Simple Interest Interest is earned only on principal. Example:Compute simple interest on $100 invested at 6%per year for three years. 1st year interest is S6.00 2nd yearinterest is S6.00 3rd year interest is $6.00 Total interest earned:$18.00 THE COURSE OF FINANCE 2017 SPRING SJTU 6-6

Simple Interest Interest is earned only on principal. Example: Compute simple interest on $100 invested at 6% per year for three years. 1st year interest is $6.00 2nd yearinterest is $6.00 3rd year interest is $6.00 Total interest earned: $18.00 THE COURSE OF FINANCE 2017 SPRING SJTU 6-6

Compound Interest Compounding is when interest paid on an investment during the first period is added to the principal;then, during the second period,interest is earned on the new sum (that includes the principal and interest earned so far). THE COURSE OF FINANCE 2017 SPRING STTU 6-7

Compound Interest Compounding is when interest paid on an investment during the first period is added to the principal; then, during the second period, interest is earned on the new sum (that includes the principal and interest earned so far). THE COURSE OF FINANCE 2017 SPRING SJTU 6-7

Compound Interest Example:Compute compound interest on $100 invested at 6%for three years with annual compounding. 1st year interest is $6.00 Principal now is $106.00 2nd year interest is S6.36 Principal now is $112.36 3rd year interest is $6.74 Principal now is S119.11 Total interest earned:S19.10 THE COURSE OF FINANCE 2017 SPRING SJTU 6-8

Compound Interest Example: Compute compound interest on $100 invested at 6% for three years with annual compounding. 1st year interest is $6.00 Principal now is $106.00 2nd year interest is $6.36 Principal now is $112.36 3rd year interest is $6.74 Principal now is $119.11 Total interest earned: $19.10 THE COURSE OF FINANCE 2017 SPRING SJTU 6-8

Compounding Example Assume that the interest rate is 10%percent annually. What this means is that if you invest $1 for one year? DS1*(1+10%)or$1.10in1year Investing $1 for yet another year 1.10*(1+10%)orS1.21in2-years THE COURSE OF FINANCE 2017 SPRING STTU 9

Compounding Example Assume that the interest rate is 10% percent annually. What this means is that if you invest $1 for one year? $1*(1+10%) or $1.10 in 1 year Investing $1 for yet another year 1.10 *(1+10%) or $1.21 in 2-years THE COURSE OF FINANCE 2017 SPRING SJTU 9

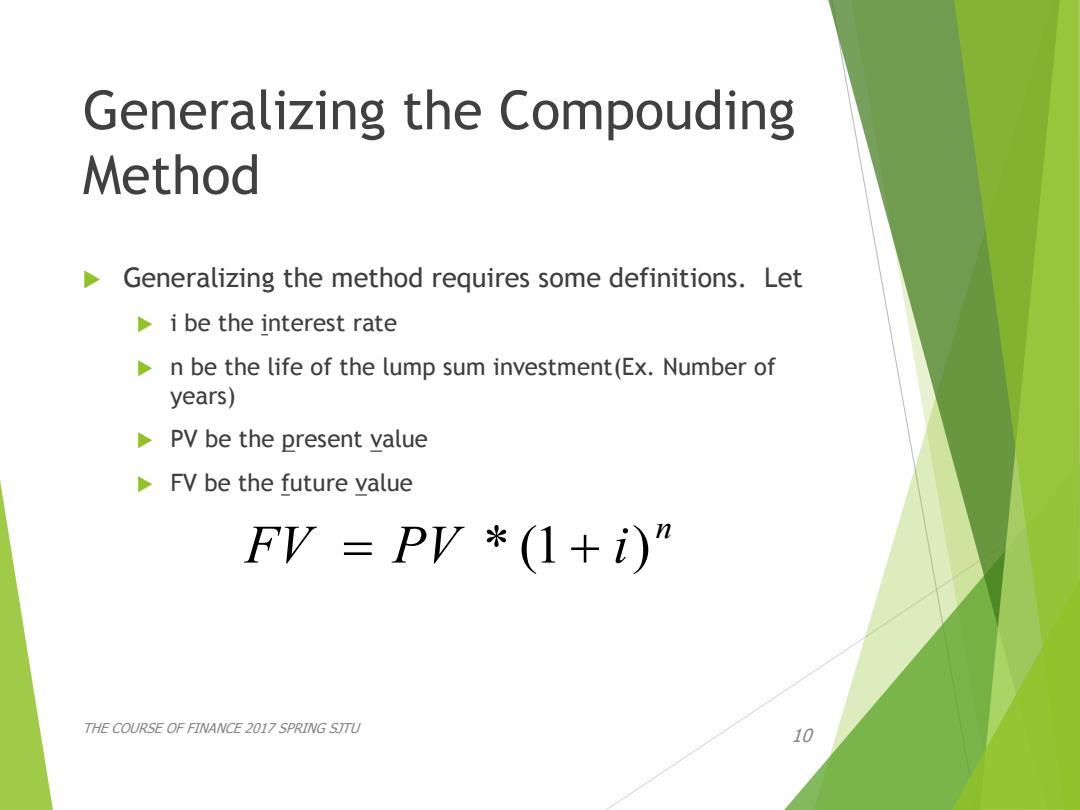

Generalizing the Compouding Method Generalizing the method requires some definitions.Let i be the interest rate n be the life of the lump sum investment(Ex.Number of years) PV be the present value FV be the future value FV=PV*(1+i)” THE COURSE OF FINANCE 2017 SPRING STTU 10

Generalizing the Compouding Method Generalizing the method requires some definitions. Let i be the interest rate n be the life of the lump sum investment(Ex. Number of years) PV be the present value FV be the future value THE COURSE OF FINANCE 2017 SPRING SJTU 10 n FV PV * (1 i)