Utility Risk averse 8 16 14 ■■■■■■■■■ 13 10 Risk loving (a) 18 10 1516 20 30 Income 18 ■■■■ E ($1000) D 10.5" 8 C 12 Risk neutral 6 20 30 10 20 30 (b) Risk Aversion (c)

Utility Income ($1000) E 10 13 14 16 18 10 15 16 20 30 10 20 30 3 8 18 6 12 18 10 20 30 (b) (c) (a) Risk Aversion A C E A C E D C B A F 10.5 D Risk loving Risk averse Risk neutral

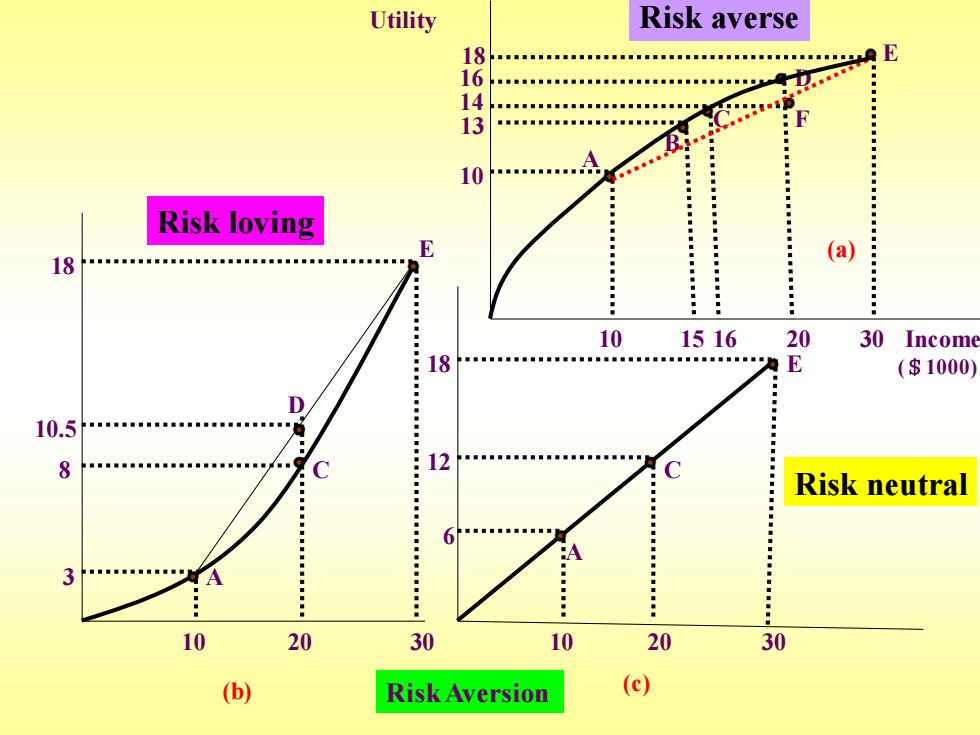

People differ in their preferences toward risk. In (a),a consumer's marginal utility diminishes as income increases. The consumer is risk averse because she would prefer a certain income of $20,000(with a utility of 16)to a gamble with a 0.5 probability of $10,000 and a 0.5 probability of $30,000 [and expected utility(E(u))of 14]. In (b),the consumer is risk loving:She would prefer the same gamble(with expected utility of 10.5)to the certain income (with a utility of 8). in (c)the consumer is risk neutral and indifferent between certain events and uncertain events with the same expected income

• People differ in their preferences toward risk. ✓ In (a), a consumer's marginal utility diminishes as income increases. The consumer is risk averse because she would prefer a certain income of $20,000(with a utility of 16)to a gamble with a 0.5 probability of $10,000 and a 0.5 probability of $30,000 [and expected utility(E(u) ) of 14]. ✓ In (b), the consumer is risk loving: She would prefer the same gamble(with expected utility of 10.5)to the certain income (with a utility of 8). ✓ in (c) the consumer is risk neutral and indifferent between certain events and uncertain events with the same expected income

>Risk premium(风险溢价,风险酬金))-Maximum amount of money that a risk-averse person will pay to avoid taking a risk. Utility Risk premium Risk premium 20 nn■nn■gtt■■■ang■ns”■■nnng n■■■■n■saen■nn G 184""4“4 14 ◆ 10 ■■■■■■■■■ 10 16 20 30 40 Income ($1000) Risk premium

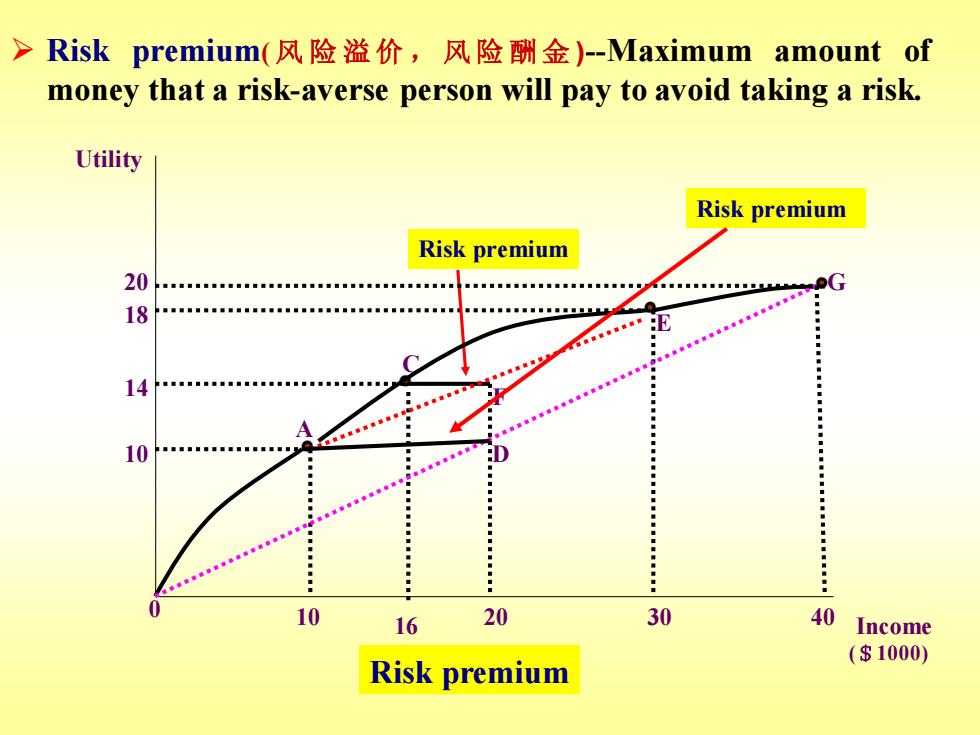

➢ Risk premium( 风 险 溢 价 , 风 险 酬 金 )-Maximum amount of money that a risk-averse person will pay to avoid taking a risk. 20 30 40 16 10 10 14 18 20 Income ($1000) Utility Risk premium Risk premium G E C A F 0 D Risk premium

The risk premium,CF,measures the amount of income that an individual would give up to leave(留下)her indifference(无差异) between a risky choice and a certain one. Here,the risk premium is $4000 because a certain income of $16,000 (at point C)gives her the same expected utility (14)as the uncertain income (a 0.5 probability of being at point A and a 0.5 probability of being at point E)that has an expected value of $20,000

• The risk premium, CF, measures the amount of income that an individual would give up to leave(留下)her indifference (无差异) between a risky choice and a certain one. Here, the risk premium is $4000 because a certain income of $16,000 (at point C) gives her the same expected utility (14) as the uncertain income (a 0.5 probability of being at point A and a 0.5 probability of being at point E)that has an expected value of $20,000. •