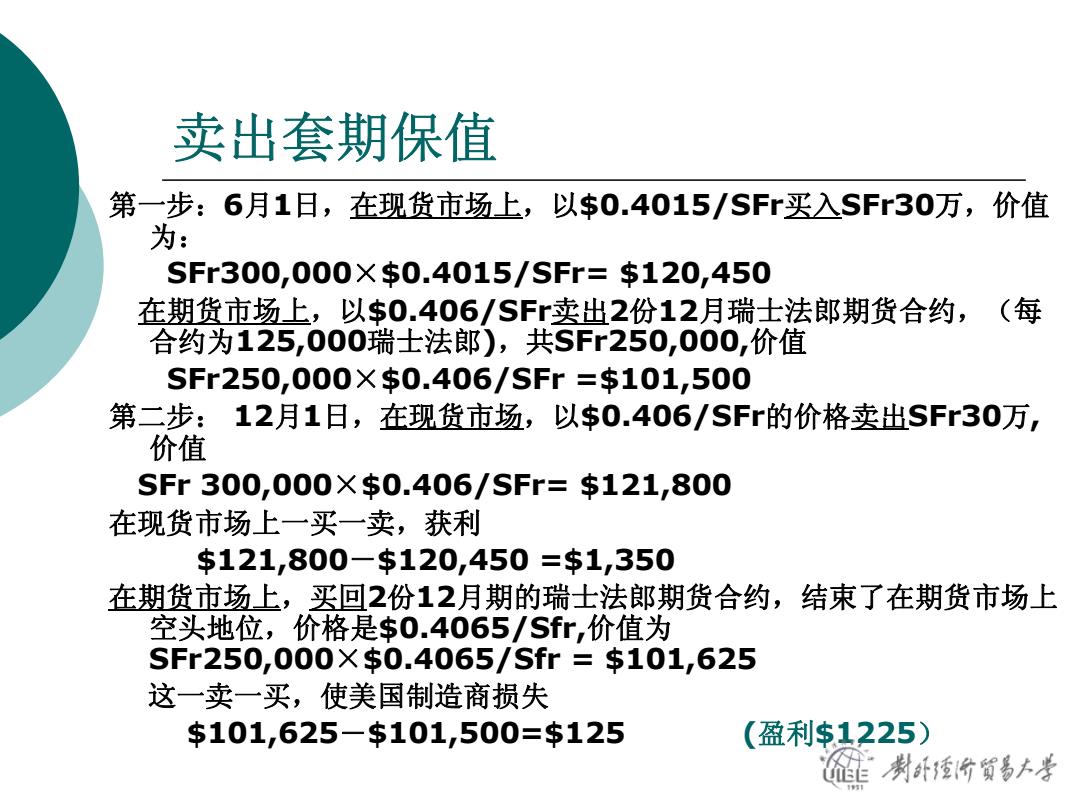

卖出套期保值 第一步:6月1日,在现货市场上,以$0.4015/SFr买入SFr30万,价值 为: SFr300,000×$0.4015/SFr=$120,450 在期货市场上,以$0.406/SFr卖出2份12月瑞士法郎期货合约,(每 合约为125,000瑞士法郎),共SFr250,000,价值 SFr250,000×$0.406/SFr=$101,500 第二步:12月1日,在现货市场,以$0.406/SFr的价格卖出SFr30万, 价值 SFr300,000×$0.406/SFr=$121,800 在现货市场上一买一卖,获利 $121,800-$120,450=$1,350 在期货市场上,买回2份12月期的瑞士法郎期货合约,结束了在期货市场上 空头地位,价格是$0.4065/Sfr,价值为 SFr250,000X$0.4065/Sfr=$101,625 这一卖一买,使美国制造商损失 $101,625-$101,500=$125 (盈利$1225) 制计价贸多+孝

卖出套期保值 第一步: 6 月 1日,在现货市场上,以$0.4015/SFr买入SFr30万,价值 为: SFr300,000 ×$0.4015/SFr= $120,450 在期货市场上,以$0.406/SFr卖出 2 份12月瑞士法郎期货合约,(每 合约为 125,000瑞士法郎 ),共SFr250,000,价值 SFr250,000 ×$0.406/SFr =$101,500 第二步: 12 月 1日,在现货市场,以$0.406/SFr的价格卖出SFr30 万, 价值 SFr 300,000 ×$0.406/SFr= $121,800 在现货市场上一买一卖,获利 $121,800 -$120,450 =$1,350 在期货市场上,买回 2 份12月期的瑞士法郎期货合约,结束了在期货市场上 空头地位,价格是 $0.4065/Sfr,价值为 SFr250,000 ×$0.4065/Sfr = $101,625 这一卖一买,使美国制造商损失 $101,625 -$101,500=$125 (盈利$1225 )

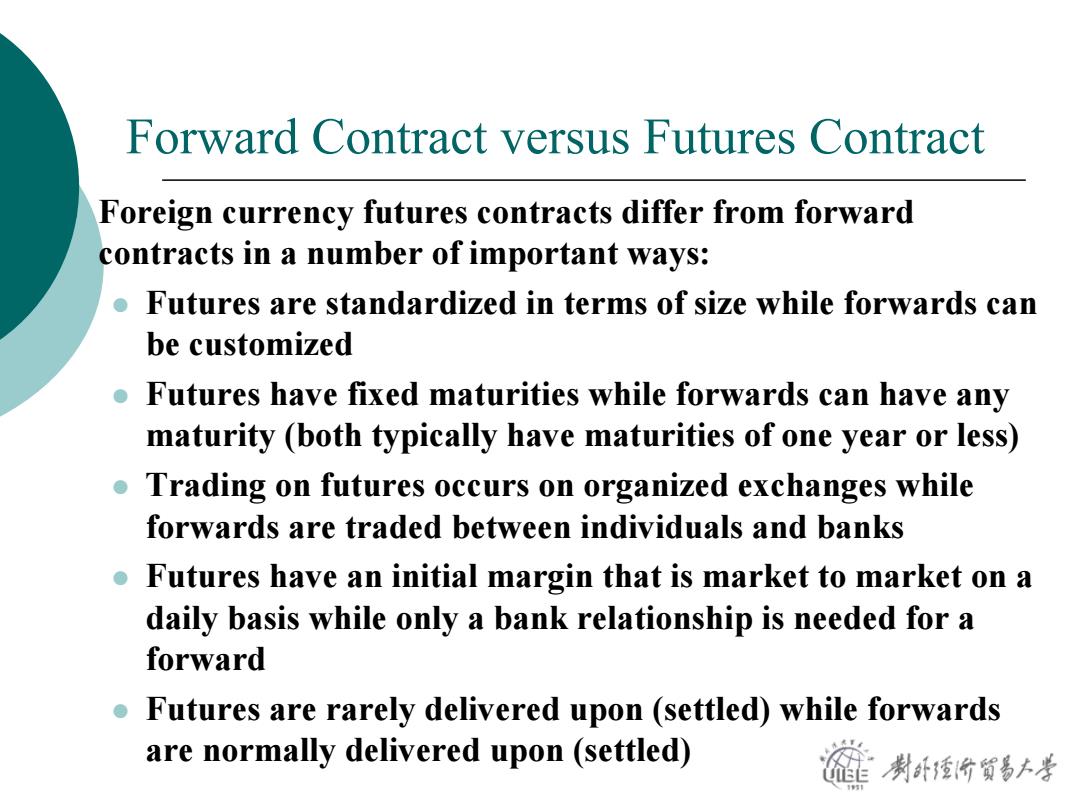

Forward Contract versus Futures Contract Foreign currency futures contracts differ from forward contracts in a number of important ways: Futures are standardized in terms of size while forwards can be customized Futures have fixed maturities while forwards can have any maturity (both typically have maturities of one year or less) ●1 Trading on futures occurs on organized exchanges while forwards are traded between individuals and banks Futures have an initial margin that is market to market on a daily basis while only a bank relationship is needed for a forward Futures are rarely delivered upon (settled)while forwards are normally delivered upon (settled) 制卧价贸易大孝

Forward Contract versus Futures Contract { Foreign currency futures contracts differ from forward contracts in a number of important ways: z Futures are standardized in terms of size while forwards can be customized z Futures have fixed maturities while forwards can have any maturity (both typically have maturities of one year or less) z Trading on futures occurs on organized exchanges while forwards are traded between individuals and banks z Futures have an initial margin that is market to market on a daily basis while only a bank relationship is needed for a forward z Futures are rarely delivered upon (settled) while forwards are normally delivered upon (settled)

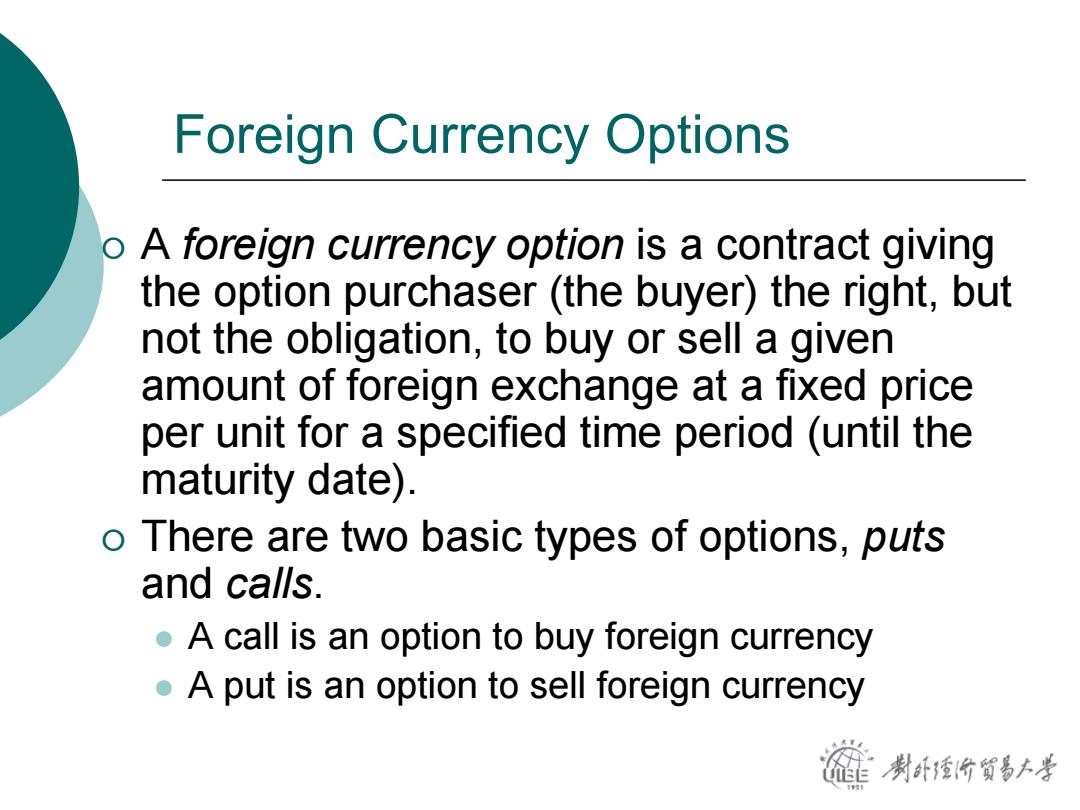

Foreign Currency Options o A foreign currency option is a contract giving the option purchaser (the buyer)the right,but not the obligation,to buy or sell a given amount of foreign exchange at a fixed price per unit for a specified time period (until the maturity date). o There are two basic types of options,puts and calls. A call is an option to buy foreign currency A put is an option to sell foreign currency 制卧价贸易大考

Foreign Currency Options { A foreign currency option is a contract giving the option purchaser (the buyer) the right, but not the obligation, to buy or sell a given amount of foreign exchange at a fixed price per unit for a specified time period (until the maturity date). { There are two basic types of options, puts and calls. z A call is an option to buy foreign currency z A put is an option to sell foreign currency

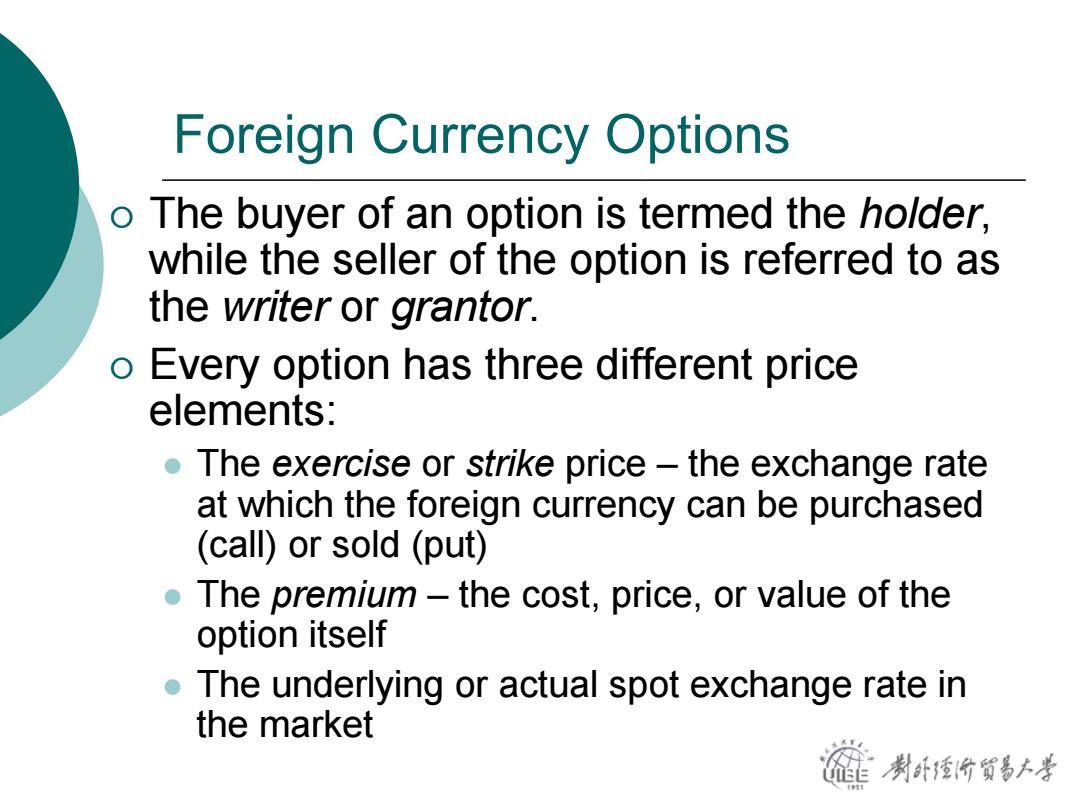

Foreign Currency Options o The buyer of an option is termed the holder, while the seller of the option is referred to as the writer or grantor. o Every option has three different price elements: .The exercise or strike price the exchange rate at which the foreign currency can be purchased (call)or sold (put) The premium-the cost,price,or value of the option itself The underlying or actual spot exchange rate in the market 制卧价贸易大考

Foreign Currency Options { The buyer of an option is termed the holder, while the seller of the option is referred to as the writer or grantor. { Every option has three different price elements: z The exercise or strike price – the exchange rate at which the foreign currency can be purchased (call) or sold (put) z The premium – the cost, price, or value of the option itself z The underlying or actual spot exchange rate in the market

Foreign Currency Options o An American option gives the buyer the right to exercise the option at any time between the date of writing and the expiration or maturity date. o A European option can be exercised only on its expiration date,not before. o The premium,or option price,is the cost of the option. 制卧价贸易大孝

Foreign Currency Options { An American option gives the buyer the right to exercise the option at any time between the date of writing and the expiration or maturity date. { A European option can be exercised only on its expiration date, not before. { The premium, or option price, is the cost of the option