Iigure 4.3 Present Value of $100 at Various ...continued Discount Rates 100 80 60 2% 40 5% 10% 20 0 5 10 15 20 25 30 t(Year) E上* 贸到方是 YO年N0l事0EO00

11 Figure 4.3 Present Value of $100 at Various Discount Rates ...continued ...continued

...continued What is the PV of $100 one year from now with 12 percent interest compounded monthly? PV=$100×1/(1+.1212)12×) =$100×1/(1.126825) =$100×(.88744923) =$88.74 PVo=FV (PVIF) =$100(887) From Table II =$88.70 渊外校价货多方号 YO年NEB证事0000

12 ...continued continued • What is the PV of $100 one year from now with 12 percent interest compounded monthly? PV0 = $100 × 1/(1 + .12/12)(12 × 1) = $100 × 1/(1.126825) = $100 × (.88744923) = $ 88.74 PV0 = FVn(PVIFi, n) = $100(.887) From Table II = $ 88.70

Special Problems O Solving for the interest rate Solving for the number of compounding periods 渊外经价货多方是 YO年NEB证事00003

Special Problems Special Problems zSolving for the interest rate zSolving for the number of compounding periods

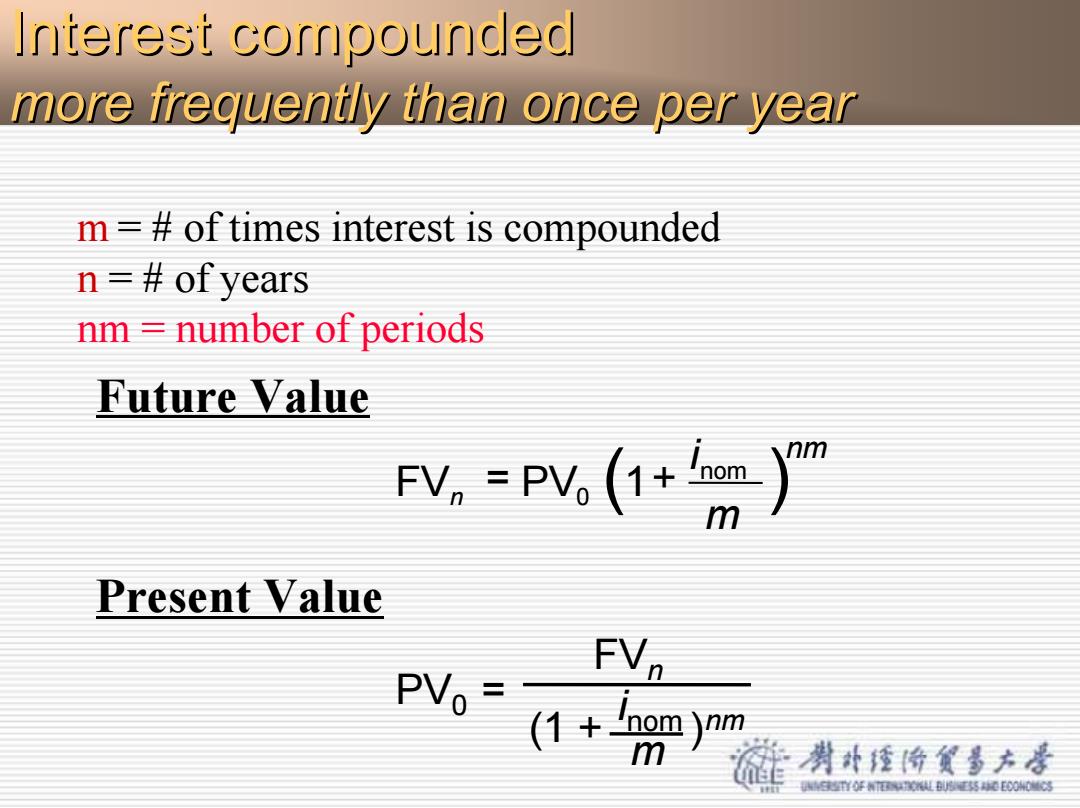

Interest compounded more frequently than once per year m of times interest is compounded n of years nm number of periods Future Value P,Pv(+” m Present Value PVo=(1 (1+om )om m 渊外经价货多方是 YO年N0事0E0003

Interest compounded Interest compounded more frequently than once per year more frequently than once per year m = # of times interest is compounded n = # of years nm = number of periods Future Value nm nom n 0 m i FV = PV ( 1 + ) Present Value )nm m i (1 + nom FV n PV 0 =

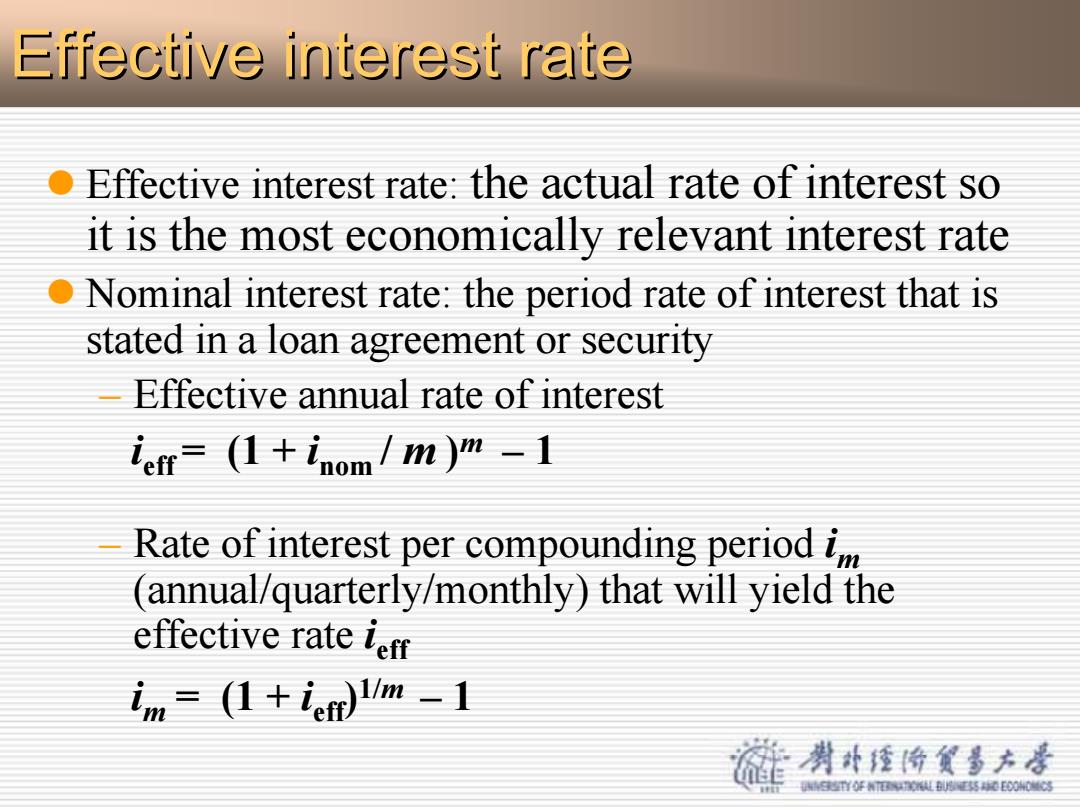

Effective interest rate O Effective interest rate:the actual rate of interest so it is the most economically relevant interest rate O Nominal interest rate:the period rate of interest that is stated in a loan agreement or security Effective annual rate of interest ictr=(1+inom/m)m-1 Rate of interest per compounding period (annual/quarterly/monthly)that will yield the effective rate ierr im=(1+ieft)I/m-1 剥外经价贫多方号 YO年NEB证事0000

Effective interest rate Effective interest rate z Effective interest rate: the actual rate of interest so it is the most economically relevant interest rate z Nominal interest rate: the period rate of interest that is stated in a loan agreement or security – Effective annual rate of interest ieff = (1 + inom / m ) m – 1 – Rate of interest per compounding period im (annual/quarterly/monthly) that will yield the effective rate ieff im = (1 + ieff)1/ m – 1