economies of large-scale production.Analyze two policies intended to maintain Japanese rice produetion (1)aper-pound subsidy tofarmers for ench pound of rice produced,or (2)a per-pound tariff on imported rice. supply-and-demand diagrams the equilibrium price and quantity,domestic rice production,government revenue or deficit,and deadweight loss from each policy. Which policy is the Japanese government likely to prefer?Which policy are Japanese farmers likely to prefer? nd domestie der by the buyers.a nd Pis the equilibrium prie without the subsidy,assumingno imports.With the subsidy,buyers demand Q.Farmers gain amounts equivalent to areas Aand B.This is the increase in producer surplus.Consumers gain areas Cand F This is the increase in consumer suplus. area +C+F+E equa Figure 9.3b sho ment pays ws the gainsand price,and Po is the equilibrium price.With the tariff,assumed to be equal toP Pu buyers demand Qn farmers supply Qp and Qr-Qp is imported.Farmers requivalont to area A.Consupers b areB C:thig is the er surplus. adw is equal to Band C Pri B D Quantity Figure 9.3.a

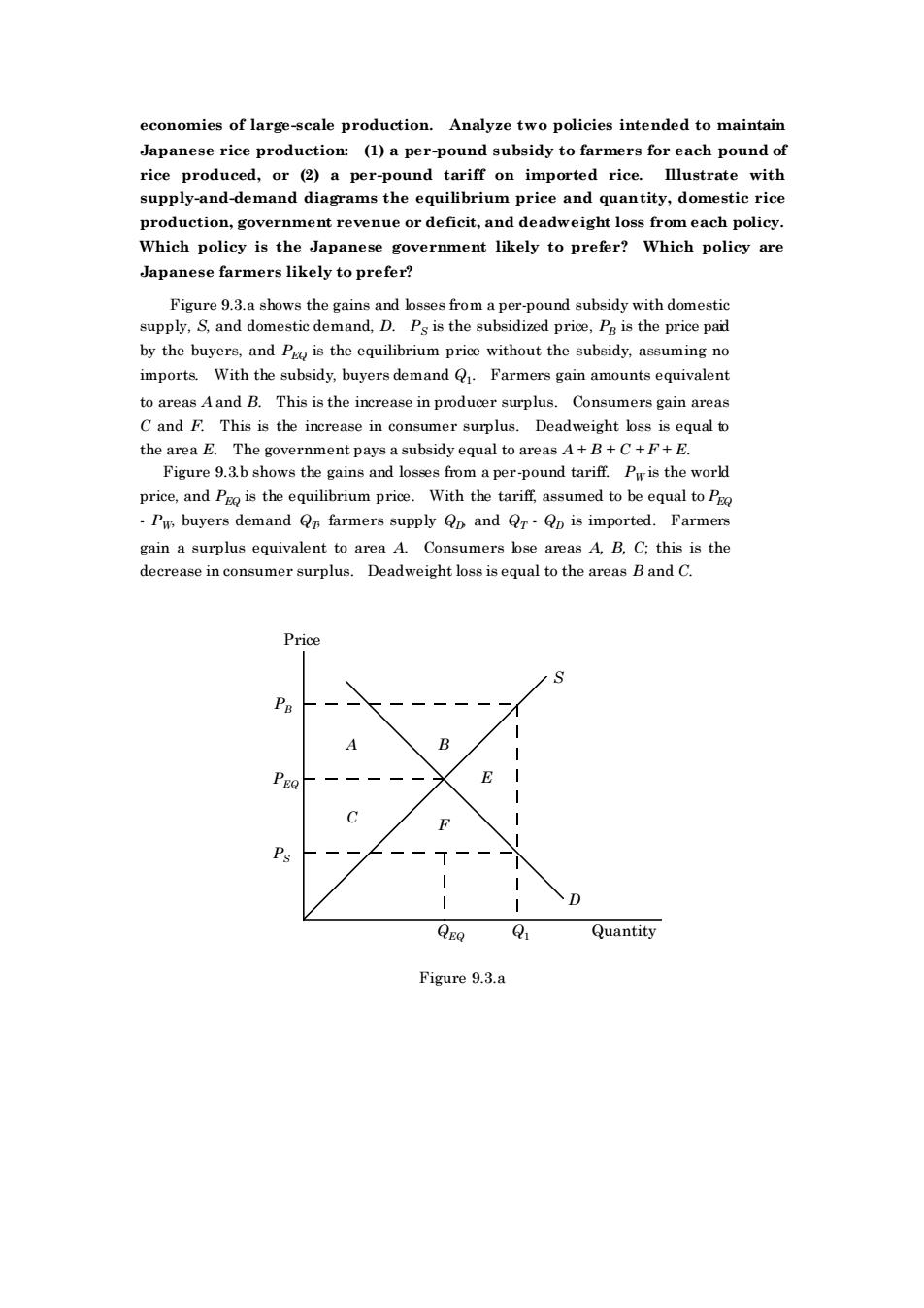

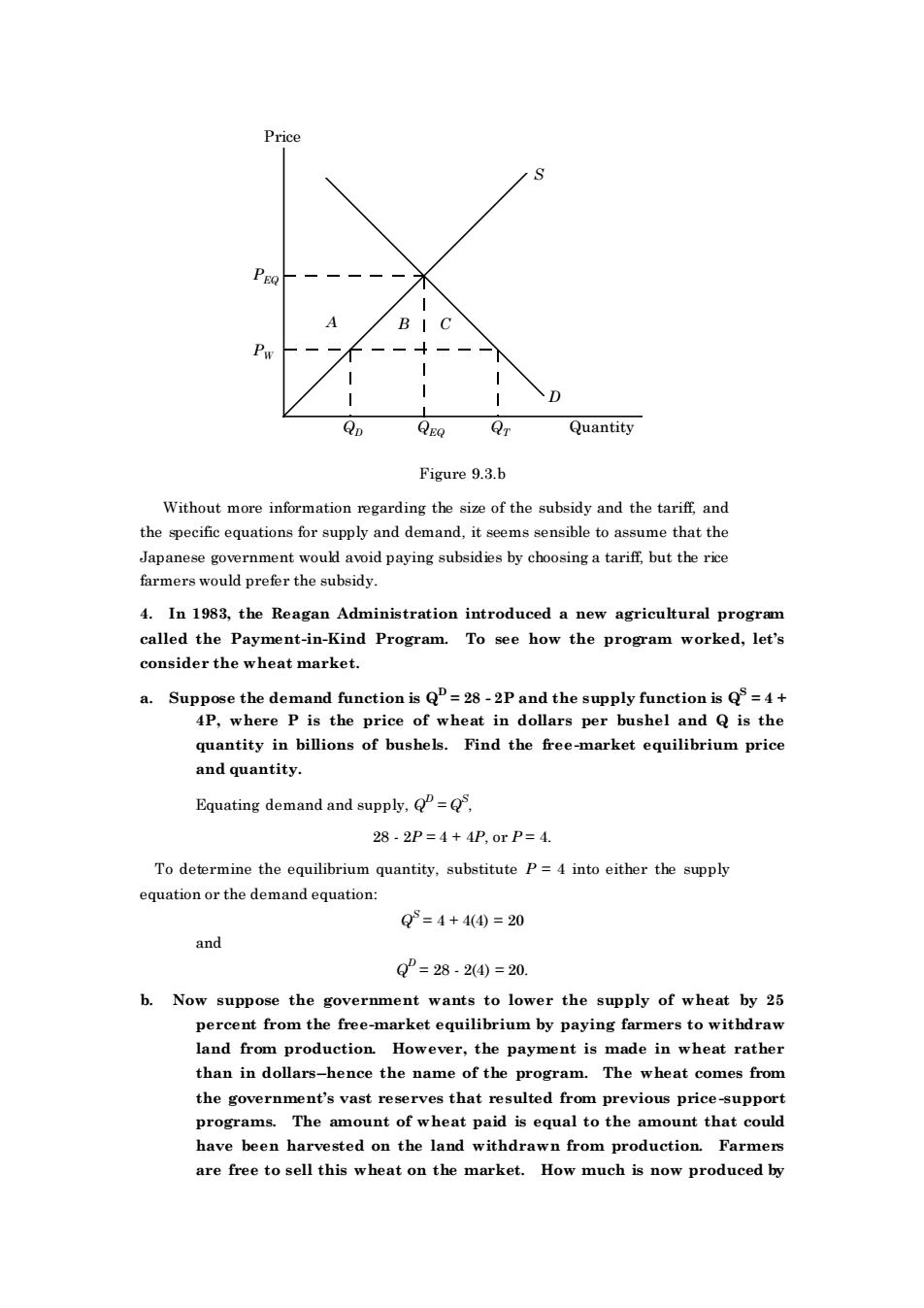

economies of large-scale production. Analyze two policies intended to maintain Japanese rice production: (1) a per-pound subsidy to farmers for each pound of rice produced, or (2) a per-pound tariff on imported rice. Illustrate with supply-and-demand diagrams the equilibrium price and quantity, domestic rice production, government revenue or deficit, and deadweight loss from each policy. Which policy is the Japanese government likely to prefer? Which policy are Japanese farmers likely to prefer? Figure 9.3.a shows the gains and losses from a per-pound subsidy with domestic supply, S, and domestic demand, D. PS is the subsidized price, PB is the price paid by the buyers, and PEQ is the equilibrium price without the subsidy, assuming no imports. With the subsidy, buyers demand Q1 . Farmers gain amounts equivalent to areas A and B. This is the increase in producer surplus. Consumers gain areas C and F. This is the increase in consumer surplus. Deadweight loss is equal to the area E. The government pays a subsidy equal to areas A + B + C + F + E. Figure 9.3.b shows the gains and losses from a per-pound tariff. PW is the world price, and PEQ is the equilibrium price. With the tariff, assumed to be equal to PEQ - PW, buyers demand QT, farmers supply QD, and QT - QD is imported. Farmers gain a surplus equivalent to area A. Consumers lose areas A, B, C; this is the decrease in consumer surplus. Deadweight loss is equal to the areas B and C. Price Quantity S D PB PEQ PS A C B E F QEQ Q1 Figure 9.3.a

C D Quantity Figure 9.3.b Without more information egarding thesize of the subsidy and the tarif,and the specific equations for supply and demand,it seems sensible to assume that the Japanese government would avoid paying subsidies by choosing a tariff,but the rice farmers would prefer the subsidy 4.In 1983,the Reagan Administration introduced a new agricultural program called the Payment-in-Kind Program. To see how the program worked,let's consider the wheat market. a.Suppose the demand function is =28-2P and the supply function is=4+ 4P,where P is the price of wheat in dollars per bushel and Q is the quantity in billions of bushels.Find the free-market equilibrium price and quantitv. Equating demand and supply,= 28.2P=4+4P,orP=4 To determine the equilibrium quantity,substitute P=4 into either the supply equation or the demand equation Q=4+44)=20 and Q°=28-2④=20. b.Now suppose the government wants to lower the supply of wheat by 25 percent from the free-market equilibrium by paying farmers to withdraw land from production.However,the payment is made in wheat rather than in dollars-hence the name of the program.The wheat comes from the government's vast reserves that resulted from previous price-support programs.The amount of wheat paid is equal to the amount that could have been harvested on the land withdrawn from production.Farmers are free to sell this wheat on the market.How much is now produced by

Price S D PEQ PW A B C QD QEQ QT Quantity Figure 9.3.b Without more information regarding the size of the subsidy and the tariff, and the specific equations for supply and demand, it seems sensible to assume that the Japanese government would avoid paying subsidies by choosing a tariff, but the rice farmers would prefer the subsidy. 4. In 1983, the Reagan Administration introduced a new agricultural program called the Payment-in-Kind Program. To see how the program worked, let’s consider the wheat market. a. Suppose the demand function is QD = 28 - 2P and the supply function is QS = 4 + 4P, where P is the price of wheat in dollars per bushel and Q is the quantity in billions of bushels. Find the free-market equilibrium price and quantity. Equating demand and supply, Q D = QS , 28 - 2P = 4 + 4P, or P = 4. To determine the equilibrium quantity, substitute P = 4 into either the supply equation or the demand equation: Q S = 4 + 4(4) = 20 and Q D = 28 - 2(4) = 20. b. Now suppose the government wants to lower the supply of wheat by 25 percent from the free-market equilibrium by paying farmers to withdraw land from production. However, the payment is made in wheat rather than in dollars-hence the name of the program. The wheat comes from the government’s vast reserves that resulted from previous price-support programs. The amount of wheat paid is equal to the amount that could have been harvested on the land withdrawn from production. Farmers are free to sell this wheat on the market. How much is now produced by

farmers?How much is indirectly supplied to the market by the government?What is the new market price?How much do the farmers gain?Do consumers gain or lose? Because the free market supply by farmers is 20 billion bushels.the 25 percent reduction required by the new Payment-In-Kind(PIK)Program would imply that the farmers now produce 15 billion bushels.To encourage farmers to withdraw their land from cultivation.the overnment must give them5billion bushels which they sell on the market Because the total supply to the market is still 20 billion bushels,the market price does not ch ange;it remains at $4 per bushel.The farmers gain $20 billion, equal to ($4)(5 billion bushels).from the PIK Program,because they incur no costs in supplying the wheat (which they received from the government)to the market. The PIK program does not affect consumers in the wheat market,because they purchase the same amount at the same price as they did in the free market case c.Had the goverament not given the wheat back to would have stored or destroyed it.Do taxpayers gain from the program? Wha potential problems does the program create? Taxpayers gain because the government is not required to store the wheat. Although everyone seems to gain from the PIK program,it can only last while there are government wheat reserves.The PIK program assumes that the land removed Po业nmtd pmdiction when如arehouted cannot be done,consumers may eventually pay morefor wheat-based product 5.About 100 million Year.and tho pounds of jeny bn ae consum in the United State e has been about 50 cents per pound. However,jelly bear producers feel that their incomes are too low,and they have convinced the government that price supports are in order.The government will therefore buy up as many jelly beans as necessary to keep the price at $1per pound.However government ec 101 ists a worried about impaet of th s program,because they have no estimates ofthe elasticities ofjelly bean demand or supply. a.Could this program cost the government more than $50 million per year? Under what conditions?Could it cost less than $50 million per year? Under what conditions?Illustrate with a diagram. If the quantities demanded and supplied are very responsive to price changes then a government program that doubles the price of ielly beans could easily cost more than $50 million this case,the change in pri will au a large chango in quantity supplied,and a large change in quantity demanded.In Figure 9.5.ai the cost of the program is (Qs-QD)$1.Given Qs-QD is larger than 50 million,then the government will pay more than 50 million dollars.If instead supply and demand were relatively price inelastic.then the change in price would result in ery small changes in quantity supplied and quantity demanded and (Qs-Qo)woul be less than50 million,as illustrated in figure9.5.a.i

farmers? How much is indirectly supplied to the market by the government? What is the new market price? How much do the farmers gain? Do consumers gain or lose? Because the free market supply by farmers is 20 billion bushels, the 25 percent reduction required by the new Payment-In-Kind (PIK) Program would imply that the farmers now produce 15 billion bushels. To encourage farmers to withdraw their land from cultivation, the government must give them 5 billion bushels, which they sell on the market. Because the total supply to the market is still 20 billion bushels, the market price does not change; it remains at $4 per bushel. The farmers gain $20 billion, equal to ($4)(5 billion bushels), from the PIK Program, because they incur no costs in supplying the wheat (which they received from the government) to the market. The PIK program does not affect consumers in the wheat market, because they purchase the same amount at the same price as they did in the free market case. c.Had the government not given the wheat back to the farmers, it would have stored or destroyed it. Do taxpayers gain from the program? What potential problems does the program create? Taxpayers gain because the government is not required to store the wheat. Although everyone seems to gain from the PIK program, it can only last while there are government wheat reserves. The PIK program assumes that the land removed from production may be restored to production when stockpiles are exhausted. If this cannot be done, consumers may eventually pay more for wheat-based products. 5. About 100 million pounds of jelly beans are consumed in the United States each year, and the price has been about 50 cents per pound. However, jelly bean producers feel that their incomes are too low, and they have convinced the government that price supports are in order. The government will therefore buy up as many jelly beans as necessary to keep the price at $1 per pound. However, government economists are worried about the impact of this program, because they have no estimates of the elasticities of jelly bean demand or supply. a. Could this program cost the government more than $50 million per year? Under what conditions? Could it cost less than $50 million per year? Under what conditions? Illustrate with a diagram. If the quantities demanded and supplied are very responsive to price changes, then a government program that doubles the price of jelly beans could easily cost more than $50 million. In this case, the change in price will cause a large change in quantity supplied, and a large change in quantity demanded. In Figure 9.5.a.i, the cost of the program is (QS-QD)*$1. Given QS-QD is larger than 50 million, then the government will pay more than 50 million dollars. If instead supply and demand were relatively price inelastic, then the change in price would result in very small changes in quantity supplied and quantity demanded and (QS-QD) would be less than $50 million, as illustrated in figure 9.5.a.ii