e further difference between types of mdel of balance-of-payments theory is worth noting.Whereas the Keynesian model assumes that employment and output are variable at (relatively)constant prices and wages,the monetary models assume that output and employment levels,with reactionstochangestaking the price and wage adjustments.This difference mirrors a broader difference between the Keynesian and quantity theory approaches to monetary theory for the closed economy.The assumption of full these models areomed with the longer run,and that for this perspective the assumptionof full employment is more appropriate than the assumption of general mass unemployment for the the end of Worid War II. 1 now tufrom the discussion of theoretical issues in mode-oonstruction ton exposition ol some monetarist models of balance-of-payments behaviour in a growing world economy.The models to be are extremely simple,insmuch as the veral balance of the balance of payments,i.e.on the trend of international reserve acquisition or loss,and ignore the composition of the balance of payments as between current account,capital and veral the structureof the balance ol-payments accounts that may occur as a country passes through various stages of economic growth Nevertheless they will,I hope,provide some interesting insights into balance-of- To begin with,it is useful to develop some general expressions relating the growth rates of economie aggregates to the growth rates of their components or of the independent variables to which they are.by elementary calculus,and are merely stated here.In the formulas,g is the growth rate per unit of time of a subscripted aggregate or variable,A and B are components of an aggregate,f(A,B)is a function of A and B,anddenotes the elasticity of the agregate defined by the function with respect to the subscripted variable.Then we have Ra”AB队+A平B别 8A-B=A-B &A -A-B 8B EAB =gA +gB 8A/B =BA-8B gf(A.B)TABA BEB (where denotes an elasticity). exchange rate with the rest of the world,assumed to be growing over time.and small enough and diversified enough in relation to the world economy for its price level to be the world price level,and its the orld inter rate.(Differ and foreig 22

prices indices.o between domestic and foreign interest rates,oud readily be allowed or, provided they are assumed fixed by economic conditions.In addition,it is assumed that the supply of money is instantausyadjusted to the demand for it.because the residents of the or through the international securities market.Which mechanism of adjustment of money supplyto moey demand prevails will determine the way in which moneary policy affects the the balance of payments,but that not pursued in the present analysis. The of these assumptions is that domestic monetary policy does not determine the domestic money supply but instead determines ony the division of the backing of the money supply the public demands,between international reserves and domestic credit.Monetary the um of mstic creditand not the mney supply:and verdomestic credit the balance of pyments and thus the behaviour of te country's interational reserves. The demand for money may be simply specified as Ma pf(y,i) where M is the nominal quantity of domestic money demanded.y is real output,i is the interest olding the foreign and therefore domestic pric level,andiicthe demand ore(by the standard homogeneity postulate of monetary theory.The supply of money is M.=R+D money supply.Since by assumption M,must be equal to M. R=M-D and 取=B()=0最8知 where Bithe curent ovenll baance of pyments.Letinthe imitial intemation reserve ratio,and substitutingfor =(g+%8,+,)-,8 Simplifying by world prices and interest rates. 8=%,-1' that is reserve growth and the balance of payments are positively relatedto domesticm 23

growth and theinme elasticityof demand for money,and negatively related to therateof domestic credit expansion.Simplifying still further by assuming no domestic growth (g=0) that is,the balnce of related otherateofdomestic credit expansion. These results are to be contrasted with various Keynesian theories about the relation growth and the balance of payments.Acording thory derived from the multiplier analysis,cconomic growth must worsen the balance of payments through increasing imports relative to exports;this theory neglects the influence of the demand for and import demand and on the interational According to another and more sophisticated theory,domestic credit expansion will tend to improve the balance of payments by stimulating investment and productivity increase and so owering omestic price improvingthe ntaccount through the resulting substitutions of domestic for foreign goods in the foreign and domestic markets. This theory begs a number of questions even in naive Keynesian terms;in terms of the present the error of attempting to deduce expansion from its presumed relative price effects without reference to the monetary aspect of balance-of-payments surpluses and deficits. Henceforth the analysis will be simplified by assuming that world interest rates are constant.so that the growth of demand for real balances depends only on the growth of real output (the growth of demand for nominal money balances depends of oourse also on the rate of change of the price leve).This assumption can be justified on the grounds that real rates of return on investment are relatively stable,and that money rates of interest in a longer-run growth context will be equal to real rates of retumn plus the (actual and expected)rate of world price inflationor minus the(actual and expected)rate of world price deflation The foregoing mdel was.Th next model considers monetary equilibrium in the world system as a whole.For initial simplicity it is assumed that there is a single world money. e.no national credit money it can be rationalised on the assumption that each national economy's domestic banking system can be cmpressed into a functional relation between itsrel ouput and its demand for real neThesiffere bet this model and the predngistha the world price level becomes endogenous instead of exogenous,determined by the relation between the growth rates of demand for and supply of intemational serves For the world economy,the growth rate of demand for interational money,assuming the homogeneity postulate as before,is

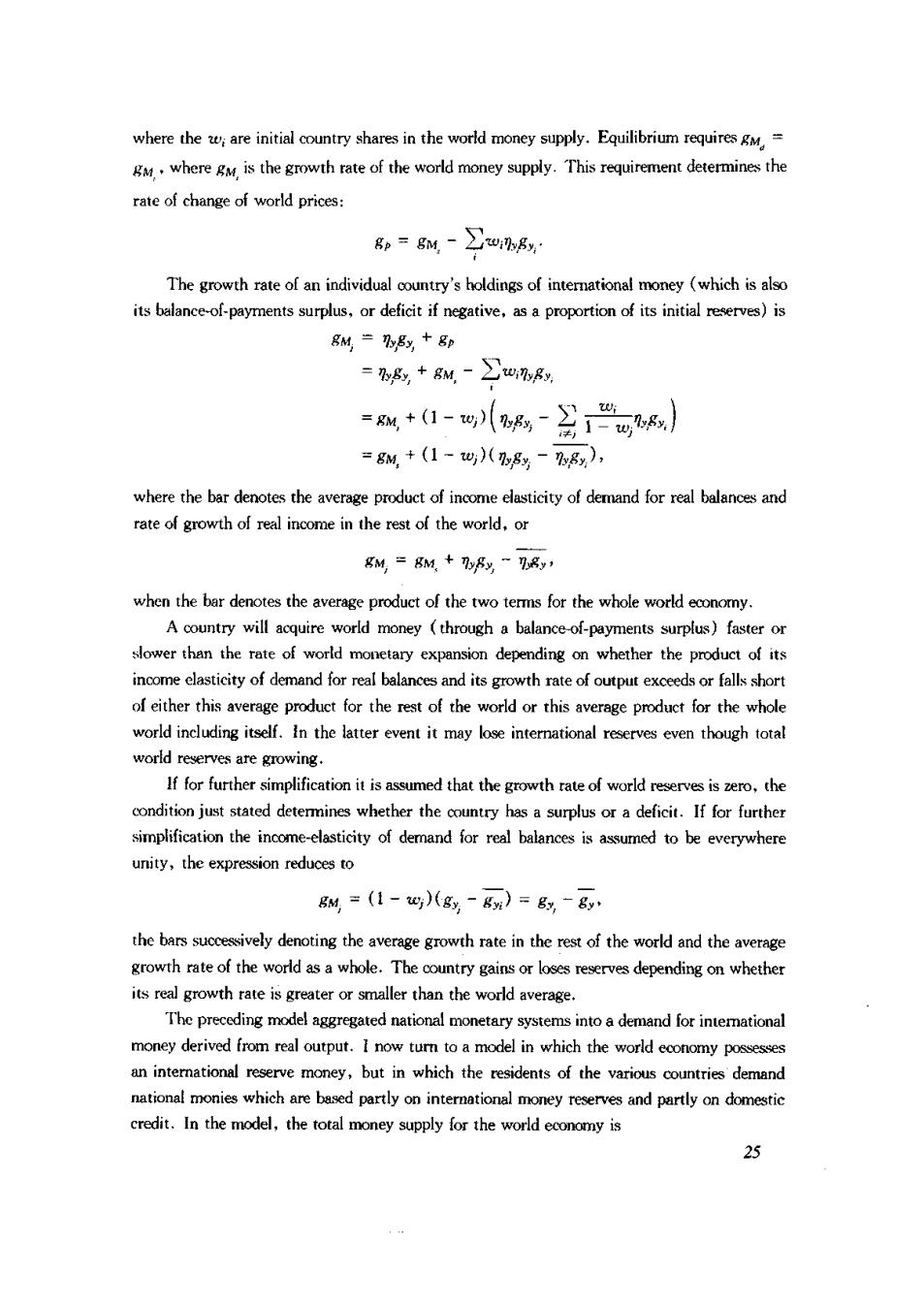

where theare shares in the world money supply.Equilibriumrequires where is the growth rate of the world money supply.This requirement determines the rate of change of world prices: 8=gM-∑awg The growth rateofn individual ouny's holdings of intemational money(which is als its balance-of-payments surplus,or deficit if negative,as a proportion of its initial reserves)is 8制=乃5影+8n =%8+g8别-∑ug %+1,多6小 =g别+(1-四(%5-w品), where the bar denotes the average product of inme elasticity of demand for real balances and rate of growth of real income in the rest of the world,or g8M=8M+75y7, A counry will acquire world money (through a balance-of-payments surplus)fasteror slower than the rate of world monetary expansion depending on whether the product of its income clasticity of demnd for real baances and its growthrate of output ofther thisverdct for the etofe ord or this averngefor thewhole world including itself.In the latter event it may lose international reserves even though total world reserves are growing. If for further simplification it is assumed that the growth rate of world reserves is zero,the ondition ust stated determines whether the coury has a surplusor a deficit.If for further simplification the inme-elasticity of demand for real balances tobe everywhere unity,the expression reduces to 8别=(1-q(8影-8对)=6-8、 the bars successively denoting the average growth rate in the rest of the world and the average growthrateof the world as a whole.dependingon whether its real growth rate is greater or smaller than the world average. The preceding model aggregated national monetary systems into a demand for interational an international reserve money,but in which the residents of the various countries demand national monies which are based partly on interational money reserves and partly on domestic credit.In the model,the total money supplyfor the 25

M=R+∑D =∑gM+∑,(1-r)M, where R is total international reserve money,D,is domestic credit in country is country in the tot world stock of money andisconryi's ratio of interational reserve money to its domestic money supply. As before,the rate of growth of world demand for money is gM,=:78+gp: The rate of growth of the world money supply is g别=07kR+∑(1-7)知 These determine the rate of changeof world prices,through the requirement that 8M gM: gp=∑urgR+∑:(1-r)gD,-∑wngy From previous results,the growth rate of an individual country's reserves is =1∑wrR取+习w1-r)8+,- ={∑r8取+(B影-,)-[(1-5)g2-1-7m], where the bars again indicate the average product of the barred terms for the world economy. This expression indicates that a try's reserves willgrow faster the lower its initial reserve ratio,the faster the growth of total world reserves,the higher its inme elasticityof demand for money and its real growth rate relative to other countries,and the lower its Simplifying by assuming that income elasticities of demand for money are everywhere unity,and that international reserve ratios are also the same everywhere,we obtain =取+(8影-,(-8D which shows that the growth rateof'seserveswilln tend to be faster than the world average if itsreal growth rate is greater than the worid average,an slower than the world average if its rate of credit expansion is greater than the world average. 26