国际财务管理 第五讲外汇风险管理 对外经济贸易大学国际商学院会计学系制作

国际财务管理 第五讲 外汇风险管理 对外经济贸易大学国际商学院会计学系制作

Foreign Exchange Risk Management Risk Exposure The future is unknown The value of its assets actual outcomes can or liabilities can deviate from expected change with outcome unexpected change in currency value. How much is at risk 制计价货易本孝

Foreign Exchange Risk Management Risk The future is unknown actual outcomes can deviate from expected outcome Exposure The value of its assets or liabilities can change with unexpected change in currency value. How much is at risk

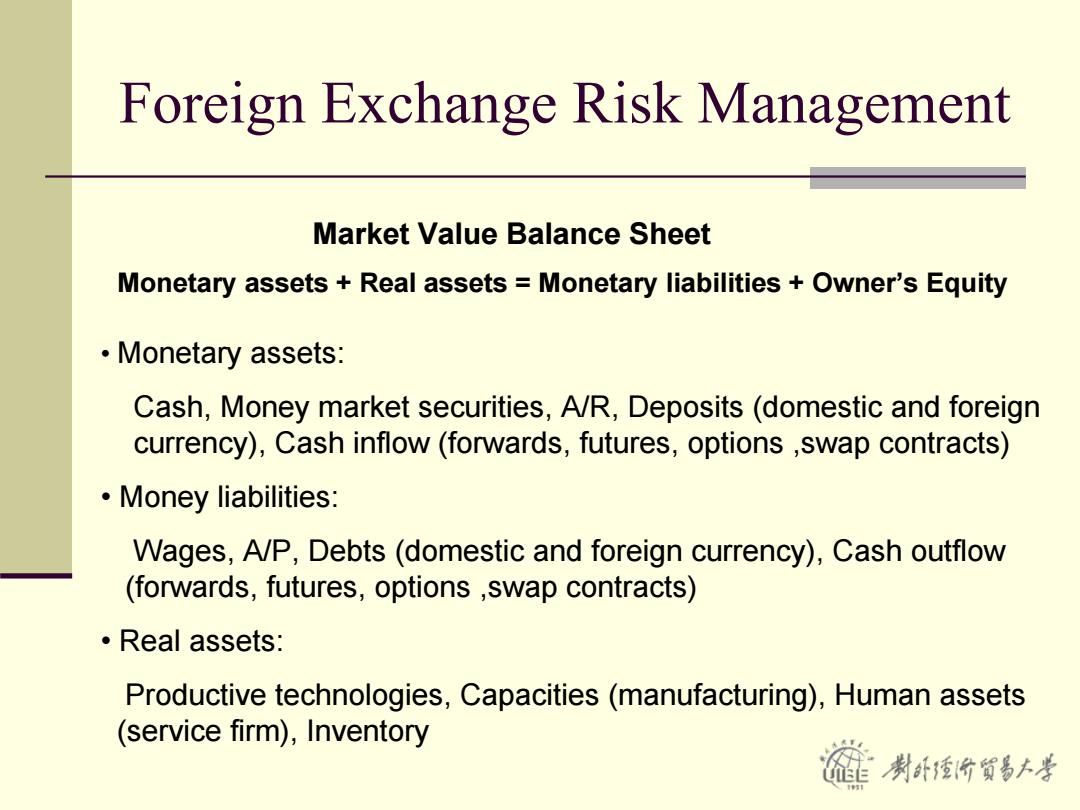

Foreign Exchange Risk Management Market Value Balance Sheet Monetary assets Real assets Monetary liabilities Owner's Equity ·Monetary assets: Cash,Money market securities,A/R,Deposits(domestic and foreign currency),Cash inflow(forwards,futures,options swap contracts) ·Money liabilities: Wages,A/P,Debts(domestic and foreign currency),Cash outflow (forwards,futures,options ,swap contracts) ·Real assets: Productive technologies,Capacities(manufacturing),Human assets (service firm),Inventory 制卧爱价贸易大岁

Foreign Exchange Risk Management Market Value Balance Sheet Monetary assets + Real assets = Monetary liabilities + Owner’s Equity • Monetary assets: Cash, Money market securities, A/R, Deposits (domestic and foreign currency), Cash inflow (forwards, futures, options ,swap contracts) • Money liabilities: Wages, A/P, Debts (domestic and foreign currency), Cash outflow (forwards, futures, options ,swap contracts) • Real assets: Productive technologies, Capacities (manufacturing), Human assets (service firm), Inventory

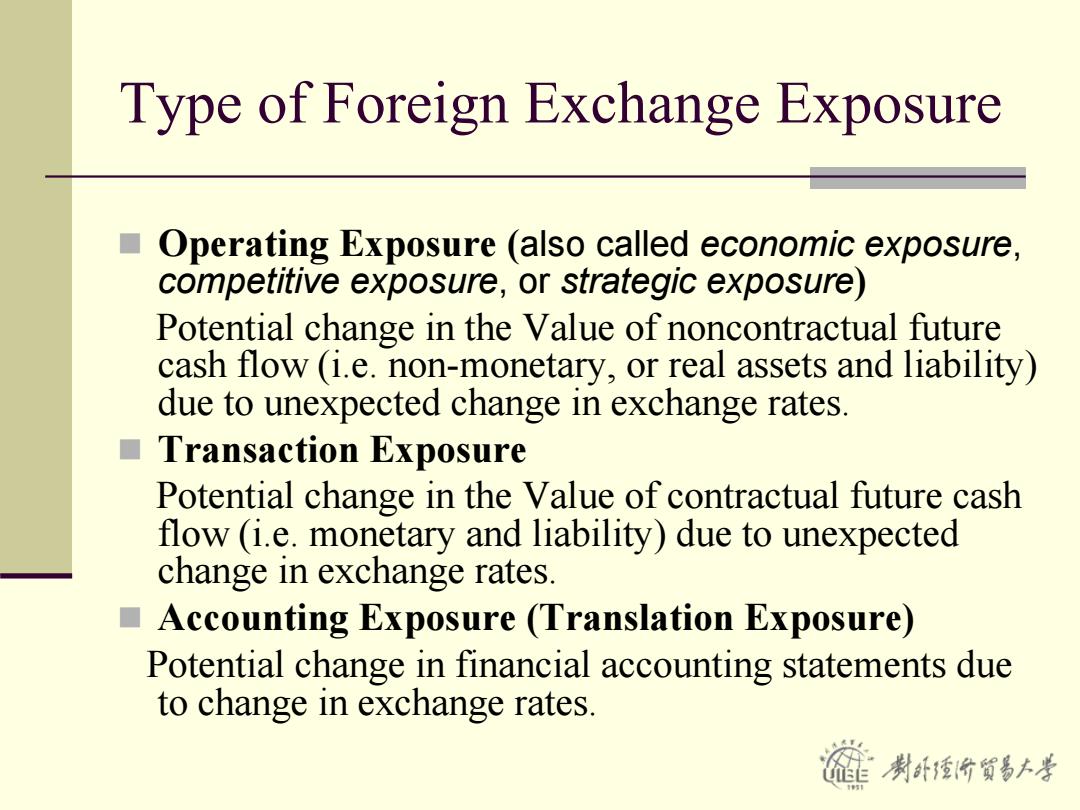

Type of Foreign Exchange Exposure Operating Exposure (also called economic exposure, competitive exposure,or strategic exposure) Potential change in the Value of noncontractual future cash flow (i.e.non-monetary,or real assets and liability) due to unexpected change in exchange rates. ■ Transaction Exposure Potential change in the Value of contractual future cash flow (i.e.monetary and liability)due to unexpected change in exchange rates. Accounting Exposure (Translation Exposure) Potential change in financial accounting statements due to change in exchange rates. 制卧价贸易大孝

Type of Foreign Exchange Exposure Operating Exposure (also called economic exposure, competitive exposure, or strategic exposure ) Potential change in the Value of noncontractual future cash flow (i.e. non-monetary, or real assets and liability) due to unexpected change in exchange rates. Transaction Exposure Potential change in the Value of contractual future cash flow (i.e. monetary and liability) due to unexpected change in exchange rates. Accounting Exposure (Translation Exposure) Potential change in financial accounting statements due to change in exchange rates

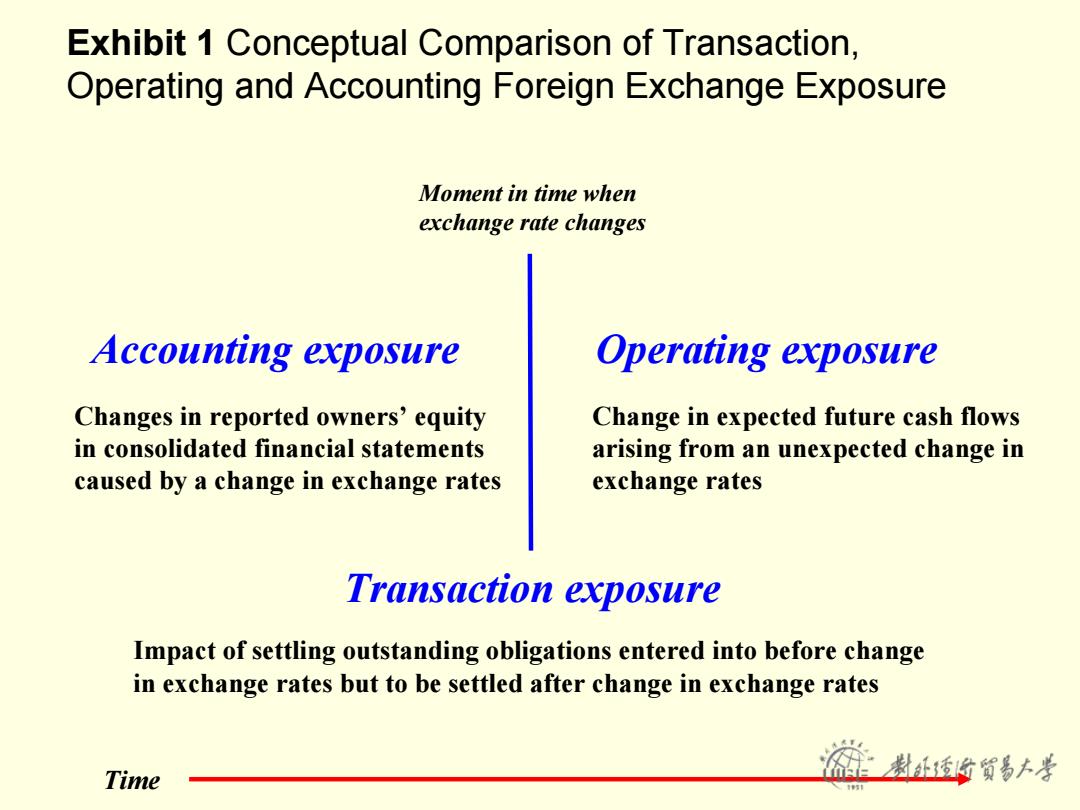

Exhibit 1 Conceptual Comparison of Transaction, Operating and Accounting Foreign Exchange Exposure Moment in time when exchange rate changes Accounting exposure Operating exposure Changes in reported owners'equity Change in expected future cash flows in consolidated financial statements arising from an unexpected change in caused by a change in exchange rates exchange rates Transaction exposure Impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange rates Time

Exhibit 1 Conceptual Comparison of Transaction, Operating and Accounting Foreign Exchange Exposure Moment in time when exchange rate changes Accounting exposure Operating exposure Changes in reported owners’ equity in consolidated financial statements caused by a change in exchange rates Change in expected future cash flows arising from an unexpected change in exchange rates Transaction exposure Impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange rates Time