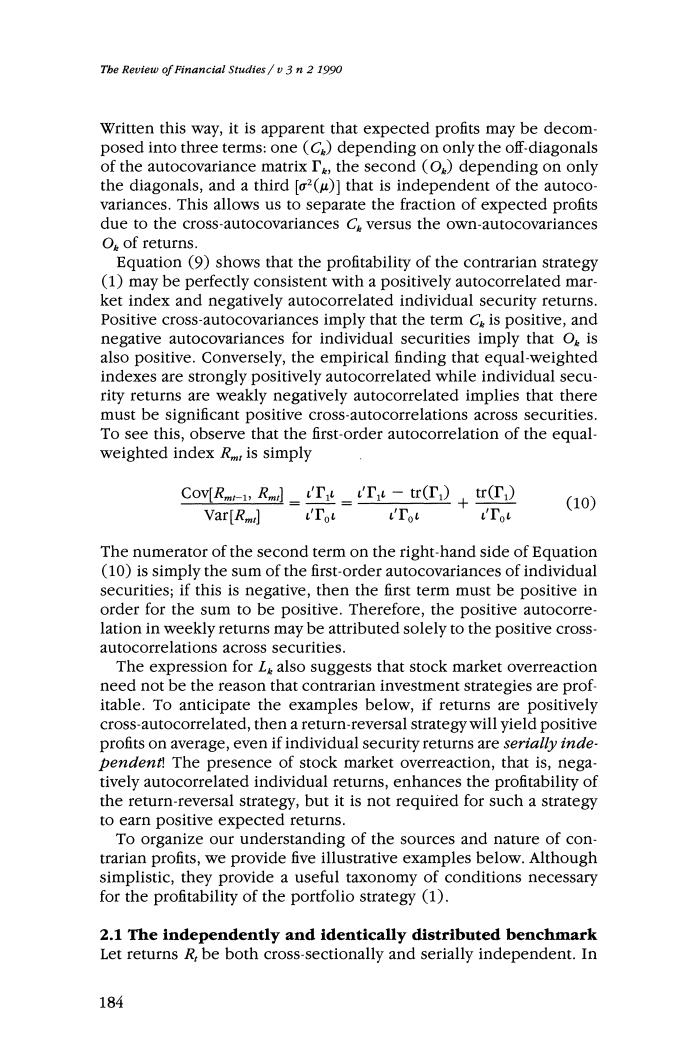

Tbe Review of Financial Studies /v 3 n 2 1990 Written this way,it is apparent that expected profits may be decom- posed into three terms:one (C)depending on only the off-diagonals of the autocovariance matrix I,the second (O)depending on only the diagonals,and a third [o2()1 that is independent of the autoco- variances.This allows us to separate the fraction of expected profits due to the cross-autocovariances C versus the own-autocovariances O of returns. Equation (9)shows that the profitability of the contrarian strategy (1)may be perfectly consistent with a positively autocorrelated mar- ket index and negatively autocorrelated individual security returns. Positive cross-autocovariances imply that the term C is positive,and negative autocovariances for individual securities imply that O is also positive.Conversely,the empirical finding that equal-weighted indexes are strongly positively autocorrelated while individual secu- rity returns are weakly negatively autocorrelated implies that there must be significant positive cross-autocorrelations across securities. To see this,observe that the first-order autocorrelation of the equal- weighted index Rm is simply COv[R1 RmTT-t)+) (10) Var[Rmd 'Tot 'Tot 'Tot The numerator of the second term on the right-hand side of Equation (10)is simply the sum of the first-order autocovariances of individual securities;if this is negative,then the first term must be positive in order for the sum to be positive.Therefore,the positive autocorre- lation in weekly returns may be attributed solely to the positive cross- autocorrelations across securities. The expression for L also suggests that stock market overreaction need not be the reason that contrarian investment strategies are prof. itable.To anticipate the examples below,if returns are positively cross-autocorrelated,then a return-reversal strategy will yield positive profits on average,even if individual security returns are serially inde- pendent!The presence of stock market overreaction,that is,nega- tively autocorrelated individual returns,enhances the profitability of the return-reversal strategy,but it is not required for such a strategy to earn positive expected returns. To organize our understanding of the sources and nature of con- trarian profits,we provide five illustrative examples below.Although simplistic,they provide a useful taxonomy of conditions necessary for the profitability of the portfolio strategy (1). 2.1 The independently and identically distributed benchmark Let returns R,be both cross-sectionally and serially independent.In 184

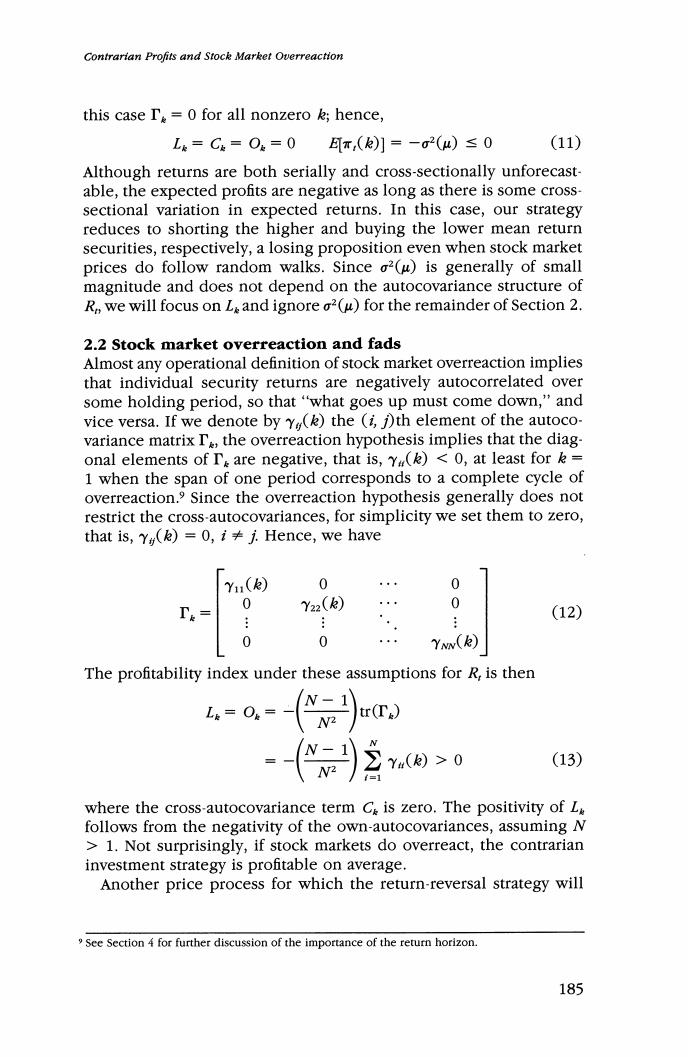

Contrarian Profits and Stock Market Overreaction this case I=0 for all nonzero k;hence, L。=C6=O。=0可x,()]=-2()≤0 (11) Although returns are both serially and cross-sectionally unforecast- able,the expected profits are negative as long as there is some cross- sectional variation in expected returns.In this case,our strategy reduces to shorting the higher and buying the lower mean return securities,respectively,a losing proposition even when stock market prices do follow random walks.Since o2(u)is generally of small magnitude and does not depend on the autocovariance structure of R,we will focus on Ls and ignore o2(u)for the remainder of Section 2. 2.2 Stock market overreaction and fads Almost any operational definition of stock market overreaction implies that individual security returns are negatively autocorrelated over some holding period,so that"what goes up must come down,"and vice versa.If we denote by Y(k)the(i,)th element of the autoco- variance matrix Ie,the overreaction hypothesis implies that the diag- onal elements of I are negative,that is,Y(k)<0,at least for k= 1 when the span of one period corresponds to a complete cycle of overreaction.'Since the overreaction hypothesis generally does not restrict the cross-autocovariances,for simplicity we set them to zero, that is,Y(k)=0,i j.Hence,we have Y11() 0 0 0 Y22() 0 (12) 0 0 YNN() The profitability index under these assumptions for R,is then L=0=- tr(Ta) -1 Y()>0 (13) where the cross-autocovariance term C is zero.The positivity of L follows from the negativity of the own-autocovariances,assuming N >1.Not surprisingly,if stock markets do overreact,the contrarian investment strategy is profitable on average. Another price process for which the return-reversal strategy will See Section 4 for further discussion of the importance of the return horizon. 185