3.Annuity OA series of equal dollar CFs for a specified number of periods Ordinary Annuity (PVAN,FVAN) is where the CFs occur at the end of each period Example:paycheck,interest payments OAnnuity Due(PVAND,FVAND) is where the CFs occur at the beginning of each period Examples:apartment rent,insurance premiums 渊补楂价货最方居 直O年N0l事e0003

16 zA series of equal dollar CFs for a specified number of periods zOrdinary Annuity (PVAN, FVAN) is where the CFs occur at the end of each period. Example: paycheck, interest payments zAnnuity Due (PVAND,FVAND) is where the CFs occur at the beginning of each period. Examples: apartment rent, insurance premiums 3. Annuity 3. Annuity

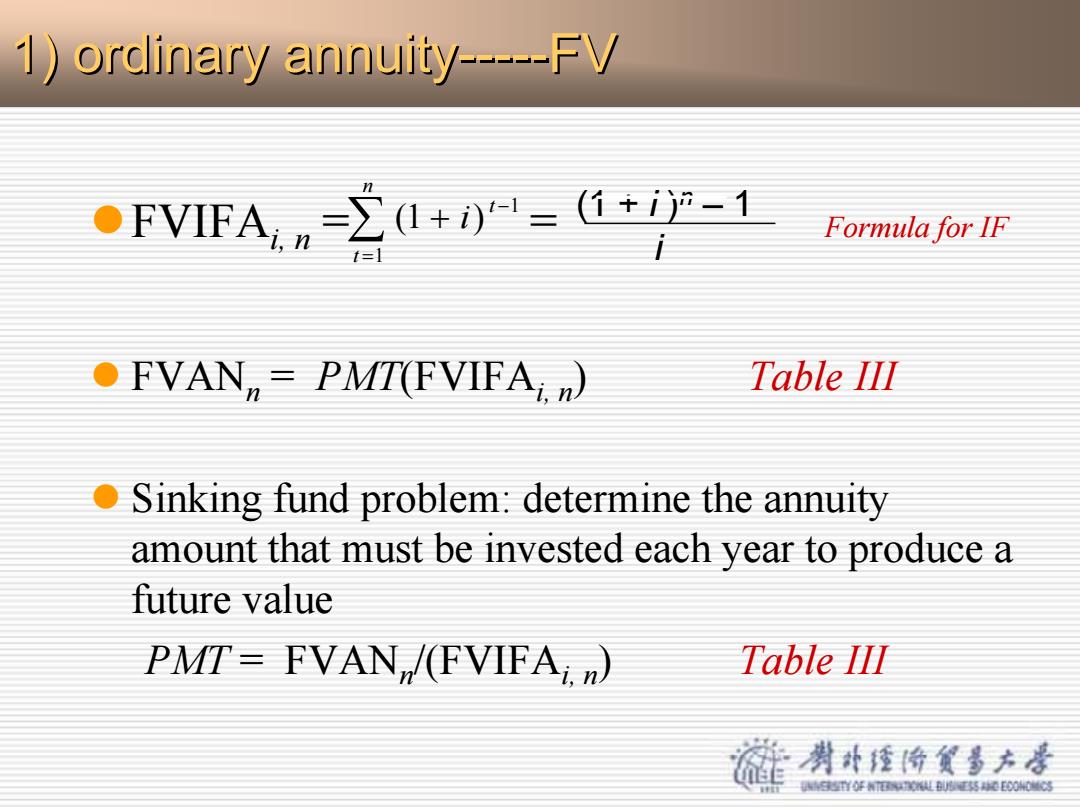

1)ordinary annuity-----FV FVIFA>(+)-=+产-1 Formula for IF t=] FVAN=PMT(FVIFA) Table III O Sinking fund problem:determine the annuity amount that must be invested each year to produce a future value PMT=FVAN,/(FVIFAi) Table III 剥外校份贫多方号 YO年N0l到8E事0E00h03

1) ordinary annuity 1) ordinary annuity-----FV zFVIFAi, n = = Formula for IF z FVAN n = PMT(FVIFAi, n ) Table III z Sinking fund problem: determine the annuity amount that must be invested each year to produce a future value PMT = FVAN n/(FVIFAi, n) Table III (1 + i ) n – 1 i ∑= − + n t t i 1 1 ( 1 )

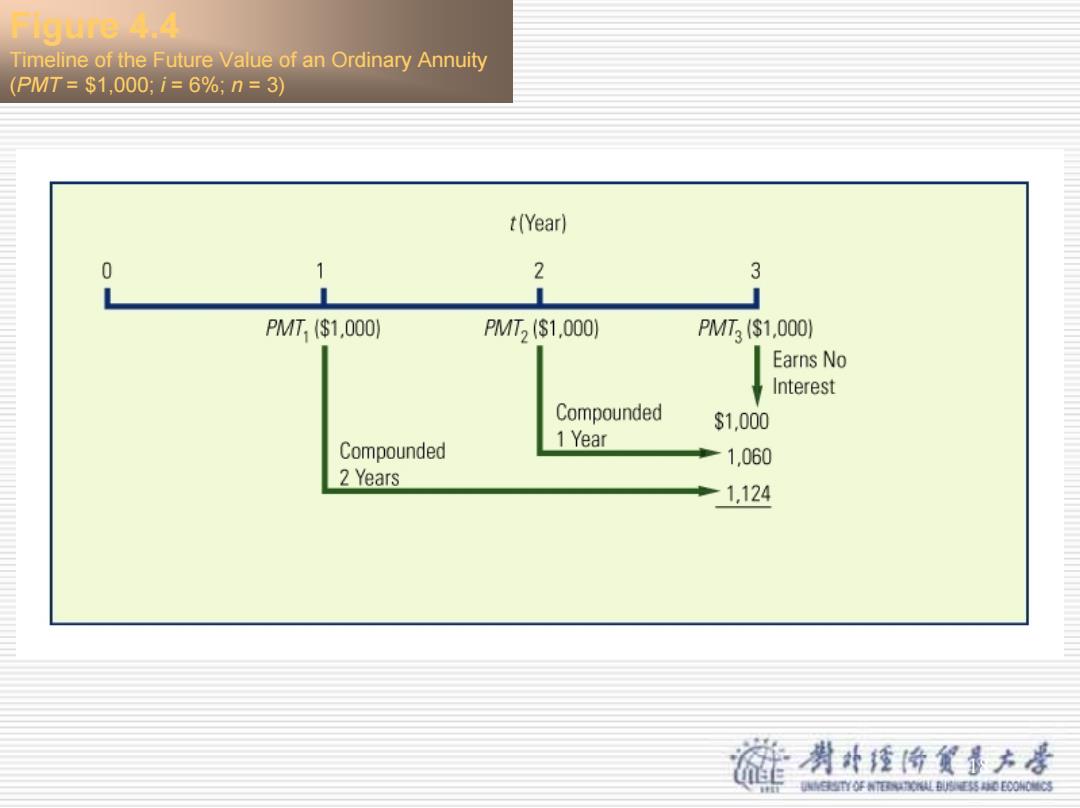

Iigure 4.4 Timeline of the Future Value of an Ordinary Annuity (PMT=$1,000:i=6%;n=3) t(Year) 0 1 2 3 PMT($1.000) PMT2($1,000) PMT3(S1,000】 Earns No Interest Compounded $1.000 Compounded 1 Year 1.060 2 Years 1.124 剥动楂份货最方是 年T0年0LB月50E000

18 Figure 4.4 Timeline of the Future Value of an Ordinary Annuity (PMT = $1,000; i = 6%; n = 3)

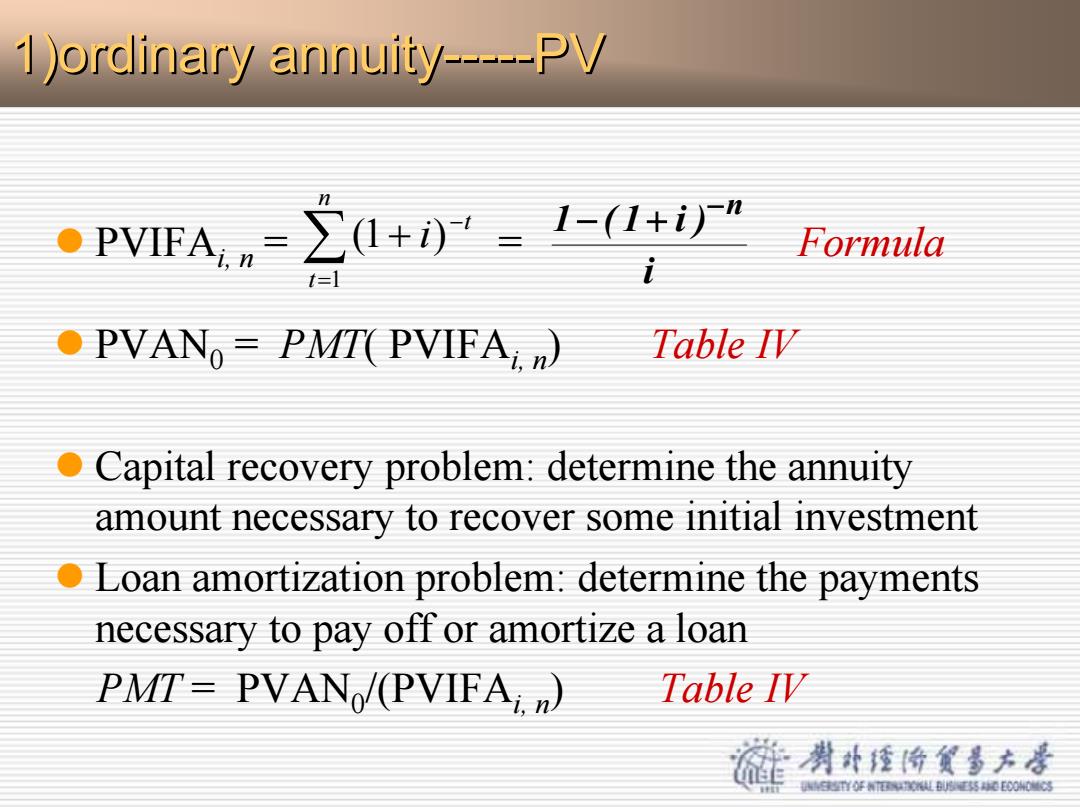

1)ordinary annuity-----PV ●PVFA,∑0+)'.1-(I+i) Formula i PVAN=PMT(PVIFA) Table IV O Capital recovery problem:determine the annuity amount necessary to recover some initial investment Loan amortization problem:determine the payments necessary to pay off or amortize a loan PMT=PVAN/(PVIFA) Table IV 剥外校份贫多方号 老YO年NE证事0EO0h3

z PVIFAi, n = = Formula z PVAN0 = PMT( PVIFAi, n) Table IV z Capital recovery problem: determine the annuity amount necessary to recover some initial investment z Loan amortization problem: determine the payments necessary to pay off or amortize a loan PMT = PVAN0/(PVIFAi, n) Table IV i 1 ( 1 i )−n − + 1)ordinary annuity 1)ordinary annuity-----PV ∑ = − + n t t i 1 (1 )

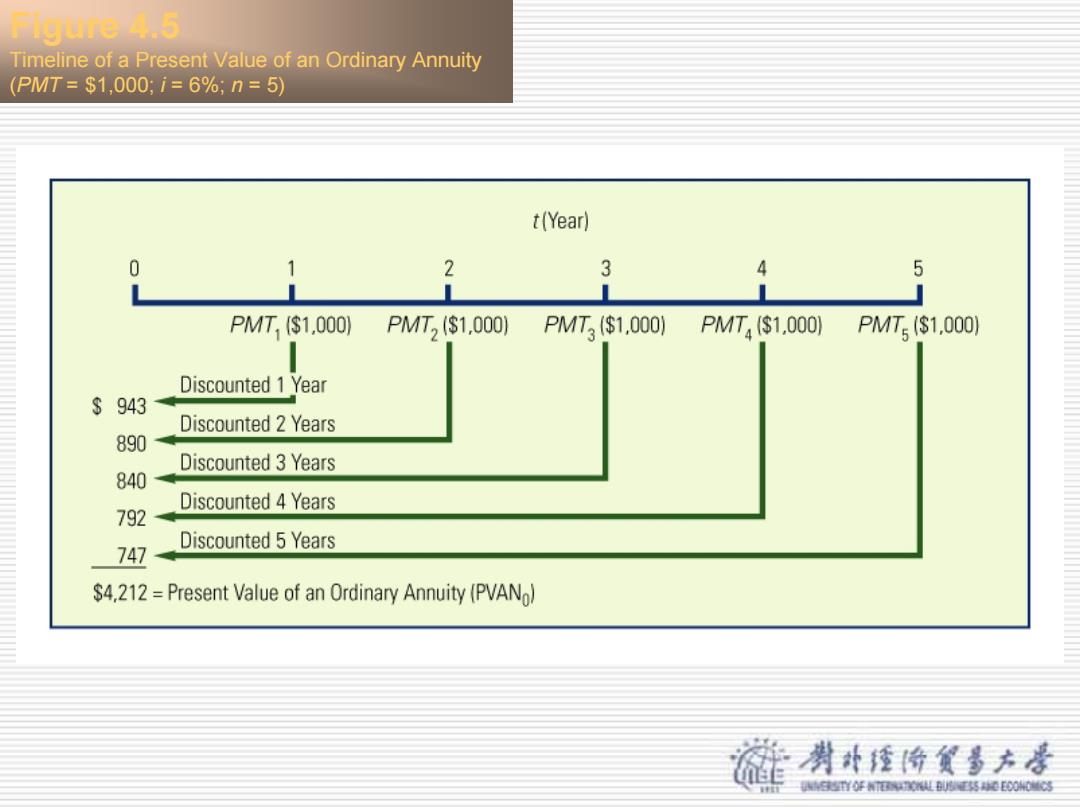

Iigare 4.5 Timeline of a Present Value of an Ordinary Annuity (PMT=$1,000:i=6%;n=5) t(Year) 0 2 3 5 PMT,($1.000) PMT2($1.000) PMT($1.000) PMT,$1.000) PMT($1.000) Discounted 1 Year $943 Discounted 2 Years 890 Discounted 3 Years 840 Discounted 4 Years 792 Discounted 5 Years 747 $4,212=Present Value of an Ordinary Annuity (PVAN) 剥补楂价货多方是 T0年0LB月50E00以

Figure 4.5 Timeline of a Present Value of an Ordinary Annuity (PMT = $1,000; i = 6%; n = 5)