国际财务管理 第七讲全球融资管理 对外经济贸易大学国际商学院会计学系制作

国际财务管理 第七讲 全球融资管理 对外经济贸易大学国际商学院会计学系制作

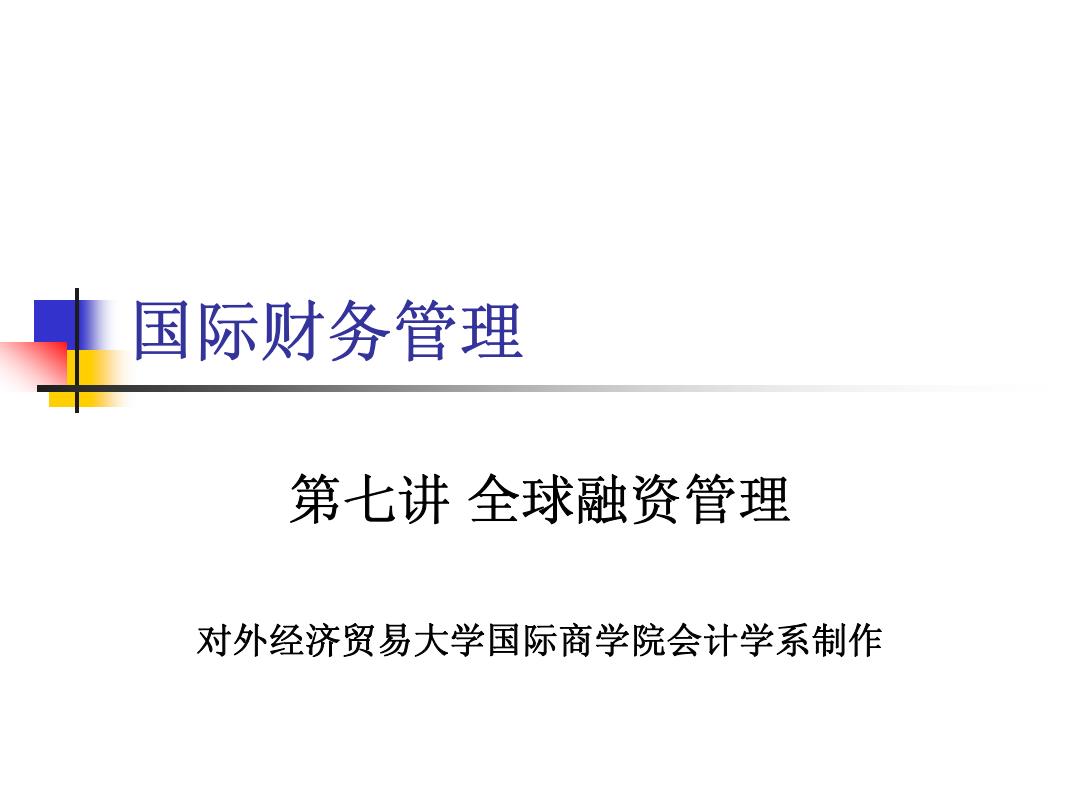

Exhibit 1 Internal Financing of the Foreign Subsidiary Cash Equity Real goods Funds from Funds parent company Debt--cash loans From Within Leads lags on intra-firm payables the Multinational Enterprise Debt--cash loans Funds from (MNE) sister subsidiaries Leads lags on intra-firm payables Subsidiary borrowing with parent guarantee Depreciation non-cash charges Funds Generated Internally by the Foreign Subsidiary Retained earnings 制计爱价贸易大考

Exhibit 1 Internal Financing of the Foreign Subsidiary Funds From Within the Multinational Enterprise (MNE) Funds Generated Internally by the Foreign Subsidiary Subsidiary borrowing with parent guarantee Funds from sister subsidiaries Funds from parent company Depreciation & non-cash charges Retained earnings Equity Cash Real goods Debt -- cash loans Leads & lags on intra-firm payables Debt -- cash loans Leads & lags on intra-firm payables

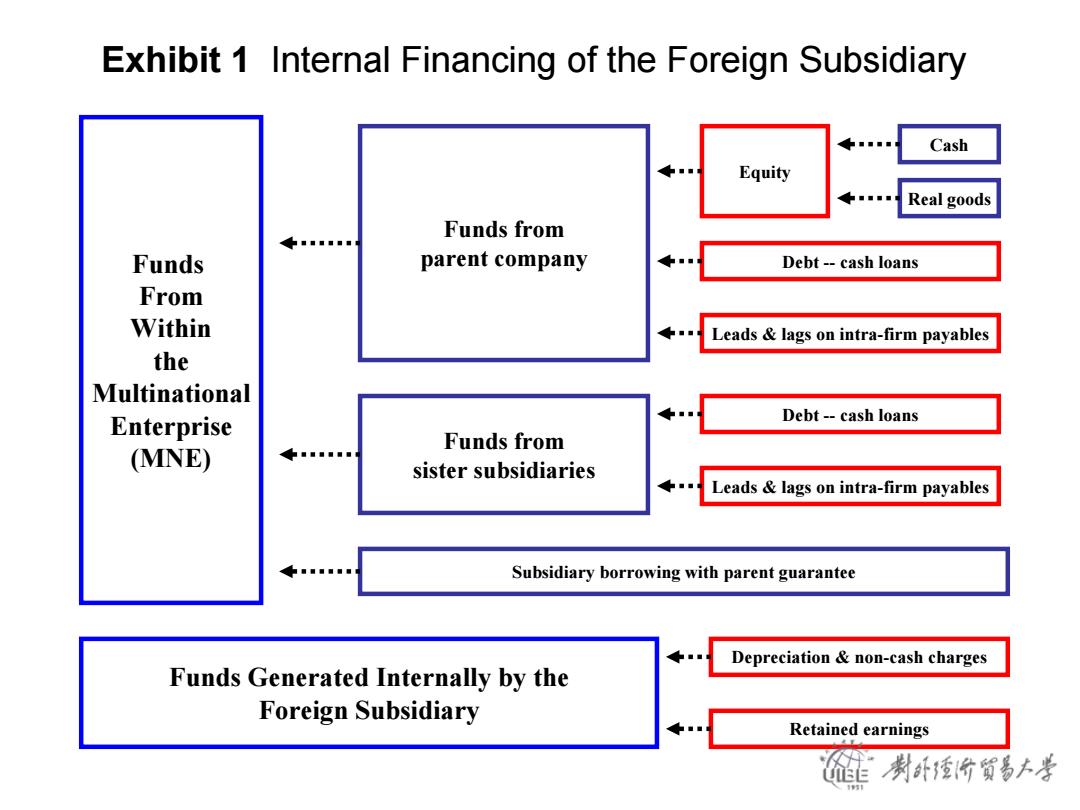

Exhibit 2 External Financing of the Foreign Subsidiary Borrowing from sources Banks other financial institutions ■■■■■■■ in parent country Security or money markets Funds External Local currency debt to the Borrowing from sources ■ outside of parent country Third-country currency debt Multinational Enterprise Eurocurrency debt (MNE) Individual local shareholders Local equity Joint venture partners 制卧价贸易大考

Exhibit 2 External Financing of the Foreign Subsidiary Funds External to the Multinational Enterprise (MNE) Borrowing from sources outside of parent country Borrowing from sources in parent country Local equity Joint venture partners Individual local shareholders Banks & other financial institutions Security or money markets Local currency debt Third-country currency debt Eurocurrency debt

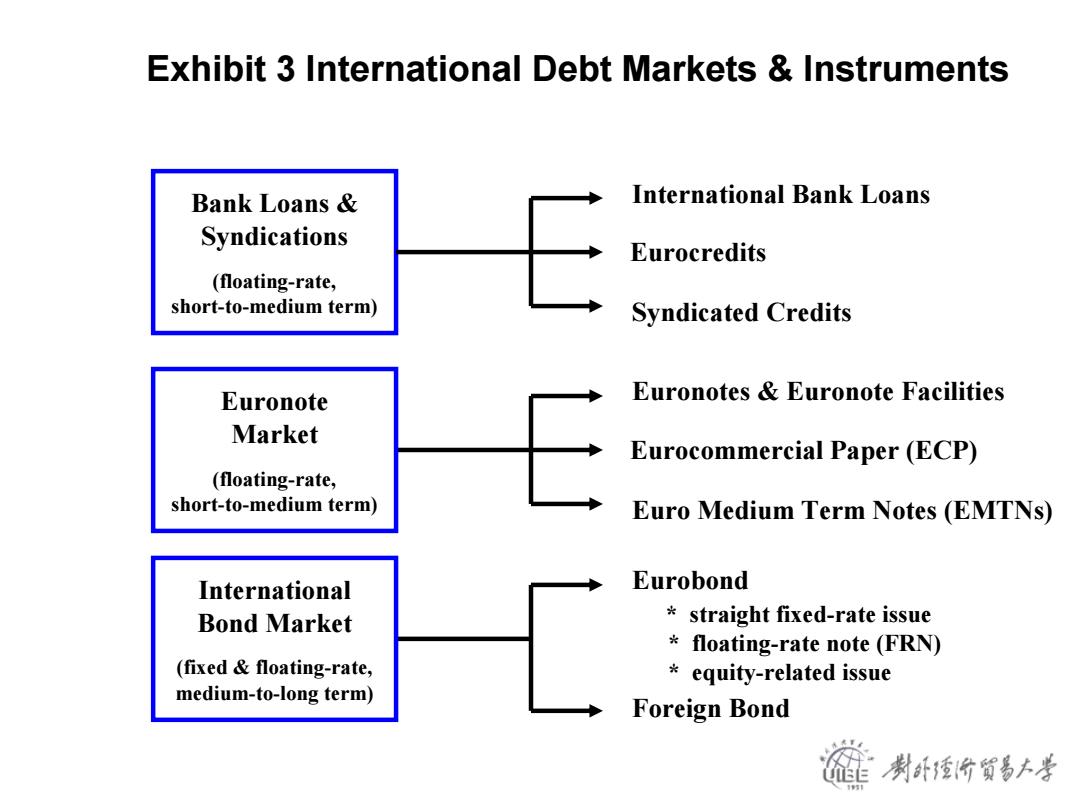

International Debt Markets The international debt market offers the borrower a wide variety of different maturities, repayment structures,and currencies of denomination. The markets and their many different instruments vary by source of funding,pricing structure,maturity,and subordination or linkage to other debt and equity instruments. The three major sources of debt funding on the international markets are depicted in the following exhibit 制纤价贸易本孝

International Debt Markets The international debt market offers the borrower a wide variety of different maturities, repayment structures, and currencies of denomination. The markets and their many different instruments vary by source of funding, pricing structure, maturity, and subordination or linkage to other debt and equity instruments. The three major sources of debt funding on the international markets are depicted in the following exhibit

Exhibit 3 International Debt Markets Instruments Bank Loans International Bank Loans Syndications Eurocredits (floating-rate, short-to-medium term) Syndicated Credits Euronote Euronotes Euronote Facilities Market Eurocommercial Paper (ECP) (floating-rate, short-to-medium term) Euro Medium Term Notes (EMTNs) International Eurobond Bond Market straight fixed-rate issue floating-rate note (FRN) (fixed floating-rate, equity-related issue medium-to-long term) Foreign Bond 制计价贸易本考

Exhibit 3 International Debt Markets & Instruments Bank Loans & Syndications (floating-rate, short-to-medium term) Eurocredits Syndicated Credits International Bank Loans Eurocommercial Paper (ECP) Euro Medium Term Notes (EMTNs) Euronotes & Euronote Facilities Foreign Bond Eurobond * straight fixed-rate issue * floating-rate note (FRN) * equity-related issue Euronote Market (floating-rate, short-to-medium term) International Bond Market (fixed & floating-rate, medium-to-long term)