Bank and Nonbank Foreign Exchange Dealers Banks and a few nonbank foreign exchange dealers operate in both the interbank and client markets. The profit from buying foreign exchange at a "bid" price and reselling it at a slightly higher“offer”or“ask' price. Dealers in the foreign exchange department of large international banks often function as market makers." ■ These dealers stand willing at all times to buy and sell those currencies in which they specialize and thus maintain an "inventory?position in those currencies. 制卧价贸易大孝

Bank and Nonbank Foreign Exchange Dealers Banks and a few nonbank foreign exchange dealers operate in both the interbank and client markets. The profit from buying foreign exchange at a “bid ” price and reselling it at a slightly higher “offer ” or “ask ” price. Dealers in the foreign exchange department of large international banks often function as “market makers. ” These dealers stand willing at all times to buy and sell those currencies in which they specialize and thus maintain an “inventory ” position in those currencies

Direct Trade: A:HI BANK OF A CALLING SPOT DM FOR 3 USD PLS B:10/20 A:3 YOURS B:OK DONE AT 1.8110 WE BUY USD 3 MIO AGAINST DM VALUE MAY19,1993 USD TO BANK OF TOKYO NEWYORK FOR OUR A/C 544-9-21236 A:DM TO DEUTSCHE BANK FRANKFURT FOR OUR A/C 5678901 制卧价贸易上考

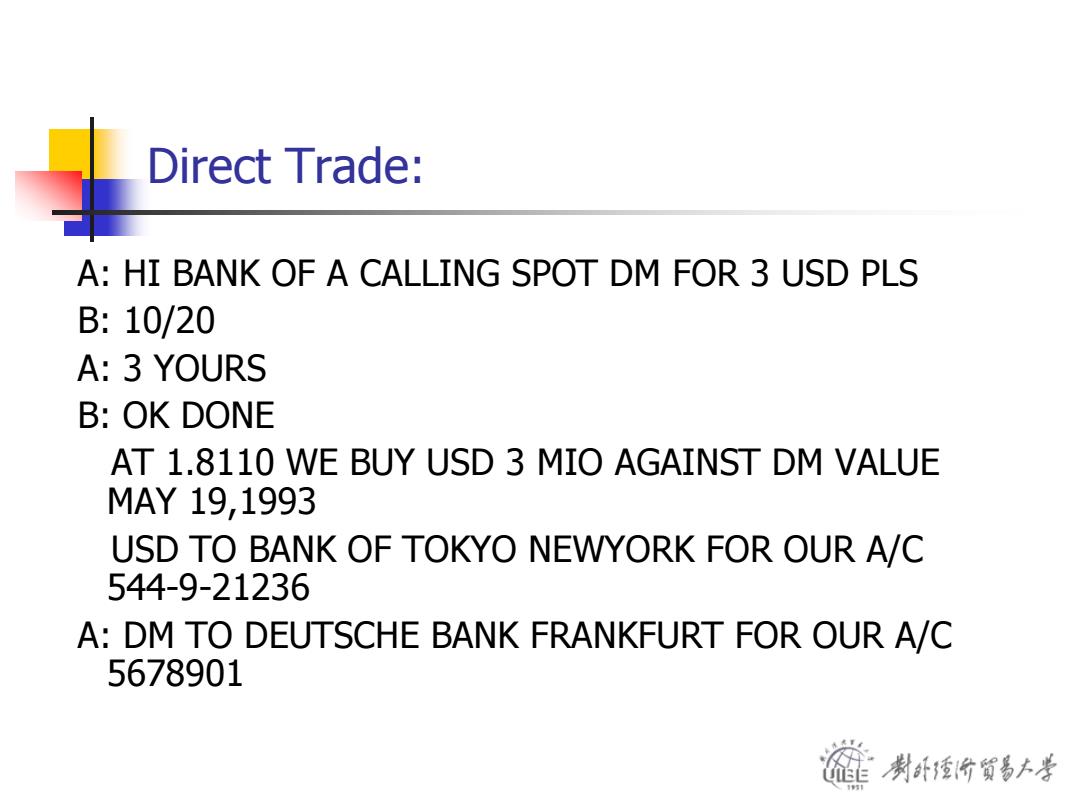

Direct Trade: A: HI BANK OF A CALLING SPOT DM FOR 3 USD PLS B: 10/20 A: 3 YOURS B: OK DONE AT 1.8110 WE BUY USD 3 MIO AGAINST DM VALUE MAY 19,1993 USD TO BANK OF TOKYO NEWYORK FOR OUR A/C 544-9-21236 A: DM TO DEUTSCHE BANK FRANKFURT FOR OUR A/C 5678901

Individuals and Firms Individuals (such as tourists)and firms (such as importers,exporters and MNEs)conduct commercial and investment transactions in the foreign exchange market. Their use of the foreign exchange market is necessary but nevertheless incidental to their underlying commercial or investment purpose. Some of the participants use the market to "hedge"foreign exchange risk. 制计爱价贸易上考

Individuals and Firms Individuals (such as tourists) and firms (such as importers, exporters and MNEs) conduct commercial and investment transactions in the foreign exchange market. Their use of the foreign exchange market is necessary but nevertheless incidental to their underlying commercial or investment purpose. Some of the participants use the market to “hedge ” foreign exchange risk

Speculators and Arbitragers Speculators and arbitragers seek to profit from trading in the market itself. They operate in their own interest,without a need or obligation to serve clients or ensure a continuous market. ■ While dealers seek the bid/ask spread,speculators seek all the profit from exchange rate changes and arbitragers try to profit from simultaneous exchange rate differences in different markets. 制卧价蜀易上孝

Speculators and Arbitragers Speculators and arbitragers seek to profit from trading in the market itself. They operate in their own interest, without a need or obligation to serve clients or ensure a continuous market. While dealers seek the bid/ask spread, speculators seek all the profit from exchange rate changes and arbitragers try to profit from simultaneous exchange rate differences in different markets

Central Banks and Treasuries Central banks and treasuries use the market to acquire or spend their country's foreign exchange reserves as well as to influence the price at which their own currency is traded. They may act to support the value of their own currency because of policies adopted at the national level or because of commitments entered into through membership in joint agreements such as the European Monetary System. The motive is not to earn a profit as such,but rather to influence the foreign exchange value of their currency in a manner that will benefit the interests of their citicizens. As willing loss takers,central banks and treasuries differ in motive from all other market participants 制卧香价贸易上孝

Central Banks and Treasuries Central banks and treasuries use the market to acquire or spend their country’s foreign exchange reserves as well as to influence the price at which their own currency is traded. They may act to support the value of their own currency because of policies adopted at the national level or because of commitments entered into through membership in joint agreements such as the European Monetary System. The motive is not to earn a profit as such, but rather to influence the foreign exchange value of their currency in a manner that will benefit the interests of their citicizens. As willing loss takers, central banks and treasuries differ in motive from all other market participants