1058 N.Barberis and R.Thaler performance of money managers tells us little about whether prices reflect fundamental value. Second,while some researchers accept that there is a distinction between "prices are right"and "there is no free lunch",they believe that the debate should be more about the latter statement than about the former.We disagree with this emphasis.As economists,our ultimate concern is that capital be allocated to the most promising investment opportunities.Whether this is true or not depends much more on whether prices are right than on whether there are any free lunches for the taking 2.2.Theory In the previous section,we emphasized the idea that when a mispricing occurs, strategies designed to correct it can be both risky and costly,thereby allowing the mispricing to survive.Here we discuss some of the risks and costs that have been identified.In our discussion,we return to the example of Ford,whose fundamental value is $20,but which has been pushed down to $15 by pessimistic noise traders. Fundamental risk.The most obvious risk an arbitrageur faces if he buys Ford's stock at $15 is that a piece of bad news about Ford's fundamental value causes the stock to fall further,leading to losses.Of course,arbitrageurs are well aware of this risk,which is why they short a substitute security such as General Motors at the same time that they buy Ford.The problem is that substitute securities are rarely perfect,and often highly imperfect,making it impossible to remove all the fundamental risk.Shorting General Motors protects the arbitrageur somewhat from adverse news about the car industry as a whole,but still leaves him vulnerable to news that is specific to Ford- news about defective tires,say+. Noise trader risk.Noise trader risk,an idea introduced by De Long et al.(1990a) and studied further by Shleifer and Vishny (1997),is the risk that the mispricing being exploited by the arbitrageur worsens in the short run.Even if General Motors is a perfect substitute security for Ford,the arbitrageur still faces the risk that the pessimistic investors causing Ford to be undervalued in the first place become even more pessimistic,lowering its price even further.Once one has granted the possibility that a security's price can be different from its fundamental value,then one must also grant the possibility that future price movements will increase the divergence. Noise trader risk matters because it can force arbitrageurs to liquidate their positions early,bringing them potentially steep losses.To see this,note that most real-world arbitrageurs-in other words,professional portfolio managers-are not managing their 4Another problem is that even if a substitute security exists,it may itself be mispriced.This can happen in situations involving industry-wide mispricing:in that case,the only stocks with similar future cash flows to the mispriced one are themselves mispriced

1058 N. Barberis and R. Thaler performance of money managers tells us little about whether prices reflect fundamental value. Second, while some researchers accept that there is a distinction between “prices are right” and “there is no free lunch”, they believe that the debate should be more about the latter statement than about the former. We disagree with this emphasis. As economists, our ultimate concern is that capital be allocated to the most promising investment opportunities. Whether this is true or not depends much more on whether prices are right than on whether there are any free lunches for the taking. 2.2. Theory In the previous section, we emphasized the idea that when a mispricing occurs, strategies designed to correct it can be both risky and costly, thereby allowing the mispricing to survive. Here we discuss some of the risks and costs that have been identified. In our discussion, we return to the example of Ford, whose fundamental value is $20, but which has been pushed down to $15 by pessimistic noise traders. Fundamental risk. The most obvious risk an arbitrageur faces if he buys Ford’s stock at $15 is that a piece of bad news about Ford’s fundamental value causes the stock to fall further, leading to losses. Of course, arbitrageurs are well aware of this risk, which is why they short a substitute security such as General Motors at the same time that they buy Ford. The problem is that substitute securities are rarely perfect, and often highly imperfect, making it impossible to remove all the fundamental risk. Shorting General Motors protects the arbitrageur somewhat from adverse news about the car industry as a whole, but still leaves him vulnerable to news that is specific to Ford – news about defective tires, say 4. Noise trader risk. Noise trader risk, an idea introduced by De Long et al. (1990a) and studied further by Shleifer and Vishny (1997), is the risk that the mispricing being exploited by the arbitrageur worsens in the short run. Even if General Motors is a perfect substitute security for Ford, the arbitrageur still faces the risk that the pessimistic investors causing Ford to be undervalued in the first place become even more pessimistic, lowering its price even further. Once one has granted the possibility that a security’s price can be different from its fundamental value, then one must also grant the possibility that future price movements will increase the divergence. Noise trader risk matters because it can force arbitrageurs to liquidate their positions early, bringing them potentially steep losses. To see this, note that most real-world arbitrageurs – in other words, professional portfolio managers – are not managing their 4 Another problem is that even if a substitute security exists, it may itself be mispriced. This can happen in situations involving industry-wide mispricing: in that case, the only stocks with similar future cash flows to the mispriced one are themselves mispriced

Ch.18:A Survey of Behavioral Finance 1059 own money,but rather managing money for other people.In the words of Shleifer and Vishny (1997),there is "a separation of brains and capital". This agency feature has important consequences.Investors,lacking the specialized knowledge to evaluate the arbitrageur's strategy,may simply evaluate him based on his returns.If a mispricing that the arbitrageur is trying to exploit worsens in the short run,generating negative returns,investors may decide that he is incompetent, and withdraw their funds.If this happens,the arbitrageur will be forced to liquidate his position prematurely.Fear of such premature liquidation makes him less aggressive in combating the mispricing in the first place. These problems can be severely exacerbated by creditors.After poor short-term returns,creditors,seeing the value of their collateral erode,will call their loans,again triggering premature liquidation. In these scenarios,the forced liquidation is brought about by the worsening of the mispricing itself.This need not always be the case.For example,in their efforts to remove fundamental risk,many arbitrageurs sell securities short.Should the original owner of the borrowed security want it back,the arbitrageur may again be forced to close out his position if he cannot find other shares to borrow.The risk that this occurs during a temporary worsening of the mispricing makes the arbitrageur more cautious from the start. Implementation costs.Well-understood transaction costs such as commissions,bid- ask spreads and price impact can make it less attractive to exploit a mispricing. Since shorting is often essential to the arbitrage process,we also include short-sale constraints in the implementation costs category.These refer to anything that makes it less attractive to establish a short position than a long one.The simplest such constraint is the fee charged for borrowing a stock.In general these fees are small-D'Avolio (2002)finds that for most stocks,they range between 10 and 15 basis points-but they can be much larger;in some cases,arbitrageurs may not be able to find shares to borrow at any price.Other than the fees themselves,there can be legal constraints:for a large fraction of money managers-many pension fund and mutual fund managers in particular-short-selling is simply not allowed5. We also include in this category the cost of finding and learning about a mispricing, as well as the cost of the resources needed to exploit it [Merton (1987)].Finding 5 The presence of per-period transaction costs like lending fees can expose arbitrageurs to another kind of risk,horizon risk,which is the risk that the mispricing takes so long to close that any profits are swamped by the accumulated transaction costs.This applies even when the arbitrageur is certain that no outside party will force him to liquidate early.Abreu and Brunnermeier (2002)study a particular type of horizon risk,which they label synchronization risk.Suppose that the elimination of a mispricing requires the participation of a sufficiently large number of separate arbitrageurs.Then in the presence of per-period transaction costs,arbitrageurs may hesitate to exploit the mispricing because they don't know how many other arbitrageurs have heard about the opportunity,and therefore how long they will have to wait before prices revert to correct values

Ch. 18: A Survey of Behavioral Finance 1059 own money, but rather managing money for other people. In the words of Shleifer and Vishny (1997), there is “a separation of brains and capital”. This agency feature has important consequences. Investors, lacking the specialized knowledge to evaluate the arbitrageur’s strategy, may simply evaluate him based on his returns. If a mispricing that the arbitrageur is trying to exploit worsens in the short run, generating negative returns, investors may decide that he is incompetent, and withdraw their funds. If this happens, the arbitrageur will be forced to liquidate his position prematurely. Fear of such premature liquidation makes him less aggressive in combating the mispricing in the first place. These problems can be severely exacerbated by creditors. After poor short-term returns, creditors, seeing the value of their collateral erode, will call their loans, again triggering premature liquidation. In these scenarios, the forced liquidation is brought about by the worsening of the mispricing itself. This need not always be the case. For example, in their efforts to remove fundamental risk, many arbitrageurs sell securities short. Should the original owner of the borrowed security want it back, the arbitrageur may again be forced to close out his position if he cannot find other shares to borrow. The risk that this occurs during a temporary worsening of the mispricing makes the arbitrageur more cautious from the start. Implementation costs. Well-understood transaction costs such as commissions, bid– ask spreads and price impact can make it less attractive to exploit a mispricing. Since shorting is often essential to the arbitrage process, we also include short-sale constraints in the implementation costs category. These refer to anything that makes it less attractive to establish a short position than a long one. The simplest such constraint is the fee charged for borrowing a stock. In general these fees are small – D’Avolio (2002) finds that for most stocks, they range between 10 and 15 basis points – but they can be much larger; in some cases, arbitrageurs may not be able to find shares to borrow at any price. Other than the fees themselves, there can be legal constraints: for a large fraction of money managers – many pension fund and mutual fund managers in particular – short-selling is simply not allowed 5. We also include in this category the cost of finding and learning about a mispricing, as well as the cost of the resources needed to exploit it [Merton (1987)]. Finding 5 The presence of per-period transaction costs like lending fees can expose arbitrageurs to another kind of risk, horizon risk, which is the risk that the mispricing takes so long to close that any profits are swamped by the accumulated transaction costs. This applies even when the arbitrageur is certain that no outside party will force him to liquidate early. Abreu and Brunnermeier (2002) study a particular type of horizon risk, which they label synchronization risk. Suppose that the elimination of a mispricing requires the participation of a sufficiently large number of separate arbitrageurs. Then in the presence of per-period transaction costs, arbitrageurs may hesitate to exploit the mispricing because they don’t know how many other arbitrageurs have heard about the opportunity, and therefore how long they will have to wait before prices revert to correct values

1060 N.Barberis and R.Thaler mispricing,in particular,can be a tricky matter.It was once thought that if noise traders influenced stock prices to any substantial degree,their actions would quickly show up in the form of predictability in returns.Shiller(1984)and Summers (1986) demonstrate that this argument is completely erroneous,with Shiller(1984)calling it "one of the most remarkable errors in the history of economic thought".They show that even if noise trader demand is so strong as to cause a large and persistent mispricing,it may generate so little predictability in returns as to be virtually undetectable In contrast,then,to straightforward-sounding textbook arbitrage,real world arbitrage entails both costs and risks,which under some conditions will limit arbitrage and allow deviations from fundamental value to persist.To see what these conditions are,consider two cases. Suppose first that the mispriced security does not have a close substitute.By definition then,the arbitrageur is exposed to fundamental risk.In this case,sufficient conditions for arbitrage to be limited are(i)that arbitrageurs are risk averse and(ii)that the fundamental risk is systematic,in that it cannot be diversified by taking many such positions.Condition(i)ensures that the mispricing will not be wiped out by a single arbitrageur taking a large position in the mispriced security.Condition(ii) ensures that the mispricing will not be wiped out by a large number of investors each adding a small position in the mispriced security to their current holdings. The presence of noise trader risk or implementation costs will only limit arbitrage further. Even if a perfect substitute does exist,arbitrage can still be limited.The existence of the substitute security immunizes the arbitrageur from fundamental risk.We can go further and assume that there are no implementation costs,so that only noise trader risk remains.De Long et al.(1990a)show that noise trader risk is powerful enough,that even with this single form of risk,arbitrage can sometimes be limited.The sufficient conditions are similar to those above,with one important difference.Here arbitrage will be limited if:(i)arbitrageurs are risk averse and have short horizons and(ii)the noise trader risk is systematic.As before,condition (i)ensures that the mispricing cannot be wiped out by a single,large arbitrageur,while condition(ii)prevents a large number of small investors from exploiting the mispricing.The central contribution of Shleifer and Vishny (1997)is to point out the real world relevance of condition (i): the possibility of an early,forced liquidation means that many arbitrageurs effectively have short horizons. In the presence of certain implementation costs,condition (ii)may not even be necessary.If it is costly to learn about a mispricing,or the resources required it to exploit it are expensive,that may be enough to explain why a large number of different individuals do not intervene in an attempt to correct the mispricing It is also important to note that for particular types of noise trading,arbitrageurs may prefer to trade in the same direction as the noise traders,thereby exacerbating the mispricing,rather than against them.For example,De Long et al.(1990b)

1060 N. Barberis and R. Thaler mispricing, in particular, can be a tricky matter. It was once thought that if noise traders influenced stock prices to any substantial degree, their actions would quickly show up in the form of predictability in returns. Shiller (1984) and Summers (1986) demonstrate that this argument is completely erroneous, with Shiller (1984) calling it “one of the most remarkable errors in the history of economic thought”. They show that even if noise trader demand is so strong as to cause a large and persistent mispricing, it may generate so little predictability in returns as to be virtually undetectable. In contrast, then, to straightforward-sounding textbook arbitrage, real world arbitrage entails both costs and risks, which under some conditions will limit arbitrage and allow deviations from fundamental value to persist. To see what these conditions are, consider two cases. Suppose first that the mispriced security does not have a close substitute. By definition then, the arbitrageur is exposed to fundamental risk. In this case, sufficient conditions for arbitrage to be limited are (i) that arbitrageurs are risk averse and (ii) that the fundamental risk is systematic, in that it cannot be diversified by taking many such positions. Condition (i) ensures that the mispricing will not be wiped out by a single arbitrageur taking a large position in the mispriced security. Condition (ii) ensures that the mispricing will not be wiped out by a large number of investors each adding a small position in the mispriced security to their current holdings. The presence of noise trader risk or implementation costs will only limit arbitrage further. Even if a perfect substitute does exist, arbitrage can still be limited. The existence of the substitute security immunizes the arbitrageur from fundamental risk. We can go further and assume that there are no implementation costs, so that only noise trader risk remains. De Long et al. (1990a) show that noise trader risk is powerful enough, that even with this single form of risk, arbitrage can sometimes be limited. The sufficient conditions are similar to those above, with one important difference. Here arbitrage will be limited if: (i) arbitrageurs are risk averse and have short horizons and (ii) the noise trader risk is systematic. As before, condition (i) ensures that the mispricing cannot be wiped out by a single, large arbitrageur, while condition (ii) prevents a large number of small investors from exploiting the mispricing. The central contribution of Shleifer and Vishny (1997) is to point out the real world relevance of condition (i): the possibility of an early, forced liquidation means that many arbitrageurs effectively have short horizons. In the presence of certain implementation costs, condition (ii) may not even be necessary. If it is costly to learn about a mispricing, or the resources required it to exploit it are expensive, that may be enough to explain why a large number of different individuals do not intervene in an attempt to correct the mispricing. It is also important to note that for particular types of noise trading, arbitrageurs may prefer to trade in the same direction as the noise traders, thereby exacerbating the mispricing, rather than against them. For example, De Long et al. (1990b)

Ch.18:A Survey of Behavioral Finance 1061 consider an economy with positive feedback traders,who buy more of an asset this period if it performed well last period.If these noise traders push an asset's price above fundamental value,arbitrageurs do not sell or short the asset.Rather,they buy it,knowing that the earlier price rise will attract more feedback traders next period,leading to still higher prices,at which point the arbitrageurs can exit at a profit. So far,we have argued that it is not easy for arbitrageurs like hedge funds to exploit market inefficiencies.However,hedge funds are not the only market participants trying to take advantage of noise traders:firm managers also play this game.If a manager believes that investors are overvaluing his firm's shares,he can benefit the firm's existing shareholders by issuing extra shares at attractive prices.The extra supply this generates could potentially push prices back to fundamental value. Unfortunately,this game entails risks and costs for managers,just as it does for hedge funds.Issuing shares is an expensive process,both in terms of underwriting fees and time spent by company management.Moreover,the manager can rarely be sure that investors are overvaluing his firm's shares.If he issues shares,thinking that they are overvalued when in fact they are not,he incurs the costs of deviating from his target capital structure,without getting any benefits in return. 2.3.Evidence From the theoretical point of view,there is reason to believe that arbitrage is a risky process and therefore that it is only of limited effectiveness.But is there any evidence that arbitrage is limited?In principle,any example of persistent mispricing is immediate evidence of limited arbitrage:if arbitrage were not limited,the mispricing would quickly disappear.The problem is that while many pricing phenomena can be interpreted as deviations from fundamental value,it is only in a few cases that the presence of a mispricing can be established beyond any reasonable doubt.The reason for this is what Fama(1970)dubbed the"joint hypothesis problem".In order to claim that the price of a security differs from its properly discounted future cash flows,one needs a model of"proper"discounting.Any test of mispricing is therefore inevitably a joint test of mispricing and of a model of discount rates,making it difficult to provide definitive evidence of inefficiency. In spite of this difficulty,researchers have uncovered a number of financial market phenomena that are almost certainly mispricings,and persistent ones at that. These examples show that arbitrage is indeed limited,and also serve as interesting illustrations of the risks and costs described earlier. 2.3.1.Twin shares In 1907,Royal Dutch and Shell Transport,at the time completely independent companies,agreed to merge their interests on a 60:40 basis while remaining separate entities.Shares of Royal Dutch,which are primarily traded in the USA and in the

Ch. 18: A Survey of Behavioral Finance 1061 consider an economy with positive feedback traders, who buy more of an asset this period if it performed well last period. If these noise traders push an asset’s price above fundamental value, arbitrageurs do not sell or short the asset. Rather, they buy it, knowing that the earlier price rise will attract more feedback traders next period, leading to still higher prices, at which point the arbitrageurs can exit at a profit. So far, we have argued that it is not easy for arbitrageurs like hedge funds to exploit market inefficiencies. However, hedge funds are not the only market participants trying to take advantage of noise traders: firm managers also play this game. If a manager believes that investors are overvaluing his firm’s shares, he can benefit the firm’s existing shareholders by issuing extra shares at attractive prices. The extra supply this generates could potentially push prices back to fundamental value. Unfortunately, this game entails risks and costs for managers, just as it does for hedge funds. Issuing shares is an expensive process, both in terms of underwriting fees and time spent by company management. Moreover, the manager can rarely be sure that investors are overvaluing his firm’s shares. If he issues shares, thinking that they are overvalued when in fact they are not, he incurs the costs of deviating from his target capital structure, without getting any benefits in return. 2.3. Evidence From the theoretical point of view, there is reason to believe that arbitrage is a risky process and therefore that it is only of limited effectiveness. But is there any evidence that arbitrage is limited? In principle, any example of persistent mispricing is immediate evidence of limited arbitrage: if arbitrage were not limited, the mispricing would quickly disappear. The problem is that while many pricing phenomena can be interpreted as deviations from fundamental value, it is only in a few cases that the presence of a mispricing can be established beyond any reasonable doubt. The reason for this is what Fama (1970) dubbed the “joint hypothesis problem”. In order to claim that the price of a security differs from its properly discounted future cash flows, one needs a model of “proper” discounting. Any test of mispricing is therefore inevitably a joint test of mispricing and of a model of discount rates, making it difficult to provide definitive evidence of inefficiency. In spite of this difficulty, researchers have uncovered a number of financial market phenomena that are almost certainly mispricings, and persistent ones at that. These examples show that arbitrage is indeed limited, and also serve as interesting illustrations of the risks and costs described earlier. 2.3.1. Twin shares In 1907, Royal Dutch and Shell Transport, at the time completely independent companies, agreed to merge their interests on a 60:40 basis while remaining separate entities. Shares of Royal Dutch, which are primarily traded in the USA and in the

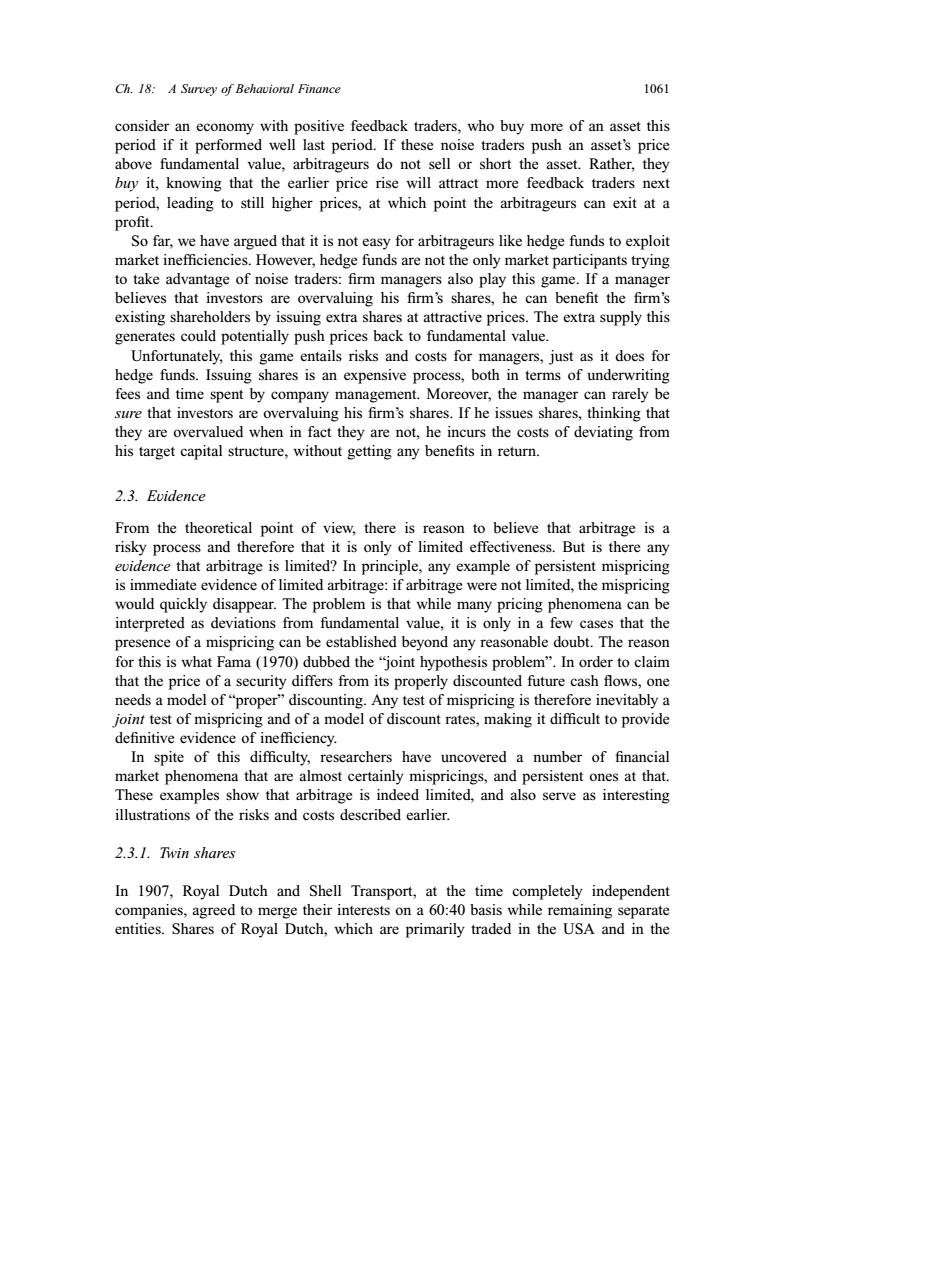

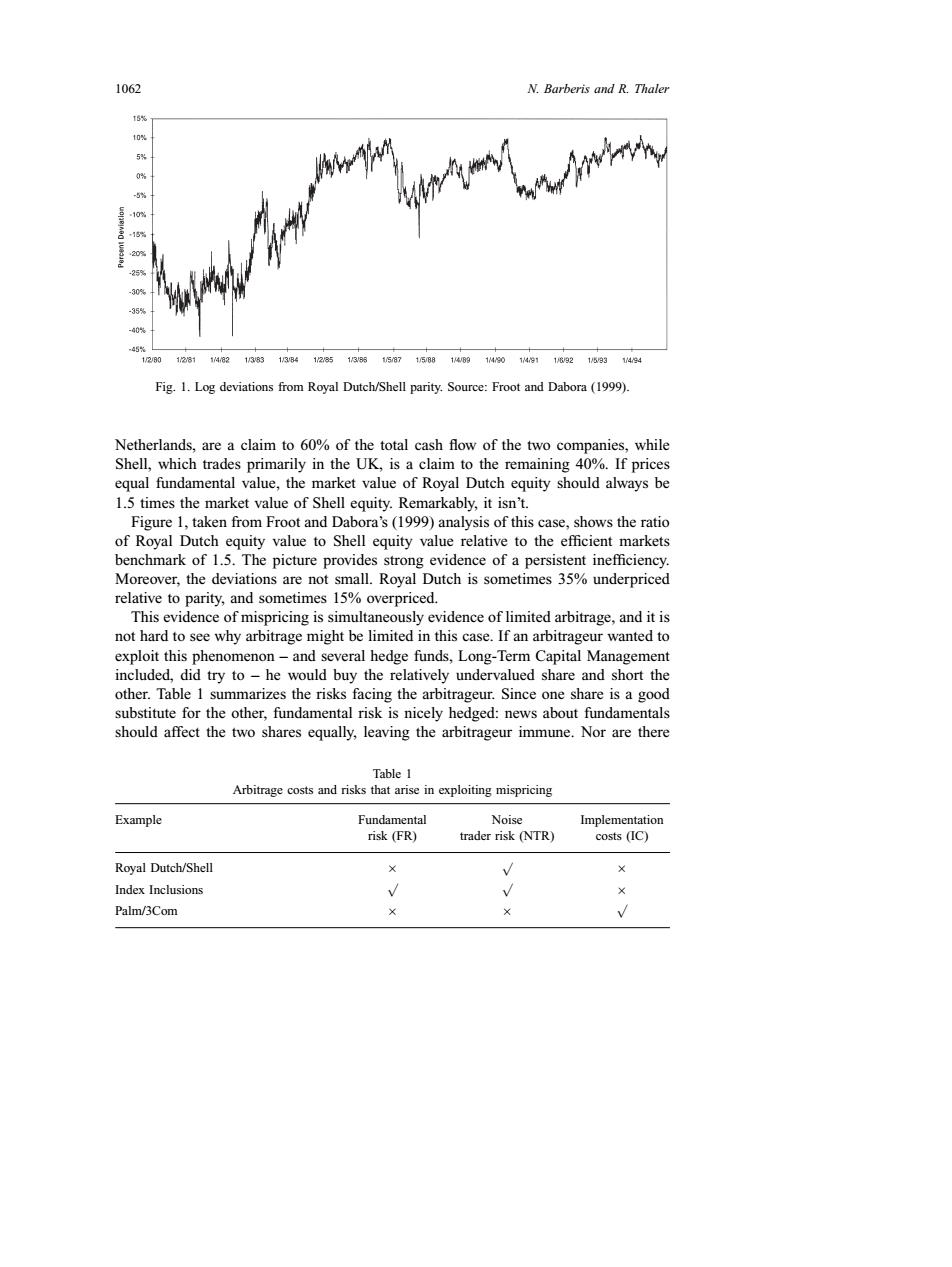

1062 N.Barberis and R.Thaler 5% 25 30% 35% 40 45 1/280 128114,82138313B4128513951587158814B914301491183215931494 Fig.1.Log deviations from Royal Dutch/Shell parity.Source:Froot and Dabora (1999). Netherlands,are a claim to 60%of the total cash flow of the two companies,while Shell,which trades primarily in the UK,is a claim to the remaining 40%.If prices equal fundamental value,the market value of Royal Dutch equity should always be 1.5 times the market value of Shell equity.Remarkably,it isn't. Figure 1,taken from Froot and Dabora's (1999)analysis of this case,shows the ratio of Royal Dutch equity value to Shell equity value relative to the efficient markets benchmark of 1.5.The picture provides strong evidence of a persistent inefficiency. Moreover,the deviations are not small.Royal Dutch is sometimes 35%underpriced relative to parity,and sometimes 15%overpriced. This evidence of mispricing is simultaneously evidence of limited arbitrage,and it is not hard to see why arbitrage might be limited in this case.If an arbitrageur wanted to exploit this phenomenon-and several hedge funds,Long-Term Capital Management included,did try to-he would buy the relatively undervalued share and short the other.Table 1 summarizes the risks facing the arbitrageur.Since one share is a good substitute for the other,fundamental risk is nicely hedged:news about fundamentals should affect the two shares equally,leaving the arbitrageur immune.Nor are there Table 1 Arbitrage costs and risks that arise in exploiting mispricing Example Fundamental Noise Implementation risk(FR) trader risk (NTR) costs (IC) Royal Dutch/Shell × Index Inclusions V Palm/3Com

1062 N. Barberis and R. Thaler Fig. 1. Log deviations from Royal Dutch/Shell parity. Source: Froot and Dabora (1999). Netherlands, are a claim to 60% of the total cash flow of the two companies, while Shell, which trades primarily in the UK, is a claim to the remaining 40%. If prices equal fundamental value, the market value of Royal Dutch equity should always be 1.5 times the market value of Shell equity. Remarkably, it isn’t. Figure 1, taken from Froot and Dabora’s (1999) analysis of this case, shows the ratio of Royal Dutch equity value to Shell equity value relative to the efficient markets benchmark of 1.5. The picture provides strong evidence of a persistent inefficiency. Moreover, the deviations are not small. Royal Dutch is sometimes 35% underpriced relative to parity, and sometimes 15% overpriced. This evidence of mispricing is simultaneously evidence of limited arbitrage, and it is not hard to see why arbitrage might be limited in this case. If an arbitrageur wanted to exploit this phenomenon – and several hedge funds, Long-Term Capital Management included, did try to – he would buy the relatively undervalued share and short the other. Table 1 summarizes the risks facing the arbitrageur. Since one share is a good substitute for the other, fundamental risk is nicely hedged: news about fundamentals should affect the two shares equally, leaving the arbitrageur immune. Nor are there Table 1 Arbitrage costs and risks that arise in exploiting mispricing Example Fundamental risk (FR) Noise trader risk (NTR) Implementation costs (IC) Royal Dutch/Shell × √ × Index Inclusions √ √ × Palm/3Com × × √