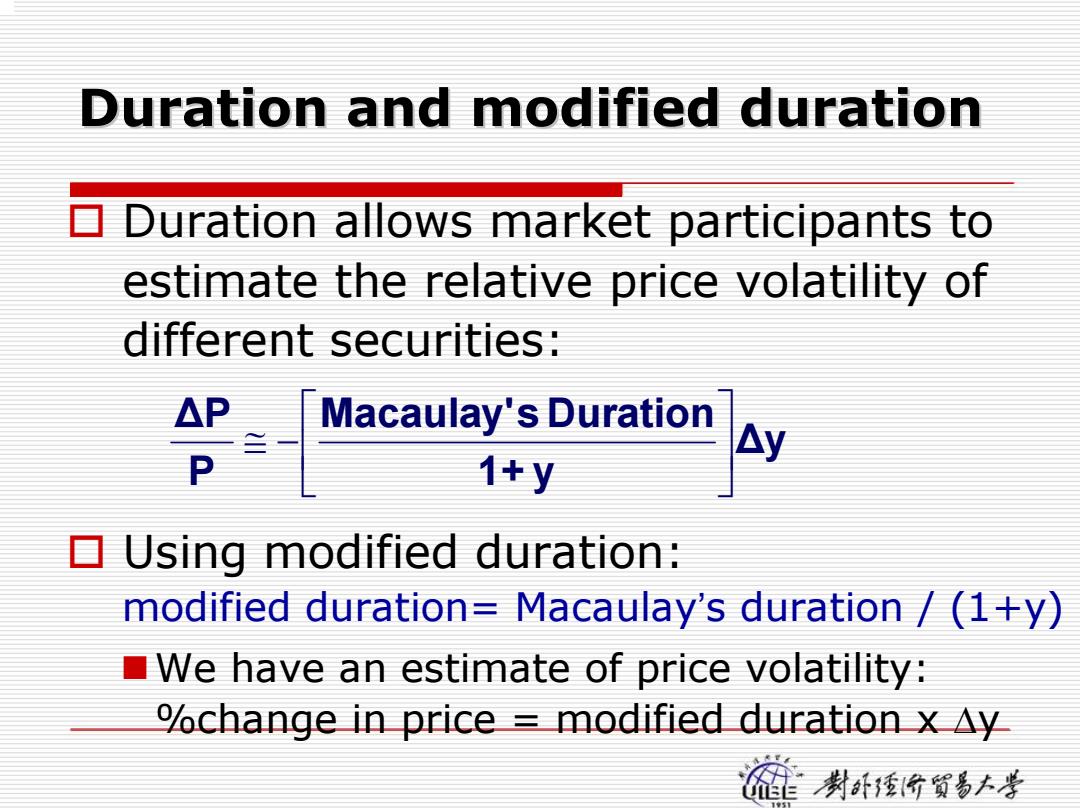

Duration and modified duration Duration allows market participants to estimate the relative price volatility of different securities: △P Macaulay's Duration y 1+y Using modified duration: modified duration=Macaulay's duration /(1+y) IWe have an estimate of price volatility: %change in price modified duration x ay 制酥价贸号大孝

Duration and modified duration Duration and modified duration ∆ y 1 + y Macaulay' s Duration P ∆ P ⎥ ⎦ ⎤ ⎢ ⎣ ⎡ ≅ − Duration allows market participants to estimate the relative price volatility of different securities: Using modified duration: modified duration= Macaulay’s duration / (1+y) We have an estimate of price volatility: %change in price = modified duration x ∆ y

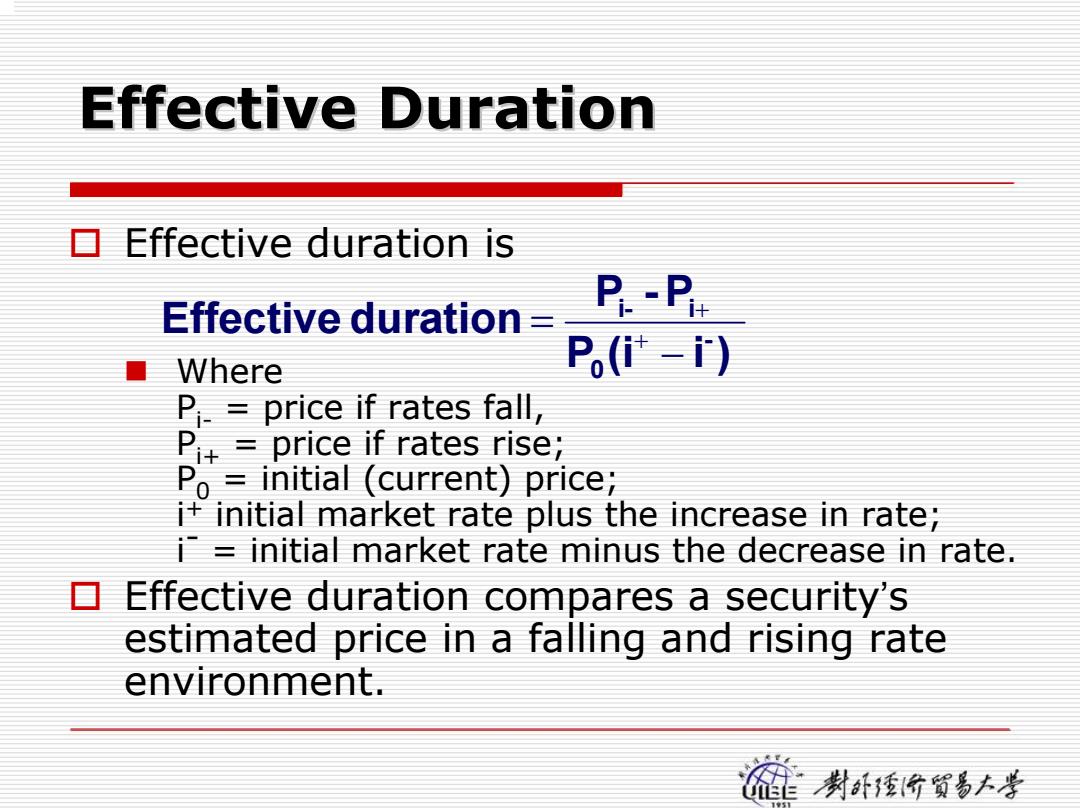

Effective Duration Effective duration is Effective duration三 P.-Pi Where P(世-) P.=price if rates fall, P+=price if rates rise; Po initial(current)price; i+initial market rate plus the increase in rate; i=initial market rate minus the decrease in rate. 目 Effective duration compares a security's estimated price in a falling and rising rate environment. 麓的贫香小手

Effective Duration Effective Duration P (i i ) P - P Effective duration - 0 i- i − = + + Effective duration is Where Pi- = price if rates fall, Pi+ = price if rates rise; P 0 = initial (current) price; i + initial market rate plus the increase in rate; i - = initial market rate minus the decrease in rate. Effective duration compares a security’s estimated price in a falling and rising rate environment

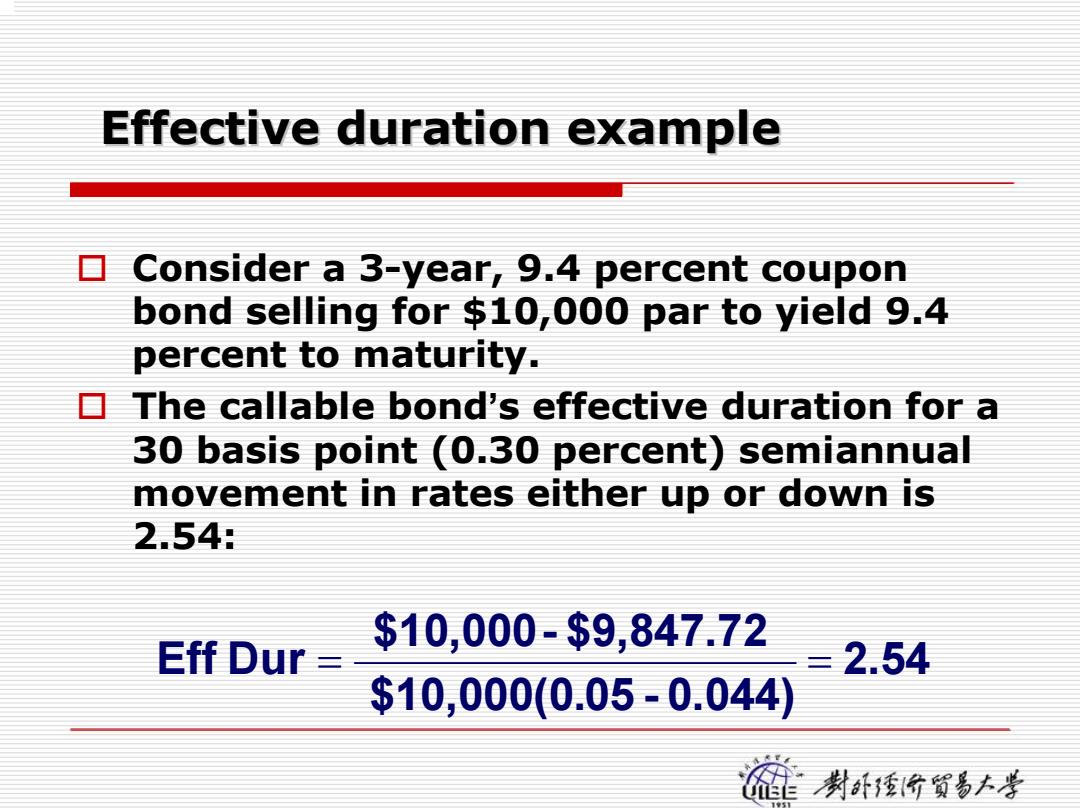

Effective duration example 目 Consider a 3-year,9.4 percent coupon bond selling for $10,000 par to yield 9.4 percent to maturity. 目 The callable bond's effective duration for a 30 basis point (0.30 percent)semiannual movement in rates either up or down is 254: $10,000-$9,847.72 Eff Dur 三 =2.54 $10,000(0.05-0.044) 爸封强的黄香+孝

Effective duration example Effective duration example Consider a 3-year, 9.4 percent coupon bond selling for $10,000 par to yield 9.4 percent to maturity. The callable bond’s effective duration for a 30 basis point (0.30 percent) semiannual movement in rates either up or down is 2.54: 2.54 $10,000(0.05 - 0.044) $10,000 - $9,847.72 Eff Dur = =