JEAN TIROLE

Contents nd the Financial elpertalOalston 2.3 24 10 11 oenie 50m ns of the 53 1.9 3.5 03

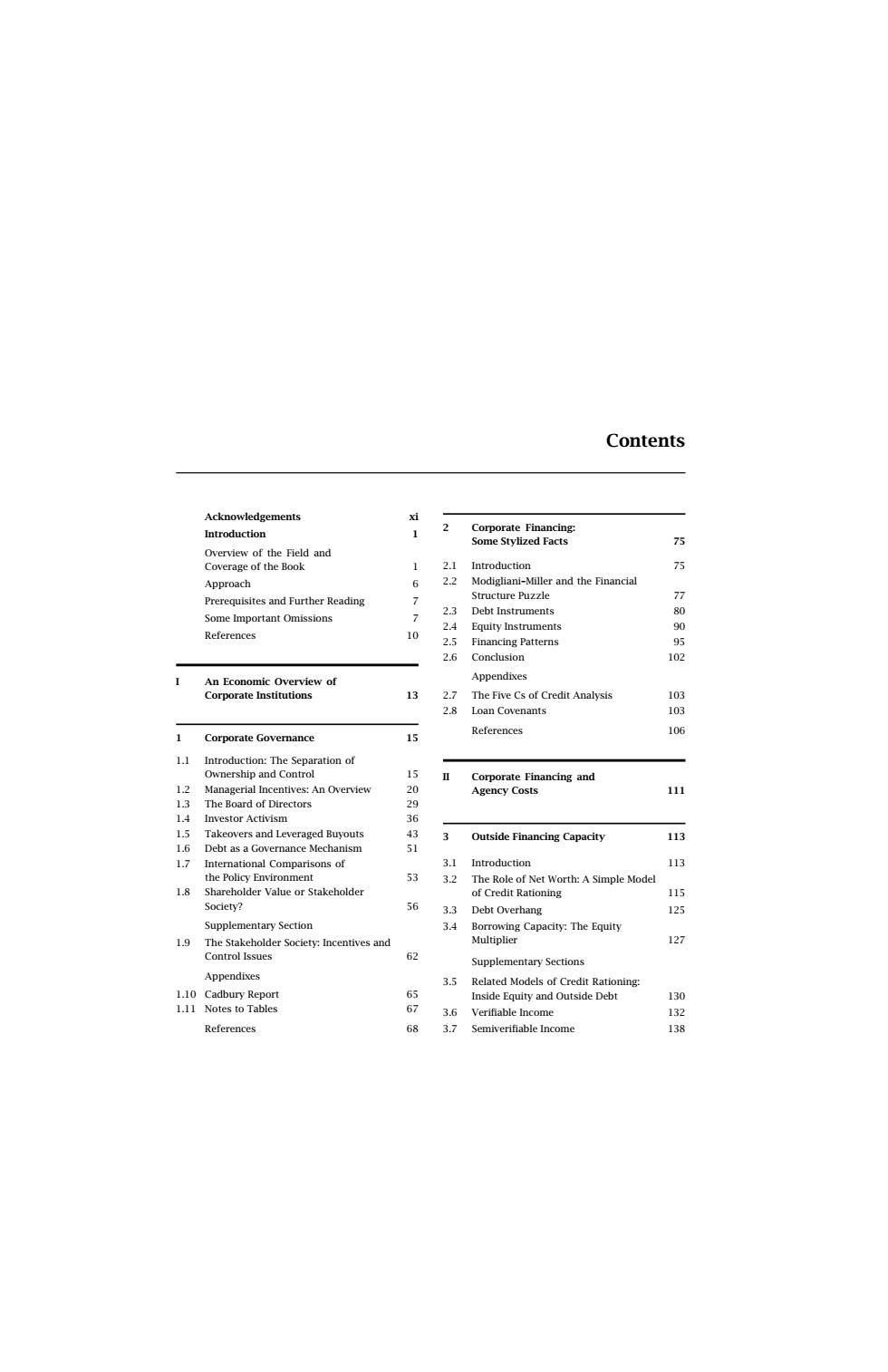

Contents Acknowledgements xi Introduction 1 Overview of the Field and Coverage of the Book 1 Approach 6 Prerequisites and Further Reading 7 Some Important Omissions 7 References 10 I An Economic Overview of Corporate Institutions 13 1 Corporate Governance 15 1.1 Introduction: The Separation of Ownership and Control 15 1.2 Managerial Incentives: An Overview 20 1.3 The Board of Directors 29 1.4 Investor Activism 36 1.5 Takeovers and Leveraged Buyouts 43 1.6 Debt as a Governance Mechanism 51 1.7 International Comparisons of the Policy Environment 53 1.8 Shareholder Value or Stakeholder Society? 56 Supplementary Section 1.9 The Stakeholder Society: Incentives and Control Issues 62 Appendixes 1.10 Cadbury Report 65 1.11 Notes to Tables 67 References 68 2 Corporate Financing: Some Stylized Facts 75 2.1 Introduction 75 2.2 Modigliani–Miller and the Financial Structure Puzzle 77 2.3 Debt Instruments 80 2.4 Equity Instruments 90 2.5 Financing Patterns 95 2.6 Conclusion 102 Appendixes 2.7 The Five Cs of Credit Analysis 103 2.8 Loan Covenants 103 References 106 II Corporate Financing and Agency Costs 111 3 Outside Financing Capacity 113 3.1 Introduction 113 3.2 The Role of Net Worth: A Simple Model of Credit Rationing 115 3.3 Debt Overhang 125 3.4 Borrowing Capacity: The Equity Multiplier 127 Supplementary Sections 3.5 Related Models of Credit Rationing: Inside Equity and Outside Debt 130 3.6 Verifiable Income 132 3.7 Semiverifiable Income 138

154 157 A0Bn面s 26 158 ity Tradeoff 280 283 Markets 283 5 19 299 13333 d Lewis'sCoumotArays 33 Reference 25 81 237 333 237 33R

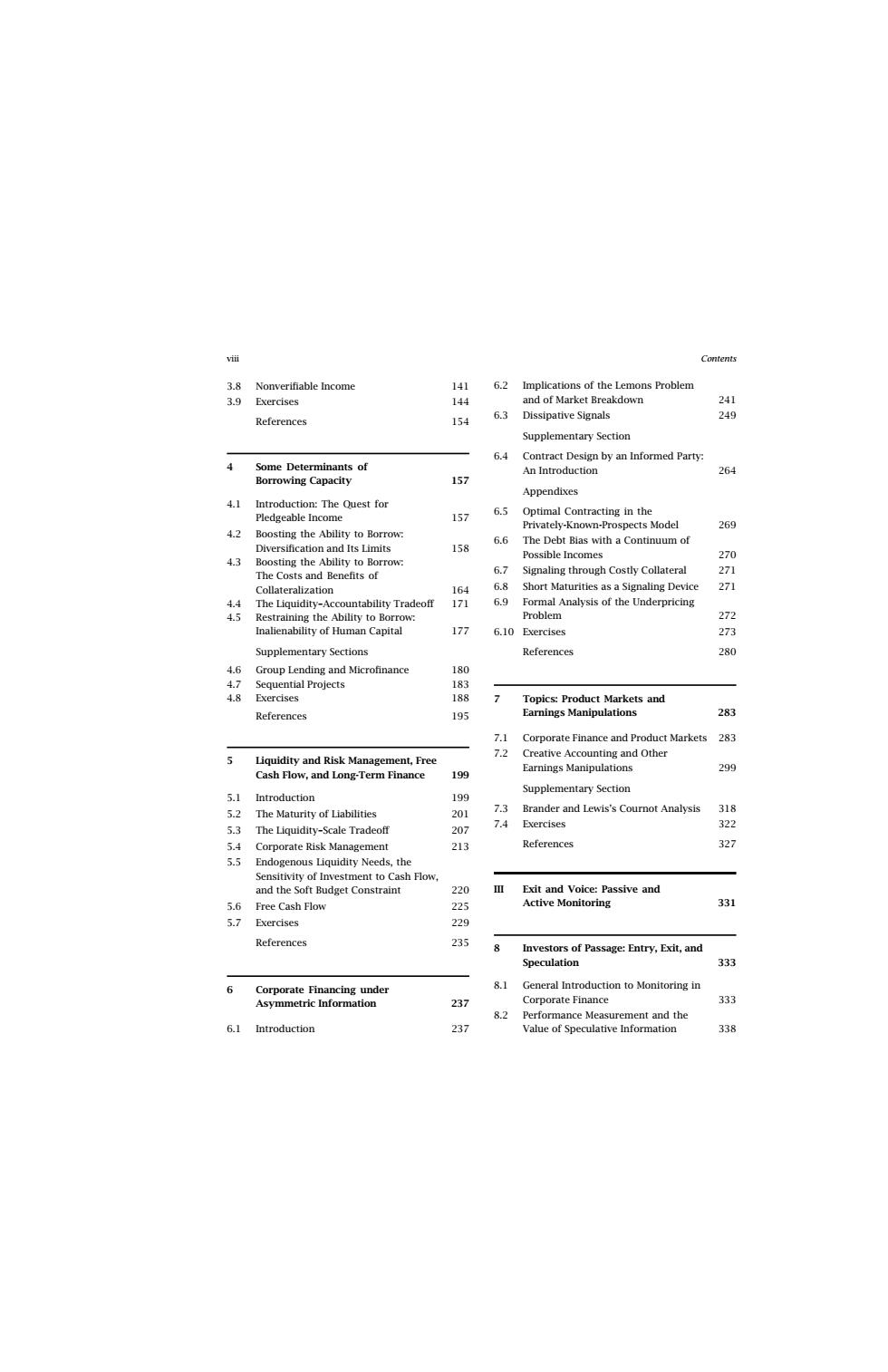

viii Contents 3.8 Nonverifiable Income 141 3.9 Exercises 144 References 154 4 Some Determinants of Borrowing Capacity 157 4.1 Introduction: The Quest for Pledgeable Income 157 4.2 Boosting the Ability to Borrow: Diversification and Its Limits 158 4.3 Boosting the Ability to Borrow: The Costs and Benefits of Collateralization 164 4.4 The Liquidity–Accountability Tradeoff 171 4.5 Restraining the Ability to Borrow: Inalienability of Human Capital 177 Supplementary Sections 4.6 Group Lending and Microfinance 180 4.7 Sequential Projects 183 4.8 Exercises 188 References 195 5 Liquidity and Risk Management, Free Cash Flow, and Long-Term Finance 199 5.1 Introduction 199 5.2 The Maturity of Liabilities 201 5.3 The Liquidity–Scale Tradeoff 207 5.4 Corporate Risk Management 213 5.5 Endogenous Liquidity Needs, the Sensitivity of Investment to Cash Flow, and the Soft Budget Constraint 220 5.6 Free Cash Flow 225 5.7 Exercises 229 References 235 6 Corporate Financing under Asymmetric Information 237 6.1 Introduction 237 6.2 Implications of the Lemons Problem and of Market Breakdown 241 6.3 Dissipative Signals 249 Supplementary Section 6.4 Contract Design by an Informed Party: An Introduction 264 Appendixes 6.5 Optimal Contracting in the Privately-Known-Prospects Model 269 6.6 The Debt Bias with a Continuum of Possible Incomes 270 6.7 Signaling through Costly Collateral 271 6.8 Short Maturities as a Signaling Device 271 6.9 Formal Analysis of the Underpricing Problem 272 6.10 Exercises 273 References 280 7 Topics: Product Markets and Earnings Manipulations 283 7.1 Corporate Finance and Product Markets 283 7.2 Creative Accounting and Other Earnings Manipulations 299 Supplementary Section 7.3 Brander and Lewis’s Cournot Analysis 318 7.4 Exercises 322 References 327 III Exit and Voice: Passive and Active Monitoring 331 8 Investors of Passage: Entry, Exit, and Speculation 333 8.1 General Introduction to Monitoring in Corporate Finance 333 8.2 Performance Measurement and the Value of Speculative Information 338

4 345 11 Takeovers 42s 353 9 s and sand M: 35 431 93 11.9 95 Exercises 382 383 387 47 e 123Rm 457 22

Contents ix 8.3 Market Monitoring 345 8.4 Monitoring on the Debt Side: Liquidity-Draining versus Liquidity-Neutral Runs 350 8.5 Exercises 353 References 353 9 Lending Relationships and Investor Activism 355 9.1 Introduction 355 9.2 Basics of Investor Activism 356 9.3 The Emergence of Share Concentration 366 9.4 Learning by Lending 369 9.5 Liquidity Needs of Large Investors and Short-Termism 374 9.6 Exercises 379 References 382 IV Security Design: The Control Right View 385 10 Control Rights and Corporate Governance 387 10.1 Introduction 387 10.2 Pledgeable Income and the Allocation of Control Rights between Insiders and Outsiders 389 10.3 Corporate Governance and Real Control 398 10.4 Allocation of Control Rights among Securityholders 404 Supplementary Sections 10.5 Internal Capital Markets 411 10.6 Active Monitoring and Initiative 415 10.7 Exercises 418 References 422 11 Takeovers 425 11.1 Introduction 425 11.2 The Pure Theory of Takeovers: A Framework 425 11.3 Extracting the Raider’s Surplus: Takeover Defenses as Monopoly Pricing 426 11.4 Takeovers and Managerial Incentives 429 11.5 Positive Theory of Takeovers: Single-Bidder Case 431 11.6 Value-Decreasing Raider and the One-Share–One-Vote Result 438 11.7 Positive Theory of Takeovers: Multiple Bidders 440 11.8 Managerial Resistance 441 11.9 Exercise 441 References 442 V Security Design: The Demand Side View 445 12 Consumer Liquidity Demand 447 12.1 Introduction 447 12.2 Consumer Liquidity Demand: The Diamond–Dybvig Model and the Term Structure of Interest Rates 447 12.3 Runs 454 12.4 Heterogenous Consumer Horizons and the Diversity of Securities 457 Supplementary Sections 12.5 Aggregate Uncertainty and Risk Sharing 461 12.6 Private Signals and Uniqueness in Bank Run Models 463 12.7 Exercises 466 References 467

518 46的 153A 523 133 and the redit Crunche 478 48 165 555 66 56码 The Model 144 Answers to Selected Exercises 2 517

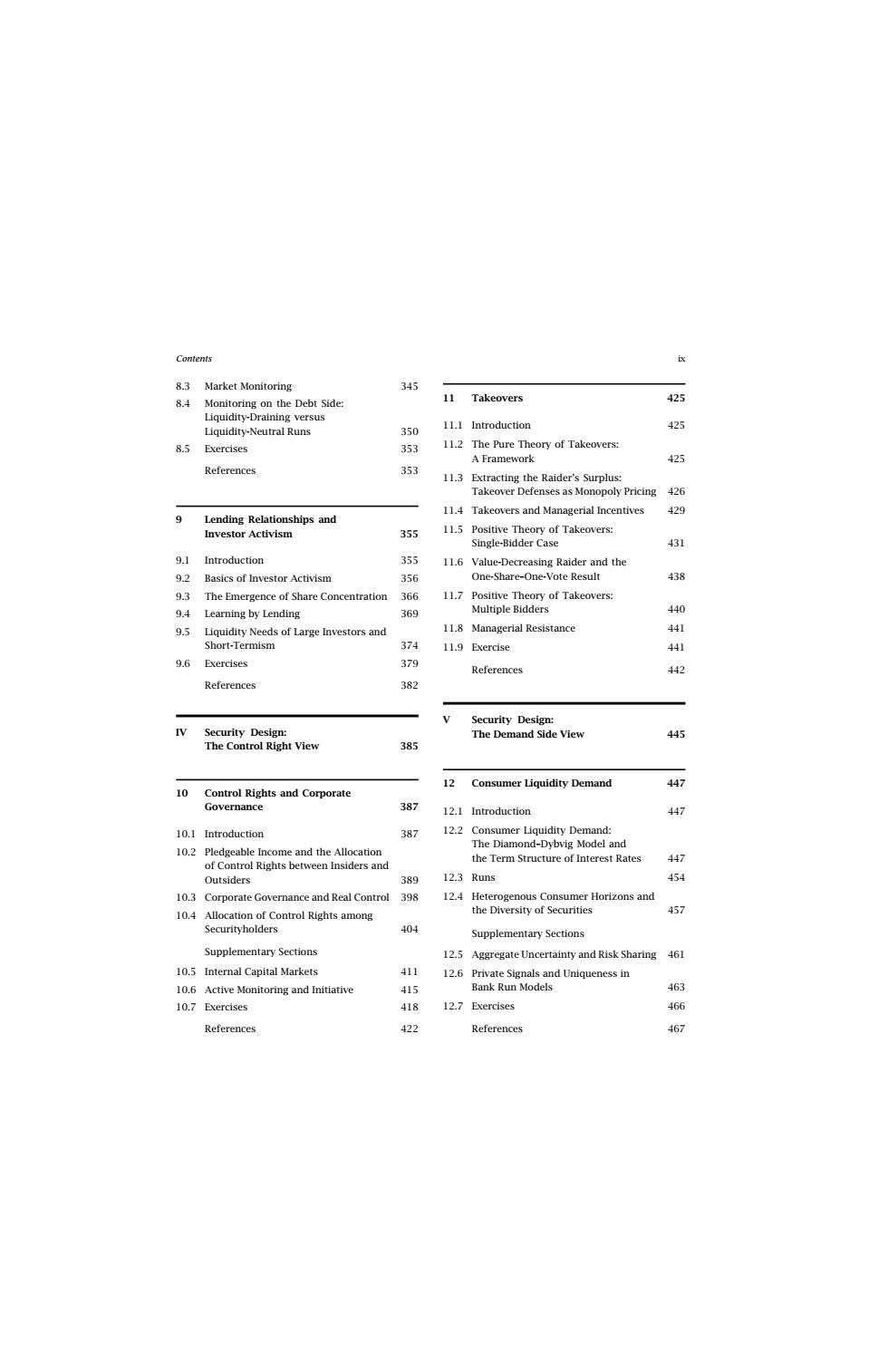

x Contents VI Macroeconomic Implications and the Political Economy of Corporate Finance 469 13 Credit Rationing and Economic Activity 471 13.1 Introduction 471 13.2 Capital Squeezes and Economic Activity: The Balance-Sheet Channel 471 13.3 Loanable Funds and the Credit Crunch: The Lending Channel 478 13.4 Dynamic Complementarities: Net Worth Effects, Poverty Traps, and the Financial Accelerator 484 13.5 Dynamic Substitutabilities: The Deflationary Impact of Past Investment 489 13.6 Exercises 493 References 495 14 Mergers and Acquisitions, and the Equilibrium Determination of Asset Values 497 14.1 Introduction 497 14.2 Valuing Specialized Assets 499 14.3 General Equilibrium Determination of Asset Values, Borrowing Capacities, and Economic Activity: The Kiyotaki–Moore Model 509 14.4 Exercises 515 References 516 15 Aggregate Liquidity Shortages and Liquidity Asset Pricing 517 15.1 Introduction 517 15.2 Moving Wealth across States of Nature: When Is Inside Liquidity Sufficient? 518 15.3 Aggregate Liquidity Shortages and Liquidity Asset Pricing 523 15.4 Moving Wealth across Time: The Case of the Corporate Sector as a Net Lender 527 15.5 Exercises 530 References 532 16 Institutions, Public Policy, and the Political Economy of Finance 535 16.1 Introduction 535 16.2 Contracting Institutions 537 16.3 Property Rights Institutions 544 16.4 Political Alliances 551 Supplementary Sections 16.5 Contracting Institutions, Financial Structure, and Attitudes toward Reform 555 16.6 Property Rights Institutions: Are Privately Optimal Maturity Structures Socially Optimal? 560 16.7 Exercises 563 References 567 VII Answers to Selected Exercises, and Review Problems 569 Answers to Selected Exercises 571 Review Problems 625 Answers to Selected Review Problems 633 Index 641