《高级财务管理(P4)》课程教学大纲 一、课程基本信息 课程代码:16004803 课程名称:高级财务管理 英文名称:Advanced Financial Management 课程类别:专业课 学 时:48 学 分:2 适用对象:ACCA专业 考核方式:考试 先修课程:F9-Financial Management;F2-Management Accounting 二、课程简介 Advanced Financial Management(P4):this paper builds upon the skills and knowledge examined in the F9 Financial Management paper.At this stage candidates will be expected to demonstrate an integrated knowledge of the subject and an ability to relate their technical understanding of the subject to issues of strategic importance to the organisation. The study guide specifies the wide range of contextual understanding that is required to achieve a satisfactory standard at this level. The course starts by exploring the role and responsibility of a senior executive or advisor in meeting competing needs of stakehokders within the business of multinationals.The course then re-examines investment and financing decisions,with the emphasis moving towards the strategic consequences of making such decisions in a 0 domestic,as well as international,context.Students are then expected to develop further advisory skills in planning strategic acquisitions and mergers and corporate re-organisations. 三、课程性质与教学目的 This course develops upon the core financial management knowledge and skills covered in the F9 Financial Management,syllabus at the Fundamentals level and prepares candidates to advise management and/or clients on complex strategic financial management issues facing an organisation. 本课程强调课程思政的嵌入,让学生把握财务管理在经济社会中的角色,通过课 堂的讲授和互动,将财务管理知识体系中蕴含的思想价值和精神内涵传递给学生,更

1 《高级财务管理(P4)》课程教学大纲 一、课程基本信息 课程代码:16004803 课程名称:高级财务管理 英文名称:Advanced Financial Management 课程类别:专业课 学 时:48 学 分:2 适用对象: ACCA 专业 考核方式:考试 先修课程:F9-Financial Management; F2-Management Accounting 二、课程简介 Advanced Financial Management(P4): this paper builds upon the skills and knowledge examined in the F9, Financial Management , paper. At this stage candidates will be expected to demonstrate an integrated knowledge of the subject and an ability to relate their technical understanding of the subject to issues of strategic importance to the organisation. The study guide specifies the wide range of contextual understanding that is required to achieve a satisfactory standard at this level. The course starts by exploring the role and responsibility of a senior exe cutive or advisor in meeting competing needs of stakeholders within the business environment of multinationals. The course then re-examines investment and financing decisions, with the emphasis moving towards the strategic consequences of making such decisions in a domestic, as well as international, context. Students are then expected to develop further advisory skills in planning strategic acquisitions and mergers and corporate re-organisations. 三、课程性质与教学目的 This course develops upon the core financial management knowledge and skills covered in the F9, Financial Management, syllabus at the Fundamentals level and prepares candidates to advise management and/or clients on complex strategic financial management issues facing an organisation. 本课程强调课程思政的嵌入,让学生把握财务管理在经济社会中的角色,通过课 堂的讲授和互动,将财务管理知识体系中蕴含的思想价值和精神内涵传递给学生,更

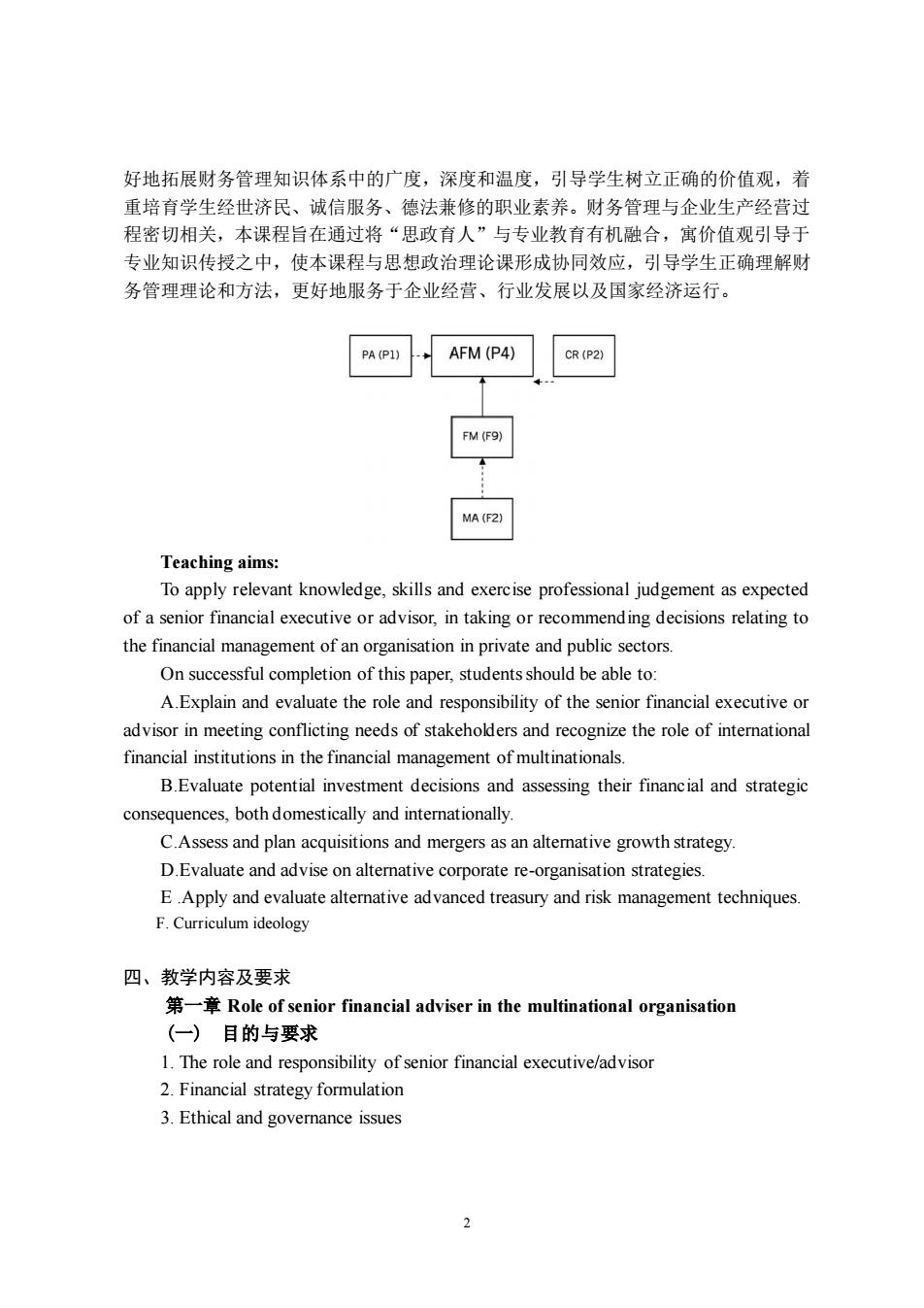

好地拓展财务管理知识体系中的广度,深度和温度,引导学生树立正确的价值观,着 重培育学生经世济民、诚信服务、德法兼修的职业素养。财务管理与企业生产经营过 程密切相关,本课程旨在通过将“思政育人”与专业教育有机融合,寓价值观引导于 专业知识传授之中,使本课程与思想政治理论课形成协同效应,引导学生正确理解财 务管理理论和方法,更好地服务于企业经营、行业发展以及国家经济运行。 PA(P1)AFM (P4) CR (P2) FM (F9) MA (F2) Teaching aims: To apply relevant knowledge,skills and exercise professional judgement as expected of a senior financial executive or advisor,in taking or recommending decisions relating to the financial management of an organisation in private and public sectors On successful completion of this paper.students should be able to: a Explain and evaluate the role and responsibility of the senior financial executive or advisor in meeting conflicting needs of stakehokders and recognize the role of international financial institutions in the financial management of multinationals. B.Evaluate potential investment decisions and assessing their financial and strategic consequences,bothdomestically and internationally. C.Assess and plan acquisitions and mergers as an altemative growth strategy. D.Evaluate and advise onaltemative corporate re-organisation strategies. EApply and evaluate altemative advanced treasury and risk management techniques. F.Curriculum ideology 四、教学内容及要求 Role of senior financial adviser in the multinational organisation (一)目的与要求 1.The role and responsibility of senior financial executive/advisor 2.Financial strategy formulation 3.Ethical and governance issues

2 好地拓展财务管理知识体系中的广度,深度和温度,引导学生树立正确的价值观,着 重培育学生经世济民、诚信服务、德法兼修的职业素养。财务管理与企业生产经营过 程密切相关,本课程旨在通过将“思政育人”与专业教育有机融合,寓价值观引导于 专业知识传授之中,使本课程与思想政治理论课形成协同效应,引导学生正确理解财 务管理理论和方法,更好地服务于企业经营、行业发展以及国家经济运行。 Teaching aims: To apply relevant knowledge, skills and exercise professional judgement as expected of a senior financial executive or advisor, in taking or recommending decisions relating to the financial management of an organisation in private and public sectors. On successful completion of this paper, students should be able to: A.Explain and evaluate the role and responsibility of the senior financial executive or advisor in meeting conflicting needs of stakeholders and recognize the role of international financial institutions in the financial management of multinationals. B.Evaluate potential investment decisions and assessing their financial and strategic consequences, both domestically and internationally. C.Assess and plan acquisitions and mergers as an alternative growth strategy. D.Evaluate and advise on alternative corporate re-organisation strategies. E .Apply and evaluate alternative advanced treasury and risk management techniques. F. Curriculum ideology 四、教学内容及要求 第一章 Role of senior financial adviser in the multinational organisation (一) 目的与要求 1. The role and responsibility of senior financial executive/advisor 2. Financial strategy formulation 3. Ethical and governance issues

4.Management of international trade and finance 5.Strategic business and financial planning for multinational organisations 6.Dividend policy in multinationals and transfer pricing (二)教学内容 第一节 1.主要内容 The role and responsibility of senior financial executive/advisor 2.基本概念和知识点 a)Develop strategies for the achievement of the organisational goals in line with its agreed policy framework. b)Recommend strategies for the management of the financial resources of the organisation such that they are utilised in an efficient,effective and transparent way. c)Advise the board of directors or management of the organisation in setting the financial goals of the business and in its financial policy development particular reference to: i)Investment selection and capital resource allocation ii)Minimising the cost of capital iii)Distribution and retention policy iv)Communicating financial policy and corporate goals to internal and external stakeholders v)Financial planning and control vi)The management of risk. 3.问题与应用 a)What is capital resource allocation? b)How to minimising the cost of capital? 第二者 1.主要内容 financial strate formulation 2.基本概念和知识点 a)Assess organisational performance using methods such as ratios and trends b)Recommend the optimum capital mix and structure within a specified business context and capital asset structure. c)Recommend appropriate distribution and retention policy

3 4. Management of international trade and finance 5. Strategic business and financial planning for multinational organisations 6. Dividend policy in multinationals and transfer pricing (二)教学内容 第一节 1. 主要内容 The role and responsibility of senior financial executive/advisor 2.基本概念和知识点 a) Develop strategies for the achievement of the organisational goals in line with its agreed policy framework. b) Recommend strategies for the management of the financial resources of the organisation such that they are utilised in an efficient, effective and transparent way. c) Advise the board of directors or management of the organisation in setting the financial goals of the business and in its financial policy development particular reference to: i) Investment selection and capital resource allocation ii) Minimising the cost of capital iii) Distribution and retention policy iv) Communicating financial policy and corporate goals to internal and external stakeholders v) Financial planning and control vi) The management of risk. 3. 问题与应用 a)What is capital resource allocation? b)How to minimising the cost of capital? 第二节 1.主要内容 Financial strategy formulation 2.基本概念和知识点 a) Assess organisational performance using methods such as ratios and trends b) Recommend the optimum capital mix and structure within a specified business context and capital asset structure. c) Recommend appropriate distribution and retention policy

d)Explain the theoretical and practical rationale for the management of risk. e)Assess the organisation's exposure to business and financial risk including operational,reputational,political,economic,regulatory and fiscal risk f)Develop a framework for risk management,comparing and contrasting risk mitigation,hedging and diversification strategies. g)Establish capital investment monitoring and risk management systems. h)Advise on the impact of behavioural finance on financial strategies securities prices and why they may not follow the conventional financial theories. 3.问题与应用 a)Take an example of using ratios to assess organizational performance. b)What does the risk include? 第三节 1.主要内容 a)Assess the ethical dimension within business issues and decisions and advise on best practice in the financial management of the organisation. b)Demonstrate an understanding of the interconnectedness of the ethics of good business practice between all of the functional areas of the organisation. c)Recommend,within specified problem domains,appropriate strategies for the resolution of stakeholder conflict and advise on alternative approaches that may be adopted. d)Recommend an ethical framework for the development of an organisation' s financial policies and a system for the assessment of its ethical impact upon the financial management of the organisation. e)Explore the areas within the ethical framework of the organisation which may be undermined by agency effects and/or stakeholder conflicts and establish strategies for dealing with them. f)Establish an ethical financial policy for the financial management of the organisation which is grounded in good governance,the highest standards of probity and is fully aligned with the ethical principles of the Association. 4

4 d) Explain the theoretical and practical rationale for the management of risk. e) Assess the organisation’s exposure to business and financial risk including operational, reputational, political, economic, regulatory and fiscal risk f) Develop a framework for risk management, comparing and contrasting risk mitigation, hedging and diversification strategies. g) Establish capital investment monitoring and risk management systems. h) Advise on the impact of behavioural finance on financial strategies / securities prices and why they may not follow the conventional financial theories. 3. 问题与应用 a)Take an example of using ratios to assess organizational performance. b)What does the risk include? 第三节 1. 主要内容 Ethical and governance issues 2.基本概念和知识点 a) Assess the ethical dimension within business issues and decisions and advise on best practice in the financial management of the organisation. b) Demonstrate an understanding of the interconnectedness of the ethics of good business practice between all of the functional areas of the organisation. c) Recommend, within specified problem domains, appropriate strategies for the resolution of stakeholder conflict and advise on alternative approaches that may be adopted. d) Recommend an ethical framework for the development of an organisation’ s financial policies and a system for the assessment of its ethical impact upon the financial management of the organisation. e) Explore the areas within the ethical framework of the organisation which may be undermined by agency effects and/or stakeholder conflicts and establish strategies for dealing with them. f) Establish an ethical financial policy for the financial management of the organisation which is grounded in good governance, the highest standards of probity and is fully aligned with the ethical principles of the Association

g)Assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions. h)Assess and advise on the impact of investment and financing strategies and decisions on the organisation's stakeholders,from an integrated reporting and governance perspective 3.问题与应用 a)What is the conflict between stakeholders? b)How to assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions? 第四节 1.主要内容 Management of international trade and finance 2.基本概念和知识点 a)Advise on the theory and practice of free trade and the management of barriers to trade. b)Demonstrate an up to date understanding of the major trade agreements and common markets and,on the basis of contemporary circumstances,advise on their policies and strategic implications for a given business. c)Discuss how the actions of the World Trade Organisation,the International Monetary Fund,The World Bank and Central Banks can affect a multinational organisation. d)Discuss the role of international financial institutions within the context of a globalised economy.with particular attention to (the fed.Bank of England,European Central Bank and the Bank of Japan). e)Discuss the role of the international financial markets with respect to the management of global debt,the financial development of the emerging economies and the maintenance of global financial stability. f)Discuss the significance to the organisation,of latest developments in the world financial markets such as the causes and impact of the recent financial crisis:growth and impact of dark pool trading systems;the removal of barriers to the free movement of capital;and the international regulations on money laundering. g)Demonstrate an awareness of new developments in the macroeconomic environment,assessing their impact upon the organisation,and advising on the appropriate response to those developments both internally and externally. 5

5 g) Assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions. h) Assess and advise on the impact of investment and financing strategies and decisions on the organisation’s stakeholders, from an integrated reporting and governance perspective 3. 问题与应用 a)What is the conflict between stakeholders? b)How to assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions? 第四节 1. 主要内容 Management of international trade and finance 2.基本概念和知识点 a) Advise on the theory and practice of free trade and the management of barriers to trade. b) Demonstrate an up to date understanding of the major trade agreements and common markets and, on the basis of contemporary circumstances, advise on their policies and strategic implications for a given business. c) Discuss how the actions of the World Trade Organisation, the International Monetary Fund, The World Bank and Central Banks can affect a multinational organisation. d) Discuss the role of international financial institutions within the context of a globalised economy, with particular attention to (the Fed, Bank of England, European Central Bank and the Bank of Japan). e) Discuss the role of the international financial markets with respect to the management of global debt, the financial development of the emerging economies and the maintenance of global financial stability. f) Discuss the significance to the organisation, of latest developments in the world financial markets such as the causes and impact of the recent financial crisis; growth and impact of dark pool trading systems; the removal of barriers to the free movement of capital; and the international regulations on money laundering. g) Demonstrate an awareness of new developments in the macroeconomic environment, assessing their impact upon the organisation, and advising on the appropriate response to those developments both internally and externally