Agency Problem and Legal Strategies Reporter:Jin Jie,Yang Wenjie and Zhang Na

Agency Problem and Legal Strategies Reporter: Jin Jie, Yang Wenjie and Zhang Na

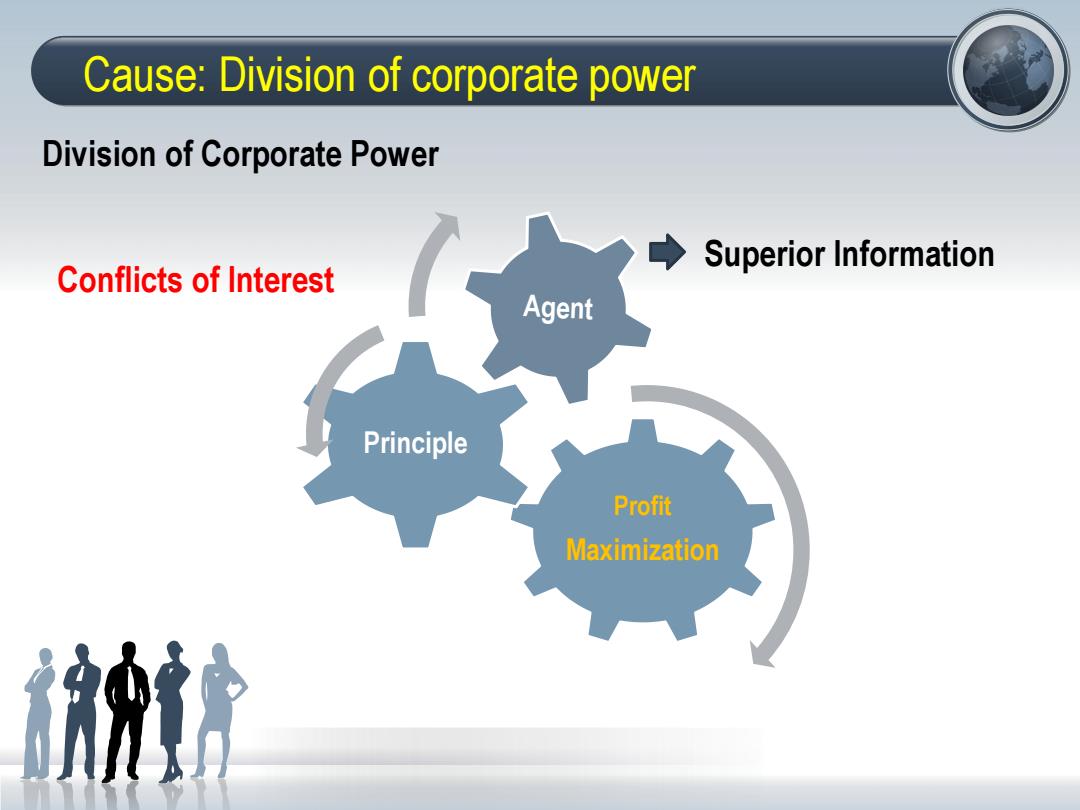

Cause:Division of corporate power Division of Corporate Power Superior Information Conflicts of Interest Principle Profit Maximization

Cause: Division of corporate power Profit Maximization Principle Agent Division of Corporate Power Superior Information Conflicts of Interest

Composition Residual Loss Agency cost Monitoring Cost of the Principal Bonding Cost of the Agent Theory of the Firm:Managerial Behavior,Agency Costs and Ownership Structure,Michael C.Jensen and William H.Meckling,Journal of Financial ms ceNo-

Composition Agency cost Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure, Michael C. Jensen and William H. Meckling, Journal of Financial Economics, October, 1976, V.3, No.4, pp.305-360. Residual Loss Monitoring Cost of the Principal Bonding Cost of the Agent

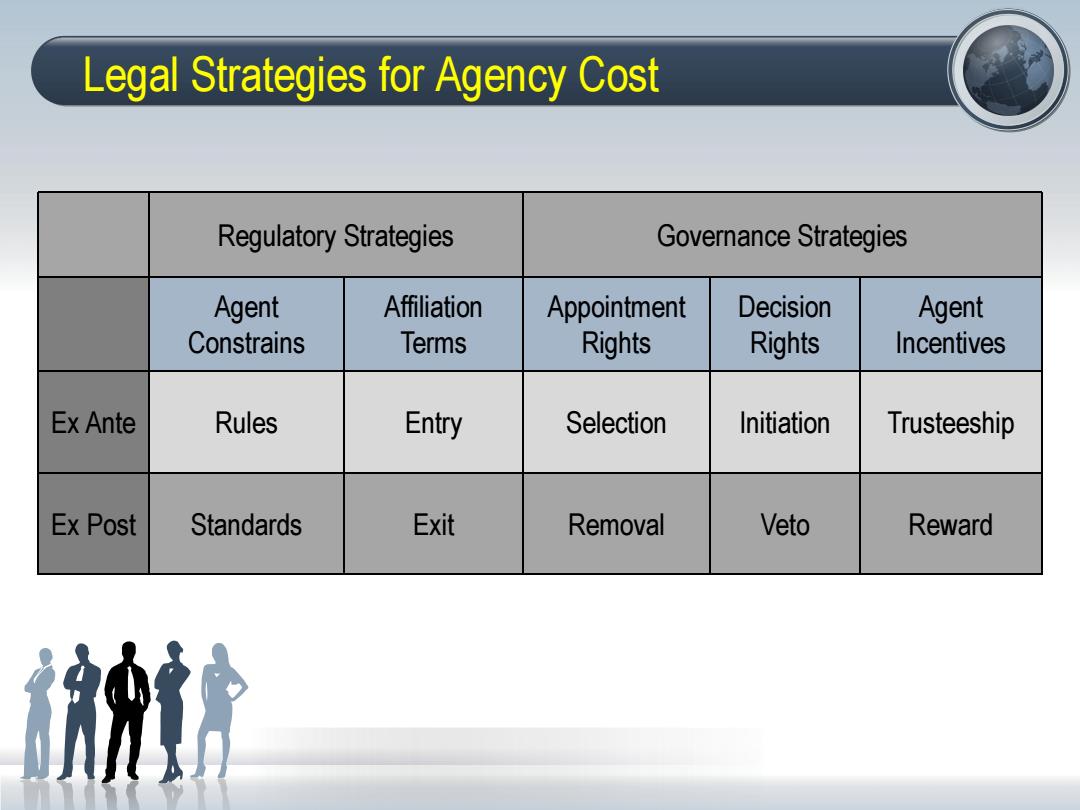

Legal Strategies for Agency Cost Regulatory Strategies Governance Strategies Agent Affiliation Appointment Decision Agent Constrains Terms Rights Rights Incentives Ex Ante Rules Entry Selection Initiation Trusteeship Ex Post Standards Exit Removal Veto Reward

Regulatory Strategies Governance Strategies Agent Constrains Affiliation Terms Appointment Rights Decision Rights Agent Incentives Ex Ante Rules Entry Selection Initiation Trusteeship Ex Post Standards Exit Removal Veto Reward Legal Strategies for Agency Cost

Regulatory vs.Governance Strategies Regulatory:directly constrain the actions of corporate actors. E.g.a standard of behavior such as a director's duty of loyalty and care. Governance:channel the distribution of power and payoffs within companies to reduce opportunism. E.g.the law may accord direct decision rights to a vulnerable corporate constituency,as when it requires shareholder approval of mergers

Regulatory vs. Governance Strategies Regulatory: directly constrain the actions of corporate actors. E.g. a standard of behavior such as a director’s duty of loyalty and care. Governance: channel the distribution of power and payoffs within companies to reduce opportunism. E.g. the law may accord direct decision rights to a vulnerable corporate constituency, as when it requires shareholder approval of mergers