Chapter Seven Principles of Market Valuation Multiple Choice 1.In regard to an asset,the is defined as the process well-informed investors must pay for it in a free and competitive market. (a)analyst value (b)technical value (c)competitive value (d)fundamental value Answer:(d) 2.In corporate finance decision making,an extremely important rule is to choose the investment that_ current shareholders'wealth. (a)minimizes (b)maximizes (c)provides zero change in (d)jeopardizes Answer:(b) 3.In asset valuation,the method used to accomplish the estimation depends on the (a)number of participants (b)quality of calculating instruments (c)richness of the information set available (d)geographic location Answer:(c) 7-1

7-1 Chapter Seven Principles of Market Valuation Multiple Choice 1. In regard to an asset, the ________ is defined as the process well-informed investors must pay for it in a free and competitive market. (a) analyst value (b) technical value (c) competitive value (d) fundamental value Answer: (d) 2. In corporate finance decision making, an extremely important rule is to choose the investment that ________ current shareholders’ wealth. (a) minimizes (b) maximizes (c) provides zero change in (d) jeopardizes Answer: (b) 3. In asset valuation, the method used to accomplish the estimation depends on the ________. (a) number of participants (b) quality of calculating instruments (c) richness of the information set available (d) geographic location Answer: (c)

4.The states that in a competitive market,if two assets are equivalent,they will tend to have the same market price. (a)Law of Real Interest Rates (b)Law of One Price (c)Law of Price Equivalency (d)Law of Futures Answer:(b) 5.The Law of One Price is enforced by a process called the purchase and immediate sale of equivalent assets in order to earn a sure profit from a difference in their prices. (a)swapping (b)maximization (c)arbitrage (d)speculation Answer:(c) 6 refers to the totality of costs such as shipping,handling,insuring,and broker fees. (a)Shipping costs (b)Transaction costs (c)Installation costs (d)Insurance costs Answer:(b) 7.The Law of One price is a statement about the price of one asset the price of another. (a)absolute to (b)relative to (c)multiplied by (d)independent of Answer:(b) 7-2

7-2 4. The ________ states that in a competitive market, if two assets are equivalent, they will tend to have the same market price. (a) Law of Real Interest Rates (b) Law of One Price (c) Law of Price Equivalency (d) Law of Futures Answer: (b) 5. The Law of One Price is enforced by a process called ________, the purchase and immediate sale of equivalent assets in order to earn a sure profit from a difference in their prices. (a) swapping (b) maximization (c) arbitrage (d) speculation Answer: (c) 6. ________ refers to the totality of costs such as shipping, handling, insuring, and broker fees. (a) Shipping costs (b) Transaction costs (c) Installation costs (d) Insurance costs Answer: (b) 7. The Law of One price is a statement about the price of one asset ________ the price of another. (a) absolute to (b) relative to (c) multiplied by (d) independent of Answer: (b)

8.If an entity borrows at a lower rate and lends at a higher rate,this is an example of (a)opportunity arbitrage (b)interest-rate arbitrage (c)exchange arbitrage (d)nominal arbitrage Answer:(b) 9.If arbitrage ensures that any three currencies are freely convertible in competitive markets, then: (a)it is enough to know only one exchange rate to determine the third (b)we can estimate two exchange rates based on one exchange rate only (c)it is enough to know the exchange rates between any two in order to determine the third (d)it is necessary to know all three rates Answer:(c) 10.Suppose you have $15,000 in a bank account earning an interest rate of 4%per year.At the same time you have an unpaid balance on your credit card of $6,000 on which you are paying an interest rate of 17%per year.What arbitrage opportunity do you face? (a)$240 per year (b)$600 per year (c)$780 per year (d))$l,020 per year Answer:(c) 11.If the dollar price of Japanese Yen is $0.009594 per Japanese Yen and the dollar price of Chinese Yuan is $0.1433 per Chinese Yuan,what is the Japanese Yen price of a Chinese Yuan?(i.e.,JPY/CNY) (a)0.001375JPY/CNY (b)0.066950JPY/CNY (c)9.594 JPY/CNY (d)14.936419JPY/CNY Answer:(d) 7-3

7-3 8. If an entity borrows at a lower rate and lends at a higher rate, this is an example of ________. (a) opportunity arbitrage (b) interest-rate arbitrage (c) exchange arbitrage (d) nominal arbitrage Answer: (b) 9. If arbitrage ensures that any three currencies are freely convertible in competitive markets, then: (a) it is enough to know only one exchange rate to determine the third (b) we can estimate two exchange rates based on one exchange rate only (c) it is enough to know the exchange rates between any two in order to determine the third (d) it is necessary to know all three rates Answer: (c) 10. Suppose you have $15,000 in a bank account earning an interest rate of 4% per year. At the same time you have an unpaid balance on your credit card of $6,000 on which you are paying an interest rate of 17% per year. What arbitrage opportunity do you face? (a) $240 per year (b) $600 per year (c) $780 per year (d) $1,020 per year Answer: (c) 11. If the dollar price of Japanese Yen is $0.009594 per Japanese Yen and the dollar price of Chinese Yuan is $0.1433 per Chinese Yuan, what is the Japanese Yen price of a Chinese Yuan? (i.e., JPY/CNY) (a) 0.001375 JPY/CNY (b) 0.066950 JPY/CNY (c) 9.594 JPY/CNY (d) 14.936419 JPY/CNY Answer: (d)

12.If the dollar price of guilders is $0.5634 per Guilder and the dollar price of Euros is $1.5576 per Euro,what is the Euro price of the Guilder?(i.e.,EUR/ANG) (a)0.361700EUR/ANG (b)0.877552EUR/ANG (c)2.764643EUR/ANG (d)5.634 EUR/ANG Answer:(d) 13.Suppose the price of gold is 51.09 British pounds per ounce.If the dollar price of gold is $100 per ounce,what would you expect the dollar price of a British pound to be? (a)$1.95733 per GBP (b)$1.5109 per GBP (c)$0.5109 per GBP (d)$0.4891 per GBP Answer:(a) Questions 14-18 refer to the following exchange rate table.To answer 14-18 you will have to fill in the missing exchange rates. U.S.Dollar Peso(MXN) Euro(EUR) Cdn DIr(CAD) (USD) U.S.Dollar $1 Peso 10.398 Euro 0.6420 Cdn DIr 1.0003 14.What is the Euro/Peso exchange rate?(i.e.,EUR/MXN) (a)0.617426EUR/MXN (b)0.641807EUR/MXN (c)6.675516EUR/MXN (d)16.196262EUR/MXN Answer:(a) 7-4

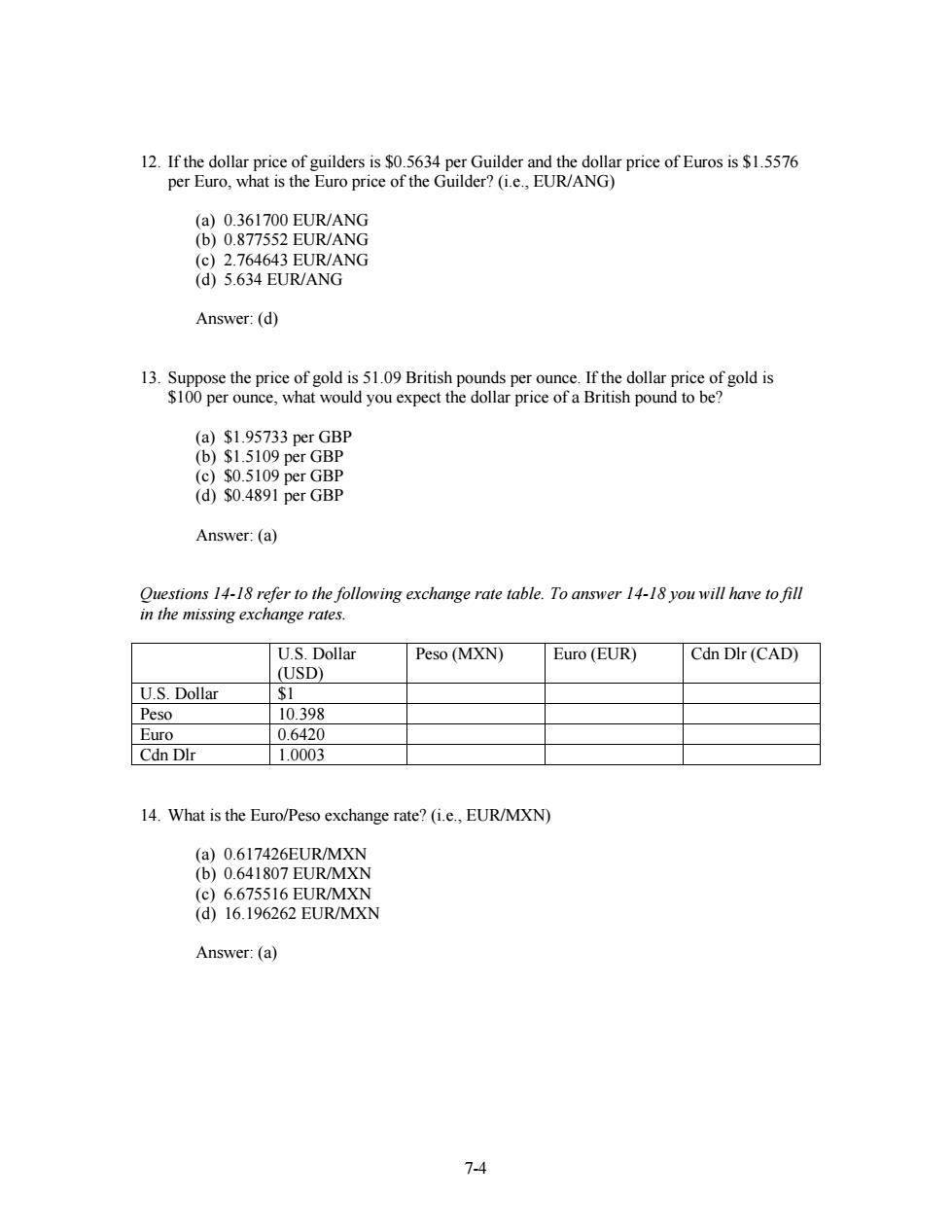

7-4 12. If the dollar price of guilders is $0.5634 per Guilder and the dollar price of Euros is $1.5576 per Euro, what is the Euro price of the Guilder? (i.e., EUR/ANG) (a) 0.361700 EUR/ANG (b) 0.877552 EUR/ANG (c) 2.764643 EUR/ANG (d) 5.634 EUR/ANG Answer: (d) 13. Suppose the price of gold is 51.09 British pounds per ounce. If the dollar price of gold is $100 per ounce, what would you expect the dollar price of a British pound to be? (a) $1.95733 per GBP (b) $1.5109 per GBP (c) $0.5109 per GBP (d) $0.4891 per GBP Answer: (a) Questions 14-18 refer to the following exchange rate table. To answer 14-18 you will have to fill in the missing exchange rates. U.S. Dollar (USD) Peso (MXN) Euro (EUR) Cdn Dlr (CAD) U.S. Dollar $1 Peso 10.398 Euro 0.6420 Cdn Dlr 1.0003 14. What is the Euro/Peso exchange rate? (i.e., EUR/MXN) (a) 0.617426EUR/MXN (b) 0.641807 EUR/MXN (c) 6.675516 EUR/MXN (d) 16.196262 EUR/MXN Answer: (a)

15.What is the Cdn Dlr/Euro exchange rate?(i.e.,CAD/EUR) (a)0.641807CAD/EUR (b)1.558099CAD/EUR (c)6.420 CAD/EUR (d)16.196262CAD/EUR Answer:(b) 16.What is the Euro/Cdn DIr exchange rate?(i.e.,EUR/CAD) (a)0.3583 EUR/CAD (b)0.641807EUR/CAD (c)1.558099EUR/CAD (d)10.394 EUR/CAD Answer:(b) 17.What is the Peso/Cdn DIr exchange rate?(i.e.,MXN/CAD) (a)0.096201MXN/CAD (b)0.641807MXN/CAD (c)10.394882MXN/CAD (d)16.196262MXN/CAD Answer:(c) 18.What is the Peso/Euro exchange rate?(i.e.,MXN/EUR) (a)0.617426MXN/EUR (b)6.675516MXN/EUR (c)15.581112MXN/EUR (d)16.196262MXN/EUR Answer:(d) 7-5

7-5 15. What is the Cdn Dlr/Euro exchange rate? (i.e., CAD/EUR) (a) 0.641807 CAD/EUR (b) 1.558099 CAD/EUR (c) 6.420 CAD/EUR (d) 16.196262 CAD/EUR Answer: (b) 16. What is the Euro/Cdn Dlr exchange rate? (i.e., EUR/CAD) (a) 0.3583 EUR/CAD (b) 0.641807 EUR/CAD (c) 1.558099 EUR/CAD (d) 10.394 EUR/CAD Answer: (b) 17. What is the Peso/Cdn Dlr exchange rate? (i.e., MXN/CAD) (a) 0.096201 MXN/CAD (b) 0.641807 MXN/CAD (c) 10.394882 MXN/CAD (d) 16.196262 MXN/CAD Answer: (c) 18. What is the Peso/Euro exchange rate? (i.e., MXN/EUR) (a) 0.617426 MXN/EUR (b) 6.675516 MXN/EUR (c) 15.581112 MXN/EUR (d) 16.196262 MXN/EUR Answer: (d)