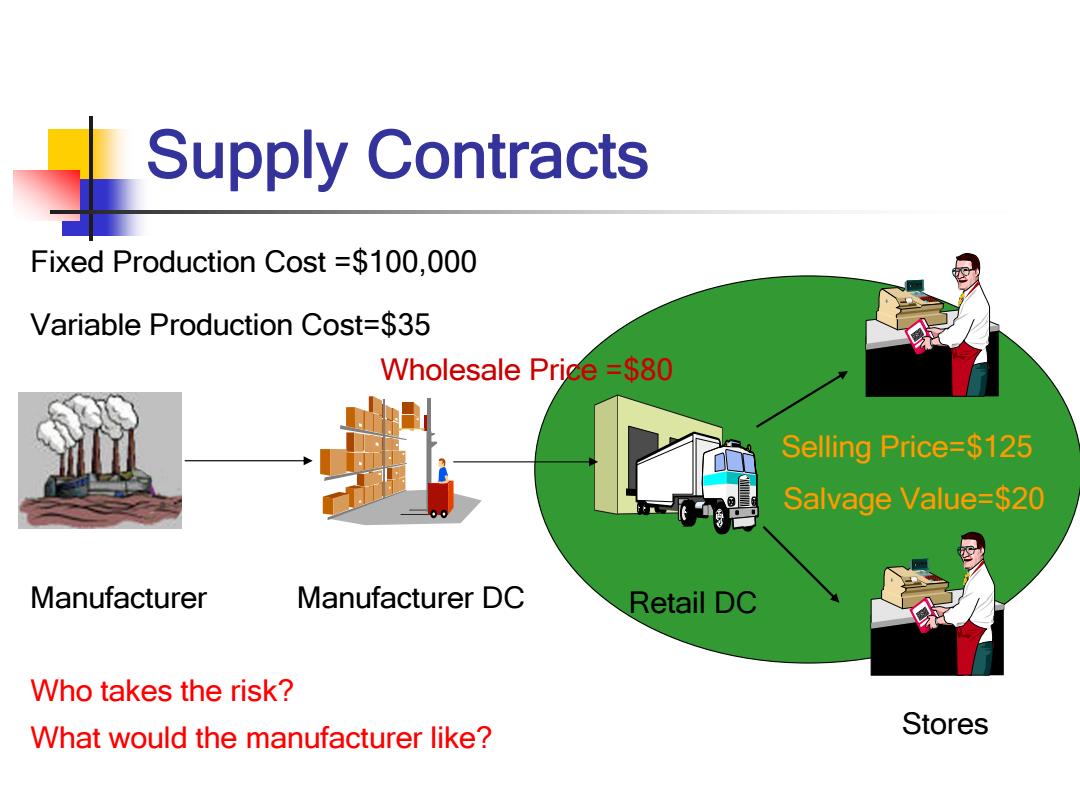

_Supply Contracts Fixed Production Cost =$100,000 Variable Production Cost=$35 Wholesale Price =$80 Selling Price=$125 Salvage Value=$20 Manufacturer Manufacturer DC Retail DC Who takes the risk? What would the manufacturer like? Stores

Manufacturer Manufacturer DC Retail DC Stores Fixed Production Cost =$100,000 Variable Production Cost=$35 Selling Price=$125 Salvage Value=$20 Wholesale Price =$80 Who takes the risk? What would the manufacturer like? Supply Contracts

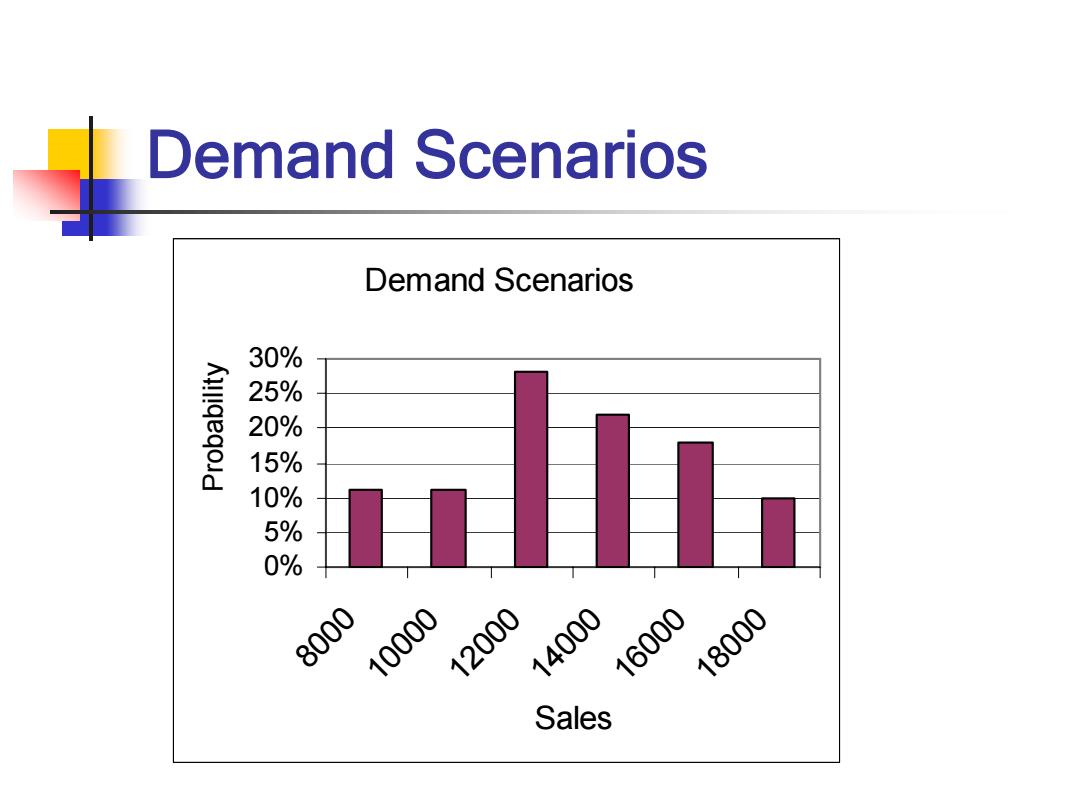

Demand Scenarios Demand Scenarios 30% 25% 20% 15% 10% 5% 0% 8000 10000 12000 14000 16000 18000 Sales

Demand Scenarios Demand Scenarios 0% 5% 10% 15% 20% 25% 30% 8000 10000 12000 14000 16000 18000 Sales Probability

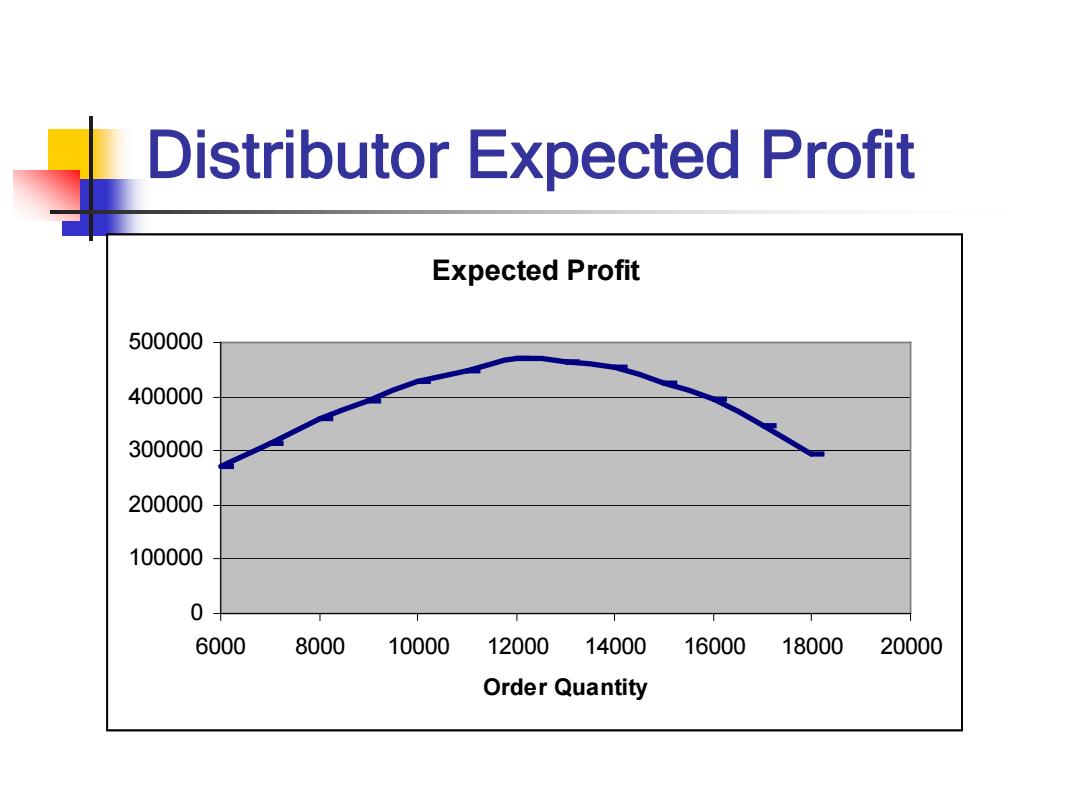

Distributor Expected Profit Expected Profit 500000 400000 300000 200000 100000 0 6000 8000 10000 12000 14000 16000 18000 20000 Order Quantity

Distributor Expected Profit Expected Profit 0 100000 200000 300000 400000 500000 6000 8000 10000 12000 14000 16000 18000 20000 Order Quantity

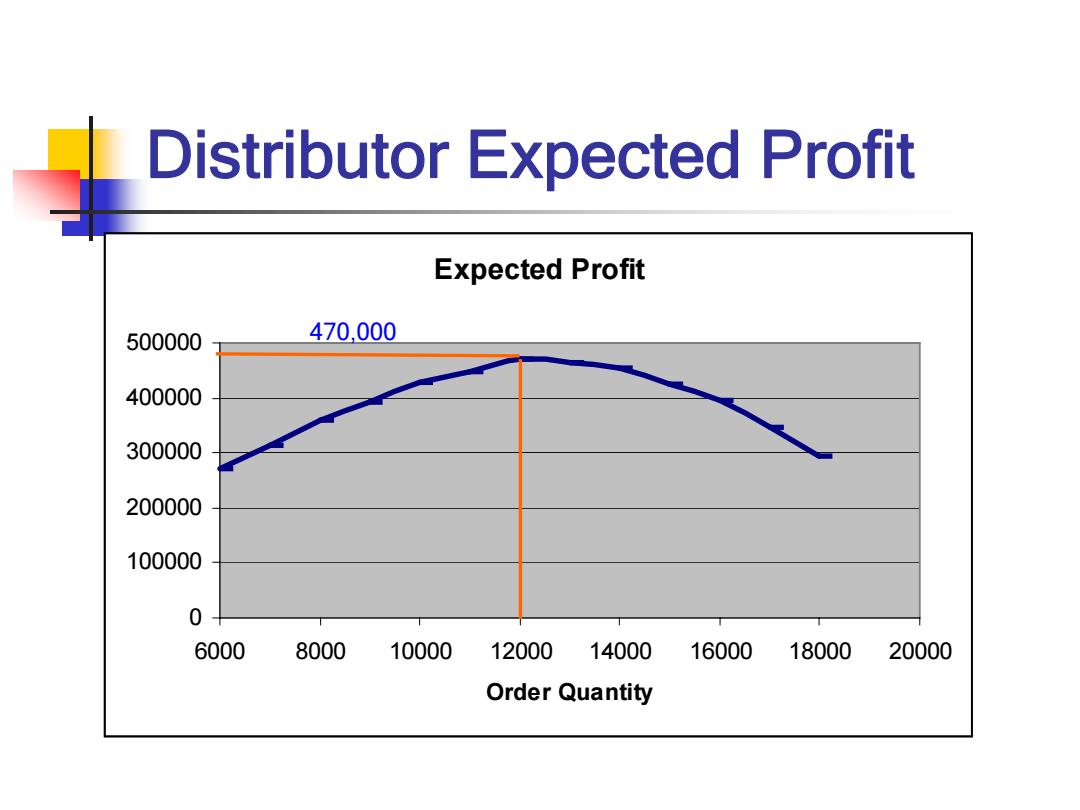

Distributor Expected Profit Expected Profit 500000 470,000 400000 300000 200000 100000 0 6000 8000 10000 12000 14000 16000 18000 20000 Order Quantity

Distributor Expected Profit Expected Profit 0 100000 200000 300000 400000 500000 6000 8000 10000 12000 14000 16000 18000 20000 Order Quantity 470,000

Supply Contracts Distributor optimal order quantity is 12.000 units Distributor expected profit is $470,000 Manufacturer profit is $440,000 Supply Chain Profit is $910,000 How can the distributor and manufacturer increase the profit of both?

Supply Contracts Distributor optimal order quantity is 12,000 units Distributor expected profit is $470,000 Manufacturer profit is $440,000 Supply Chain Profit is $910,000 How can the distributor and manufacturer increase the profit of both?