16 The Yale Law Journal [Vol.111:1 institutions into their elaborate web of cross-shareholdings because any attempt to liquidate these blocks would have been punitively taxed.Yet effective January 1,2002,the capital gains tax on such ir climinated,and some of the largest German financial institutions have already announced plans to reduce the extent of their cross-shareholdings.37 The apparent eagerness of German financial institutions to divest themsel es of long-held blocks and to scale back re a sets raises the always-lurking question about how deeply the German system of concentrated ownership was truly entrenched.Professor Roe,among others, has suggested that concentrated ownership (and correspondingly weak securities markets)reflects a strong social and political commitment to a cluster of social values that he calls"social democracy.Y Yet,if a simple change in the corporate tax laws causes the system to collapse by the mutual consent of those locked into this system of cross-shareholdings,the simpler explanation for concentrated ownership may be that German tax l ws eithe r caused this system 0 more e likely,enforced its persistence w e after competitive forces would otherwise have compelled its dismantling. C.The Growth of European Stock Markets Continental stock markets have long been thin and illiquid.For some, this was arguably a virtue of European corporate governance because it protected corporate managements from the tyranny of a "short-sighted" stock marke and ing permitte long-term corporations in conjunction with their principal stakeholders. Whatever the historical validity of this story,it now seems increasingly dated. A particularly useful recent study shows that the number of firms listing on European stock changes rose sharply at the end of the 1990s: eTo Red ce Co ntry's strictive Tax n of 39.German so cholars have also suggested that the German tax system may be the better r at l own d G COL M..EUR.L213.24151999 PARADIGM IMPLICA THADDEN THE CHAN Library.Workake ntooerm ttereat of utside RNATIONAL HARMON 00) able c.be/fli/WP/wp200 Ph.D.d ssertation ir Imaged with the Permission of Yale Law Journal

The Yale Law Journal institutions into their elaborate web of cross-shareholdings because any attempt to liquidate these blocks would have been punitively taxed. 6 Yet effective January 1, 2002, the capital gains tax on such investments will be eliminated, and some of the largest German financial institutions have already announced plans to reduce the extent of their cross-shareholdings.37 The apparent eagerness of German financial institutions to divest themselves of long-held blocks and to scale back noncore assets raises the always-lurking question about how deeply the German system of concentrated ownership was truly entrenched. Professor Roe, among others, has suggested that concentrated ownership (and correspondingly weak securities markets) reflects a strong social and political commitment to a cluster of social values that he calls "social democracy."38 Yet, if a simple change in the corporate tax laws causes the system to collapse by the mutual consent of those locked into this system of cross-shareholdings, the simpler explanation for concentrated ownership may be that German tax laws either caused this system, or, more likely, enforced its persistence well after competitive forces would otherwise have compelled its dismantling.39 C. The Growth of European Stock Markets Continental stock markets have long been thin and illiquid. For some, this was arguably a virtue of European corporate governance because it protected corporate managements from the tyranny of a "short-sighted" stock market and instead permitted long-term business planning by corporations in conjunction with their principal stakeholders." Whatever the historical validity of this story, it now seems increasingly dated. A particularly useful recent study shows that the number of firms listing on European stock changes rose sharply at the end of the 1990s:4' 36. Haig Simonian, Germany Unbound: Measures To Reduce the Country's Restrictive Tax Burden Have Delighted Many Businesses, FIN. TIMES (London), Aug. 10, 2000, at 14. 37. Id. (noting the plan of Allianz and Munich Re to reduce their cross-holdings). 38. Roe, supra note 12, at 543. 39. German scholars have also suggested that the German tax system may be the better explanation for at least the contemporary system of concentrated ownership in Germany. E.g., Friedrich Kiibler, On Mark Roe, German Codetermination and German Securities Markets, 5 COLUM. J. EUR. L. 213, 214-15 (1999). 40. Some observers wholly disagree with LLS&V and consider concentrated ownership to be more efficient, in part because managers possess information that market participants lack. See ERIK BERGLOF & ERNST-LUDWIG VON THADDEN, THE CHANGING CORPORATE GOVERNANCE PARADIGM: IMPLICATIONS FOR TRANSITION AND DEVELOPING COUNTRIES 14 (SSRN Elec. Library, Working Paper No. 183,708, 1999) (noting the "popular view" that "outside investors do not necessarily take into account the long-term interest of the firm"), available at http://papers.ssm.com/paper.taf?abstractid=183708. 41. CHRISTOPH VAN DER ELST, THE EQUITY MARKETS, OWNERSHIP STRUCTURES AND CONTROL: TOWARDS AN INTERNATIONAL HARMONISATION? (Fin. Law Inst., Working Paper No. WP 2000-04, 2000), available at http://systemO4.rug.ac.be/fli/WP/wp2000-O4.pdf [hereinafter VAN DER ELST, EQUITY MARKETS]. This paper is a preliminary version of a Ph.D. dissertation in Imaged with the Permission of Yale Law Journal [Vol. I111: 1

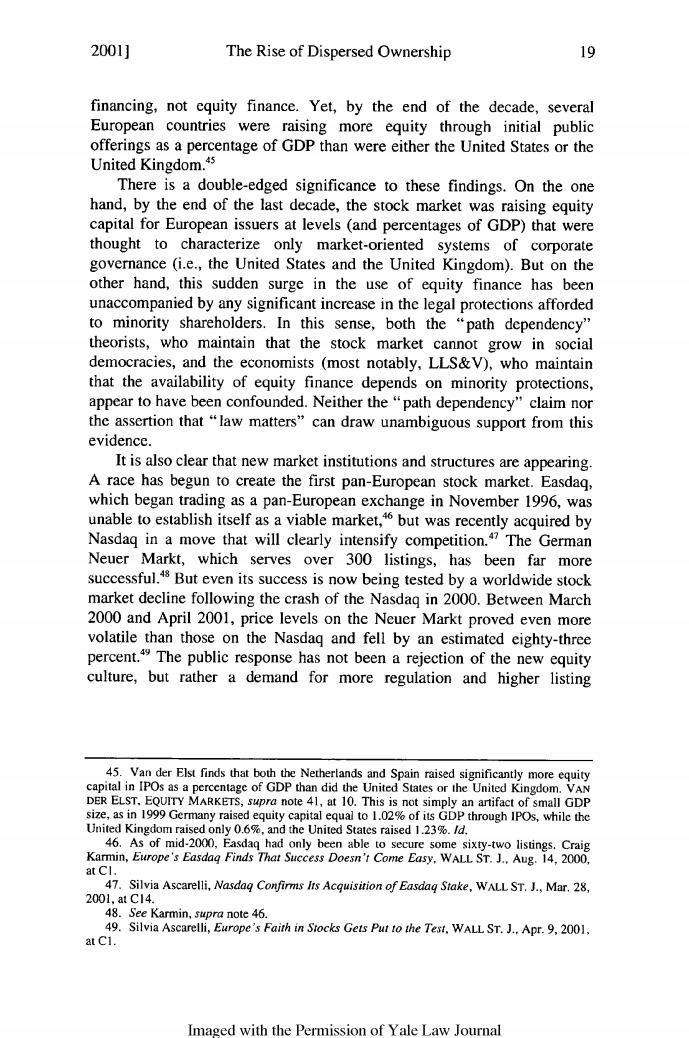

2001] The Rise of Dispersed Ownership 17 TABLE 2.EVOLUTION OF THE NUMBER OF STOCK EXCHANGE LISTED COMPANIES+2 %Growth 1990 1993 1996 1999 (1990- 1999) Network-oriented: Belgium 182 159 136 140 -23.1% france (excluding Marche Libre 443 726 686 968 118.5% Germany 548 568 579 1043 90.3% Italy 257 242 244 247 -3.99% Netherlands 222 239 217 233 5.0% Spain ·1992) 429 b404 357 718 67.4% Japan (Tokyo) (1998) 16271667 1766 1838 13.0% Market-oriented: United Kingdom 194619272339 2292 17.8% United States (NYSE) 177419452476 2631 48.39% United States (Nasdaq) 387643105167 4829 24.6% Although the pattern is far from uniform.listings on the equity market rose rapidly in the late 1990s in France,Germany,and Spain,more rapidly than in the United States or the United Kingdom.Elsewhere,the number of listed companies may have declined,possibly because of an international wave of mergers and acquisitions,which is itself a sign of convergence. Beyond this growth in the nur mber of listed companies,two othe statistics reveal even more clearly the suddenly increased role of the equity markets in European economies,a transition that again seems to date only from the latter half of the last decade.First,stock market capitalization as a -indeed,to iDP skyrocketed in severa Puropean countric one or two European countries approach or exceed the same ratios in the United States or the United Kingdom.The following selected uderss 2001 t)(on author)hr rtationl Imaged with the permission of Yale law lournal

The Rise of Dispersed Ownership TABLE 2. EVOLUTION OF THE NUMBER OF STOCK EXCHANGE LISTED COMPANIES4 2 % Growth 1990 1993 1996 1999 (1990- . .. . .. 1999) Network-oriented: Belgium 182 159 136 140 -23.1% France ( excluding March6 Libre) 443 726 686 '968 118.5% Germany 548 568 579 1043 90.3% Italy 257 242 244 247 -3.9% Netherlands 222 239 217 233 5.0% Spain (1992) 429 b404 357 718 67.4% Japan (Tokyo) (1998) 1627 1667 1766 '1838 13.0% Market-oriented: United Kingdom 1946 1927 2339 2292 17.8% United States (NYSE) 1774 1945 2476 2631 48.3% United States (Nasdaq) 3876 4310 5167 4829 24.6% Although the pattern is far from uniform, listings on the equity market rose rapidly in the late 1990s in France, Germany, and Spain, more rapidly than in the United States or the United Kingdom. Elsewhere, the number of listed companies may have declined, possibly because of an international wave of mergers and acquisitions, which is itself a sign of convergence. Beyond this growth in the number of listed companies, two other statistics reveal even more clearly the suddenly increased role of the equity markets in European economies, a transition that again seems to date only from the latter half of the last decade. First, stock market capitalization as a percentage of GDP skyrocketed in several European countries-indeed, to the point that one or two European countries approach or exceed the same ratios in the United States or the United Kingdom. The following selected Dutch. Chrstoph Van der Elst, Aandeethoudersstructuren, Aandeelhoudersconcentratie en Controle Van Beursgenoteerde Ondernemingen (2001) (unpublished Ph.D. dissertation, Universiteit Gent) (on file with author) [hereinafter Van der Elst, Dissertation]. 42. Van der Elst, Dissertation, supra note 41, at tbl.3.1. Imaged with the Permission of Yale Law Journal 2001]

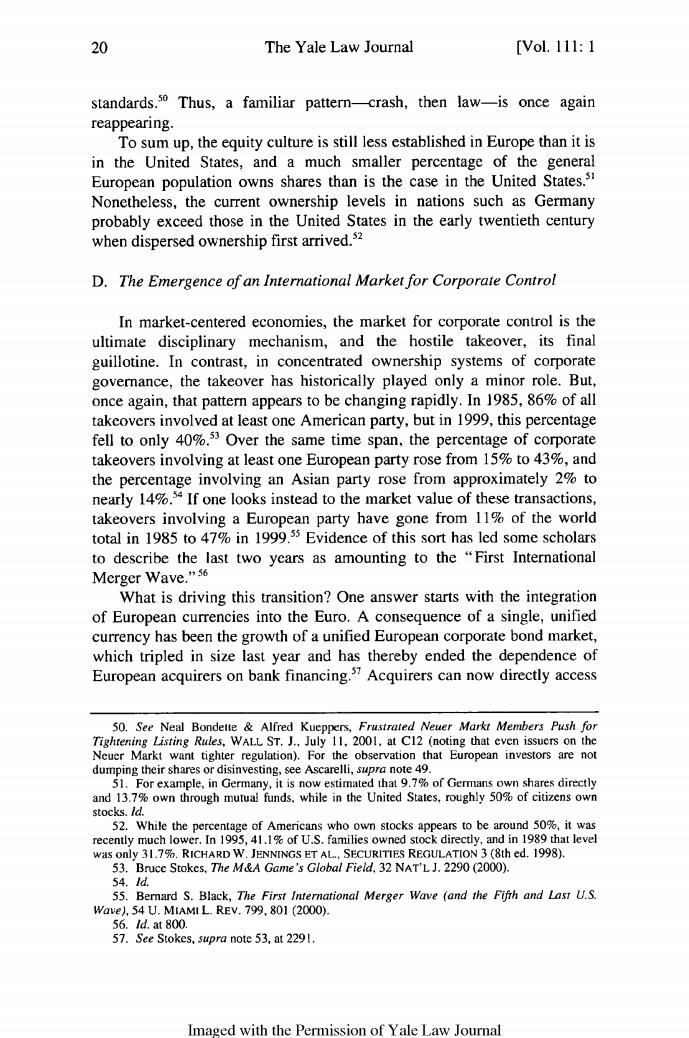

伊 The Yale Law Journal [Vol.111:1 examples show how long-stable percentages veered suddenly upward at the end of the decade. TABLE 3.EVOLUTION OF MARKET CAPITALIZATION AS A PERCENTAGE OF GDP(1990-1999) 1975 1980 1990 1996 1998 1999 Network-oriented: Belgium 15% 8% 33% 44% 97.5% 75.4% France 10% 8% 26% 38% 67.8% 105.3% Germany 12% 9% 22% 28% 50.6% 68.1% Italy 5% 6% 14% 21% 47.9% 62.4% Netherlands 21% 17% 42% 95% 157.6% 177.3% Spain 8% 23% 33% 71.9% 72.6% Sweden 3% 10% 40% 95% 122.3% 156.3% Switzerland 30% 42% 69% 136% 259.4% 267.5% Market-oriented: United Kingdom 37%38% 87%142% 167.3%198.0% United States 48%50%56%114%157.0%181.19% Of course,these percentages are subject to greater fluctuation in countries with small populations(such as the Netherlands and Switzerland). and much of the market canitalization in these countries may remain in the hands of a fev controlling owners Nonetheless,the real is the suddenness of the transition.Essentially,as the European market integrated in the mid-1990s,stock market values soared,both in absolute terms and as a percentage of GDP. Second,while IPOs once characterized only the markets of the United States and the United Kingdom,they have become In 1999,Germany saw 168 IPOs,and France saw 75.For the decade, France led with 581 IPOs,Germany followed with 380,and Spain was a close third with 355.The significance of this point bears emphasis cause systems of concentrated ownership were ught to lack the institutions necessary to bring new companies directly into the equity market.Instead,new firms were believed to be dependent on bank and debt 积侣 Imaged with the Permission of Yale Law Journal

The Yale Law Journal examples show how long-stable percentages veered suddenly upward at the end of the decade. TABLE 3. EVOLUTION OF MARKET CAPITALIZATION AS A PERCENTAGE OF GDP (1990-1999) 4 1 1975 1980 1990 1996 1998 1999 Network-oriented: Belgium 15% 8% 33% 44% 97.5% 75.4% France 10% 8% 26% 38% 67.8% 105.3% Germany 12% 9% 22% 28% 50.6% 68.1% Italy 5% 6% 14% 21% 47.9% 62.4% Netherlands 21% 17% 42% 95% 157.6% 177.3% Spain - 8% 23% 33% 71.9% 72.6% Sweden 3% 10% 40% 95% 122.3% 156.3% Switzerland 30% 42% 69% 136% 259.4% 267.5% Market-oriented: United Kingdom 37% 38% 87% 142% 167.3% 198.0% United States 48% 50% 56% 114% 157.0% 181.1% Of course, these percentages are subject to greater fluctuation in countries with small populations (such as the Netherlands and Switzerland), and much of the market capitalization in these countries may remain in the hands of a few controlling owners. Nonetheless, the real point is the suddenness of the transition. Essentially, as the European market integrated in the mid- 1990s, stock market values soared, both in absolute terms and as a percentage of GDP. Second, while IPOs once characterized only the markets of the United States and the United Kingdom, they have become common across Europe. In 1999, Germany saw 168 IPOs, and France saw 75. For the decade, France led with 581 IPOs, Germany followed with 380, and Spain was a close third with 355.' The significance of this point bears emphasis because systems of concentrated ownership were thought to lack the institutions necessary to bring new companies directly into the equity market. Instead, new firms were believed to be dependent on bank and debt 43. Id. at tbl.3.4. 44. Id. at tbl.3.5. Imaged with the Permission of Yale Law Journal [Vol. I111: 1

2001] The Rise of Dispersed Ownership 19 financing,not cquity finance.Yet,by the end of the decade,several European countries were raising more equity through initial public offerings as a percentage of GDP than were either the Unit ited States or the United Kingdon 45 There is a double-edged significance to these findings.On the one hand,by the end of the last decade,the stock market was raising equity capital for European issuers at levels (and percentages of GDP)that were thought to market- systems of corporate governance (i.e.,the United States and the United Kingdom).But on the other hand,this sudden surge in the use of equity finance has been unaccompanied by any significant increase in the legal protections afforded to minority shareholders.In this ser c oth D the “path dependency theorists,who maintain that the stock market cannot grow in social democracies,and the economists (most notably,LLS&V),who maintain that the availability of equity finance depends on minority protections, have been confounded.Neither the"path depende ncy taim assertion that"law matter can draw unambiguous support from this evidence. It is also clear that new market institutions and structures are appearing A race has begun to create the first pan-European stock market. which began tr as a pan-Eu nge in Noven ber 1996.was Nasdaq in a move that will clearly intensify competition.The German Neuer Markt,which serves over 300 listings,has been far more successful.But even its success is now being tested orldwide stock market decline follo wing the crash of the Nasdaq in 2000.Between March 2000 and April 2001,price levels on the Neuer Markt proved even more volatile than those on the Nasdag and fell by an estimated eighty-three percent.4 The public response has not been a rejection of the nev culture,but rather a demand for more regulation and higher listing 45.Van der Elst finds that both the Netherlands and Spair capital tage of GDP than did Germany rai 46.A5ofmd-200. had nly hee sraised cri Nadag Conc WALT.M. Imaged with the Permission of Yale Law Journal

The Rise of Dispersed Ownership financing, not equity finance. Yet, by the end of the decade, several European countries were raising more equity through initial public offerings as a percentage of GDP than were either the United States or the United Kingdom.45 There is a double-edged significance to these findings. On the one hand, by the end of the last decade, the stock market was raising equity capital for European issuers at levels (and percentages of GDP) that were thought to characterize only market-oriented systems of corporate governance (i.e., the United States and the United Kingdom). But on the other hand, this sudden surge in the use of equity finance has been unaccompanied by any significant increase in the legal protections afforded to minority shareholders. In this sense, both the "path dependency" theorists, who maintain that the stock market cannot grow in social democracies, and the economists (most notably, LLS&V), who maintain that the availability of equity finance depends on minority protections, appear to have been confounded. Neither the "path dependency" claim nor the assertion that "law matters" can draw unambiguous support from this evidence. It is also clear that new market institutions and structures are appearing. A race has begun to create the first pan-European stock market. Easdaq, which began trading as a pan-European exchange in November 1996, was unable to establish itself as a viable market,' but was recently acquired by Nasdaq in a move that will clearly intensify competition.47 The German Neuer Markt, which serves over 300 listings, has been far more successful.48 But even its success is now being tested by a worldwide stock market decline following the crash of the Nasdaq in 2000. Between March 2000 and April 2001, price levels on the Neuer Markt proved even more volatile than those on the Nasdaq and fell by an estimated eighty-three percent.49 The public response has not been a rejection of the new equity culture, but rather a demand for more regulation and higher listing 45. Van der Elst finds that both the Netherlands and Spain raised significantly more equity capital in IPOs as a percentage of GDP than did the United States or the United Kingdom. VAN DER ELST. EQUITY MARKETS, supra note 41, at 10. This is not simply an artifact of small GDP size, as in 1999 Germany raised equity capital equal to 1.02% of its GDP through IPOs, while the United Kingdom raised only 0.6%, and the United States raised 1.23%. Id. 46. As of mid-2000, Easdaq had only been able to secure some sixty-two listings. Craig Karmin, Europe's Easdaq Finds That Success Doesn't Come Easy, WALL ST. J., Aug. 14, 2000, at Cl. 47. Silvia Ascarelli, Nasdaq Confirms Its Acquisition of Easdaq Stake, WALL ST. J., Mar. 28, 2001, at C14. 48. See Karmin, supra note 46. 49. Silvia Ascarelli, Europe's Faith in Stocks Gets Put to the Test, WALL ST. J., Apr. 9, 2001, at Cl. Imaged with the Permission of Yale Law Journal 2001]

20 The Yale Law Journal [Vol.111:1 standards.30 Thus,a familiar pattern-crash,then law-is once again reappearing To sum up,the equity culture is still less established in Europe than it is in the United States,and a much smaller percentage of the general European population owns shares than is the case in the United States.3 Nonetheless,the current ownership levels in nations such as Germany ates in the early twentieth century when dispersed ownership first arrived. D.The Emergence of an International Market for Corporate Control In market-centered economies,the market for corporate control is the ultimate disciplinary mechanism,and the hostile takeover,its final guillotine.In st,in co ntrated ownership systems of corporate governance,the takeover has historically played only a minor role. once again,that pattern appears to be changing rapidly.In 1985,86%of all takeovers involved at least one American party,but in 1999,this percentage fell to only 40%.3 Over the same time span,the percentage of corporate takeovers involving at leastone European party rose an the percentage involving an Asian party rose from approximately 2%to nearly 14%.If one looks instead to the market value of these transactions, takeovers involving a European party have gone from 11%of the world total in 1985 to 47%in 1999.35 Evide ence of this sort has led some scholars to describe the last two years as amounting to the “First Internationa Merger Wave." What is driving this transition?One answer starts with the integration of European currencies into the Euro.A consequence of a single,unified currency has bee n th e growth of Europe rate bond which tripled in size last year and has thereby ended the dependence o European acquirers on bank financing."'Acquirers can now directly access K 不cbrrrehereoAecato on the serva that European investors are not 1.For exam is no estim that 9.7%of Gem and s ld 、把a设密品 3(8thcd.1998). Wave Imaged with the Permission of Yale Law Journal

The Yale Law Journal standards.5 " Thus, a familiar pattern-crash, then law-is once again reappearing. To sum up, the equity culture is still less established in Europe than it is in the United States, and a much smaller percentage of the general European population owns shares than is the case in the United States." Nonetheless, the current ownership levels in nations such as Germany probably exceed those in the United States in the early twentieth century when dispersed ownership first arrived.52 D. The Emergence of an International Market for Corporate Control In market-centered economies, the market for corporate control is the ultimate disciplinary mechanism, and the hostile takeover, its final guillotine. In contrast, in concentrated ownership systems of corporate governance, the takeover has historically played only a minor role. But, once again, that pattern appears to be changing rapidly. In 1985, 86% of all takeovers involved at least one American party, but in 1999, this percentage fell to only 40%." Over the same time span, the percentage of corporate takeovers involving at least one European party rose from 15% to 43%, and the percentage involving an Asian party rose from approximately 2% to nearly 14%. 54 If one looks instead to the market value of these transactions, takeovers involving a European party have gone from 11% of the world total in 1985 to 47% in 1999."5 Evidence of this sort has led some scholars to describe the last two years as amounting to the "First International Merger Wave." 56 What is driving this transition? One answer starts with the integration of European currencies into the Euro. A consequence of a single, unified currency has been the growth of a unified European corporate bond market, which tripled in size last year and has thereby ended the dependence of European acquirers on bank financing.57 Acquirers can now directly access 50. See Neal Bondette & Alfred Kueppers, Frustrated Neuer Markt Members Push for Tightening Listing Rules, WALL ST. J., July 11, 2001, at C12 (noting that even issuers on the Neuer Marki want tighter regulation). For the observation that European investors are not dumping their shares or disinvesting, see Ascarelli, supra note 49. 51. For example, in Germany, it is now estimated that 9.7% of Germans own shares directly and 13.7% own through mutual funds, while in the United States, roughly 50% of citizens own stocks. Id. 52. While the percentage of Americans who own stocks appears to be around 50%, it was recently much lower. In 1995, 41.1% of U.S. families owned stock directly, and in 1989 that level was only 31.7%. RICHARD W. JENNINGS FT AL., SECURITIES REGULATION 3 (8th ed. 1998). 53. Bruce Stokes, The M&A Game's Global Field, 32 NAT'L J. 2290 (2000). 54. Id. 55. Bernard S. Black, The First International Merger Wave (and the Fifth and Last U.S. Wave), 54 U. MIAMI L. REv. 799, 801 (2000). 56. id. at 800. 57. See Stokes, supra note 53, at 2291. Imaged with the Permission of Yale Law Journal [Vol. I111: 1