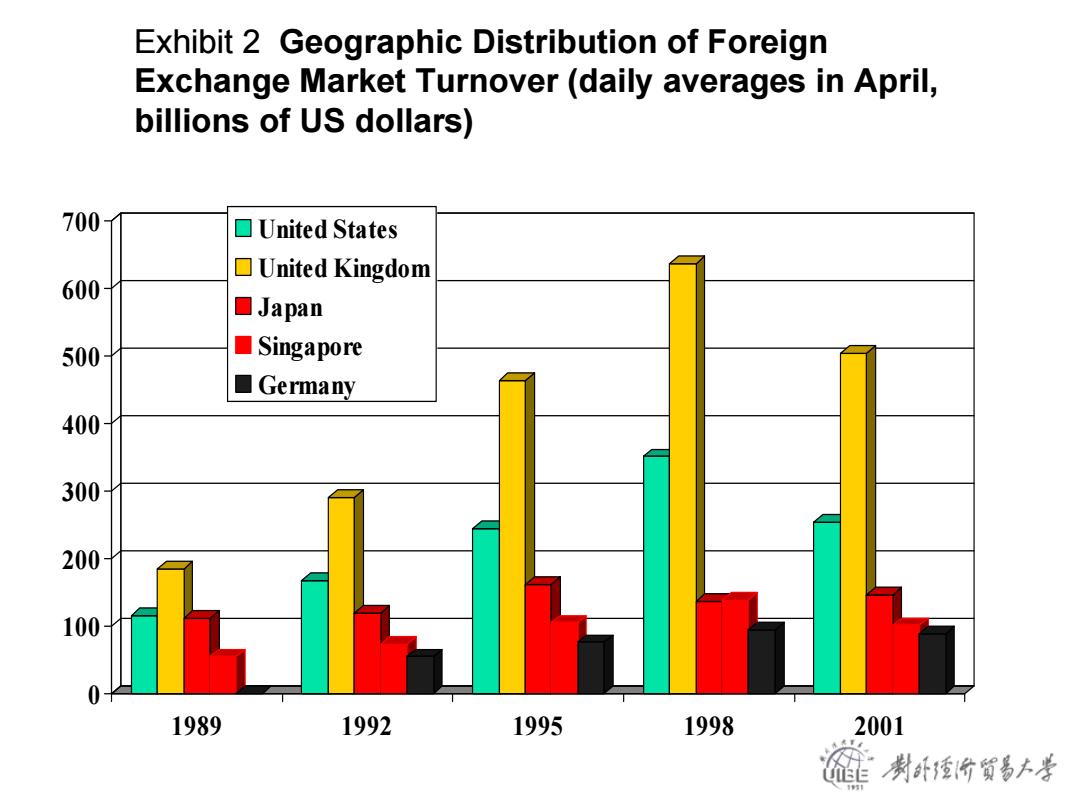

Exhibit 2 Geographic Distribution of Foreign Exchange Market Turnover(daily averages in April, billions of US dollars) 700 ▣United States United Kingdom 600 口Japan 500 Singapore Germany 400 300 200 100 1989 1992 1995 1998 2001 制卧价黄多大孝

Exhibit 2 Geographic Distribution of Foreign Exchange Market Turnover (daily averages in April, billions of US dollars) 0 100 200 300 400 500 600 700 1989 1992 1995 1998 2001 United States United Kingdom Japan Singapore Germany

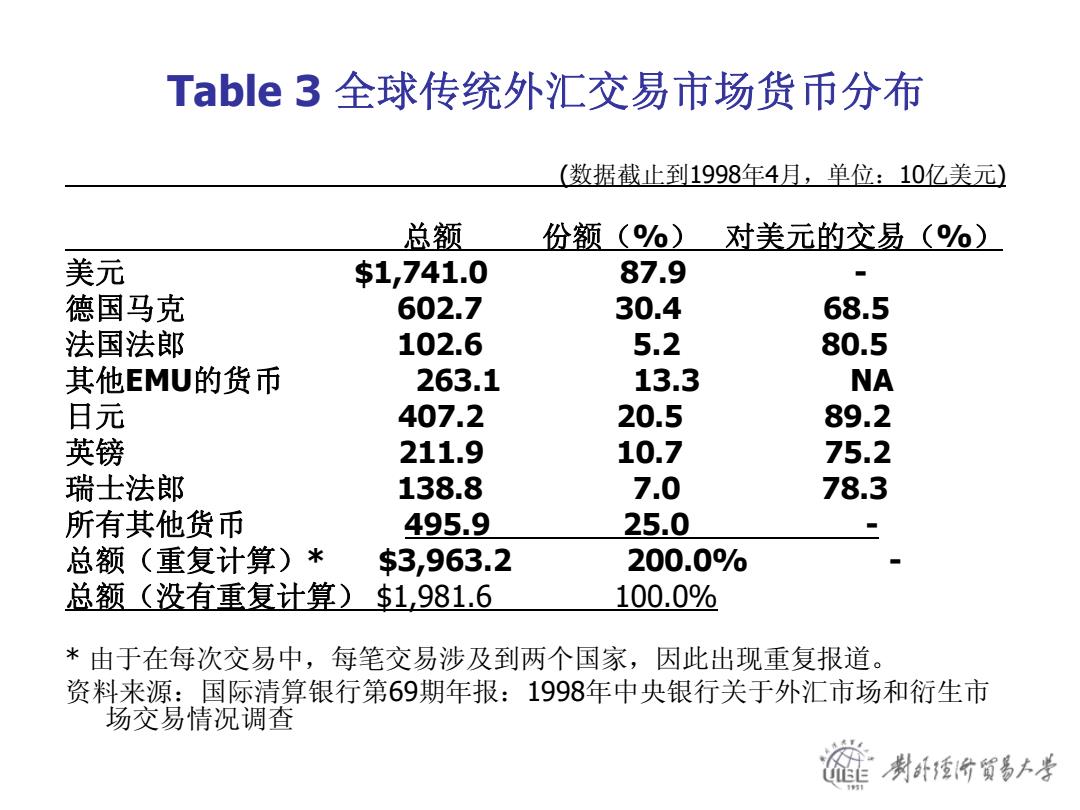

Table3全球传统外汇交易市场货币分布 (数据截止到1998年4月,单位:10亿美元) 总额 份额(%) 对美元的交易(%) 美元 $1,741.0 87.9 德国马克 602.7 30.4 68.5 法国法郎 102.6 5.2 80.5 其他EMU的货币 263.1 13.3 NA 日元 407.2 20.5 89.2 英镑 211.9 10.7 75.2 瑞士法郎 138.8 7.0 78.3 所有其他货币 495.9 25.0 总额(重复计算)* $3,963.2 200.0% 总额(没有重复计算)$1981.6 100.0% *由于在每次交易中,每笔交易涉及到两个国家,因此出现重复报道。 资料来源:国际清算银行第69期年报:1998年中央银行关于外汇市场和衍生市 场交易情况调查 制计爱价贸易上考

Table 3 全球传统外汇交易市场货币分布 (数据截止到1998年4月,单位:10亿美元) 总额 份额(%) 对美元的交易(%) 美元 $1,741.0 87.9 - 德国马克 602.7 30.4 68.5 法国法郎 102.6 5.2 80.5 其他EMU的货币 263.1 13.3 NA 日元 407.2 20.5 89.2 英镑 211.9 10.7 75.2 瑞士法郎 138.8 7.0 78.3 所有其他货币 495.9 25.0 - 总额(重复计算)* $3,963.2 200.0% - 总额(没有重复计算) $1,981.6 100.0% * 由于在每次交易中,每笔交易涉及到两个国家,因此出现重复报道。 资料来源:国际清算银行第69期年报:1998年中央银行关于外汇市场和衍生市 场交易情况调查

Exhibit 3 Currency Distribution of Global Foreign Exchange Market Turnover(percentage shares of average daily turnover in april) 90 ☐US dollar 80 euro ☐Deutshemark 70 ■French franc 60 ■EMS currencies ☐Japanese yen 50 ■Pound sterling 40 ■Swiss franc 30 20 10 1989 1992 1995 1998 2001

Exhibit 3 Currency Distribution of Global Foreign Exchange Market Turnover (percentage shares of average daily turnover in April) 0 10 20 30 40 50 60 70 80 90 1989 1992 1995 1998 2001 US dollar euro Deutshemark French franc EMS currencies Japanese yen Pound sterling Swiss franc

Functions of the Foreign Exchange Market The foreign exchange Market is the mechanism by which participants: Transfer purchasing power between countries Obtain or provide credit for international trade transactions Minimize exposure to the risks of exchange rate changes 制计价贸易上考

Functions of the Foreign Exchange Market The foreign exchange Market is the mechanism by which participants: Transfer purchasing power between countries Obtain or provide credit for international trade transactions Minimize exposure to the risks of exchange rate changes

Market Participants The foreign exchange market consists of two tiers: The interbank or wholesale market(multiples of $1MM US or equivalent in transaction size) The client or retail market (specific,smaller amounts) Five broad categories of participants operate within these two tiers;bank and nonbank foreign exchange dealers,individuals and firms,speculators and arbitragers,central banks and treasuries,and foreign exchange brokers. 制卧价贸易大孝

Market Participants The foreign exchange market consists of two tiers: The interbank or wholesale market (multiples of $1MM US or equivalent in transaction size) The client or retail market (specific, smaller amounts) Five broad categories of participants operate within these two tiers; bank and nonbank foreign exchange dealers, individuals and firms, speculators and arbitragers, central banks and treasuries, and foreign exchange brokers