and vice versa. An altemative approach in this model is to formulate the money supply for the world in terms of the ratio of intemational reserves to total money stock,initial shares in international erves5and initial ratiosof domestic credit to reservesd(Note that=1/1+d,where dis the ratio of reerves.)Then M=∑sR+∑dR 8M,=∑(1+d)g+gp RM=r(gR+∑dsD) E=r(oR+Edasp.)-s(1+di) 8飘,=(1+d)(+%8影)-dgo =1+d)+[1+d)g,~,+d)2k] -[d8e-(1+d,)r∑48] =1+d)rg+[1+d)-(1+d,)s] -(o+号y4o This altemative formulation.which will not be explored further here,naturally produces the The next stage in making the "monetary"model of balanceof-payments behaviour more realistic is to introduce a reserve currency country whose currency is held as a substitute for the of the reserve currency country.The total world money supply is as before the sum of reserves and domestic credit created by the individual countries;but the reserve currency role enables own domestic credit,instead ofor in addition to providing their own money by domestic credit As before we have g别=or8取+w1-g知 8=∑8+∑1-r8-8x But now the behaviour of the reserve currencyou'sreserves is determined by the relation between the growth of both foreign ad domestic demand for its money.and its domestic credit expansion.Still assuming homogeneity in money demand,we have

=+%+R影+(1-h)g]-5 where is the e ouy's held by residents the rate of growth of foreign demand for its money as a reserve currency,in real terms.This can be rewritten as 熙=[1-A)g+wrR+(h%-元R- -[(1-)8D-1-rm】 If the real forcign demand for the reserve ountry's currency is assumed o be a onstan proportion of the foreign money supply,the expression simplifies to 熙=少uw8+h(%R-乃8-1-5-T-ro] Assuming unitary income-elasticities of demand for real balances everywhere and the same initial ratios of international reserves to domestic money,it simplifies further to 期=殿+色(g,-)-1(m一动. That is,the reserve currency country will gain reserves faster than the rate of growth of otal rves if its real growth rate xed the world averageor itsrate expansion is below the world average,and vice versa. An alternative formulation of the problem,using the same two assumptions for simplicity. 8=h1-r题-即)-(hg,-g1. That is,foreign demand for the reserve currency must grow faster,the larger the reserve currency country's rate of domestic credit expansion relative to the rate of credit expansion aboad and the lower its real rate of growth relative to rate Finally,Iapply the general cass of monetary models of the balance of payments developed above to the problem of the effects of a devaluation of a currency.The application is not entirely theoretically.since the mathematics employed relate where a devaluation isa onceover affair.Still,the results are suggestive. For this problem,retain the assumption that domestic prices must keep in line with foreign prices,rate that can be changed,and represe devaluation by an instantaneous rate of change of the exchange rate.The demand for money now becomes Ma=pp (y,i). where is the foreign price level and is the price of foreign currency in terms of domestic 28

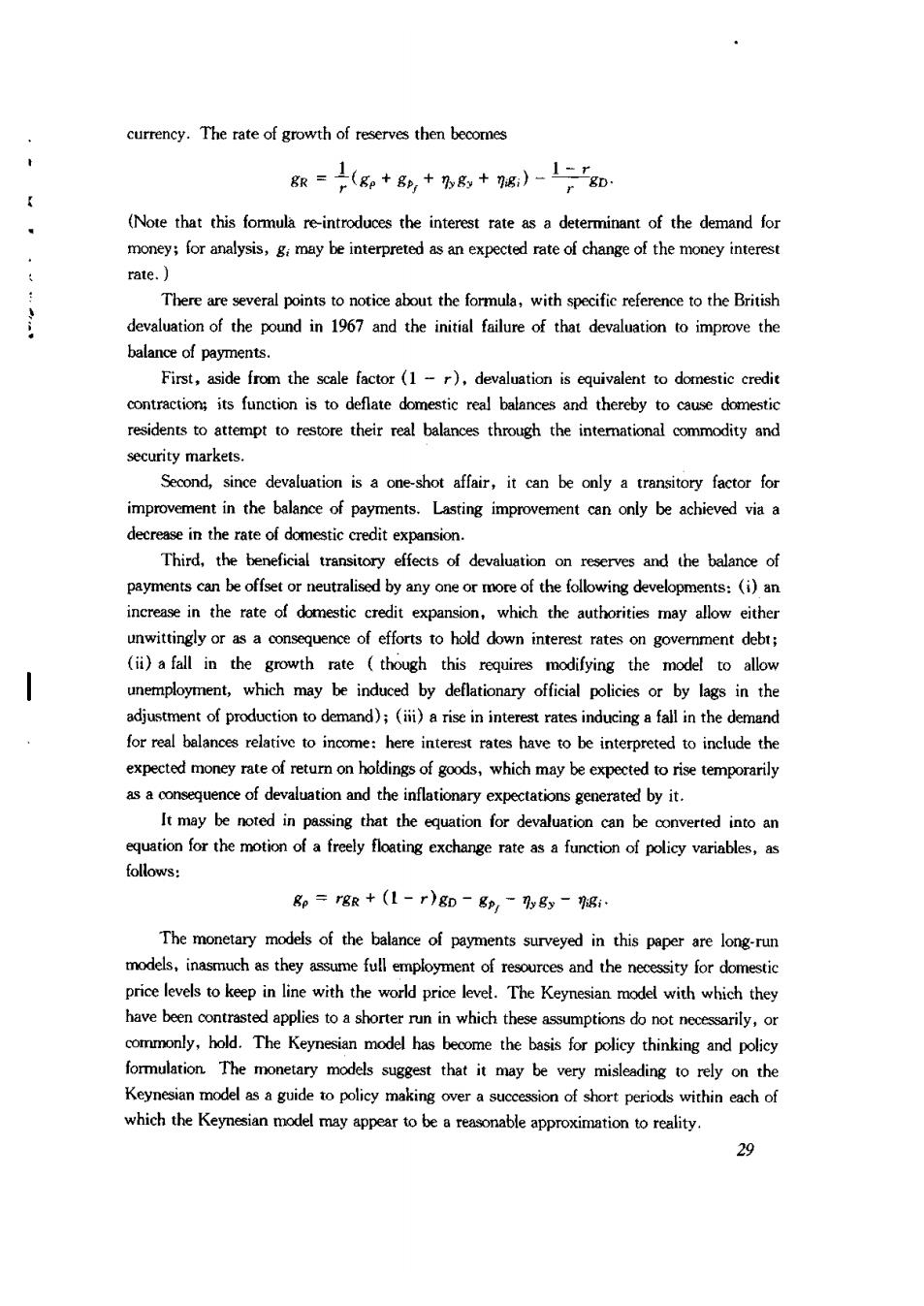

currency.The rate of growth of reserves then becomes 服=上(g+8,+%,+隔)-片知 (Note that this formula re-introduces the interest rate as a determinant of the demand for money;for analysis,g may be interpreted asan expected rate of change of the money interes rate.)】 There are several points to notice about the formula,with specific reference to the British devaluation of the pound in 1967 and the initi failure of that the balance of payments. First,aside from the scale factor(1-r),devaluation is equivalent to domestic credit is todeflate domestic al residents to attempt to restore their real balances through the intemational commodity and security markets. Seond,since devaluation is a one-shot affair,it can be ony a transitory factor for improvement in the balance of payments.Lasting improvement can only be achieved via a decrease in domestic credit expansion. Third,the beneficial transitory effects of devaluation on reserves and the balance of payments can be offset or neutralised by any one or more of the following developments:(i)an increase in the rate of domestic credit expansion,which the authorities may allow either unwittingly or as a of efforts to hold down interest rates on goverment debt; (ii)a fall in the growth rate though this requires modifying the model to allow unemployment,which may be induced by deflationary official policies or by lags in the adjustment of production to demand);()a rise in interest rates inducing a fall in the demand for real balances relative to income:here interest rates have to be interpreted to include the expected of gods,which may asaonsequence of devaluation and the inflationary expectations generated by it. It may be noted in passing that the equation for devaluation can be converted into an ollows: =rgR+(1-r)g-g,-%8y- The monetary models of the balance of payments surveyed in this paper are long-run models,inasmuch as they assume full employment of resources and the necessity for domestic rice keep in line with the world price level.The Keynesian model with which they have been contrasted applies to a shorter run in which these assumptions do not necessarily,or commony,hold.The Keynesian model has become the basis for policy thinking and policy foruation The monetary models suggest that it may be very misleadingorely on the Keynesian model as a guide to policy making over a succession of short periods within each of which the Keynesian model may appearo bereasonable approximation to reality. 29

3 Flexible Exchange Rates,1973-1980: How Bad Have They Really Been? Richard Cooper 本文是研究浮动汇率制的一篇力作,发表于1981年。受到一些论文集的选载。 作者简介:Richard Cooper是当代美国著名经济学家,在国际金融和世界经 济方面发表了大量专著和论文。《相互依存经济学》(《The Economics of Interdependence》)是其代表作之一,现任美国哈佛大学肯尼迪政府学院和经济 系讲座救授。 论文提要:本文从实证角度分析,认为1973年以来实行的浮动汇率制并非 错误的选择。世界经济当时经历的低增长率、高失业率和高通胀率并非浮动汇 率制本身造成,而是两次石油冲击和国际清偻力过度扩张引起的后果。文章分 析美国、日本和德国在1973-1980年间各自的名义有效汇率、实际有效汇率与 经常项日差额之间的关系,认为经通胀调整而得的实际汇率在这个期间相当稳 定。作者认为浮动汇率不是导致各国经济状况显著差异的原因,也不是冲击的 来源,而是阻止贸易保护主义的抬头和促进世界贸易的增长。最后作者探讨浮 动汇率制与隔绝外部冲击的关系。 Grand claims were once made for a system of flexible exchange rates.The classic statement was by Milton Friedman (1953),and the most complete development was Egon Sohmen's Flezible Exchange Rates:Theory and Controversy (1%1). Robert Triffin,while never discussing flexible exchange rates in analytical detail,has over around the loss of discipline on fiscal and monetary authorities that flexible exchange rates permit with respect to anti-inflation policies.Triffin has also been concerned with the that flexibe might lead to suurbu-price relationship that they would engender protectionist actions.He has feared the disintegrative impact that fexible exchange rates might have and,hence,upon political relations between nations,an impact that would run strongly counter to his lifelong objective of promoting economic integration among nations,and especially among European nations. (1955:16) 30

By March 1981 we had eight years'experience with major currencies floating against one another in exchange markets.What can we say about this experience-and particularly against the grand caims that made for rates and Triffin'ne abou them?D First,it is necessary to admit that on any comparative measure,the world's performance during the late 19s,when generalid flating prevailed,was worse than its performance during the final years of the adjustable peg system.For example, real economic growth was only 60 percent as rapid during 1973-1979 as it was in the predingsven-year perid;in percen higher,and inflation rates were more than double. These lamentable developments,however,cannot be attributed to the introduction of flexible exchange rates.Post hc des not imply propterhc.this,weneed ony recall two other factors that greatly affected conomic performance during this period-the quadrupling of world oil prices in 1973-1974 and the further doubling of those prices in 1979; and the liquidity in the 1970-1973.the last years of the fixed exchange rate system.These factors together forced national economic policymakers to deal simultaneously with high unemployment and high inflation,a task to whichourstandard suited. If we make allowance for the severe disturbances to which the world economy was subjected during this period,I conclude that the experience under floating exchange rates has beena good one.It is worth keeping in mind that the smoothess of a ride depends on the size of the bumps on the road as well as on the quality of the shock absorbers.If we abstract from sharp day-to-day movements,floating exchange rates performed about as well as newould have expcted given the disturbances.avoided (indeed,major trade liberalization was agreed),and world trade continued to grow In what follows,I first want to make some analytical distinctions that pertain to movementsin exchange rates.Then I will discuss the actua movements in exchange rates during 1973 to 1980.Following that,I consider the possibility that flexible exchange rates may have been a substantial cause of some of the disturbances experienced by the world economy Real Versus Nominal Movements in Exchange Rates Oe attribute of flexible exchange rates is that they can correct for differential nationa rates of inflation at the border,leaving all real variables unchanged.Fixed exchange rates,in contrast,lead to an alteration of relative prices among tradable goods