裢贵华经将贸墨去号 公司理财 EXAM PAPER 2 I.True(T)or False(F).Please fill in the bracket with T or F.(15%) 1.It is hard to find exceptionally profitable projects in competitive markets.( 2.For securities with cash flows that are constant in each year but where there is no specified maturity,such as preferred stock,the present value equals the dollar amount of the annual dividend by the investor's required rate of return.( 3.Marginal cost of capital refers to the cost of the next dollar of capital to be raised.( 4.When evaluating the mutually exclusive projects,the conclusions are the same weather using IRR or NPV.( 5.Both stock split and stock dividend can increase the stockholder's equity. 6.Systematic risk can be eliminated by holding a well-diversified portfolio of shares.( 7.The major difference in profit maximization and shareholder wealth maximization are risk and timing considerations.( 8.If an investor were to have only one asset,the measure of its specific risk would be its covariance with the market. 9.If two assts have perfect negative correlation,the risk of the portfolio can be zero under one combination of the assets.( 10.The approach that will result in the best decision in the greatest number of decision is internal rate of return.( Il.Multiple Choice(15%) 1.Leto Ltd has 10 million $1-00 ordinary shares in issue that have a current market value of $2-00 per share.The company also has irredeemable loan capital in issue with a nominal value of $20 million that is quoted at $150 per $100 nominal value.The cost of ordinary shares is estimated at 15%and the rate of interest on the loan capital is 12%.The rate of corporation tax is 25%. What is the weighted average cost of capital for the company? A.13-0% 第1页共13页

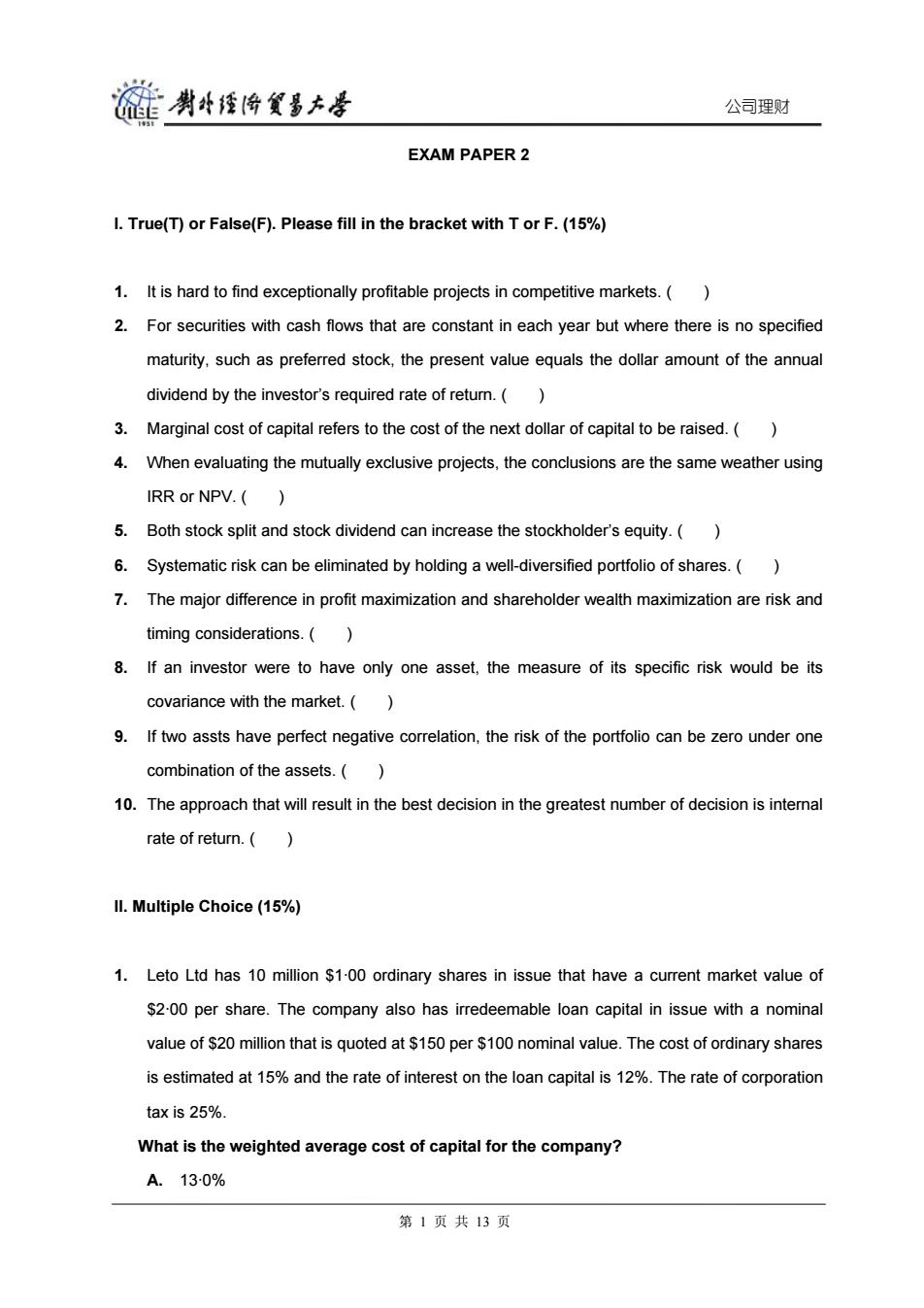

公司理财 EXAM PAPER 2 I. True(T) or False(F). Please fill in the bracket with T or F. (15%) 1. It is hard to find exceptionally profitable projects in competitive markets. ( ) 2. For securities with cash flows that are constant in each year but where there is no specified maturity, such as preferred stock, the present value equals the dollar amount of the annual dividend by the investor’s required rate of return. ( ) 3. Marginal cost of capital refers to the cost of the next dollar of capital to be raised. ( ) 4. When evaluating the mutually exclusive projects, the conclusions are the same weather using IRR or NPV. ( ) 5. Both stock split and stock dividend can increase the stockholder’s equity. ( ) 6. Systematic risk can be eliminated by holding a well-diversified portfolio of shares. ( ) 7. The major difference in profit maximization and shareholder wealth maximization are risk and timing considerations. ( ) 8. If an investor were to have only one asset, the measure of its specific risk would be its covariance with the market. ( ) 9. If two assts have perfect negative correlation, the risk of the portfolio can be zero under one combination of the assets. ( ) 10. The approach that will result in the best decision in the greatest number of decision is internal rate of return. ( ) II. Multiple Choice (15%) 1. Leto Ltd has 10 million $1·00 ordinary shares in issue that have a current market value of $2·00 per share. The company also has irredeemable loan capital in issue with a nominal value of $20 million that is quoted at $150 per $100 nominal value. The cost of ordinary shares is estimated at 15% and the rate of interest on the loan capital is 12%. The rate of corporation tax is 25%. What is the weighted average cost of capital for the company? A. 13·0% 第 1 页 共 13 页

肖外径份氨多本是 公司理财 B.114% C.110% D.132%. 2. Elara Ltd is considering an investment in a new process.The new process will require an increase in stocks of $30,000 during the first year.There will also be an increase in debtors outstanding of $40,000 and an increase of creditors outstanding of $35,000 during the first year.The new process will use machinery that was purchased immediately before the first year of operations at a cost of $300,000.The machinery is depreciated using the straight-line method and has an estimated life of five years and no residual value.During the first year,the net operating profit before depreciation from the new process is expected to be $180,000.The business uses the net present value method when evaluating investment proposals When undertaking the net present value calculations,what would be the estimated net cash flow during the first year of the project?(Ignore taxation) A.$85,000 B.$215,000 C.$145,000 D.$155,000. 3.Starling Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales:long-term capital employed 2:1 Debt:equity ratio 1:4 Sales:operating profit 10:1 Corporation tax:net profit before taxation 0-2:1 The sales for the forthcoming year are expected to be $6 million and the interest payments for the period are expected to be $100,000. What is the forecast return on ordinary shareholder's funds for the period? A.167% B.200% C.25-0% 第2页共13页

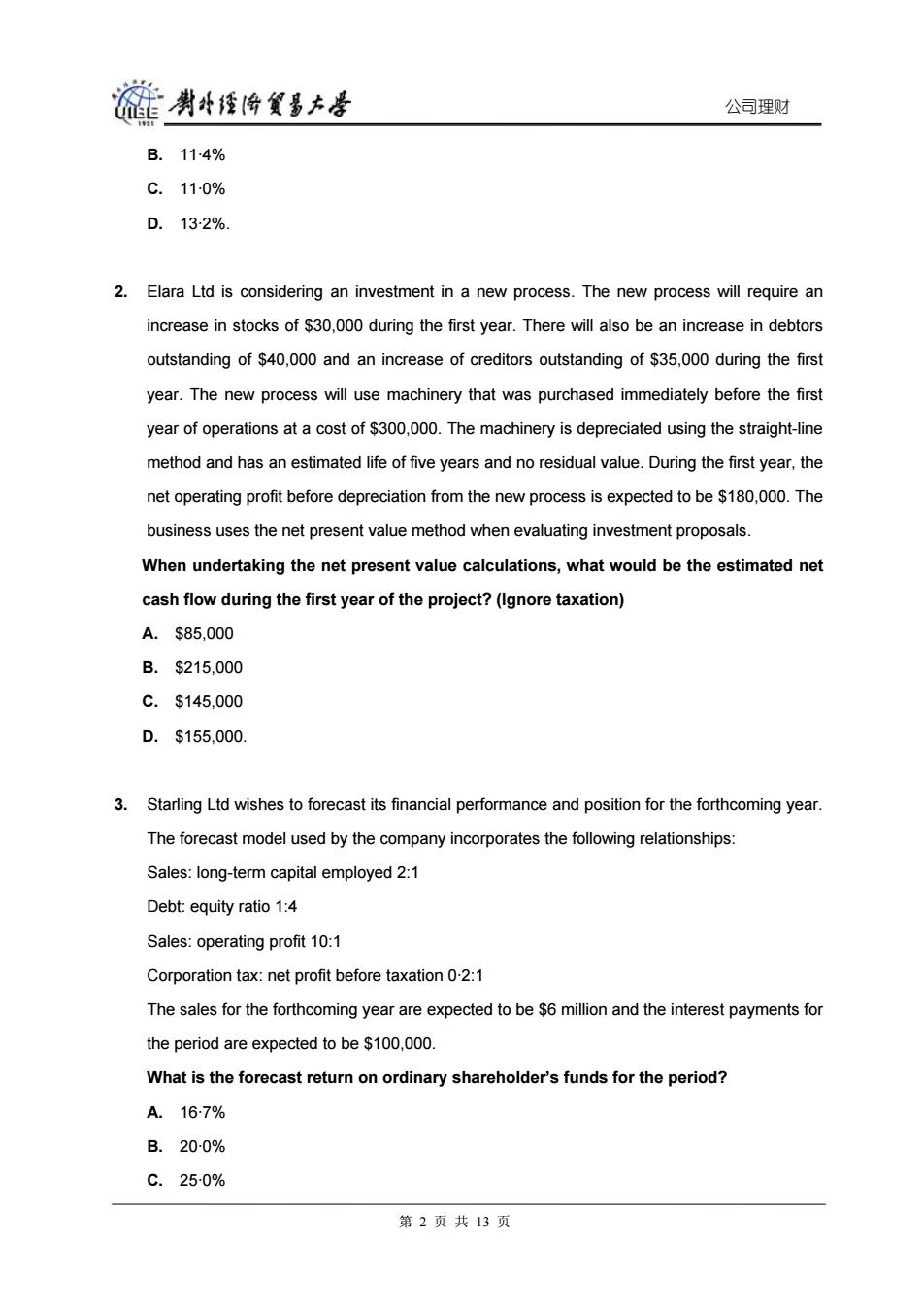

公司理财 B. 11·4% C. 11·0% D. 13·2%. 2. Elara Ltd is considering an investment in a new process. The new process will require an increase in stocks of $30,000 during the first year. There will also be an increase in debtors outstanding of $40,000 and an increase of creditors outstanding of $35,000 during the first year. The new process will use machinery that was purchased immediately before the first year of operations at a cost of $300,000. The machinery is depreciated using the straight-line method and has an estimated life of five years and no residual value. During the first year, the net operating profit before depreciation from the new process is expected to be $180,000. The business uses the net present value method when evaluating investment proposals. When undertaking the net present value calculations, what would be the estimated net cash flow during the first year of the project? (Ignore taxation) A. $85,000 B. $215,000 C. $145,000 D. $155,000. 3. Starling Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales: long-term capital employed 2:1 Debt: equity ratio 1:4 Sales: operating profit 10:1 Corporation tax: net profit before taxation 0·2:1 The sales for the forthcoming year are expected to be $6 million and the interest payments for the period are expected to be $100,000. What is the forecast return on ordinary shareholder’s funds for the period? A. 16·7% B. 20·0% C. 25·0% 第 2 页 共 13 页

肖外径份氨多去是 公司理财 D.667% 4.The shares of Danae Ltd have a beta of 0-5 and the shares of Alcmene Ltd have a beta of 2-0. Investors have an expected rate of return of 4%from shares in Danae Ltd and the expected returns to the market are 6%. Using the Capital Asset Pricing Model,what will be the expected rate of return for investors in Alcmene Ltd? A.8% B.10% C.12% D.16% 5.Sanderling Ltd buys raw materials from suppliers on six weeks'credit,which are delivered immediately.The raw materials are held in stock for four weeks before being issued to production.The production process takes three weeks and the finished goods are held in stock for two weeks before being sold on credit.Customers are allowed eight weeks'credit and pay promptly at the end of the period. What is the length of the operating cash cycle of the business? A.9 weeks B.11 weeks C.17 weeks D.23 weeks. 6.Lisburn Ltd has three possible investment opportunities,the details of which are as follows: Initial outlay Total present value $000 $000 Project Alpha 200 265 Project Beta 250 310 Project Gamma 120 170 The company has a limited investment budget for the current year and will be unable to invest in all profitable opportunities. 第3页共13页

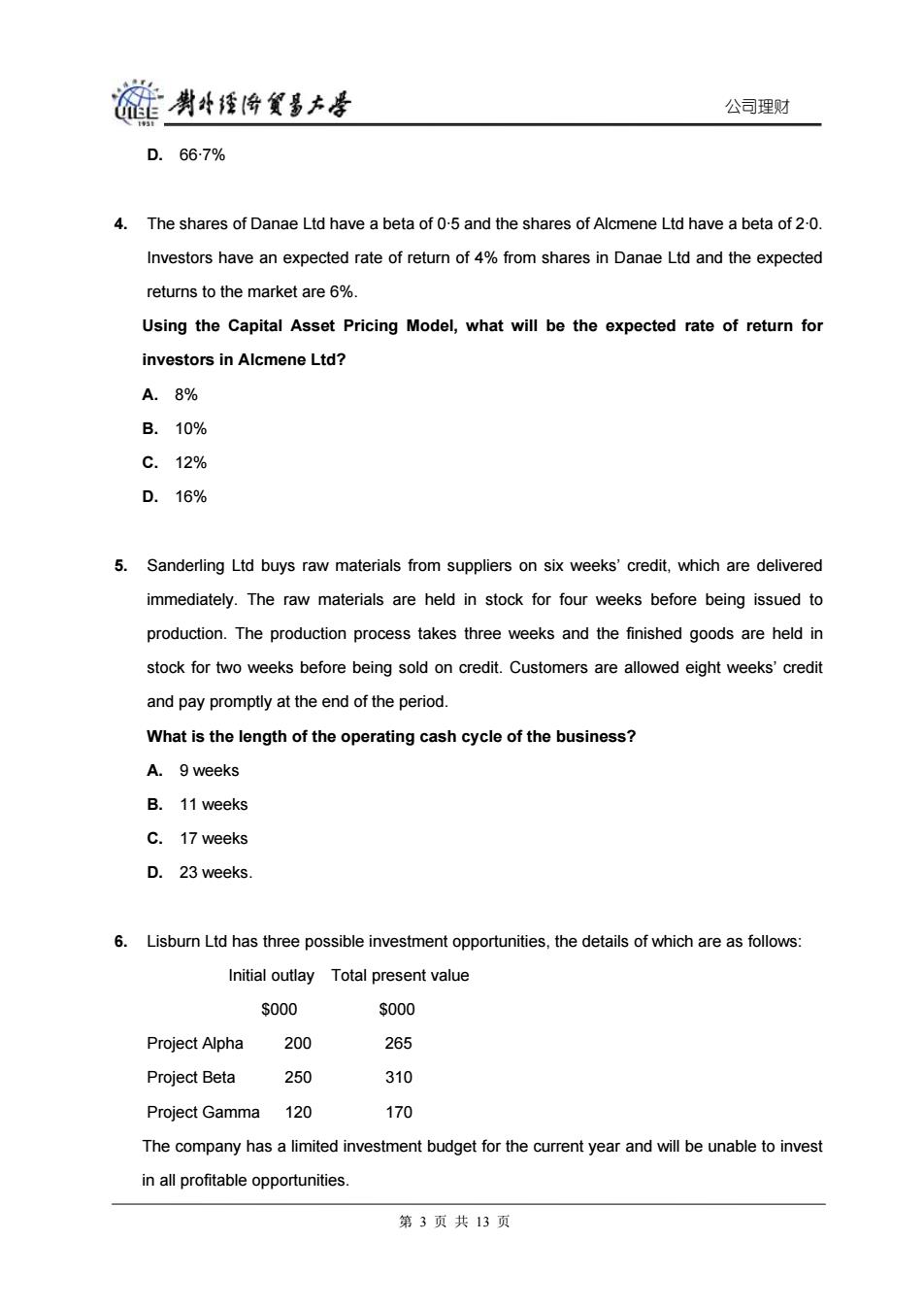

公司理财 D. 66·7% 4. The shares of Danae Ltd have a beta of 0·5 and the shares of Alcmene Ltd have a beta of 2·0. Investors have an expected rate of return of 4% from shares in Danae Ltd and the expected returns to the market are 6%. Using the Capital Asset Pricing Model, what will be the expected rate of return for investors in Alcmene Ltd? A. 8% B. 10% C. 12% D. 16% 5. Sanderling Ltd buys raw materials from suppliers on six weeks’ credit, which are delivered immediately. The raw materials are held in stock for four weeks before being issued to production. The production process takes three weeks and the finished goods are held in stock for two weeks before being sold on credit. Customers are allowed eight weeks’ credit and pay promptly at the end of the period. What is the length of the operating cash cycle of the business? A. 9 weeks B. 11 weeks C. 17 weeks D. 23 weeks. 6. Lisburn Ltd has three possible investment opportunities, the details of which are as follows: Initial outlay Total present value $000 $000 Project Alpha 200 265 Project Beta 250 310 Project Gamma 120 170 The company has a limited investment budget for the current year and will be unable to invest in all profitable opportunities. 第 3 页 共 13 页

裢勇牛经降贸昌大是 公司理财 Assuming that the company wishes to maximise the wealth of its shareholders,what should be the order of priority for the three projects? Order of priority Alpha Beta Gamma A.123 B.312 C.32 1 D.231 7. Larne Ltd is considering investing in a new project.The project has the following cash flows: $000 Year 0 (240) 1 120 2 140 160 4 110 5 200 The cost of capital for the company is 15%. If the cash flows in Year 3 were revised to $250,000,what would be the effect on the internal rate of return,payback period and discounted payback period of the project? Internal rate of return Payback period Discounted payback period A.Increase Decrease Decrease B.Increase No change Decrease C.Increase No change No change D.No change Decrease Decrease 8.Which one of the following statements accurately reflects an assertion of the weak form of the efficient markets hypothesis? A.Investors have access to all relevant information B.The price of a share will fluctuate randomly around its 'true value' 第4页共13页

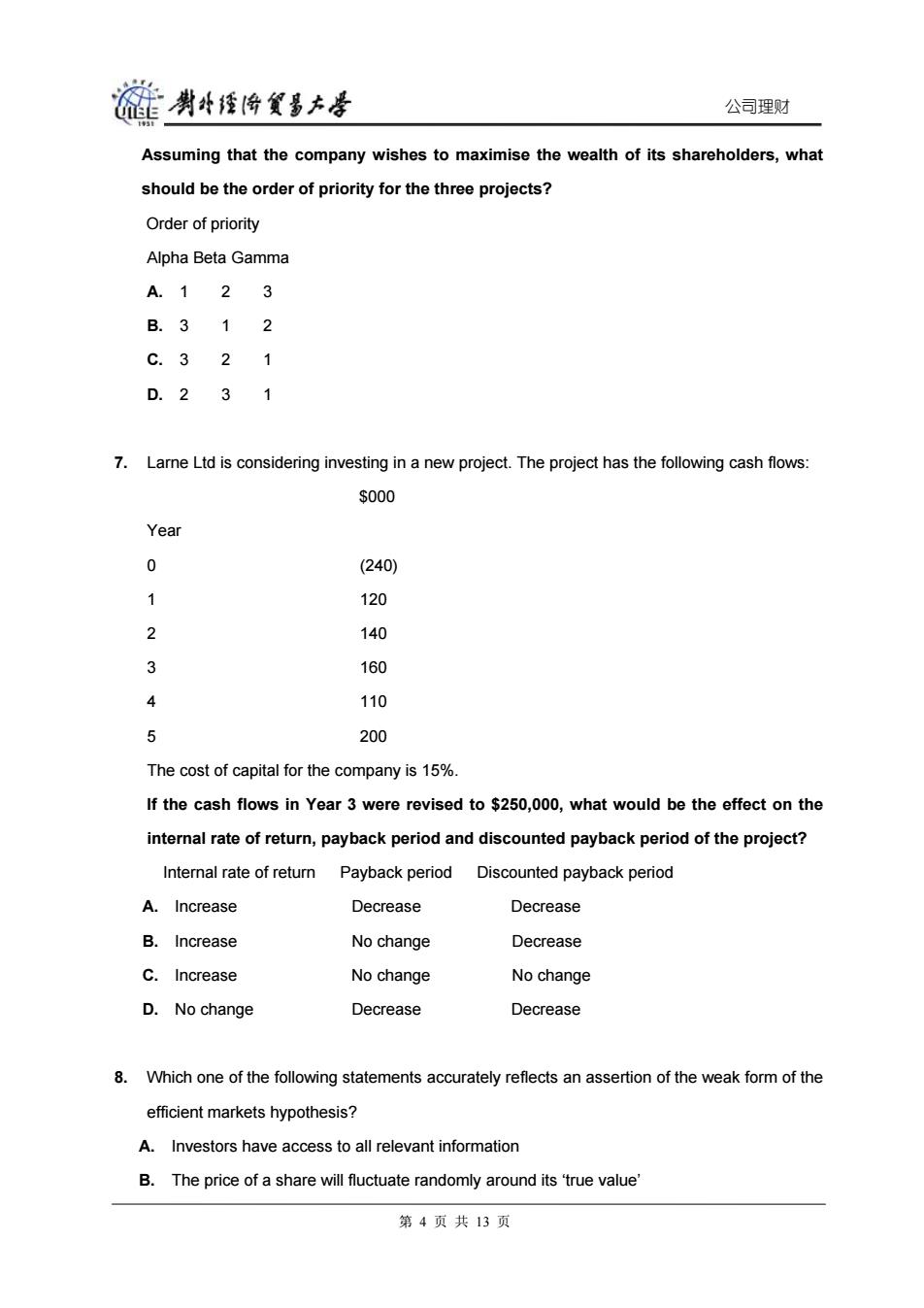

公司理财 Assuming that the company wishes to maximise the wealth of its shareholders, what should be the order of priority for the three projects? Order of priority Alpha Beta Gamma A. 1 2 3 B. 3 1 2 C. 3 2 1 D. 2 3 1 7. Larne Ltd is considering investing in a new project. The project has the following cash flows: $000 Year 0 (240) 1 120 2 140 3 160 4 110 5 200 The cost of capital for the company is 15%. If the cash flows in Year 3 were revised to $250,000, what would be the effect on the internal rate of return, payback period and discounted payback period of the project? Internal rate of return Payback period Discounted payback period A. Increase Decrease Decrease B. Increase No change Decrease C. Increase No change No change D. No change Decrease Decrease 8. Which one of the following statements accurately reflects an assertion of the weak form of the efficient markets hypothesis? A. Investors have access to all relevant information B. The price of a share will fluctuate randomly around its ‘true value’ 第 4 页 共 13 页

能男经哈贸多大是 公司理财 C.Over the long term,the expected return from all shares will be the same D.Past movements in share prices cannot be used to predict future movements in share prices 9.Gypsum Ltd has 20 million $0-25 ordinary shares in issue.The company has a market capitalisation of $60 million and has reported post-tax profits of $15 million for the year that has just ended.The company expects profits to rise by 20%and the dividend payout ratio is expected to be 30%in the forthcoming year.The company is committed to increasing the dividend by 4%per annum for the foreseeable future. Which one of the following is the expected rate of return from the ordinary shares? A.41% B.115% C.130% D.151% 10.A share that has a beta of 1-0 will have which one of the following properties? A.An expected return that is equal to the risk-free rate B.An expected return that is equal to the expected returns from the market C.An expected return that is above the expected returns from the market D.No non-diversifiable risk. 11.Which one of the following may indicate that a business is over-capitalised? A.Higher-than-average debt to equity ratio B.Lower-than-average acid-test ratio C.Lower-than-average sales to working capital ratio D.A higher-than-average net profit margin. 12.Teal Ltd has a market capitalisation of $30 million and forecast post-tax profits for the forthcoming year of $10 million.The company has an issued share capital of $1 million,which is made up of $0-50 ordinary shares.The policy of Teal Ltd is to maintain a constant dividend cover of 2-5 times.Dividends are expected to increase by 5%per annum for the foreseeable 第5页共13页

公司理财 C. Over the long term, the expected return from all shares will be the same D. Past movements in share prices cannot be used to predict future movements in share prices 9. Gypsum Ltd has 20 million $0·25 ordinary shares in issue. The company has a market capitalisation of $60 million and has reported post-tax profits of $15 million for the year that has just ended. The company expects profits to rise by 20% and the dividend payout ratio is expected to be 30% in the forthcoming year. The company is committed to increasing the dividend by 4% per annum for the foreseeable future. Which one of the following is the expected rate of return from the ordinary shares? A. 4·1% B. 11·5% C. 13·0% D. 15·1% 10. A share that has a beta of 1·0 will have which one of the following properties? A. An expected return that is equal to the risk-free rate B. An expected return that is equal to the expected returns from the market C. An expected return that is above the expected returns from the market D. No non-diversifiable risk. 11. Which one of the following may indicate that a business is over-capitalised? A. Higher-than-average debt to equity ratio B. Lower-than-average acid-test ratio C. Lower-than-average sales to working capital ratio D. A higher-than-average net profit margin. 12. Teal Ltd has a market capitalisation of $30 million and forecast post-tax profits for the forthcoming year of $10 million. The company has an issued share capital of $1 million, which is made up of $0·50 ordinary shares. The policy of Teal Ltd is to maintain a constant dividend cover of 2·5 times. Dividends are expected to increase by 5% per annum for the foreseeable 第 5 页 共 13 页