Measurement of Transaction Exposure Foreign exchange transaction exposure can be managed by contractual,operating,and financial hedges. The main contractual hedges employ the forward,money,futures,and options markets. ■( Operating and financial hedges employ the use of risk-sharing agreements,leads and lags in payment terms,swaps,and other strategies. 制卧价贸易大考

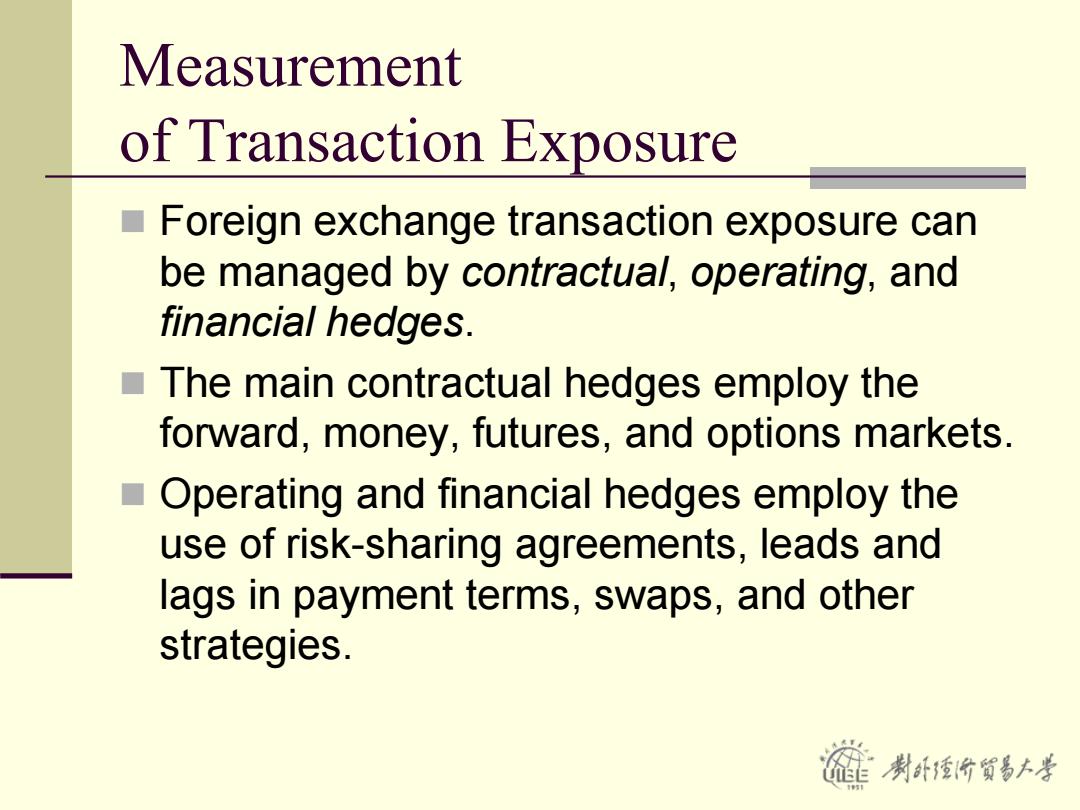

Measurement of Transaction Exposure Foreign exchange transaction exposure can be managed by contractual, operating, and financial hedges. The main contractual hedges employ the forward, money, futures, and options markets. Operating and financial hedges employ the use of risk-sharing agreements, leads and lags in payment terms, swaps, and other strategies

通用电气的交易风险管理 美国通用电气公司在1月份向英国航空公司出售涡轮机螺旋桨,价值 1,000,000英镑。该公司的资本成本为12%,有关报价如下: S(t)=$1.76401£ F1/4=$1.75401£ (三个月远期汇率表明英镑年贴水2.2676%) 1uk贷=10%p.a.Iuk投=8.0%p.a. 1us贷=8.0%p.a.Ius投=6.0%p.a. )在费城股票交易所,6月份到期的英镑看跌期权:合约金额: 31,250,协定价格S=$1.75/£,期权费P=$0.025/E,佣金为每份合约 $50. 2)在场外(OTC)交易,6月份到期的英镑看跌期权:合约金额 £1,000,000,协定价格S=$1.75/E,期权费1.5%。 另外通用公司预测3个月后的即期价格为$1.76/E,因此公司有以下四 种方案可供该公司选择: 制卧价贸易大学

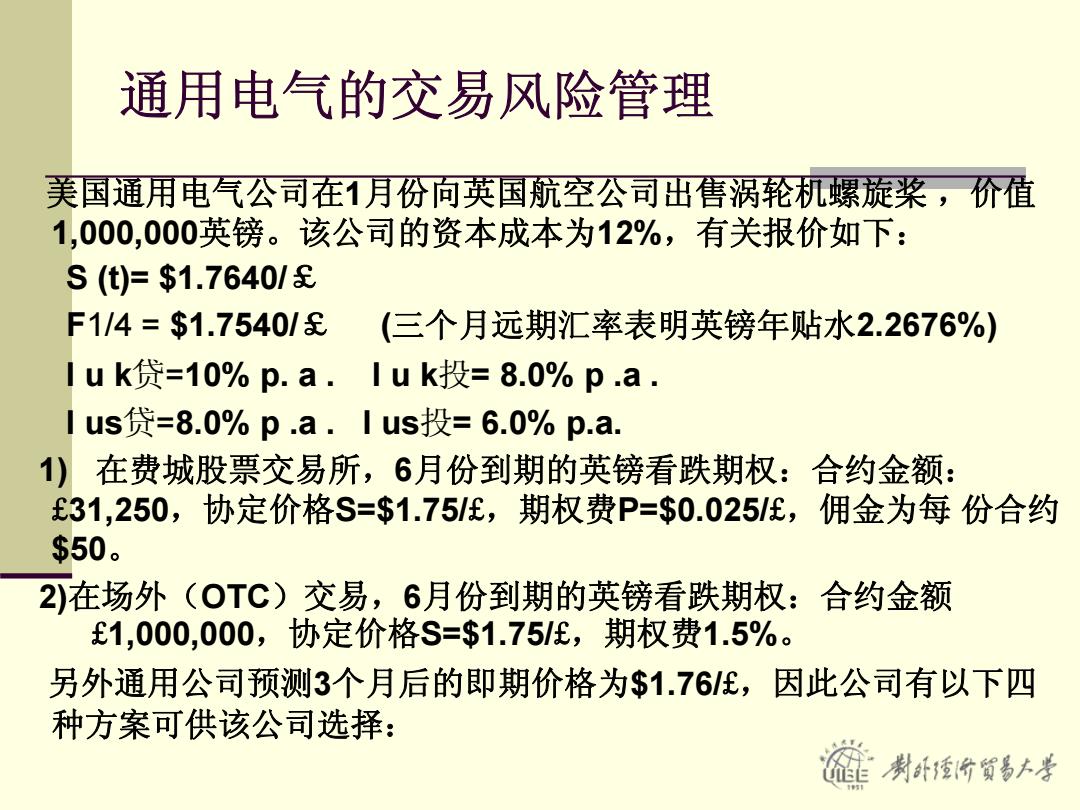

通用电气的交易风险管理 美国通用电气公司在 1月份向英国航空公司出售涡轮机螺旋桨 ,价值 1,000,000英镑。该公司的资本成本为12%,有关报价如下: S (t)= $1.7640/ £ F1/4 = $1.7540/ £ (三个月远期汇率表明英镑年贴水2.2676%) I u k 贷 =10% p. a . I u k 投= 8.0% p .a . I us 贷 =8.0% p .a . I us 投= 6.0% p.a. 1) 在费城股票交易所, 6月份到期的英镑看跌期权:合约金额: £31,250,协定价格S=$1.75/£,期权费P=$0.025/£,佣金为每 份合约 $50 。 2)在场外(OTC)交易, 6月份到期的英镑看跌期权:合约金额 £1,000,000,协定价格S=$1.75/£,期权费1.5% 。 另外通用公司预测 3个月后的即期价格为$1.76/£,因此公司有以下四 种方案可供该公司选择:

通用电气的交易风险 Contractual Techniques Unhedged Position Forward Market Hedge Money Market Hedge Option Market Hedge These choices apply to an account receivable and/or an account payable 制计价贸易大学

Contractual Techniques Unhedged Position Forward Market Hedge Money Market Hedge Option Market Hedge These choices apply to an account receivable and/or an account payable 通用电气的交易风险

通用电气的交易风险(Option Market Hedge) 每份期权的价格($0.025×£31,250) $781.25 每份期权的佣金 50 每份期权成本 $831.25 所需合约数(£1,000,000/£31,250) 32 期权合约的总成本(32×$831.25) $26,600 每英镑的期权成本=$831.25/£31,250=$0.0266 场外交易的期权成本为: £1,000,000×0.015×$1.7640=$26,460 考虑6个月后的成本为 826,460(1+ 6 ×12%)=828,047.6 制卧价贸易大学

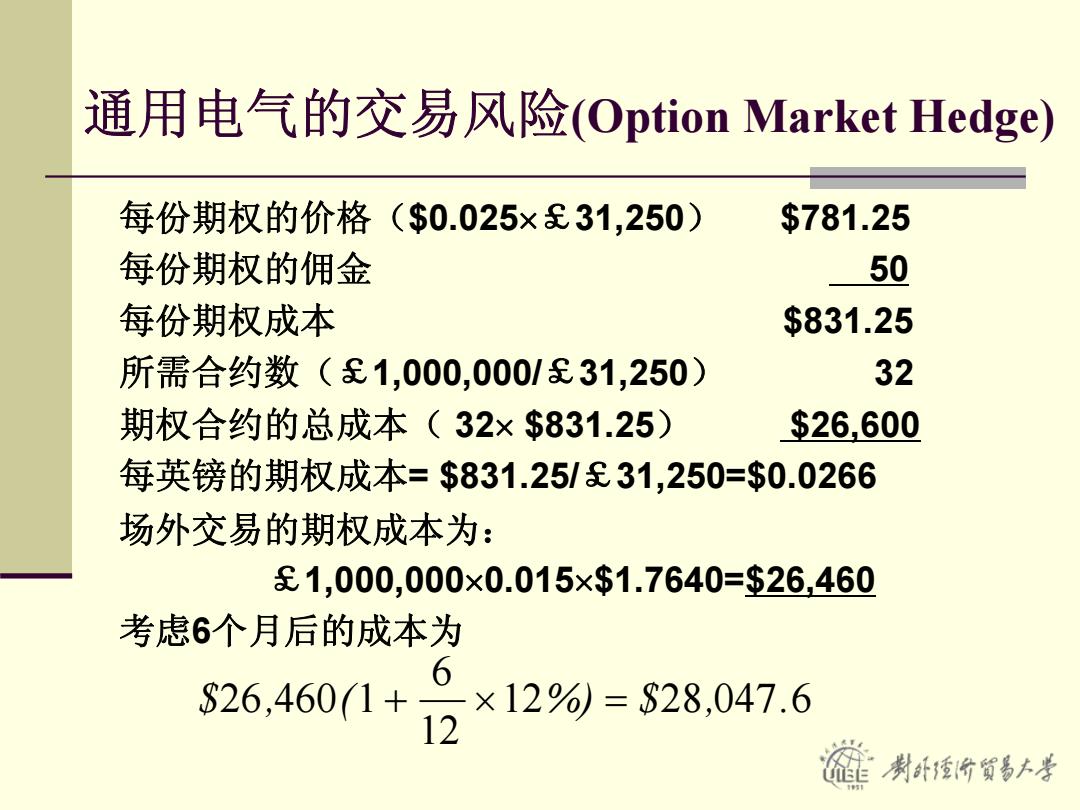

每份期权的价格($0.025×£31,250) $781.25 每份期权的佣金 50 每份期权成本 $831.25 所需合约数(£1,000,000/£31,250) 32 期权合约的总成本( 32× $831.25) $26,600 每英镑的期权成本= $831.25/£31,250=$0.0266 场外交易的期权成本为: £1,000,000×0.015×$1.7640=$26,460 考虑6个月后的成本为 通用电气的交易风险(Option Market Hedge) 60472812 12 6 (,$ 146026 =×+ .,$%)

通用电气的交易风险(Other Hedging) Risk Shifting Ps/1.7540=£1,000,000 or Ps=$1,754,000 制卧爱价觉易大孝

Risk Shifting P$ /1.7540=£1,000,000 or P$ = $1,754,000 通用电气的交易风险(Other Hedging)