Chapter 15 Investment,Time, and Capital Markets Chapter Outline >Stocks versus Flows >Present Discounted Value >The value of a Bond >The Net Present Value Criterion for Capital Investment Decisions >Adjustments for Risk >Investment Decisions by Consumers >Intertemporal Production Decisions- Depletable Resources >How Are Interest Rates Determined?

Chapter 15 Investment, Time, and Capital Markets Chapter Outline ➢ Stocks versus Flows ➢ Present Discounted Value ➢ The value of a Bond ➢ The Net Present Value Criterion for Capital Investment Decisions ➢ Adjustments for Risk ➢ Investment Decisions by Consumers ➢ Intertemporal Production Decisions— Depletable Resources ➢ How Are Interest Rates Determined?

2 1.9 12 MOId ySe Jo ACd 54321096 0.6 0.5 0 0.05 0.10 0.15 0.20 Interest Rate Present Value of the Cash Flow from a Bond

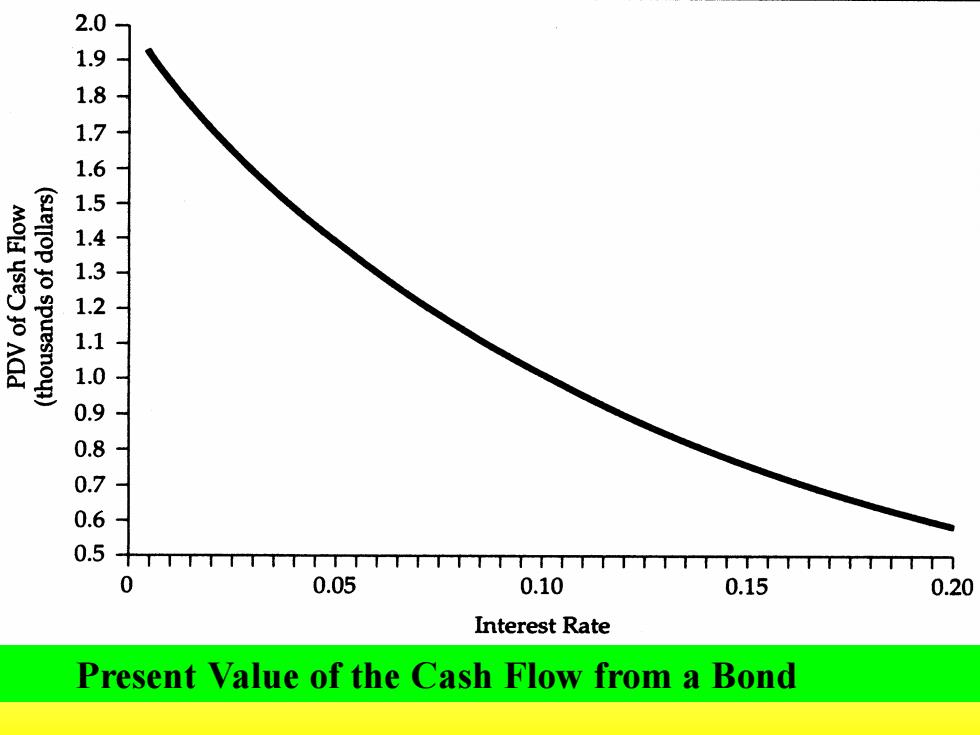

Present Value of the Cash Flow from a Bond

Because most of the bond's payments occur in the future,the present Discounted value declines as the interest rare increases. For example,when the interest rate is 5 percent,the PDV of a 10-year bond paying $100 per year on a principal of $1000 is $1386

Because most of the bond's payments occur in the future, the present Discounted va1ue declines as the interest rare increases. For example, when the interest rate is 5 percent, the PDV of a 10-year bond paying $100 per year on a principal of $1000 is $l386

2.0 1.9 1.8 1.7 (puog jo anten)squawAed Jo ACd (sIellop jo spuesnoyl) 06 0 0.4十n t 0 0.05 0.10 0.15 0.20 Interest Rate Effective Yield on a Bond

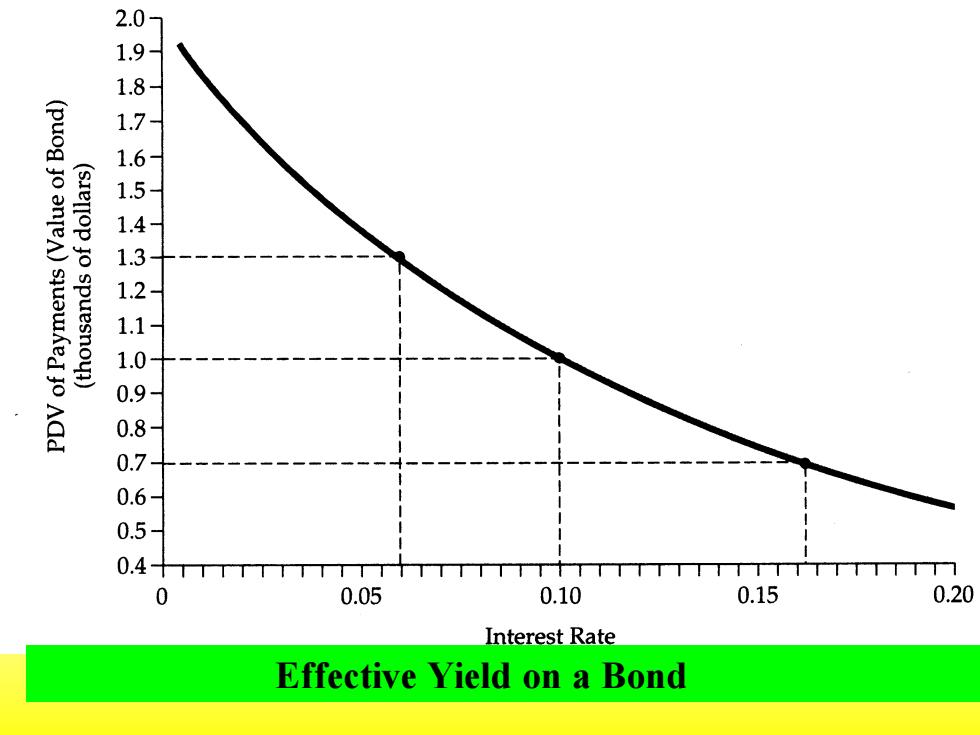

Effective Yield on a Bond

The effective yield is the interest rate that equates the present value of the bond's payment stream with the bond's market price. The figure shows the present value of the payment stream as a function of the interest rate.The effective yield can thus be found by drawing a horizontal line at the level of the bond's price

The effective yield is the interest rate that equates the present value of the bond's payment stream with the bond's market price. The figure shows the present value of the payment stream as a function of the interest rate. The effective yield can thus be found by drawing a horizontal line at the level of the bond's price