Financial Econometrics Chapter 10.Propensity Score Matching Jin Ling School of Finance,Zhongnan University of Economics and Law

Financial Econometrics Chapter 10. Propensity Score Matching Jin Ling School of Finance, Zhongnan University of Economics and Law 1

Outline The Matching Methodology for Causal Inference The Propensity Score Matching The Application for Propensity Score Matching 2

• The Matching Methodology for Causal Inference • The Propensity Score Matching • The Application for Propensity Score Matching 2 Outline

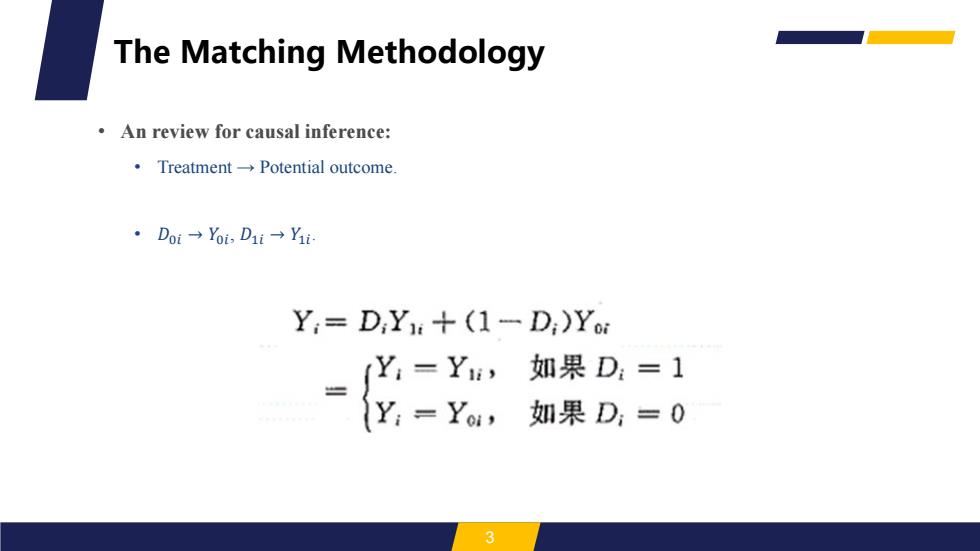

The Matching Methodology An review for causal inference: 。Treatment→Potential outcome. ·Doi→YoiD1i→Yi Yi=D;Y+(1-D:)Yo (Y:=Yi,如果D:=1 {Y:=Yu,如果D,=0 3

• An review for causal inference: • Treatment → Potential outcome. • 𝐷0𝑖 → 𝑌0𝑖 , 𝐷1𝑖 → 𝑌1𝑖 . 3 The Matching Methodology

The Matching Methodology An review for causal inference: ·Treatment effect:. Ti=Yi-Yoi Potential outcomes under same condition. Counterfactual outcome. Why we need counterfactual outcome? Unconfoundedness:(Yoi,Y1)IL D:X;

• An review for causal inference: • Treatment effect:. 𝜏𝑖 = 𝑌1𝑖 − 𝑌0𝑖 • Potential outcomes under same condition. • Counterfactual outcome. • Why we need counterfactual outcome? • Unconfoundedness: . 4 The Matching Methodology

The Matching Methodology How to satisfy unconfoundedness: ·Control variable. Difference-in-difference model. Instrumental variable. 5

• How to satisfy unconfoundedness: • Control variable. • Difference-in-difference model. • Instrumental variable. 5 The Matching Methodology