The Farmer and the Baker Rema wants to get rich too She sells forward 100,000b of wheat S2.00/bushel for delivery in 1-month At maturity,deliverable wheat costs $2.20/b but she is unable pay the $20,000 she owes Rema's default must be made good by one or more of the market's participants THE COURSE OF FINANCE 2017 SPRING SJTU 16

The Farmer and the Baker Rema wants to get rich too She sells forward 100,000b of wheat @ $2.00/bushel for delivery in 1-month At maturity, deliverable wheat costs $2.20/b but she is unable pay the $20,000 she owes Rema’s default must be made good by one or more of the market’s participants THE COURSE OF FINANCE 2017 SPRING SJTU 16

The Farmer and the Baker: Conclusion The farmer and the baker have both eliminated specific risks through perfectly anti-correlated assets Speculators are exposed to considerable risk,hoping to enjoy a statistical profit They provide liquidity and expertise that push the market further towards efficiency THE COURSE OF FINANCE 2017 SPRING SJTU 17

The Farmer and the Baker: Conclusion The farmer and the baker have both eliminated specific risks through perfectly anti-correlated assets Speculators are exposed to considerable risk, hoping to enjoy a statistical profit They provide liquidity and expertise that push the market further towards efficiency THE COURSE OF FINANCE 2017 SPRING SJTU 17

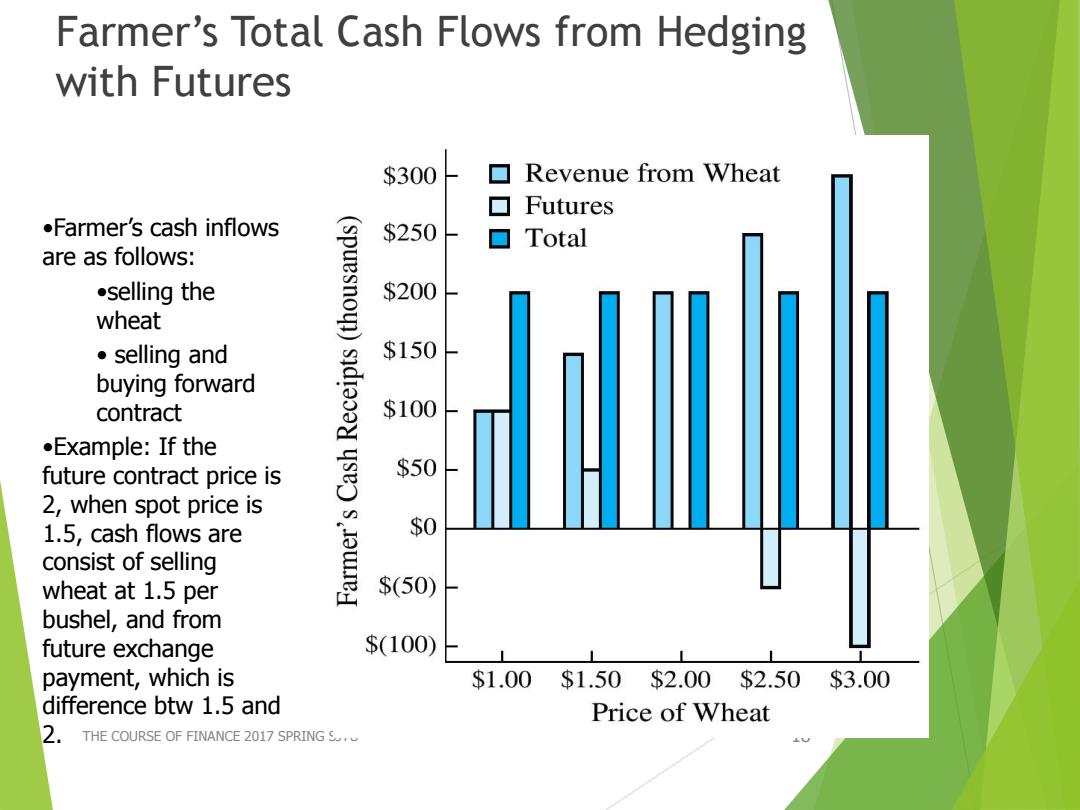

Farmer's Total Cash Flows from Hedging with Futures $300 Revenue from Wheat Futures .Farmer's cash inflows $250- ▣Total are as follows: .selling the $200 wheat ●selling and $150 buying forward contract $100 .Example:If the future contract price is yseD $50 2,when spot price is 1.5,cash flows are $0 consist of selling wheat at 1.5 per $(50) bushel,and from future exchange $(100) payment,which is $1.00$1.50 $2.00$2.50 $3.00 difference btw 1.5 and Price of Wheat 2,THE COURSE OF FINANCE 2017 SPRING S

Farmer’s Total Cash Flows from Hedging with Futures THE COURSE OF FINANCE 2017 SPRING SJTU 18 •Farmer’s cash inflows are as follows: •selling the wheat • selling and buying forward contract •Example: If the future contract price is 2, when spot price is 1.5, cash flows are consist of selling wheat at 1.5 per bushel, and from future exchange payment, which is difference btw 1.5 and 2

Risk Transfer of Hedging: Three Points Whether the transaction reduces or increases risk depends upon the particular context in which it is Both parties to a risk-reducing transaction can benefit.In retrospect,it may seem as if one of the parties has gained at the expense of the other (the difference btw.Profit or loss of hedging and the effectiveness of hedging) Even with no change in total output nor total risk,redistributing the way the risk is borne can improve the welfare of the individuals involved (all hedgers maximize their utilities through hedging) THE COURSE OF FINANCE 2017 SPRING SJTU 19

Risk Transfer of Hedging: Three Points n Whether the transaction reduces or increases risk depends upon the particular context in which it is n Both parties to a risk-reducing transaction can benefit. In retrospect, it may seem as if one of the parties has gained at the expense of the other (the difference btw. Profit or loss of hedging and the effectiveness of hedging) n Even with no change in total output nor total risk, redistributing the way the risk is borne can improve the welfare of the individuals involved (all hedgers maximize their utilities through hedging) THE COURSE OF FINANCE 2017 SPRING SJTU 19

Futures Contracts A futures contract is like a forward contract: It specifies that a certain commodity will be exchanged at a specified time in the future at a price specified today. A futures contract is different from a forward: Futures are standardized contracts trading on organized exchanges with daily resettlement ("marking to market")through a clearinghouse

Futures Contracts A futures contract is like a forward contract: It specifies that a certain commodity will be exchanged at a specified time in the future at a price specified today. A futures contract is different from a forward: Futures are standardized contracts trading on organized exchanges with daily resettlement (“marking to market”) through a clearinghouse