Two Assumptions Investors forecasts agree with respect to expectations,standard deviations,and correlations of the returns of risky securities. Therefore all investors hold risky assets in the same relative proportions Investors behave optimally In equilibrium,prices adjust so that aggregate demand for each security is equal to its supply THE COURSE OF FINANCE 2017 SPRING SJTU 6

Two Assumptions Investors forecasts agree with respect to expectations, standard deviations, and correlations of the returns of risky securities. Therefore all investors hold risky assets in the same relative proportions Investors behave optimally :In equilibrium, prices adjust so that aggregate demand for each security is equal to its supply THE COURSE OF FINANCE 2017 SPRING SJTU 6

CML and Market Portfolio Since every investor's relative holdings of the risky security is the same,the only way the asset market can clear is if those optimal relative proportions are the proportions in which they are valued in the market place that proportions are called Market Portfolio THE COURSE OF FINANCE 2017 SPRING SJTU

CML and Market Portfolio Since every investor’s relative holdings of the risky security is the same, the only way the asset market can clear is if those optimal relative proportions are the proportions in which they are valued in the market place ,that proportions are called Market Portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 7

CML and the CAPM CAPM says that in equilibrium, any investor's relative holding of risky assets will be the same as in the market portfolio Depending on their risk aversions, different investors hold portfolios with different mixes of riskless asset and the market portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 8

CML and the CAPM CAPM says that in equilibrium, any investor’s relative holding of risky assets will be the same as in the market portfolio Depending on their risk aversions, different investors hold portfolios with different mixes of riskless asset and the market portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 8

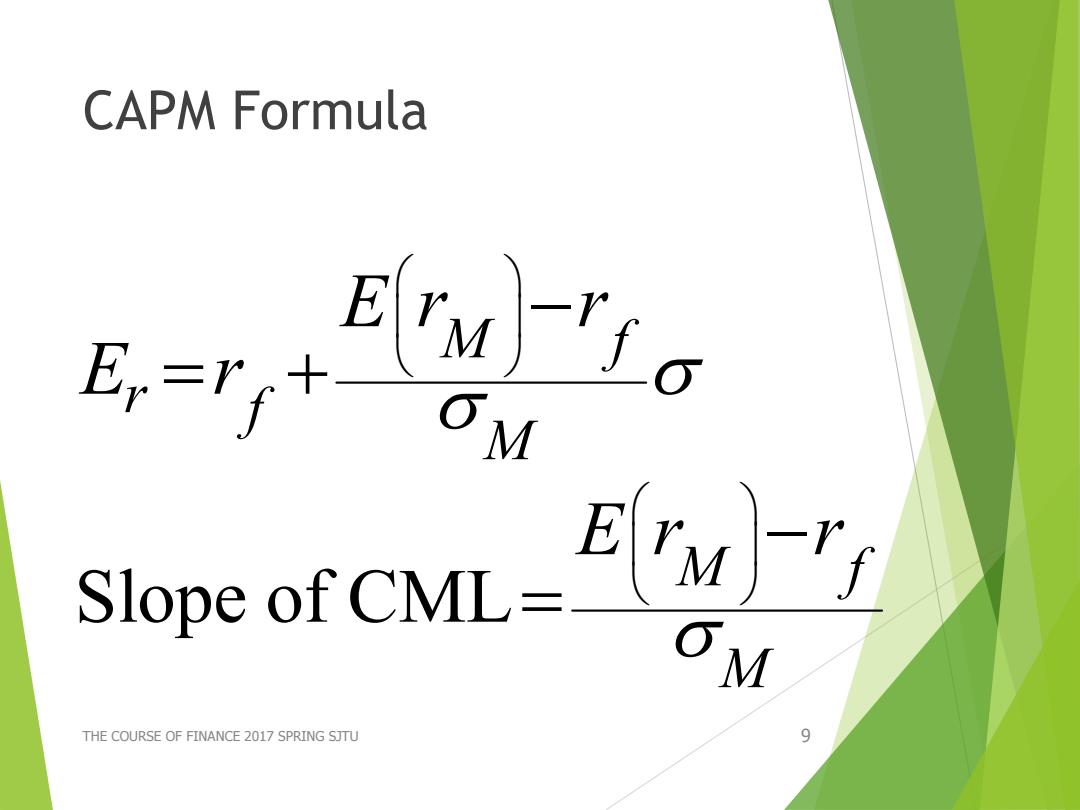

CAPM Formula En=rf十 M Slope of CML= M THE COURSE OF FINANCE 2017 SPRING SJTU 9

CAPM Formula THE COURSE OF FINANCE 2017 SPRING SJTU 9 Slope of CML M f r f M M f M E r r E r E r r

The Capital Market Line 18 16 1 M uImed panoadxy 120 8 6 4 2 5 10 15 20 25 30 Standard Deviation THE COUROL Ur FLNMINCL ZUL Fo

The Capital Market Line THE COURSE OF FINANCE 2017 SPRING SJTU 10