15.401 Recitation 7:CAPM

15.401 Recitation 7: CAPM

Learning Objectives Review of Concepts O CAPM O Beta and SML O Alpha ▣Examples O The frontier O CML and SML 2010/Yichuan Liu 2

Learning Objectives R i ev ew of Concepts oCAPM oBeta and SML oAlpha Examples oThe frontier oCML and SML 2010 / Yichuan Liu 2

Review:efficient frontier From Portfolio Choice... The CML is tangent to the efficient frontier at the tangency portfolio. The tangency portfolio is the portfolio of risky assets that maximizes the Sharpe ratio. The slope of the CML is the maximum Sharpe ratio. Rational investors always hold a combination of the tangency portfolio and the risk-free asset.The proportion depends on investors'risk preferences. 2010/Yichuan Liu 3

‐ Review: efficient frontier From Portfolio Portfolio Choice… Choice… The CML is tangent to the efficient frontier at the tangency portfolio. The tangency portfolio is the portfolio of risky assets that maximizes the Sharpe ratio. The slope of the CML is the maximum Sharpe ratio. Rational investors always hold a combination of the tangency tangency portfolio portfolio and the risk‐free asset. The proportion depends on investors’ risk preferences. 2010 / Yichuan Liu 3

Review:CAPM Since each investor holds the tangency portfolio as part of his/her overall portfolio,the market portfolio must coincide with the tangency portfolio. Idea of CAPM:the contribution of a single risky asset to the risk of the market portfolio must be proportional to its risk premium. In other words,investors are compensated for exposure to systematic risk. ldiosyncratic risk is not compensated because they can be diversified away. 2010/Yichuan Liu

Review: CAPM Since each investor investor holds the tangency tangency portfolio portfolio as part of his/her overall portfolio, the market portfolio must coincide with the tangency portfolio. Idea of CAPM: the contribution of a single risky asset to the risk of the market portfolio must be proportional proportional to its risk premium premium. In other words, investors are compensated for exposure to systematic risk. Idiosyncratic risk is not compensated because they can be diversified away. 2010 / Yichuan Liu 4

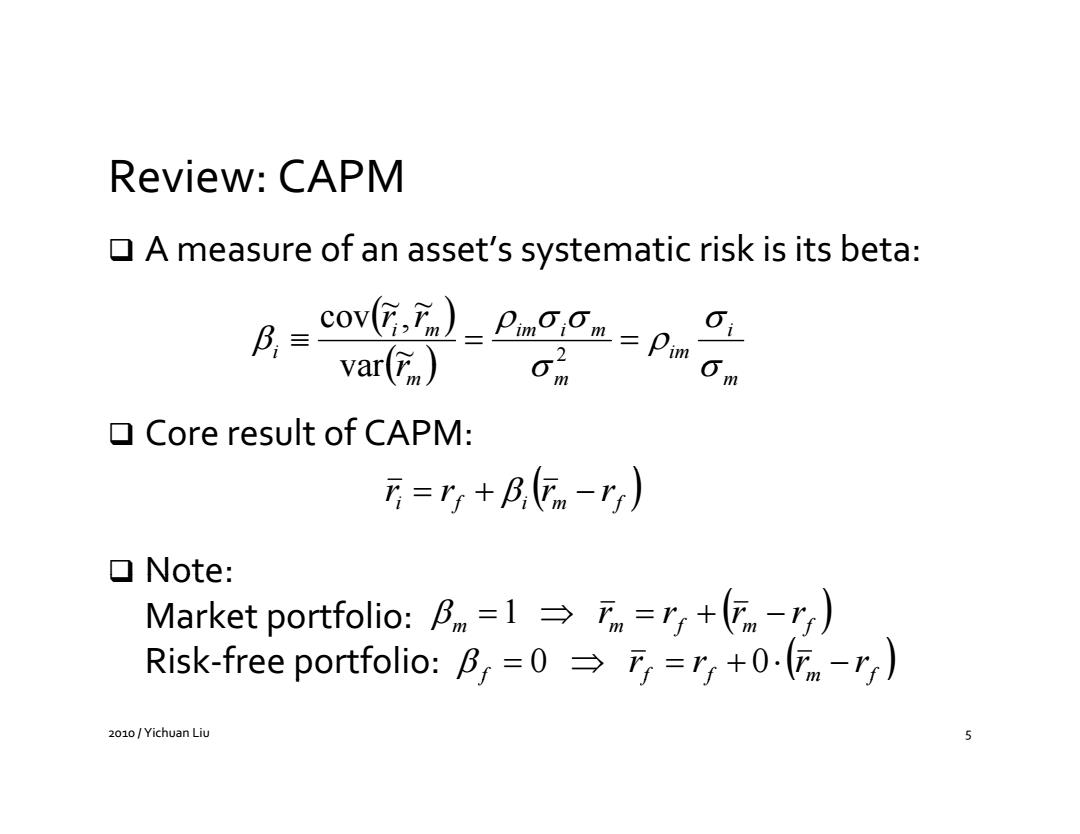

Review:CAPM A measure of an asset's systematic risk is its beta: Cov(mcon-pw var(tm) ▣Core result of CAPM: 万=r5+B,m-r) ▣Note: Market portfolio:Bnm=1→万n=ry+(m-r) Risk-free portfolio:B=0=+0.") 2010/Yichuan Liu

Review: CAPM A measure measure of an asset’s systematic systematic risk is its beta: ~ cov~ ri , rm im i m i i 2 im var~ rm m m Core result of CAPM: ri rf irm rf Note: Market portfolio: 1 r r r rf m m f m Risk‐free portfolio: f 0 rf rf 0 rm rf f 2010 / Yichuan Liu 5