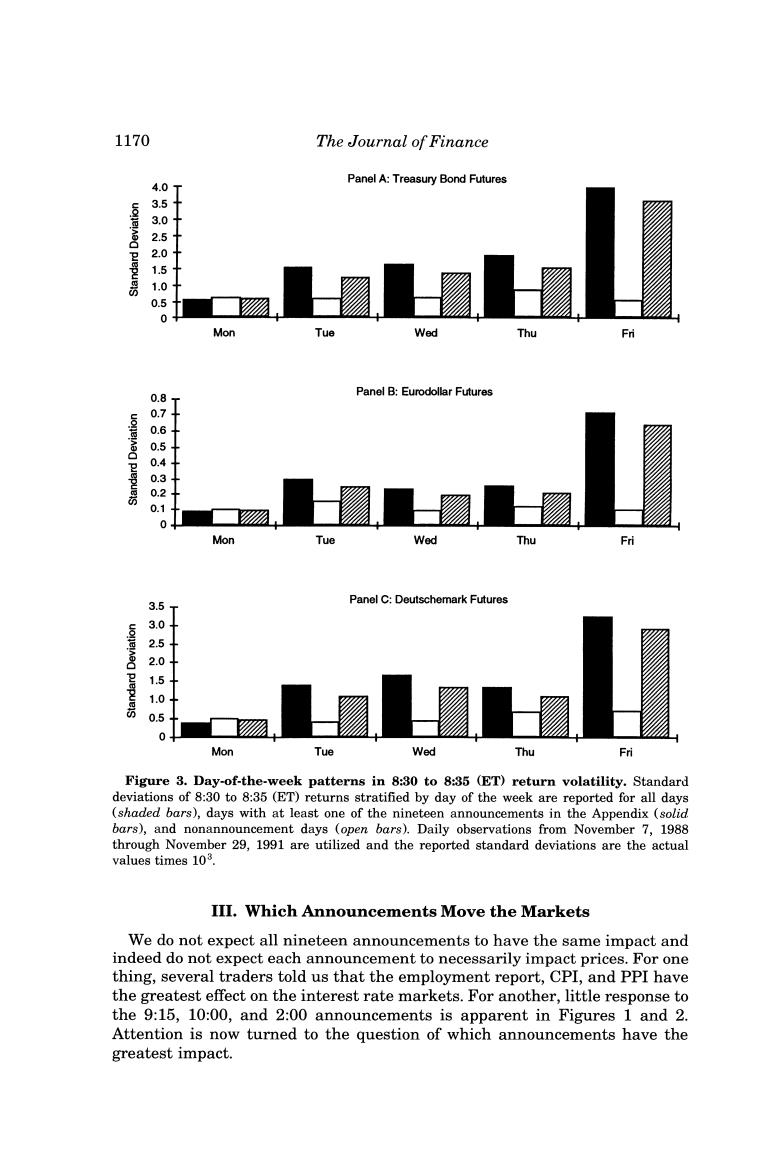

1170 The Journal of Finance Panel A:Treasury Bond Futures 4.0T 5301500 5 0 Mon Tue Wed Thu 0.8 Panel B:Eurodollar Futures O664 8 0 Mon Tue Wed Thu Fri 3.5 Panel C:Deutschemark Futures T 3053150 5 0 Mon Tue Wed Thu Fri Figure 3.Day-of-the-week patterns in 8:30 to 8:35 (ET)return volatility.Standard deviations of 8:30 to 8:35 (ET)returns stratified by day of the week are reported for all days (shaded bars),days with at least one of the nineteen announcements in the Appendix (solid bars),and nonannouncement days (open bars).Daily observations from November 7,1988 through November 29,1991 are utilized and the reported standard deviations are the actual values times 103. III.Which Announcements Move the Markets We do not expect all nineteen announcements to have the same impact and indeed do not expect each announcement to necessarily impact prices.For one thing,several traders told us that the employment report,CPI,and PPI have the greatest effect on the interest rate markets.For another,little response to the 9:15,10:00,and 2:00 announcements is apparent in Figures 1 and 2. Attention is now turned to the question of which announcements have the greatest impact

How Markets Process Information:News Releases and Volatility 1171 Panel A:Treasury Bond Futures 6.0T 5.0 40 0 Mon Tue Wed Thu Panel B:Eurodollar Futures 1.0 T 4 0.2 0 Mon Tue Wed Thu Fn Panel C:Deutschemark Futures 5.0 40 1.0 Mon Tue Wed Thu Fri Figure 4.Day-of-the-week patterns in 8:20 to 9:30(ET)return volatility.Standard deviations of 8:20 to 9:30(ET)returns stratified by day of the week are reported for all days (shaded bars),days with at least one of the nineteen announcements in the Appendix (solid bars),and nonannouncement days (open bars).Daily observations from November 7,1988 through November 29,1991 are utilized and the reported standard deviations are the actual values times 103. A.Previous Studies While there have been numerous studies of the reaction of interest and exchange rates to weekly money supply announcements,s there have been 9 The impact of money supply announcements on interest rates has been studied by Cornell (1983),Thorton(1989),and Stronglin and Tarhan(1990)among many others,and the impact on exchange rates has been studied by Hardouvelis (1984)and Thorton (1989).In general these studies find no reaction to the anticipated component of money supply announcements but a significant reaction to the unexpected component-at least during the period of money supply targeting October 1979 to October 1982