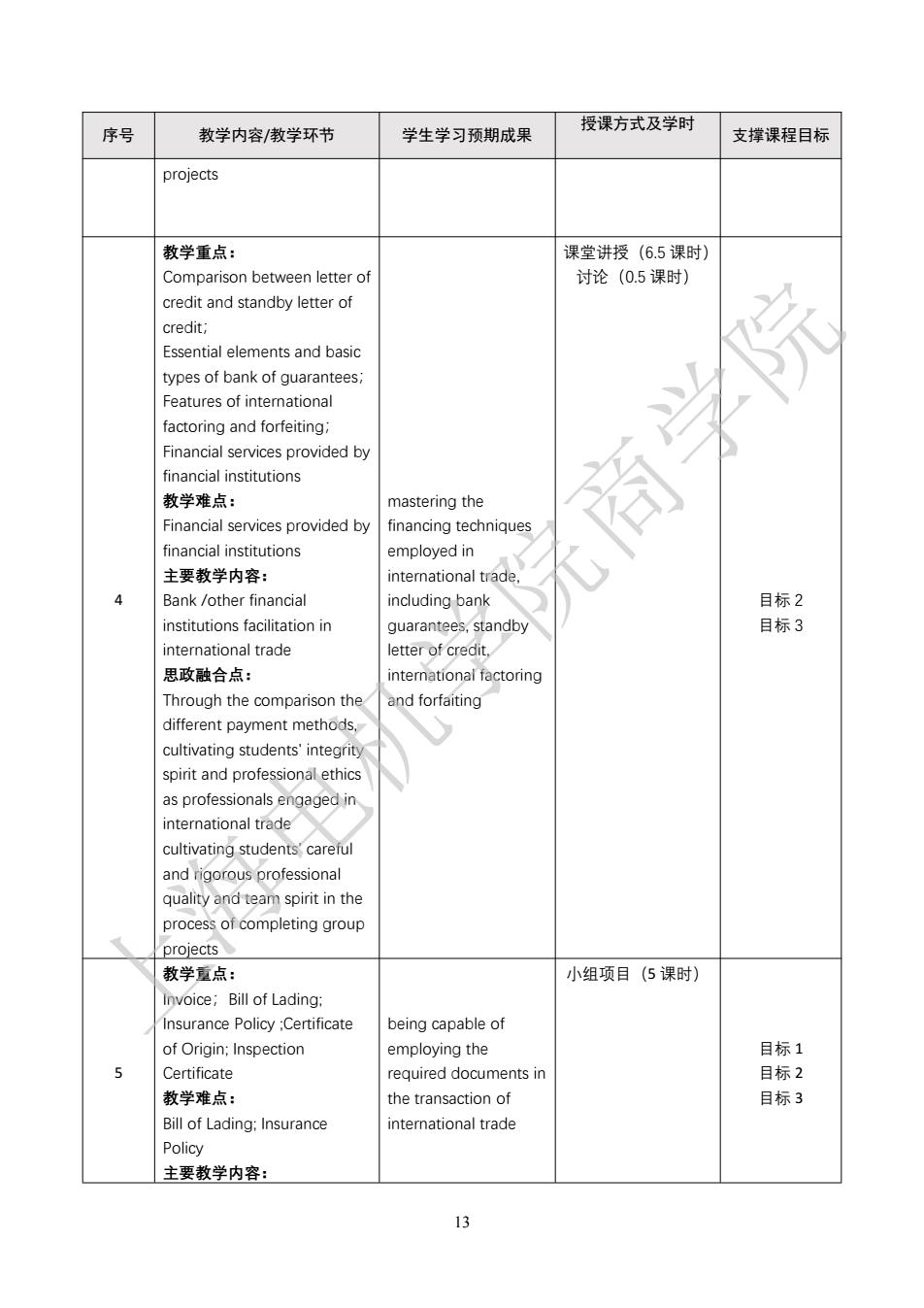

13 序号 教学内容/教学环节 学生学习预期成果 授课方式及学时 支撑课程目标 projects 4 教学重点: Comparison between letter of credit and standby letter of credit; Essential elements and basic types of bank of guarantees; Features of international factoring and forfeiting; Financial services provided by financial institutions 教学难点: Financial services provided by financial institutions 主要教学内容: Bank /other financial institutions facilitation in international trade 思政融合点: Through the comparison the different payment methods, cultivating students' integrity spirit and professional ethics as professionals engaged in international trade cultivating students' careful and rigorous professional quality and team spirit in the process of completing group projects mastering the financing techniques employed in international trade, including bank guarantees, standby letter of credit, international factoring and forfaiting 课堂讲授(6.5 课时) 讨论(0.5 课时) 目标 2 目标 3 5 教学重点: Invoice;Bill of Lading; Insurance Policy ;Certificate of Origin; Inspection Certificate 教学难点: Bill of Lading; Insurance Policy 主要教学内容: being capable of employing the required documents in the transaction of international trade 小组项目(5 课时) 目标 1 目标 2 目标 3 上海电机学院商学院