CHAPTER 14 MARKETSFOR FACTOR INPUTS 一、QUESTIONS FOR REVIEW 1.Why is a firm's demand for labor curve more inelastic when the firm has monopoly power in the output market than when the firm is producing competitively? The firm's demand curve for labor is determined by the labor known as the product of ab )the adaoa upu Curduc that the latworker pdu ag出 times the additional revenue earned by selling that output.In a competitive industry.the marginal revenue curve is perfectly elastic and equal to price.Fora monopolist,marginal revenue is downward aloping.Asmore labor is hired and more output i monopolist will charge a bwer price and revenue will diminish.All else the same,marginal revenue product will be smalle for the monopolist.This implies that the marginal revenue product for the monopolist is more inelastic than for the competitive firm. 2.Why might a labor supply curve be backward bending? A backward-bending supply curve for labor may occur when the income effect of an remade by individuals ch leisure)activities. With a larger income,the individual can afford to work fewer hours:the income effect.As the wage rate increases the value of kisure time (the opportunity cost of leisure)increases thus inducing the individual to work longer hours:the substitution effect.Because the two effects work in opposite directions the shape of an individual's labor supply curve depends on the individual's preferences for income,consumption,and leisure. 3.How is a computer company's demand for computer programmers a derived demand? A computer company's demand for inputs,including programmers depends on how many computers it sells.The firm's demand for programming labor depends on (is derived from)the demand it faces in its market for computers.As demand for computers shifts,the demand for programmersshifts 4.Compare the hiring choices of a monopsonistic and a competitive employer workers.Which will hire more workers,and which will pay the higher wages? Explain. Since the decision to hire another worker means the monopsonist must pay a higher wage for all workers and not just the last worker hired,its marginal expenditure curve lies above the input supply curve (the average expenditure curve).The monopsonist's profit-maximizing input demand,where the marginal expenditure curve intersects the marginal revenue product curve,will be less than the competitor's profit-maximizing input choice,where the average expenditure curve

CHAPTER 14 MARKETS FOR FACTOR INPUTS 一、QUESTIONS FOR REVIEW 1. Why is a firm’s demand for labor curve more inelastic when the firm has monopoly power in the output market than when the firm is producing competitively? The firm’s demand curve for labor is determined by the incremental revenue from hiring an additional unit of labor known as the marginal revenue product of labor: MRPL = (MPL)(MR), the additional output (“product”) that the last worker produced, times the additional revenue earned by selling that output. In a competitive industry, the marginal revenue curve is perfectly elastic and equal to price. For a monopolist, marginal revenue is downward sloping. As more labor is hired and more output is produced, the monopolist will charge a lower price and marginal revenue will diminish. All else the same, marginal revenue product will be smaller for the monopolist. This implies that the marginal revenue product for the monopolist is more inelastic than for the competitive firm. 2. Why might a labor supply curve be backward bending? A backward-bending supply curve for labor may occur when the income effect of an increase in the wage rate dominates the substitution effect. Labor supply decisions are made by individuals choosing the most satisfying combination of work and other (leisure) activities. With a larger income, the individual can afford to work fewer hours: the income effect. As the wage rate increases, the value of leisure time (the opportunity cost of leisure) increases, thus inducing the individual to work longer hours: the substitution effect. Because the two effects work in opposite directions, the shape of an individual’s labor supply curve depends on the individual’s preferences for income, consumption, and leisure. 3. How is a computer company’s demand for computer programmers a derived demand? A computer company’s demand for inputs, including programmers, depends on how many computers it sells. The firm’s demand for programming labor depends on (is derived from) the demand it faces in its market for computers. As demand for computers shifts, the demand for programmers shifts. 4. Compare the hiring choices of a monopsonistic and a competitive employer of workers. Which will hire more workers, and which will pay the higher wages? Explain. Since the decision to hire another worker means the monopsonist must pay a higher wage for all workers, and not just the last worker hired, its marginal expenditure curve lies above the input supply curve (the average expenditure curve). The monopsonist’s profit-maximizing input demand, where the marginal expenditure curve intersects the marginal revenue product curve, will be less than the competitor’s profit-maximizing input choice, where the average expenditure curve

intersects the demand curve.The monopsonist hires less labor,and the wage paid will be less than ina competitive market. 5.Rock musicians sometimes earn over s1 million per year.Can you explain such large incomes in terms ofeconomic rent? Economic rent is the difference between the actual payment to the factor of production and the minimum amount that the factor is willing to accept In this case,you might assume that there are a limited number of top-quality rock musicians who will continue to play rock music no matter what they are paid.This supply CU rve,or something close to it Given the high demand music,the wage will be ery high and there will be a lot of economic rent.If there was a larger supply of top-quality rock musicians,or a more elastic supply,then the economic rent would be smaller. 6.What happens to the demand for one input when the use of a complementary input increases? If the demand for the complementary input increases,the demand for the given input will inerease as well.When demand for the compmentary input there is an increase in the e quantity hir ed and possibly the price paid Both of thes changes will increase the MRP of the given input,and hence will increase the quantity hired and possibly the price paid.Whether the prices of the inputs increases depends on the degree of monopsony poweron the part of the firm. 7.For a monopsonist,what is the relationship between the supply of an input and the marginal expenditure on it? The decision to increase empbyr sonist must pay all units the highe and not just the expe curve lies above the input supply curve (the average expenditure curve).Hiring more labor will increase the marginal expenditure,which will increase the average expenditure.If the average expenditure is increasing.then the marginal expenditure must be greater than the average expenditure 8.Currently the National Football League has a system for drafting college players by which each player is picked by only one t The player must sign with that team or not play in the league.What would happen to the wages of newly drafted and more experienced football players if the draft system were repealed,and all teams could compete for college players? The National Football League draft and reserve clause (a primary issue in the 1987-1988 season's strike)creates a monopsonist cartel among the owners of nel teams.If the draft system we rerepealed,competition among teams would inereas wages of football players to the point where the marginal evenue product of eac player would be equal to the player's wage. 9.The government wants to encourage individuals on welfare to become employed.It is considering two possible incentive programs for firms

intersects the demand curve. The monopsonist hires less labor, and the wage paid will be less than in a competitive market. 5. Rock musicians sometimes earn over $1 million per year. Can you explain such large incomes in terms of economic rent? Economic rent is the difference between the actual payment to the factor of production and the minimum amount that the factor is willing to accept. In this case, you might assume that there are a limited number of top-quality rock musicians who will continue to play rock music no matter what they are paid. This results in a perfectly inelastic supply curve, or something close to it. Given the high demand for rock music, the wage will be very high and there will be a lot of economic rent. If there was a larger supply of top-quality rock musicians, or a more elastic supply, then the economic rent would be smaller. 6. What happens to the demand for one input when the use of a complementary input increases? If the demand for the complementary input increases, the demand for the given input will increase as well. When demand for the complementary input increases, there is an increase in the quantity hired and possibly the price paid. Both of these changes will increase the MRP of the given input, and hence will increase the quantity hired and possibly the price paid. Whether the prices of the inputs increases depends on the degree of monopsony power on the part of the firm. 7. For a monopsonist, what is the relationship between the supply of an input and the marginal expenditure on it? The decision to increase employment means the monopsonist must pay all units the higher price, and not just the last unit hired. Therefore, its marginal expenditure curve lies above the input supply curve (the average expenditure curve). Hiring more labor will increase the marginal expenditure, which will increase the average expenditure. If the average expenditure is increasing, then the marginal expenditure must be greater than the average expenditure. 8. Currently the National Football League has a sys tem for drafting college players by which each player is picked by only one team. The player must sign with that team or not play in the league. What would happen to the wages of newly drafted and more experienced football players if the draft system were repealed, and all teams could compete for college players? The National Football League draft and reserve clause (a primary issue in the 1987-1988 season’s strike) creates a monopsonist cartel among the owners of NFL teams. If the draft system were repealed, competition among teams would increase wages of football players to the point where the marginal revenue product of each player would be equal to the player’s wage. 9. The government wants to encourage individuals on welfare to become employed. It is considering two possible incentive programs for firms

A.Give the firm $2 per hour for every individual on welfare who is hired. B.Give each firm that hires one or more welfare workers a payment of $1000 per year,irrespective of the number of hires. To what extent is each of these programs likely to be effective at increasing the employment opportunities for welfare workers? Firms will hire additional labor as long as the extra benefit is greater than the extra cost of hiring the worker,or until MRP=w.Option A w use if the recei $2 p er h effective wage paid,w,will fall and the firm will find it optimal to hire more labor until the benefits (MRPL)again equal the costs (w)at the margin.Option B would be effective at increasing employment opportunities also in that if the firm hires an individual who has been on welfare they will then receive $1000 lan Ag时 n the firm receivesone lump sum payment regardless of the number of efare workershire In this case the firm only has an incentive to hire the one welfare worker,though they may of course choose to hire more than one welfare worker. 10.A small specialty cookie company.whose only variable input is labor.finds that the average worker can produce 50 cookies per day,the cost of the average worker is $64 per day,and the price of a cookie is $1.Is the cookie company maximizing its profit? Explain. The marginal product of labor is50(cookies per day)and the price per cookie is (S per cookie)so the marginal revenue product is $50/day.Since this is less than the wage of $64 per day the cookie company is not maximizing profit.They are employing too much labor since the cost of labor is greater than the benefit of labor at the margin,and are therefore producing too many cookies. 11.A firm uses both labor and machines in production.Explain why an increase in the avera e rate causes both a movement along the labor demand curve and a shift of the curve. An increase in the wage rate causes an upward movement along the labor demand curve.For any given marginal revenue product curve.the firm will find that they want to hire fewer workers when the wage increases (an upward movement). output Wher output falls,the firm will no ed as man machines and the marginal product of labor curve will shift to the left,assuming machines and labor are complementary.This will also reduce the demand for labor. 二、EXERCISES

A. Give the firm $2 per hour for every individual on welfare who is hired. B. Give each firm that hires one or more welfare workers a payment of $1000 per year, irrespective of the number of hires. To what extent is each of these programs likely to be effective at increasing the employment opportunities for welfare workers? Firms will hire additional labor as long as the extra benefit is greater than the extra cost of hiring the worker, or until MRPL = w. Option A would be effective because if the firm receives $2 per hour for every welfare worker hired then the effective wage paid, w, will fall and the firm will find it optimal to hire more labor until the benefits (MRPL) again equal the costs (w) at the margin. Option B would be effective at increasing employment opportunities also in that if the firm hires an individual who has been on welfare they will then receive $1000. However, plan B is not necessarily as effective as plan A given the firm only receives one lump sum payment regardless of the number of welfare workers hired. In this case the firm only has an incentive to hire the one welfare worker, though they may of course choose to hire more than one welfare worker. 10. A small specialty cookie company, whose only variable input is labor, finds that the average worker can produce 50 cookies per day, the cost of the average worker is $64 per day, and the price of a cookie is $1. Is the cookie company maximizing its profit? Explain. The marginal product of labor is 50 (cookies per day) and the price per cookie is 1 ($ per cookie) so the marginal revenue product is $50/day. Since this is less than the wage of $64 per day the cookie company is not maximizing profit. They are employing too much labor since the cost of labor is greater than the benefit of labor at the margin, and are therefore producing too many cookies. 11. A firm uses both labor and machines in production. Explain why an increase in the average wage rate causes both a movement along the labor demand curve and a shift of the curve. An increase in the wage rate causes an upward movement along the labor demand curve. For any given marginal revenue product curve, the firm will find that they want to hire fewer workers when the wage increases (an upward movement). However, when the wage increases the marginal cost will increase which will reduce desired output. When output falls, the firm will not need as many machines and the marginal product of labor curve will shift to the left, assuming machines and labor are complementary. This will also reduce the demand for labor. 二、EXERCISES

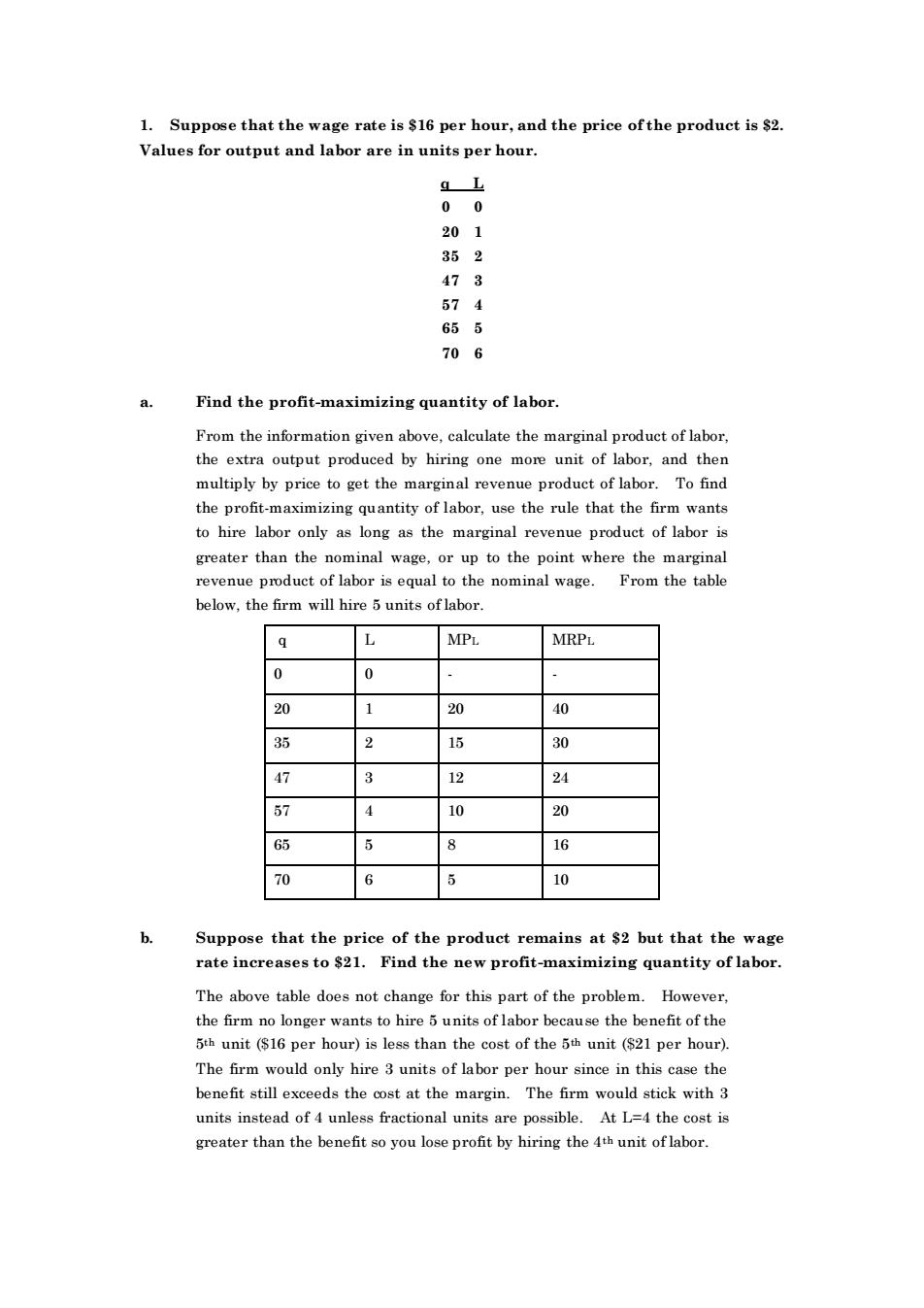

1.Suppose that the wage rate is $16 per hour,and the price ofthe product is $2. Values for output and labor are in units per hour. 201 352 473 574 655 6 Find the profit-maximizing quantity of labor. From the information given above,calculate the marginal product of labor the extra output produced by hiring one more unit of labor,and then multiply by price to get the marginal revenu e product of labor.To find the profit-maximizing quantity of labor,use the rule that thefirm wante to hire labor only as long as the marginal revenue product of labor is greater than the nominal wage.or up to the point where the marginal revenue product of labor is equal to the nominal wage. From the table below,the firm will hire 5 units oflabor L MPL MRPL 0 20 40 2 6 动 47 3 12 24 57 10 20 65 16 70 6 10 Supp se that the rice of the produet remains at $2 but that the wag rate increases to $21 1.Find the new profit-maximizing quantity of labo The above table does not change for this part of the problem. However the firm no longer wants to hire 5 units of labor because the benefit of the 5th unit ($16 per hour)is less than the cost of the 5t unit ($21 per hour). The firm would only hire 3 units of labor per hour since in this case the benefit still exceeds the ost at the margin The6rm would stick with 3 units instead of 4 unless fractional units are possible.At L=4 the cost is greater than the benefit so you lose profit by hiring the 4th unit of labor

1. Suppose that the wage rate is $16 per hour, and the price of the product is $2. Values for output and labor are in units per hour. q L 0 0 20 1 35 2 47 3 57 4 65 5 70 6 a. Find the profit-maximizing quantity of labor. From the information given above, calculate the marginal product of labor, the extra output produced by hiring one more unit of labor, and then multiply by price to get the marginal revenue product of labor. To find the profit-maximizing quantity of labor, use the rule that the firm wants to hire labor only as long as the marginal revenue product of labor is greater than the nominal wage, or up to the point where the marginal revenue product of labor is equal to the nominal wage. From the table below, the firm will hire 5 units of labor. q L MPL MRPL 0 0 - - 20 1 20 40 35 2 15 30 47 3 12 24 57 4 10 20 65 5 8 16 70 6 5 10 b. Suppose that the price of the product remains at $2 but that the wage rate increases to $21. Find the new profit -maximizing quantity of labor. The above table does not change for this part of the problem. However, the firm no longer wants to hire 5 units of labor because the benefit of the 5th unit ($16 per hour) is less than the cost of the 5th unit ($21 per hour). The firm would only hire 3 units of labor per hour since in this case the benefit still exceeds the cost at the margin. The firm would stick with 3 units instead of 4 unless fractional units are possible. At L=4 the cost is greater than the benefit so you lose profit by hiring the 4th unit of labor

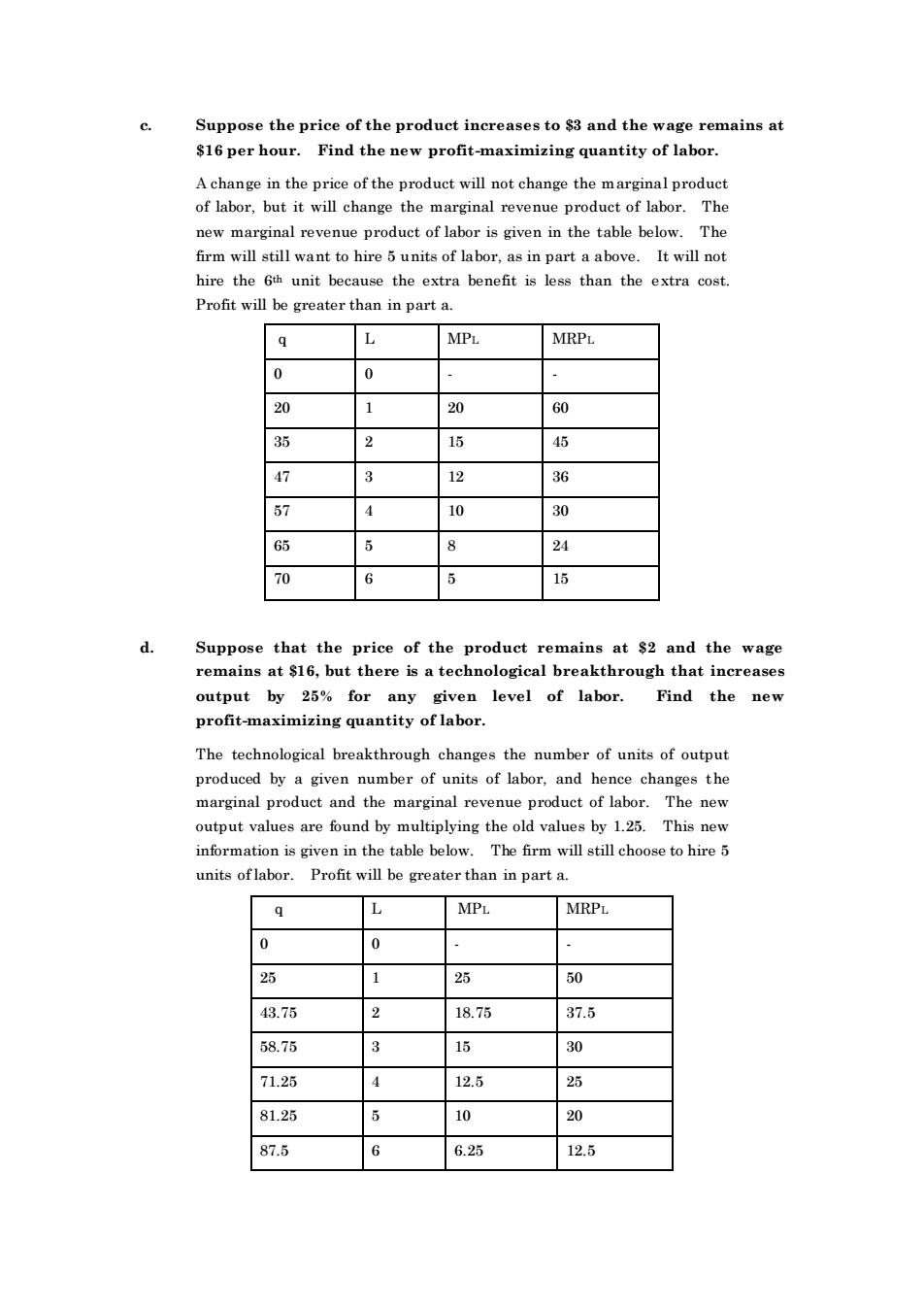

Suppose the price of the product increases to $3 and the wage remains at $16 per hour. Find the new profit-maximizing quantity of labor price of the product will not change the marginal produc change theardt The new marginal revenue product of labor is given in the table below.The firm will still want to hire 5 units of labor,as in part a above.It will not hire the 6th unit because the extra benefit is less than the extra cost. Profit will be greater than in part a. L MPL MRPL 20 60 35 2 15 45 47 3 12 36 57 4 10 30 65 24 70 15 that the price of the oduct remains at $2 and the wag rem $16 h that increa output by 25%for any given level of labor. Find the new profit-maximizing quantity of labor. The technological breakthrough changes the number of units of output produced by a given number of units of labor.and hence changes the marginal product and the marginal revenue product of labor.The new are found by tiplying the values by 1.25.This nev informa n is given in the table below The firm will still choose to hire 5 units of labor.Profit will be greater than in part a. L MPL MRPL 0 0 25 1 50 43.75 2 1876 37.6 58.75 3 30 71.25 4 12.5 25 81.25 5 20 87.6 6.25 12

c. Suppose the price of the product increases to $3 and the wage remains at $16 per hour. Find the new profit-maximizing quantity of labor. A change in the price of the product will not change the marginal product of labor, but it will change the marginal revenue product of labor. The new marginal revenue product of labor is given in the table below. The firm will still want to hire 5 units of labor, as in part a above. It will not hire the 6th unit because the extra benefit is less than the extra cost. Profit will be greater than in part a. q L MPL MRPL 0 0 - - 20 1 20 60 35 2 15 45 47 3 12 36 57 4 10 30 65 5 8 24 70 6 5 15 d. Suppose that the price of the product remains at $2 and the wage remains at $16, but there is a technological breakthrough that increases output by 25% for any given level of labor. Find the new profit-maximizing quantity of labor. The technological breakthrough changes the number of units of output produced by a given number of units of labor, and hence changes the marginal product and the marginal revenue product of labor. The new output values are found by multiplying the old values by 1.25. This new information is given in the table below. The firm will still choose to hire 5 units of labor. Profit will be greater than in part a. q L MPL MRPL 0 0 - - 25 1 25 50 43.75 2 18.75 37.5 58.75 3 15 30 71.25 4 12.5 25 81.25 5 10 20 87.5 6 6.25 12.5