For example,if the price of this bond were $1000,its effective yield would be about 10 percent.If the price were $1300,the effective yield would be about 6 percent;if the price were $700, it would be 16.2 percent

For example, if the price of this bond were $1000, its effective yield would be about 10 percent. If the price were $1300, the effective yield would be about 6 percent; if the price were $700, it would be 16.2 percent

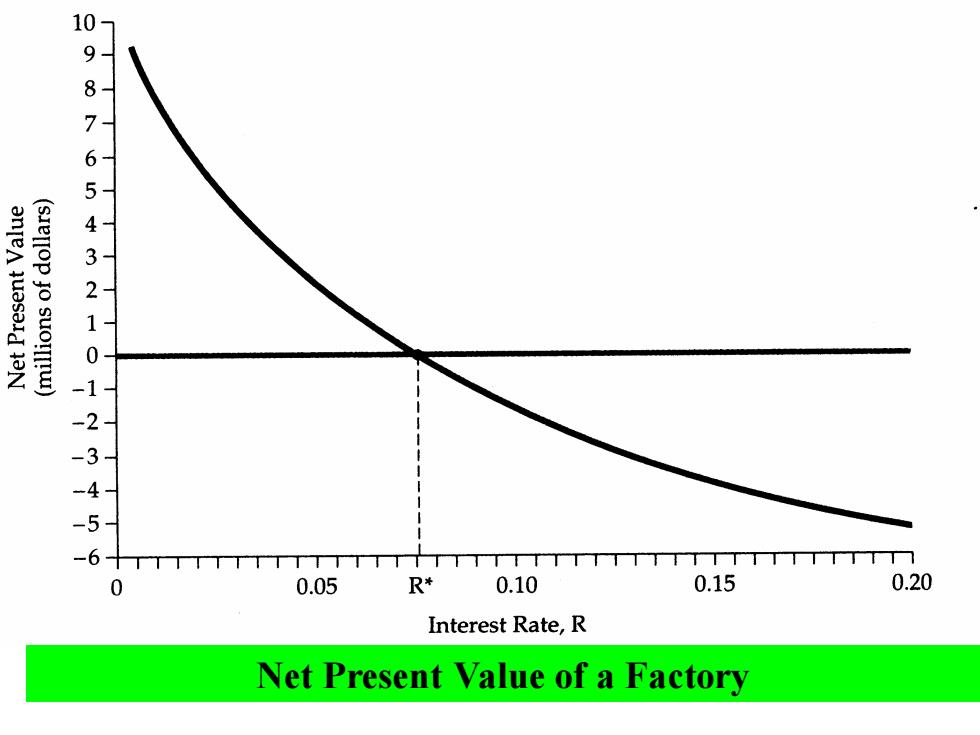

(sIellop jo suo!ll!u) 198765492101234 -5 6十TTTT 0 0.05 R* 0.10 0.15 0.20 Interest Rate,R Net Present Value of a Factory

Net Present Value of a Factory

The NPV of a factory is the present discounted value of all the cash flows involved in building and operating it. Here it is the PDV of the flow of future profits less the current cost of construction.The NPV declines as the interest rate increases.At interest rate R*,the NPV is zero

The NPV of a factory is the present discounted value of all the cash flows involved in building and operating it. Here it is the PDV of the flow of future profits less the current cost of construction. The NPV declines as the interest rate increases. At interest rate R*, the NPV is zero